比特币优势是比特币优势指数,用于衡量比特币市值占加密货币市场总资本的比例。 Jimmy Song 是第一个提出这个指数的人,他是一位比特币开发者。该指数的最初想法是为了说明市场上市值最大的加密货币的规模。

当比特币主导度较高时,对比特币的需求大于市场平均水平;相反,山寨币的平均需求越高,BTC 的主导地位就越低。

比特币的高主导地位也表明加密货币投资者倾向于安全投资;而不是持有市值较小、风险较大、流动性低于BTC的数字资产。

公式:比特币市值/总市值x 100%

Formula: Bitcoin market value/total market value x 100 per cent

计算比特币主导地位的公式

例如,如果比特币市值达到 80 亿美元,所有山寨币加起来为 30 亿美元,则比特币优势指数为:

For example, if the market value of the bitcoin is $8 billion and all the hedges add up to $3 billion, the bitcoin advantage index is:

BTC 主导地位=8/ (8+3) x 100%=72.7%

BTC dominance = 8(8+3) x 100% = 72.7%

从这里可以看出,BTC Dominance 清楚地显示了比特币在整个市场以及其他山寨币中的规模。

As can be seen here, BTC Dominance clearly shows the size of Bitcoin in the market as a whole and in other bounties. & nbsp;

#第一的。比特币主导地位与总市值之间的关系

# First. The relationship between bitcoin dominance and total market value

从比特币主导度的计算公式可以看出,发挥关键作用的因素是:比特币市值和市值。观察比特币的主导地位意味着我们正在观察价格和整体市值。

As can be seen from the formula of Bitcoin dominance, the factors that play a key role are the market value and market value of bitcoin. Observing bitcoin dominance means that we are looking at prices and overall market value. & nbsp;

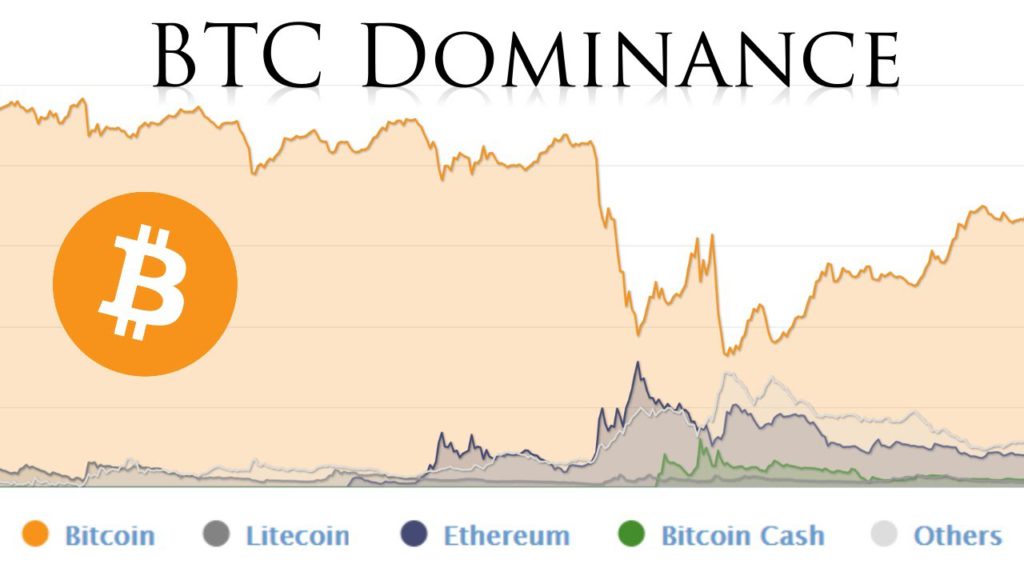

比特币是这一领域的先驱,2017年是多个币种同时ICO的转折点,市值大幅上升,比特币的主导地位也急剧下降。 2017年,比特币的涨幅也创历史新高,但为什么BTC的统治力却下降了呢?其他山寨币的增长率是多少?

Bitcoin was a pioneer in this area, and in 2017 was a turning point for multiple currencies and at the same time for the ICO, with a sharp increase in market value and a sharp decline in Bitcoin’s dominant position. In 2017, Bitcoin rose at an all-time high, but why did BTC’s dominance decline?

