历史上BTC价格从高位回落,一旦有效跌破120日均线支撑,后面往往都会有一个回抽确认的动作。今年5月大跌,自跌破120日均线后面BTC用时86天时间经过筑底后又重新站上,后面便启动了新一轮趋势行情,价格涨至69000美金再创历史新高。

Historically, BTC prices have fallen from a high position, and once the 120-day average has been effectively broken, there has often been a back-to-back movement. After a sharp fall in May this year, when BTC has come back to its feet in 86 days since it broke the 120-day average, a new trend has been set in motion, with prices rising to $69,000 to an all-time high.

2019年小牛行情结束,BTC从高位跌破120日均线支撑后,加速向下再震荡筑底,自跌破后面用时36天时间又快速回升至120日均线附近见顶,确认跌破有效后价格继续回落创新低。

In 2019, when the cattle movement ended, BTC slammed from a high altitude to the 120-day average, accelerated downwards and stunned again, taking 36 days from the fall back to the peak near the 120-day average, confirming that prices continued to fall under innovation after the fall had been effective.

2018年熊市开启,BTC从高位跌破120日均线同样加速向下,后面插针见底再反弹至120日均线附近,这一过程用时18天时间,多次试探120日均线未能重新站上,后面触顶回落继续熊市进程。

The launch of the City of Bears in 2018, when BTC fell from the 120-day average at a similar rate and then bounced back to near the 120-day average, took 18 days to test the 120-day average and failed to re-establish its position on the 120-day line, while the fall of the top continued the bear-market process.

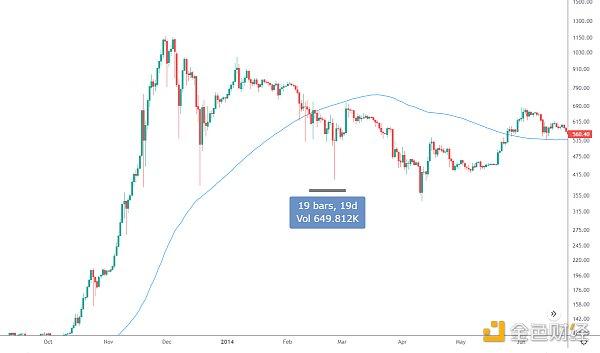

2014年熊市,BTC同样出现了高位跌破再回抽120日均线的动作,这一过程用时19天,反弹未能突破,价格继续回落创新低。

In Côte d'Ivoire in 2014, the BTC also experienced a high drop and a retrenchment of the 120-day average, a process that lasted 19 days and failed to break through, with prices continuing to fall below innovation.

2013年牛市中期大调整,BTC见一顶后高位跌破120日均线支撑,后面用时46天时间又重新站上,后面继续牛市新高行情。

The mid-term major restructuring of the cattle market in 2013 was supported by BTC falling into the 120-day average after a peak, which took 46 days to re-establish itself and continued the new high-rises of the cattle market.

我们可以发现,历史上BTC从高位跌破120日均线再回抽的概率较大,如果能够重新站上,后面一般都会启动新一轮上涨趋势行情,而如果反弹在这一带遇阻,那么后面再次回落创新低的概率大,所以120日均线在BTC趋势演变中扮演着关键作用。而目前BTC跌破120日线已有25天时间,后面一旦启动反弹,观察BTC能否重新站上120日均线,当前120日均线和前期圆弧顶颈线位重合,前期跌破这一带迎来加速下杀,反弹也将成为关键阻力位,这一带BTC若能蓄力重新站上,那么BTC将有望再次迎来新一轮上涨波段。

We can see that BTC has historically had a high probability of falling from the 120-day average, and that if it can be re-established, a new upward trend will normally be triggered, and if the rebound is blocked, the probability of falling back into the low innovation will be high, so the 120-day average will play a key role in the evolution of the BTC trend. Now that BTC has fallen from the 120-day line for 25 days, it will be able to return to the 120-day average, see if BTC can re-enter the 120-day average line once it is activated, if the 120-day mean line and the top neck of the prior arc are re-combated, and if the pre-debunking zone accelerates, the rebound will also be a key drag.

