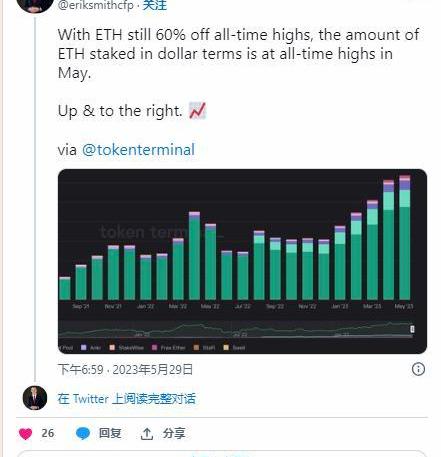

自上个月Shapella升级上线以来,加密领域的用户对以太坊质押表现出了浓厚的兴趣。在成功测试提款流程后,用户已返回重新质押他们的ETH。根据一位投资专家的推文,与流动性质押提供商锁定的ETH在5月份达到了历史新高,这是连续第五个月增长。这一轨迹最令人印象深刻的方面是,尽管ETH的价格仍比其2021年11月的峰值低60%,但质押越来越受欢迎。

Since Sharpella's upgrade last month, users in the field of encryption have shown a keen interest in Ether's pledge. After successful testing of the withdrawal process, users have returned to their ETHs. According to an investment expert's tweet, the ETHs targeted by mobile grantors reached an all-time high in May, a fifth consecutive month of growth. The most impressive aspect of this trajectory is that, although prices are still 60% lower than their peak in November 2021, they are increasingly popular.

事关重大

is important

根据Nansen仪表板,在撰写本文时,Beacon链上抵押的ETH数量已飙升至2160万个ETH,比4月12日Shapella升级期间增长了11%。即使在过去的24小时内,也有47kETH的净存款,这表明用户对质押机制更有信心。

According to the Nansen dashboard, at the time of writing, the number of ETHs held on the Beacon chain had jumped to 21.6 million, an 11% increase over the April 12 upgrade of Shapeella. Even in the last 24 hours, there were net deposits of 47KETH, indicating greater confidence on the part of users in the pledge mechanism.

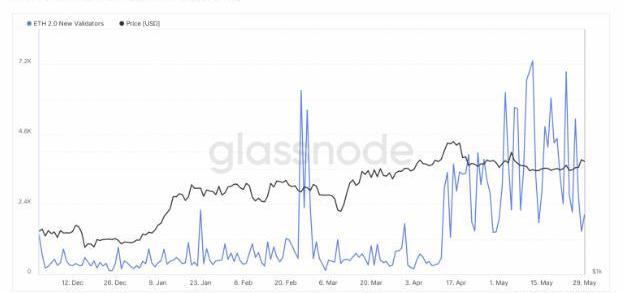

新存款地址的增长也反映了对质押的兴趣。根据Glassnode,在以太坊智能合约中锁定32ETH的新验证者数量在5月份大幅增加。

The increase in the number of new deposit addresses also reflects interest in pledges. According to Glasnode, the number of new certifications that lock 32ETH in the Ethernode intellectual contract increased significantly in May.

Shapeshift创始人:比特币和以太坊是未来金融体系的组成部分:金色财经报道,数字资产交易平台Shapeshift创始人兼首席执行官Erik Voorhees发推文称,在接下来的几个月里,黄金、比特币和以太坊都将上涨,因为它们是未来金融体系的组成部分和补充。三者没有一个具有其他两个的精确属性。它们都是市场的产物,都与法币相对立。[2020/7/28]

Founder of Shapeshift: Bitcoin and Etheria are an integral part of the future financial system: Gold Book reports, by Erik Voorhees, founder and CEO of the digital asset trading platform Shapeshift, that gold, bitcoin and Etheria will rise in the coming months because they are part of and complement the future financial system. None of the three have the exact attributes of the other two. They are the product of the market and are all against the French currency. [2020/7/28]

Stakers表现出信心

Stakers showed confidence.

与对抛售的担忧相反,ETH在升级后的第一周内上涨了13%,突破了2000美元的水平。然而,更广泛的市场状况缩短了涨势,ETH在过去三周内一直停留在1800美元区域。

Contrary to concerns about the sale, the ETH rose by 13 per cent in the first week of the upgrade, exceeding the level of $2,000. However, the broader market situation reduced the upturn, with ETH remaining in the 1800-dollar area over the past three weeks.

结果,根据从Dune仪表板获取的数据,超过60%的质押者因为将ETH锁定在网络上而蒙受损失。在2021年牛市的高峰期,很多这种质押发生在1,600美元到3,500美元之间。

As a result, according to data obtained from Dune dashboards, more than 60% of the pledgeers suffered from locking the ETH on the Internet. During the peak of the cattle market in 2021, many of these pledges took place between US$ 1,600 and US$ 3,500.

价格的稳步下跌可能会导致保守的利益相关者撤回他们的股份并在市场上兑现。然而,他们目前的趋势与这种说法背道而驰。

A steady fall in prices could lead conservative stakeholders to withdraw their shares and cash them in the market. Their current trend, however, runs counter to this assertion.

ETH会受到更多关注吗?

Is ETH getting more attention?

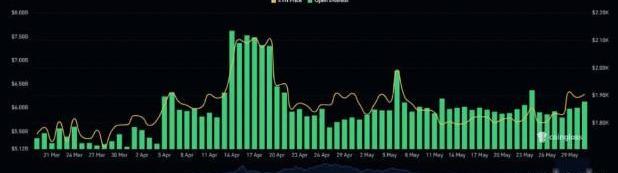

根据Coinglass的说法,就对ETH期货的需求而言,未平仓合约(OI)的名义价值在过去几天持平,这表明按市值计算的第二大山寨币的投机兴趣低迷。但是,在过去24小时内观察到略有上升。

According to Coinglass, in terms of demand for ETH futures, the nominal value of the unaltered contract (OI) has been flat in the past few days, indicating a low interest in speculation in the second largest mountain currency in terms of market value. However, a slight increase has been observed in the last 24 hours.

随着ETH多头头寸数量的增加,这一飙升吸引了看涨杠杆交易者转向ETH。

With the increase in the number of ETH multi-head positions, this surge has attracted a shift to ETH by those looking at increased leverage traders.

标签:ETHGLASSSHAPELethical怎么记OurGlassshadowcoinSPELL币

Label: ETH

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论