例如:BTC达到10,000美元到30,000美元,涨幅为300%;但其他山寨币从 1 美元涨到 5 美元,上涨了 500%;一系列山寨币一起上涨,导致BTC的统治力下降,而BTC的价值却在上升。

For example: BTC reached US$ 10,000 to US$ 30,000, an increase of 300 per cent; others rose from US$ 1 to US$ 5, an increase of 500 per cent; a series of bounties rose together, leading to a decline in BTC’s dominance while BTC’s value was rising. & nbsp;

#2.山寨币季节

#2. Monument season

随着比特币主导地位的下降,山寨币季节的迹象开始出现。这个术语描述了另类加密资产获得投资者强烈兴趣的时期。山寨币的价值在几周内 可以增长 5 倍、10倍。

The term describes the period when alternative encrypted assets gain strong investor interest. In a few weeks, the value of the bounties & nbsp; it can grow by 5 times and 10 times.

2020年,以太坊2.0的推出,给DeFi市场带来了兴奋。去年 11 月比特币价格的演变也是今年新的山寨币季节的开始按钮。最近,BTC 在重返 2017 年峰值的竞争中也出现下滑。“山寨币季节”一词诞生于当时出现与 2020 年类似的价格走势时。

In 2020, the introduction of Taiyo 2.0 gave rise to excitement in the DeFi market. Last November, the evolution of Bitcoin prices was also the starting button for this year’s new mountain season. Recently, the BTC also fell in competition to return to its 2017 peak.

加密市场见证了比特币上涨趋势的结束,投资者开始寻找其他山寨币来掀起新一波浪潮。

The encryption market witnessed the end of the surge in bitcoin, and investors started looking for other bounties to start a new wave. & nbsp;

结合比特币价格走势和比特币优势指数的分析,投资者将针对每种情况制定具体的交易策略:

In conjunction with the analysis of the Bitcoin price trends and the Bitcoin advantage index, investors will develop specific transaction strategies for each case:

例如:当BTC Dominance增加时,比特币价格就会上涨;投资者应该购买比特币来获利;或者那些囤积比特币的人可能会考虑在不久的将来获利了结。该策略对于交易者、持有者或衍生品交易都很灵活。

For example: when BTC Dominance increases, the price of bitcoins rises; investors should buy bitcoins for profit; or those who hoard bitcoins may consider profiting in the near future. The strategy is flexible for traders, holders, or derivatives.

例如,如果您是一名交易者,注意到 BTC Dominance 呈上升趋势,并且比特币价格也呈上升趋势,您可以预测未来比特币价格将继续上涨。交易者倾向于青睐多头头寸。

For example, if you are a dealer, you can predict that the price of bitcoin will continue to rise in the future, noting the upward trend in BTC Dominance and the upward trend in bitcoin prices.

比特币主导地位是衡量加密货币总市值(包括比特币)的指标;从而帮助投资者了解比特币和山寨币的趋势。投资者可以判断比特币或山寨币是否占主导地位:

The dominance of bitcoins is an indicator of the total market value of encrypted currencies (including bitcoins) and thus helps investors understand the trends of bitcoins and mountain coins. Investors can judge whether bitcoins or mountaincoins dominate:

当 BTC 主导地位增加且市值保持不变时,山寨币往往会下跌

When BTC's dominant position increases and the market value remains constant, mountain coins tend to fall.

当 BTC 主导地位下降且市值保持不变时,山寨币往往会上涨

When BTC's dominant position falls and the market value remains the same, mountain coins tend to rise.

当 BTC Dominance 和山寨币相互对抗时,投资者会观察资金流向每个特定对象;从那里,得出有关其余主题的价格发展的结论。

When BTC Dominance and Molotov cocktails compete with each other, investors observe the flow of funds to each particular target; from there, they draw conclusions about price developments on the remaining subjects. & nbsp;

应用BTC优势指数分析比特币价格和加密市场

Analysis of bitcoin prices and encryption markets using BTC Stimulus Index

比特币是市场上最大的货币,因此如果比特币发生任何事情,市场不会受到影响。 BTC Dominance有助于衡量比特币的影响力,因此对市场来说也极其重要。

Bitcoin is the largest currency on the market, so if anything happens to bitcoin, the market will not be affected. BTC Dominance helps to measure Bitcoin’s influence, and is therefore extremely important to the market.

