打响第一枪!币圈交易所交易费率实质与各家对比丨TokenData 数字货币交易所的实质是“商”不是“所”。换句话说,名为“交易所”,干的是券商的活。也许你会说,这个市场还有点像“外汇”。...

资讯 2024-06-29 阅读:163 评论:0也许你会说,这个市场还有点像“外汇”。那么,你需要知道,福汇和嘉盛这两大外汇交易平台也只是外汇经纪商。

Maybe you'll say that this market is a little bit like a foreign exchange. So, you need to know that two major foreign exchange trading platforms, Fukuoka and Giraffe, are just foreign exchange brokers.

现在,几乎所有人都心知肚明,2018年将掀起各类数字货币交易所新一轮的洗牌,竞争将纵深发展。根据coinmarket数据显示,截至到2018年5月8日,运营中并有交易量的“数字货币券商”已经达到212家。

Today, almost everyone knows that a new round of shuffling will be launched in 2018 for all kinds of digital money exchanges, and that competition will grow deep. According to coinmarket data, as of 8 May 2018, there were 212 “digital money coupons” operating and traded.

那么,作为数字货币券商现金奶牛的币圈经纪业务(手续费、保证金交易等),未来会不会重演证券行业的佣金价格战?本文还对比了前20大数字货币交易平台的费率,值得你关注,因为这与你的利益密切相关。

So, is there any future re-entry of the commission price battles in the securities industry as a cash cow broker for digital money coupons (e.g. fees, bonds, etc.)? This paper also compares the rates of the top 20 digital money trading platforms, which are of interest to you, as it is closely related to your interests.

指导 |沁雨

Guidance, rain, rain, rain, rain, rain, rain, rain, rain, rain, rain, rain, rain, rain, rain, rain, rain, rain, rain, rain, rain, rain, rain, rain, rain, rain, rain, rain, rain, rain, rain, rain, rain, rain, rain, rain, rain, rain, rain, rain, rain, rain, rain, rain, rain, rain, rain, rain

耳朵财经分析师 |孟江东 洪福川

He's a financial analyst.

数字货币券商经纪业务的四大组成

数字货币券商经纪业务的主要组成是:

The main components of the brokering of digital money vouchers are:

1、OTC交易换筹手续费。由于币币交易已成主流,大部分人民币交易者在进入加密货币市场时,需要通过OTC来换取本位币如BTC、ETH或者USDT,有的平台会在这一环节收取费用,还有的平台采取免费形式吸引用户。

1, OTC transaction exchange fees. As currency transactions become mainstream, most RMB traders need to enter the encrypted currency market through OTC in exchange for local currency such as BTC, ETH or USDT, some platforms will charge fees in this connection, and others will be free of charge to attract users.

2、场内交易手续费。这个很好理解,进入场内进行币币交易时,交易所抽取的手续费用,而影响手续费高低的主要因素是订单种类和交易平台。

2, in-house transaction fees. is a good understanding. When currency transactions are carried out at entry sites, the transaction costs are extracted by the exchange, while the main factors affecting the high transaction costs are the type of order and the trading platform.

3、保证金利息,包括期货、杠杆交易、融币等,本质是信用交易产生的利息。参与保证金交易的投资者需要支付相应的利息,而所需缴纳的利息和杠杆、利率、周期有关。在这方面,有的交易平台采取浮动利率,有的交易平台采取固定利率,针对大额保证金交易还会推出优惠利率。

3, interest on bonds, including futures, leverage transactions, currency-melting, etc., is essentially interest generated by credit transactions. investors involved in bond transactions are required to pay the corresponding interest, and the interest and leverage required, interest rates, and cycles are associated.

4、提币手续费。在证券市场,将资金划出账户需要通过银证转账来完成,而在数字货币交易平台,提币行为仍需要通过交易平台来完成,具备中介性质,因此这部分也被归为“经纪业务”。注意,这部分费率有可能很高,甚至存在成本转嫁的情况。

4, billing fees. In the securities market, the transfer of funds out of the account is done by means of a silver certificate, while in the digital currency trading platform, the act of drawing money still needs to be done through a trading platform and is intermediary in nature, so this part is also classified as a “brokering business”. Note that this part of the rate is likely to be high, even with a transfer of costs.

这四块基本组成了现在数字货币券商的经纪业务。当然,上币费带来的利润诚然可观,但这里将它归为投资银行业务,并未计入经纪业务。

These four make up basically the brokerage business of the current digital voucher dealers. Of course, the profits from the upper currency fee are significant, but here it is classified as an investment banking business and is not included in the brokerage business.