2013年牛市中期大调整,本轮牛市BTC形成双顶,一顶月线最高刺破斐波1.618压制线,不过收线未能站上,后面展开中期大调整,跌破下方斐波1.414支撑然后V形反转重新站上,并且本轮牛市二次主升浪启动前,再次大幅插针至1.414支撑带确认,然后月线有效突破1.618,强势洗盘后启动本轮牛市新一轮主升浪。

The mid-term major restructuring of the cattle market in 2013 resulted in BTC forming a double-top, with a one-month line peaking at 1.618, but the closing line failed to rise, followed by a mid-term major adjustment, which broke down the sub-field of 1.414, and then re-emerged in V., and confirmed once again that the main wave of the second run of the bull city was launched with a sharp pin to 1.414 support belts, and then that line effectively crossed the 1.618 line, triggering the new main wave of the city after a powerful wash-up.

2017年和2013年牛市不同,BTC月线直接有效站上1.618压制线,不过后面一个月大幅回踩确认,最低插针至1.414支撑带见底回升,月线收线仍是收于1.618趋势线上方,强势洗盘后迎来了这一轮牛市后期主升浪。

Unlike in the cattle market in 2017, the BTC Moon was directly and effectively positioned on the 1.618 line of repression, although the following month was confirmed with a significant backsliding, with the minimum pin to 1.414 support belts rising back to the bottom, the lunar line remained high above the 1.618 trend line, and the late main rise in the town followed by a strong wash-up.

本轮牛市和2013年走势相似,上半年最高冲到1.618斐波线上方,不过月线收线未能站上,后面迎来中期大调整,跌破下方1.414支撑见底反弹再重新站上1.414趋势线,即便后面价格再创历史新高,不过10月和11月月线仍未能有效突破1.618压制线,然后迎来这波69000美金开始的大调整,最低插针至1.414获得支撑并快速向上回升,和2013年走势比较相似,前期牛市新一轮主升启动前,都有一个大幅回踩1.414支撑带的动作,而这波69000美金的大调整也是这种走势,后面就要观察BTC能否稳住不破并形成底部结构,那么后面就有再次向上的机会,1.414支撑带位于42000-42500美金区间,关键月线1.618压制区间61500-62000美金。

The current bull market followed a similar trend in 2013 with a peak of 1.618-F4 in the first half of the year, although the line failed to rise, followed by a major mid-term adjustment to break down 1.414 below, which supported the bottom rebound and then re-emerged on the 1.414 trend line, even though the prices of the latter had reached an all-time high, although the October and November line had not been able effectively to break through the 1.6118-strength line, and then began a major adjustment of the wave of $69,000, supported by a minimum needle of 1.414 and fast upwards, and similar to the 2013 trend, with a significant back-stamp of 1.414 before the start of the first round of the main rise of the city, which was the same movement, followed by a major adjustment of $69,000 to observe BTC's ability to stay steady and form the base structure, with a subsequent opportunity to move up again, with a 1414-st support belt located between $42000-42500 and a critical line of $61,500-618 between the stress zone of the critical period.

前期69000美金开始的这波大跌,BTC周线回踩前期突破的前顶下降趋势线,价格短时刺破在回升,周线收线仍位于该线上方,并未有效跌破,RSI指标同样完成回踩,整体属于突破回踩的范畴,同时价格也踩到了55周均线支撑,上半年BTC5月大跌,最低也是跌至55周均线一带止跌企稳,筑底后迎来了29000涨至69000美金的趋势行情。

The wave, which began with $69,000 in the previous period, went back on the front-top downward trend line of the BTC week, with a short-term spike in prices, which was still above that line and did not break down effectively, and the RSI indicator, which was in the same position as the break-down, was supported by the 55-week average, with prices falling sharply in May in the first half of the year, at a low level to the 55-week average, with a downward trend of $29,000 to $69,000 after the bottom.

历史上BTC周线一旦突破长期压制线,回踩不破后面往往都会启动新一轮行情,最近的便是去年9月的一波从12500美金跌至9800美金的调整,价格回踩前期突破的2017年牛顶和2019年牛顶的长期下降趋势线,RSI指标同样回踩不破,后面BTC在该线附近震荡1个月筑底,之后启动了本轮牛市10000涨至65000美金的主升浪。

Once the BTC perimeter has broken through the long-standing repressive line, a new round is often triggered by a backsliding, the most recent of which was the fall last September from US$ 12,500 to US$ 9,800, a fall in prices back on the front-breaking cattle peaks of 2017 and the long-term decline in cattle peaks of 2019. RSI indicators are equally unbreakable, followed by a one-month boom in BTC near the line, and a major rise in the current cattle market from US$ 10,000 to US$ 65,000.

