近期的币圈似乎又开始变得不平静了。

近期的币圈似乎又开始变得不平静了。

the recent currency ring seems to be starting to get restless again.

the recent currency ring seems to be starting to get restless again.

前不久有大佬花了3000万跟巴菲特吃饭;昨晚,又有消息公布币圈大佬去世,年仅42岁。

Not long ago, the big man spent 30 million to eat with Buffett; last night, news came out that the big guy in the ring died and was only 42 years old.

事实上,这位币圈大佬并不是简单的逝世,而是自杀。

In fact, the ringer didn't just die, but committed suicide.

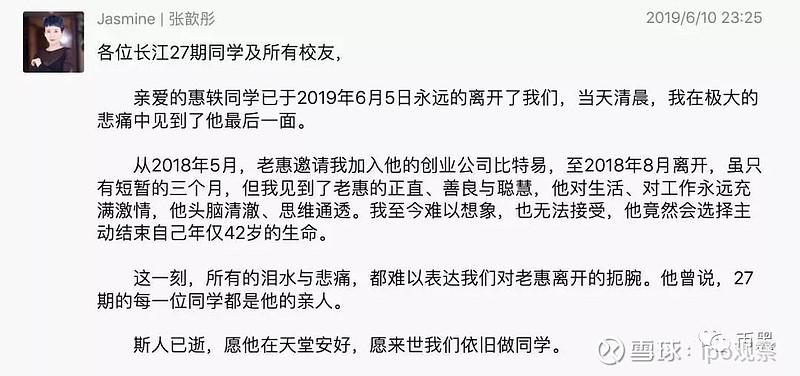

数字货币市场分析公司比特易创始人惠轶于2019年6月5日逝世,其前比特易合伙人张歆彤在“长江EMABA27官群”发文证实上述信息。

The founder of Digital Money Market Analysis, Huixiang, died on 5 June 2019, and his former partner, Zhang, confirmed this information in a communication from the “EMAA27 Group of Officials of the Yangtze River”.

张歆彤在悼念惠轶的朋友圈中写道:“从2018年5月,老惠邀请我加入他的创业公司比特易,至2018年8月离开,虽只有短暂3个月时间,但我见到了老惠的正直、善良与聪慧,他对生活、对工作永远充满激情,他头脑清澈、思维通透。”

“From May 2018, he invited me to join his start-up company, Bitley, to leave in August 2018, for a short period of three months, but I saw his integrity, goodness and wisdom, his passion for life, his work forever, his clear-mindedness and his full sense of thought”.

惠轶是谁?

惠轶是谁?

Hyeon?

Hyeon?

公开资料显示,惠轶,2003年毕业于中国科技大学,长江商学院EMBA,曾担任IBM中国研究中心高级研究员,Microsoft高级产品经理。更是在智能硬件、互联网金融等多个领域创办多家公司。

According to public sources, Huixiang graduated from the Chinese University of Science and Technology in 2003 as EMBA, a senior product manager at IBM Chinese research centre, 比特易是什么?

what's a bit easier?

what's a bit easier?

确实!比特易这个币圈的产品很多人可能都不认识,毕竟这家公司也不是很出名,唯一牛逼的地方在于他们去年拿到了软银和蓝驰的投资,没看错,就是那个投资了马云的阿里巴巴的软银,这是软银在币圈的第一笔投资,算是币圈不多的正规军公司。

Indeed, a lot of people don't know about the product of this currency ring. After all, this company is not very well known. The only thing that's so bad is that they got their investment in silver and blue last year.

但是,后续软银相关人士在微信群中回应称,比特易并非软银中国的被投企业。“比特易是软银中国在去年曾接触过的拟投资项目,但早在去年底,软银中国已最终放弃了投资计划,并未实际进行这笔投资。”

However, a follow-up figure in the Microsoft and Silver community responded that Bitley was not a soft and silver Chinese investor. “Betley is a proposed investment that was approached by the soft and silver China last year, but as early as the end of last year, the soft and silver China finally abandoned its investment plan and did not actually do so.”

据官网介绍,比特易是一家区块链市场数据分析与服务平台,为数字货币投资者提供专业的市场分析工具、数据指标和风险管理策略,帮助投资者有效控制数字货币投资风险。同时,也为监管机构、行业研究机构提供市场数据监控,项目风险监控,非法交易发现与监控等各项专业服务。

According to the Network, Bitley is a segmental market data analysis and service platform that provides digital money investors with specialized market analysis tools, data indicators, and risk management strategies to help them effectively control the risk of digital money investment. At the same time, it also provides regulatory agencies and industry research institutions with market data monitoring, project risk monitoring, and specialized services such as detection and surveillance of illegal transactions.