接下来我们会针对24小时交易量排名前20的交易平台,根据上述四大类收费情况进行统计并比较,以供投资者参考。

This will be followed by a round-the-clock trading platform of top 20 transactions, which will be measured and compared against the four categories of fees mentioned above for the information of investors.

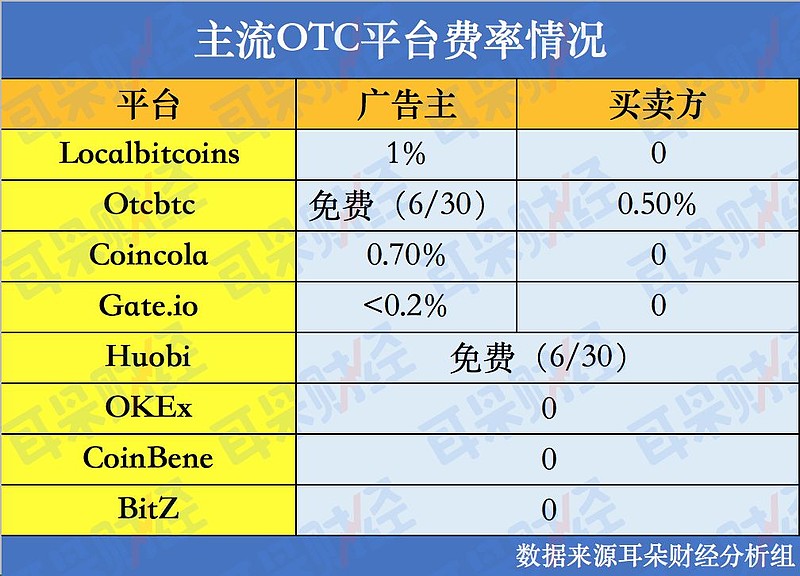

主流OTC平台费率比较

由于OTC平台信息不透明,这里只能针对主流OTC平台进行统计和比较。

Since the information on the OTC platform is not transparent, statistics and comparisons can be made only for the mainstream OTC platform.

目前,主流的OTC交易平台有6家:OKEx、Huobo、Gateio、Conicola、Otcbtc、Localbitcoins。

Currently, there are six mainstream OTC trading platforms: OKEx, Huobo, Gateio, Conicola, Otcbtc, Localbitcoins.

有意思的是,这里存在两种收费模式,一种是广告信息展示费,也就是针对发布买卖信息及兑换比例的广告方进行收费,这是主流;另一种是买卖双方成交手续费,但目前为止,这6家只有1家是收取手续费的。

Interestingly, there are two types of fees, one for advertising information displays, that is, for advertising parties that publish sales information and exchange rates, which is the mainstream, and the other for both buyers and sellers to pay fees, but so far only one of the six has been charged.

(在6月30号前,OTCBTC广告展示免费,Huobi则完全免费)

(在6月30号前,OTCBTC广告展示免费,Huobi则完全免费)

不论OTC平台使用何种形式收费,抽取的这部分费用是根据成交总额来计提的,而OTC交易额和溢价是影响其的主要因素。投资者需要注意,OTC交易溢价是数字货币市场的晴雨表之一,在交易热度较低的情况下,溢价范围为5%-10%,而当市场交易火爆时OTC的溢价经常高达20%-50%。

Regardless of the form of fees used by the OTC platform, this portion of the cost is calculated on the basis of the total amount paid, and the OTC transaction value and premium are the main factors affecting it. Investors need to note that the OTC trade premium is one of the barometers of the digital currency market, with a premium range of 5-10 per cent in the case of low transaction heat, while the OTC premium is often as high as 20-50 per cent when the market trade explodes.

场内交易手续费率横向对比

对于人民币玩家来说,场内交易就是币币交易。

For RMB players, on-site transactions are currency transactions.

币币交易涉及三种订单类型:限价单、止损单和市价单。

Currency transactions involve three types of purchase orders: limited orders, stop orders and market orders.

限价单和止损单的本质上是一种委托,无法立刻成交,对于交易平台而言,这两种单统称“挂单”。在大多数时情况下,挂单的手续费偏低,并且不成交时不产生交易手续费。

In essence, a price-limit and a loss order is a commission that cannot be concluded immediately, both of which, for a trading platform, are collectively referred to as “separation orders”. In most cases, the billing fee is low and the transaction fee is not incurred when the transaction is not made.