市场结果将围绕 4 种情况展开:

The market results will be organized around four scenarios:

由于BTC价格上涨,BTC Dominance成比例增加,导致整个市场上涨。目前的情况是最好的,价格的健康上涨正在重拾市场信心。这意味着来自外部的现金流导致总资本增加。

As a result of the BTC price increase, BTC Dominance has increased proportionally, leading to an increase in the market as a whole. The best case is now, and the healthy price increase is regaining market confidence. This means that cash flows from outside have led to an increase in total capital. & nbsp;

由于BTC价格下跌,BTC主导地位下降,导致市场暴跌。最终的结果是市场下跌、流动性差和价格暴跌。

As BTC prices fell, BTC dominated the decline, leading to a collapse in the market. The end result was a fall in markets, poor liquidity and a sharp fall in prices. & nbsp;

BTC 主导地位上升,山寨币主导地位下降;山寨币的现金流将转向比特币。这意味着外部资金流入市场,但仅流入比特币。

The BTC’s dominant position has risen, and the mountain coin’s dominant position has declined; the cash flow of the mountain coins will shift to bitcoin. This means that external capital flows to the market, but only to bitcoin.

BTC 主导地位下降,山寨币主导地位增加。 BTC横盘整理;为上升趋势做好准备。当这种情况发生时,将会出现“红色山寨币”浪潮。

BTC’s dominant position is declining, and the dominant position is increasing. BTC is organized across the board; it is prepared to rise. When this happens, there will be a wave of “red mountain currency”. & nbsp;

BTC主导地位的未来

Future of BTC dominance

DeFi 将通过许多潜在项目挑战比特币的主导地位,帮助改变世界金融。以太坊——比特币最大的竞争对手正在逐渐升级和改变,朝着从工作量证明转向权益证明的方向发展。这是对比特币统治地位的重大威胁。ETH仍然是第二大加密货币公司,并在 2020 年稳步增长,占加密货币总市值的 7%,半年内达到 10%。

DeFi will help to change world finance by challenging the dominance of Bitcoin through a number of potential projects. The Etherno-bitcoin’s largest competitor is gradually escalating and changing, moving from proof of workload to proof of equity. This is a major threat to the dominance of Bitcoin. The ETH remains the second largest cryptographic currency company, growing steadily in 2020, accounting for 7% of the total market value of encrypted money, and 10% in six months.

在以太坊平台上使用 ERC-20、ERC-721 或 ERC 1155 代币的区块链应用程序允许不同区块链系统之间进行交互。随着应用价值的增加,以太坊区块链的价值也随之增加。如果比特币无法参与这种强劲增长,它将受到威胁。

A block chain application using ERC-20, ERC-721 or ERC 1155 on the ETA platform allows interaction between the different block chain systems. As the application value increases, so does the value of the ETA block chain. If Bitcoin is unable to participate in this robust growth, it will be threatened. & nbsp;

比特币的主导地位可能会下降,但投资者仍然感兴趣。比特币在短期内仍然是一种可靠的避险资产。然而,未来是一个很难回答的预测。

Bitcoin is likely to fall in dominance, but investors are still interested. Bitcoin is still a reliable hedge asset in the short term. However, the future is a difficult forecast.

应对 BTC 主导地位的发展

Responding to BTC's dominant development

随着市值的增加,山寨币的比例下降;目前最佳的盈利机会是关注比特币。投资比例取决于投资者的风险承受能力。根据新闻因素输入订单。

As the market value increases, the proportion of bounties decreases; the best chance to make a profit is to focus on bitcoins. The proportion of investments depends on the risk tolerance of investors.

当市值下降、山寨币暴跌时,投资者会考虑决定是否参与市场。作为头寸投资者或持有者,熊市不是问题。

When the market value falls and the money falls, investors consider whether to participate in the market. As a position investor or holder, Bear City is not a problem. & nbsp;

当市值下降而山寨币上涨时,投资者可以灵活地将其投资组合转换为加密货币交易所上的其他另类资产。

Investors have the flexibility to convert their portfolios into other alternative assets on an encrypted currency exchange when the market value falls and the price of the hedges rises.

当市值和山寨币同时增长时,投资者需要考虑哪种山寨币的增长率最稳定,风险也最大。

When the market value increases at the same time as the mountain coins, investors need to consider which of them is the most stable and risky. & nbsp;

如果BTC Dominance下降,投资者还应该遵守说明以做出最终决定。

If BTC Dominance declines, investors should also follow instructions to make a final decision. & nbsp;

以上是为对加密货币市场感兴趣的投资者提供的有关比特币价值的分享。希望这些分享能够帮助您了解市场概况,并为您投资市场提供额外的基础。当然,本文并不是为了鼓励买卖数字货币。只有当你拥有充分的知识并为自己配备了坚实的形象时才进行投资。

This is about sharing the value of bitcoins with investors interested in the crypto-currency market. It is hoped that these sharings will help you understand the market profile and provide an additional basis for your investment in the market. Of course, this paper is not intended to encourage the purchase and sale of digital money. Investment is only made when you have sufficient knowledge and have a solid image of yourself.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论