比特易App显示,其为区块链市场数据分析工具,产品包括智能K线以及配合小币种、主流币、杠杆合约等服务的代币智能投顾工具,项目自身未涉及代币发行。

Bitley App shows that it is a block chain market data analysis tool, with products including smart K-lines and token investment tools that match services such as small currency, mainstream currency, leverage contracts, etc., and that the project itself does not involve the issuance of tokens.

疑似用100倍杠杆做空导致爆仓

It's possible that a 100-fold lever was used to empty the warehouse and cause the explosion.

据微信对话截图来看,惠轶疑似用100倍杠杆做空比特币导致爆仓或巨亏,这一截屏对应做空了1600个比特币,按照5月平均价格测算,对应金额5000万人民币左右。

According to the micro-letter dialogue screen, Huixiang suspected of using 100-fold leverage as an empty bitcoin to cause an explosion or a huge loss, and this screen matched 1,600 bitcoins, which, based on average prices in May, amounted to around 50 million yuan.

曾躲过P2P爆雷跟A股股灾

曾躲过P2P爆雷跟A股股灾

has escaped P2P mines and A shares.

has escaped P2P mines and A shares.

惠轶在进入区块链领域之前,是混互联网金融圈的,其第二个创业项目——神仙有财是一家P2P网贷平台。P2P和币圈是近一年公司爆雷最多的两个领域,而惠轶都蹚过。

Before entering the area of block chains, Huixiang was involved in Internet finance, and his second entrepreneurial project, the P2P Internet lending platform, was one of the two most heavily mined areas of the company in the past year.

在创办神仙有财之前,惠轶就已是互联网金融圈内“名人”。资料显示,在2014年至2015年,惠轶为花果金融联合创始人并出任CEO职位(目前花果金融已爆雷)。

Before the creation of the Queen was rich, Huixiang was a “celebrity” in the Internet financial world. According to the data, from 2014 to 2015, Huixiang was the founder of the Flower Fruit Finance Consortium and took up the post of CEO (currently the Flower Fruit Finance has exploded).

然而,在国内P2P市场最为火热时,惠轶选择退出花果金融。“市场的繁荣与现实是不匹配的,我猜测今年6、7月份,风险会暴露出来,没想到提前了。”在过去的一年多,他觉得处在这个行业“成功”变得太简单。“2014年真是一段美好的时光,几乎什么都不用做,每月数据200%地增长。”

However, when the P2P market is the hottest in the country, Huixiang chooses to exit fruit finance. “The boom of the market does not match reality, and I guess the risks will come out in June and July of this year, before it gets too early.” Over the past year, he has found it too simple to be “successful” in this industry.

除了这种“不可靠”的成功套路,让惠轶不解的是P2P行业没有一个正常的退出机制。“所有的平台加起来约5000多家,按照规律,三年后可能会剩下500家左右。大部分是要死的,而死的路径只有一个:跑路。开个饭馆还能关掉盘给被人,做P2P就一种死法。”

Apart from this “unreliable” scheme of success, Huixiang is puzzled by the fact that there is no normal exit mechanism in the P2P industry. “All platforms add up to about 5,000, which, according to the law, may be about 500 in three years. Most are about to die, and there is only one way to die: running. A restaurant can be turned off to people, and P2P is a way to die.”

沪市4800点时,他把股票全部清仓。至今有一张他与哥们的对话截图为证:“跑得时候叫我一声”“跑了”“不是吧,至少5000点以上再跑”“不赌命”。

At 4800, he cleared the stock. So far, there's a screenshot of his conversation with his friends: "Let me run when I can." "No, no, no, no, no." "No, no, no, no, no, no, no, no."

在事件爆发时,朋友们送了他一个称号“逃顶侠”。此后的3~4个月,惠轶去上了长江商学院。

When the incident broke out, his friends gave him the title “Away from the Top Man.” After three to four months, Huixiang went to the Yangtze Business School.

在长江商学院充电结束后,惠轶又踏了回来。于是又开始了他的“神仙有财”网贷之路。

When the Yangtze Business School was charged, Huixiang came back. Then he started his "Golden and Rich" net lending.