市价单是指按市价(可能存在滑点)买卖,可以立即成交的单子,对于交易平台而言,因为这种单子直接触发买一或卖一,而称它为“吃单”。相对于挂单的手续费,吃单的手续费是偏高的。

A market order refers to a purchase and sale at market value (which may have a slide point) that can be concluded immediately, for a trading platform, because it directly triggers the purchase or sale of one, which it is called a “show-eating”. The bill-eating fee is higher than the bill-loading fee.

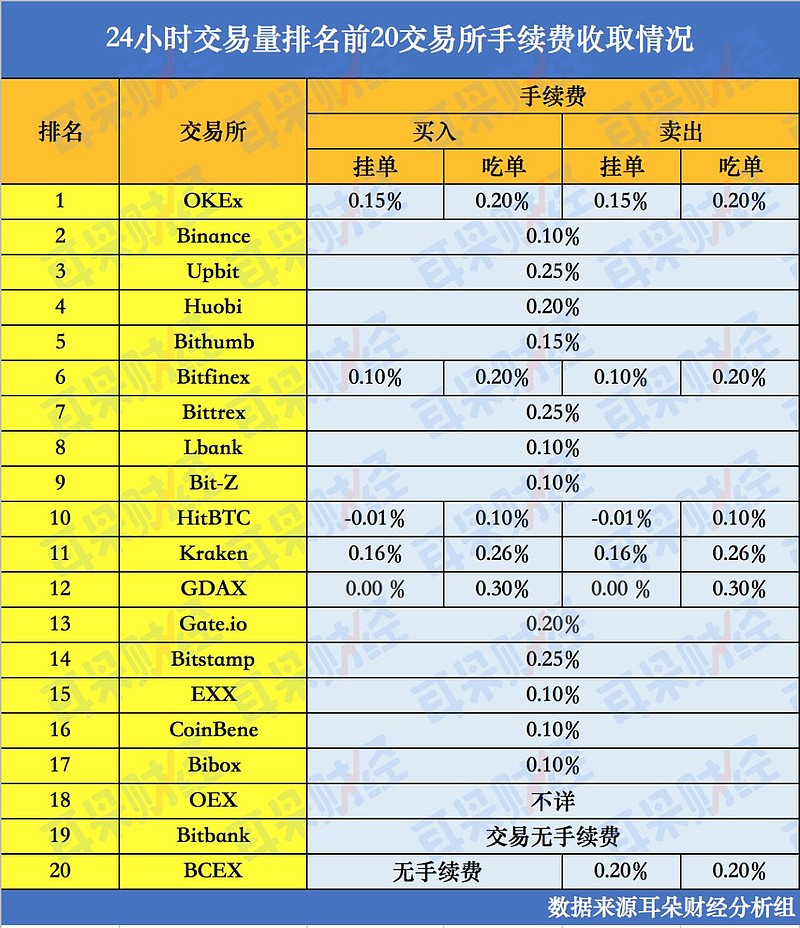

下图是24小时交易量排行前20交易平台的手续费情况,从数据中我们可以看出,交易量最高的OKEX,手续费在业内处于中间水平。而排名第二的币安,手续费相对低廉,这对于吸引新用户很有帮助。

The figure below shows the charges for the top 20 trading platforms in 24 hours, where we can see that the highest volume of transactions, OKEX, is in the middle of the industry. The second-ranking currency security, with relatively low fees, helps to attract new users.

要注意的是,这里有些特别的现象:在GDAX,挂单不收取手续费,吃单却要收取高达0.3%,这说明平台鼓励进行挂单交易,而对进行吃单操作的人收取偏高的手续费用,以抑制成单数量;Bitbank,无论哪种订单,都不收取手续费;HitBTC,如果投资者采取挂单操作并且成交,还会受到平台返还0.1%的资金奖励。

It should be noted that there are some special phenomena: in GDAX, the billing is charged up to 0.3 per cent without fees, which means that the platform encourages booking transactions and imposes a high fee on those who do so in order to curb the number of orders; Bitbank, regardless of the order, does not charge a fee; and HitBTC, where investors are offered a financial reward of 0.1 per cent for the return of funds from the platform if the order is signed and paid.

这或许可以揭示一个事实,现阶段绝大多数平台倾向于投资者进行挂单成交。

This may reveal the fact that, at this stage, the vast majority of platforms favour single deals with investors.