上一轮周线较大级别的突破在2019年4月,BTC完成3个多月的底部盘整直接启动强势行情,价格从4000美金拉升至14000美金再见顶。前面还有2015年的7月,BTC周线突破后迎来回踩,确认突破有效后迎来2016-2017年的牛市行情。

In April 2019, BTC completed a three-month-long, top-of-the-line break-up, directly triggering a strong campaign, with a price of $4,000 raised to $14,000. The BTC break-in followed in July 2015 and confirmed that the breakthrough would be effective in 2016-2017.

上升趋势中突破回踩的目的一般为了洗盘震仓,为了验证前期突破的有效性,为后面进一步拉升做准备。技术图形上BTC仍处于去年312长期上行趋势通道内运行,大方向仍是震荡向上趋势,目前又在关键支撑区域迎来反弹,并且周线反包上周阴线,价格突破前顶69000美金下降趋势线,只要支撑线一带稳住不破,后面BTC就有再次筑底的可能,那么后面就有再次上攻的机会,图形上也可以看出目前走势和上方压制线构成上升三角结构,也可以看作潜在大杯柄形态,这种一般属于回撤蓄力姿态,目标还是上方压制线,蓄力突破将会迎来高强度拉升,所以支撑未破的情况下,BTC有机会在支撑线一带震荡筑底,筑底需要时间,建议多点耐心。

The aim of a break-back in the upward trend is generally to wash the tremors and to verify the effectiveness of the previous break, in preparation for further upswings. The technical graphics BTC is still running in the long-term upward trend corridor last year at 312. The big direction is still upwards, it is now rebounding in key support areas, and the edges of last week’s downward trend of $69,000 have been reversed. As long as the support line remains intact and the later BTC has the potential to build again, there is a chance to do it again, and the graphics show that the current movement and the upper pressure line constitute an upward triangle, and can also be seen as a form of potential convex, typically a recovery posture, targeting or the upper pressure line, with a build-up that will rise in intensity, so in the case of unbroken support, the BTC has the opportunity to build the bottom of the support line, which will take time to suggest a greater degree of patience.

比特币历史上已经完成3次产量减半,通过研究每次减半后这一轮牛市见顶时间和减半周期之间的关系,推算下本轮牛市见顶大概时间。

In Bitcoin's history, three halves of production have been completed, and by studying the relationship between the peak time of the bull market and the cycle of halving it each time, it is assumed that this can be the best time.

2012年11月BTC第一次减半,后面启动牛市,从减半时币价涨至本轮牛顶,区间涨幅高达95倍,用时大概368天,如果运用斐波那锲时间推算,1位置放在第一次减半时间,0位置在BTC创世区块诞生,大概在2009年1月3日,可以发现这一轮牛顶时间位于斐波点位1.3附近。

By November 2012, BTC had been halved for the first time, followed by the launch of the cattle market, with a 95-fold increase in currency prices from the one-half to the top of the current oxen, taking about 368 days. If the first-time reduction was calculated using the Fabona time frame, the first-time reduction was set at zero in the creation block of the BTC, and on 3 January 2009, it could be observed that the ox peak was located near the 1.3-point site of the Faipoon.

2016年7月BTC第二次减半,本轮牛市启动,减半价格涨至这一轮牛顶,区间涨幅高达30倍,用时大概528天,同样运用斐波回撤时间推算,1位置在第二轮减半时间,0位置在第一次减半时间,可以发现本轮牛市见顶时间在回撤1.4位置,相比之前价格波动幅度缩小,牛市周期拉长。

In July 2016, BTC was halved for the second time, the city was launched, and the price of this cow rose by half to the top of the cow, up to a 30-fold increase in the area, about 528 days, using the same method used to calculate the time of the fall of the Faipoo, which was halved for the second round and zero for the first time, and it was found that the city was at the end of the year retreating from 1.4 positions, a reduction in price volatility compared to the previous period and the length of the cow cycle.