保证金利率对比

在保证金交易中,投资者可以选择1-10倍杠杆不等。

In bond transactions, investors can choose between 1 and 10 times the leverage.

比如数字货币的期货交易,对不同的合约期限与交割时间进行了设定。一些传统的交易所,如芝商所也开启了比特币的期货交易,不失为传统金融业试的先锋。

For example, futures transactions in digital currencies set different contractual terms and delivery times. Some traditional exchanges, such as the cheese shop, have also opened futures transactions in bitcoin, which are the vanguards of traditional financial experiments.

还有融币,可以类比股市中的“融券”,是指投资者向平台借入数字货币进行交易,并为此支付利息。

There are also monetized currencies, which can be compared to “merger bonds” in the stock market, where investors borrow digital currencies from the platform and pay interest for them.

由于前20家交易平台只有5家开设了保证金交易,这里只能针对这前5名进行比较:

Since only five of the top 20 trading platforms have a bond deal, only the top five can be compared here:

HUOBI和BITFINEX的杠杆倍数是比较保守的,虽然不高,但对于投资者来说不会很容易爆仓,造成重大的损失。

The leverage multipliers for HUOBI and BITFINEX are conservative and, although not high, they are not likely to explode easily for investors, causing significant losses.

OKEX的杠杆交易最为人诟病,却可以看到,它提供的杠杆上限是20倍,并不是市场最高的(最高的BITMEX提供高达100倍杠杆),但其提供的杠杆下限要超过了其他四家。此外,据媒体报道称,OKEX在保证金交易上添加了自动追加保证金功能,这在某些特殊情况下功能会失灵,这点尤为注意。

The leverage trade of OKEX is the most vexing, but it provides a 20-fold leverage ceiling, not the highest in the market (the highest BITMEX provides up to 100-fold leverage), but it provides leverage at a lower limit than the other four. Moreover, according to media reports, OKEX adds an automatic additional bond function to the bond transaction, which in some particular cases is not working.

值得注意的是,KRAKEN在杠杆交易中设置了4小时浮动利率,这在一定程度上提示投资者尽可能在4小时内进行结算,否则将缴纳更多利息。

It is worth noting that KRAKEN has set a floating interest rate of four hours in leverage transactions, which to some extent suggests that investors should settle within as many hours as possible, otherwise more interest will be paid.

提币费:小心!免费手续费的成本转嫁

因为提币的过程仍有交易平台介入,而这一环节,绝大多数交易平台都采取了收费态度。

Because the process of raising currency still involves trading platforms, the vast majority of trading platforms take a fee-based approach at this point.

注意,可能有的交易平台在某些时期会推出免手续费活动,但羊毛出在羊身上,成本最终会转嫁到提币费上。

Note that potential trading platforms may introduce fee-free activities at certain times, but the wool is on the sheep and the costs are ultimately passed on to the fee.

比如之前提到免手续费的平台“Bitbank”,在某些币种上,它的提币费就要高于正常收取手续费的“Bitfinex”,甚至1倍不止。

For example, the platform “Bitbank”, previously mentioned as exempting fees, would in some currencies raise more than “Bitfinex”, or even more than one times the normal charge.

在这一块,耳朵财经分析组也有进行最后的统计,在这里仅提供前10大交易平台的提币费用情况。如想获得前20大交易平台提币费用统计,请关注耳朵财经(ID:erduomi),并向后台发送“q20”,即可获得全部提币费统计情况。

In this section, the Ear Financial Analysis Group also carries out final statistics, and here only provides information on the cost of the first 10 trading platforms. If you want to get the cost of the first 20 trading platforms, pay attention to the Ear Finance (ID:erduomi) and send “q20” to the back desk, which will provide the full amount of money.

综上所述,我们可以看到Binance的各项交易费率都很低廉,再结合它平台自身丰富的Token种类,以及无杠杆环境比较适合刚入圈的投资者进行交易。其次,Bitfinex交易所以多样化功能和钱包和订单设置,以及活跃的成交量而颇受好评,比较适合一些资深的投资者进行交易,提供了很强的交易便利。

On the basis of the above, we can see that Binance’s trading rates are very low, combining its platform’s rich Token variety with the non-leveraging environment that is more suitable for entering investors. Secondly, the Bitfinex Exchange is well rated for its diverse functions and wallets and order setting, as well as for its dynamic turnover, and is more suitable for dealing with some senior investors, providing a strong trade facility.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论