随着BTC不断发展与成熟,整个加密市场牛市持续的时间是越来越长的,从减半完成到每一轮牛市最高点,第一轮用了一年,第二轮用了将近一年半,第三次减半到目前还不到600天时间,从时间周期上看,本轮牛市大概率还未结束。前两轮点位1.3和1.4,呈递增状态,这一轮如果是1.5的话,那么牛市见顶时间大概在2022年3月末4月初,历史当然不会简单重演,不过总是惊人相似。近期这一轮69000美金开始的大调整,BTC关键支撑依旧在发挥作用,大方向仍是多头趋势,建议多点耐心。

As the BTC continues to grow and mature, the whole of the encrypted market cow market lasts longer and longer, from halving to the highest point of each cow, the first round took almost a year and a half, the second round halves and the third to less than 600 days at present, and this is probably not the end of the cycle. The first two rounds, 1.3 and 1.4, are incremental. If the first two rounds are 1.5, the peak will probably be at the end of March 2022, and history will not be repeated, but will always be strikingly similar.

自今年5月大调整截至目前,BTC资金费率大部分时间都处于低位水平,就算前期价格创历史新高,资金费率也只是小冒头状态,和前期历史顶部相比,远未到市场疯狂做多阶段,研究下之前BTC资金费率持续低位盘整与后续价格走势之间的关系。

Since the major adjustment in May this year, the BTC funding rate has remained at a low level for most of the time. Even with the historical high of the previous period, the funding rate has been only a small pretence and is far from having reached the stage of market madness compared to the top of the previous period, and the relationship between the continued low BTC funding rate and subsequent price trends has been studied.

2018年熊市底部,BTC长时间位于3000-4000美金区间震荡筑底,资金费率也是一直低位区间震荡,经过2018年底6000跌至3000美金的一波腰斩,市场情绪普遍悲观,看空情绪高涨,情绪酝酿到极致,往往就会迎来行情拐点,后面BTC从3000美金一路涨至14000美金见顶,而这一波行情拉升初期,价格在涨到8000美金前,资金费率还是处于低位区间,直至后面价格涨至顶部区域,资金费率才升至高位,这说明在上涨初期,价格越涨,市场恐高情绪严重,那么后续行情一般是继续爆空拉升,直至到达市场狂热阶段。

At the bottom of the Bear City in 2018, BTC was located at the bottom of the 3,000-4,000-dollar zone for a long period of time, and at the same time at the lower point, after a wave of 6,000 to 3,000 dollars at the end of 2018, the market pessimism prevailed, the mood rose and the mood simmered to the extreme, and then the BTC continued to rise from $3,000 to $14,000, while at the beginning of the wave, the price rose to $8,000, and the later price rose to the top, so that the rate rose to a higher position, indicating that prices had risen in the early stages of the rise and that the market was inflamed, and that the follow-up situation generally continued to flare up until the stage of market fanaticism.

去年312大瀑布后的走势也是类似走法,瀑布后市场人心惶惶,BTC从3800美金启动,一直回升至瀑布前1万美金位置,期间资金费率基本都是低位震荡,一直拉升至12500美金阶段顶点,资金费率才开始向上冒头,不过远未到市场狂热阶段,后面迎来了一波调整,价格在10000-12000美金区间震荡2个月,充分洗盘后展开了拉升至65000美金的主升浪,拉升初期,资金费率也是一直处于低位,直至后面到达顶部区域,资金费率才升至高位,而这个时候行情见顶迎来中期大调整。

The trend following the previous year's 312 falls was similar, with the market panic following the falls, BTC starting from $3,800 and going back to the pre-waterfall position of $10,000, during which the rates were basically low and were pulled up to the peak of $12,500. The rates began to rise, but far from the period of market fanaticism, there was a wave of adjustment, with a two-month shock between $10,000 and $12,000, a full wash-up and an initial upturn of $65,000, and the rates of funding remained low until they reached the top area, at which point the rates rose to high levels, which was the time of the mid-term adjustment.

前期BTC从65000美金腰斩至30000美金一带震荡筑底,酝酿3个月后迎来了一波爆空大反弹,一路涨至53000美金再回落,后面跌至40000美金在涨至前顶69000美金迎来这波大调整,整个过程资金费率一直处于低位水平,即便BTC创历史新高,资金费率和前期顶部警戒线相比还是处于较低水平,市场远未到前期顶部狂热阶段,那么可以预测BTC目前见大顶的可能性不大,近期调整大概率还是洗盘,整体仍保持震荡向上趋势。

After three months of stunking from $65,000 to $30,000, BTC rebounded with a wave of blasts, rising to $53,000 and falling back, falling back to $40,000, rising to $69,000 to the top of the scale, and the financial rate of the entire process remained at a low level, even though BTC was at an all-time high, the rates of funding were still at a low level compared to the top of the front, and the market was far from reaching the height of the previous period, so it could be predicted that BTC was less likely to be at the top of the scale at the moment, and that the latest adjustment was likely to be shuffling and the overall upward trend was maintained.

2013年牛市行情,本轮牛市BTC走二顶行情,年中有一波大幅度的调整,调整幅度高达80%,很多人都以为牛市结束了,后面BTC超跌反弹再回落探底,后面震荡回升完成V形反转,然后展开新一轮主升浪,价格从这波调整最低点到牛市顶点再涨22倍,这波大幅度调整低点刚好回踩0.5趋势线,2011年牛顶也在0.5趋势线上,强势洗盘后BTC一路涨至本轮牛顶1位置一带,价格在此见终极大顶。

In 2013, the BTC of the city went two steps, with a wave of major adjustments of up to 80 per cent in the middle of the year. Many people thought that the market was over, followed by a super-shock of BTC, followed by a rebound of shock to complete the V-shaped reversal, followed by a new wave of main rises, from the lowest point of the wave to the peak of the city, which rose 22 times more. The wave of large adjustments was just back on the 0.5 trend line, and in 2011 the top of the cow was also on the 0.5 trend line, with BTC rising all the way to the top of the wheel after a powerful shuffle, where prices rose to one of the top.

2017年牛市行情,可以发现这一轮牛市和之前13年牛市走势类似,前期从最低点一路拉升,中间同样迎来了一波大幅度调整,调整低点位置也刚好位于0.5回撤线一带,2013年牛顶也在该趋势线上,后面BTC反身向上快速拉升继续牛市新高走势,在本轮牛市最后阶段,价格也是攀升至1位置附近再回落,整体走势和13年基本相似。

In 2017, a similar trend was observed in the bull market to that of the previous 13 years, with the previous period rising from the lowest point, with a similar wave of radical adjustments occurring in the middle, where the low point was located just along the 0.5-roll-back line, where the top of the bull was also on the trend in 2013, followed by a rapid upturn in the back of the BTC, which continued the new upturn in the bull market, and a fall in prices near position 1 in the final phase of the current bull market, where the overall trend was similar to that of the 13-year period.

目前这一轮牛市,BTC从3800美金启动一路拉升,期间并未出现像样的深度调整,后面便迎来了这波65000美金跌至30000美金的大调整,幅度比17年大,比不上13年,同样很多人认为牛市结束了,不过这波调整低点同样在斐波0.5趋势线获得支撑,前期1月也有过一次突破回踩,不过属于突破立即回踩,上升空间并未拉大,所以调整力度也一般,达不到强势洗盘的目的,这一次拉高再强势下杀的效果明显强很多,从成交量可以看出,包括近期这波69000美金开始的大调整,最大跌幅达到44%,也未跌破0.5趋势线支撑。

At this point in time, BTC began to pull up from $3,800 without a decent amount of depth adjustment, followed by a massive adjustment of $65,000 to $30,000, which was 17 years larger than that of 13 years, according to many, but also supported by a 0.5 trend line in the Faibo, with a breakthrough in the previous period in January, but with an immediate step back and no room for upscaling, the adjustment was generally less than the purpose of a powerful wash, and the impact of this drop was significantly greater, as can be seen from the scale of the round, including the recent major adjustment of $69,000, which had begun, with a maximum drop of 44 per cent, and did not break the 0.5 trend line.

前面两轮牛市,BTC调整至这一带止跌回升,后面爆发更疯狂的上涨。这一轮牛市BTC也是调整至这一带企稳筑底,后面一路震荡向上并创历史新高,所以前期这波大调整是很好的低吸机会,近期调整也未破0.5支撑线,前期牛市只要站上再未跌破,牛市顶部均能达到1位置高度,目前距离上方1位置空间还很大,这一轮牛市上涨速度放缓,不过大方向仍是多头趋势,目前判定牛市结束还早。

In the first two oxen, BTC has regressed to this area, with a much more insane rise. This oxen BTC has also been regressed to the bottom of the zone, with a back shock upwards and historic heights. The previous wave was a good low-sniff opportunity, and the recent adjustment has not broken the 0.5 support line. As long as the first ox has not fallen, the top of the ox market will be able to reach a level of one position, and there is still much room for one position above it. The growth of the oxen market has slowed, although the main direction is still a multi-head trend, and it is still too early to conclude the ox market.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论