神仙有财于2016年1月正式上线,平台的投资项目是以上市公司大股东融资项目为主。但2016年正是互联网金融开始监管严之时,P2P火温也已经开始下降。

The elixir was officially on the line in January 2016, when the platform’s investment project was dominated by the financing of major shareholders in the companies listed above. But in 2016, when Internet finance began to be heavily regulated, the P2P heat began to decline.

据公开信息显示,神仙有财与P2P平台夸客金融联系密切,夸客金融创始人郭震洲担任神仙有财管理委员会顾问;且当时神仙有财平台上的消费金融资产,是由夸客金融提供,夸克金融也对其供应的资产提供债权回购。

According to public information, fairies have close financial ties with the P2P platform, and Guo Chiuzhou, founder of the P2P platform, served as an adviser to the Committee for the Management of Monument’s Fiscal Council; and at the time, the Consumable Financial Assets on the Monument platform were provided by the Monument, which also offered repurchases for the assets it supplied.

而夸客金融已于去年爆雷,据上海市公安局黄浦分局案情通报,2018年8月21日,上海夸客金融信息服务有限公司法人代表郭某来黄浦公安分局投案,交代了其通过网上理财平台高息非法吸收公众存款的犯罪事实。

On 21 August 2018, the legal entity of Shanghai Kwai Financial Information Services Ltd. submitted a case on behalf of Guo Fao, on behalf of the Huang Po Public Security Division, in which he reported on the criminal act of illegally absorbing public deposits through an online financial platform with high interest rates.

虽然惠轶已于2017年进入区块链圈了,但据天眼查显示,2018年8月16日,惠轶才退出神仙有财。

Although Huixiang entered the block chain in 2017, it was only on 16 August 2018 that Huixiang withdrew.

终究没能逃过虚拟货币的杠杆交易

It's not like he's ever been able to escape the leverage of virtual money.

比特币在近两年经历了疯涨疯跌,曾在一年内大涨近20倍,又在一年内下跌80%。进入2019年,比特币总市值首次突破1500亿美元。当时,比特币报价8739美元/枚。

Bitcoin had gone crazy in the last two years, rising nearly 20 times in a year and falling by 80% in a year. In 2019, the total market value of Bitcoin had broken by $150 billion for the first time. At that time, Bitcoin had a bid of $8,739 per metre.

2019年4月下旬以来,比特币经历了一轮暴涨行情,从4000美元左右,暴涨了8000美元以上。

Since late April 2019, Bitcoin has experienced a wave of surges, from about $4,000 to over $8,000.

从惠轶100倍杠杆做空比特币巨亏情况来看,很可能是这一轮暴涨中,看错了方向,阶段性高杠杆做空,导致了巨亏。

In the case of Huixiang's 100-fold leverage to make an empty bitcoin deficit, it is likely that this round will rise in the wrong direction, with a phased high-leveraging void, resulting in a huge loss.

无论是真还是假,告诉我们的教训都是一致的:投资不存在侥幸,诱惑越大,风险也就越大!

Whether true or false, the lesson we learn is the same: the greater the temptation, the greater the risk!

6月11日上午,北京必易数据服务有限公司(比特易APP母公司)所在地大门紧闭,空无一人。隔壁公司人员表示,“他们大概上月就倒闭了”;相关物业人员则表示,“必易数据已被封了”,但未告知其被封原因。

On the morning of 11 June, the Beijing Premium Data Services Ltd. (BitleyAPP parent company) closed its doors and was empty. The next-door company said that “they were probably closed last month”, while the relevant property officials said that “the necessary data had been sealed” but did not inform it of the reasons for the sealing.

图片来源:每日经济新闻

图片来源:每日经济新闻

Photo source: Daily Economic News

Photo source: Daily Economic News

截至11日凌晨,比特易移动应用上的社区留言最新的更新信息为46天前,数据栏目的市场概况数据无信息显示。

As of the early morning of 11 November, the latest update of the community message on the Bitcomb mobile application was 46 days ago, and the market profile data for the data column were not available.

比特易的公众号在2月11日后无更新文章。1月8日,比特易公众号发布比特易首期“用户基金”收益单,三个月最终收益79%,并显示新一期基金即将开启对外募集。平台业务疑涉归集用户虚拟资产进行投资。

On January 8, Bitley launched its first “User Fund” returns, with a three-month final gain of 79%, and shows that a new fund is about to open. The platform’s operations are suspected of being linked to the investment of users’ virtual assets.

金贝财经指出,杠杆交易,即可将自己的本金作为保证金,向平台借贷,以扩大交易资金,从而扩大收益或亏损。比如3倍杠杆,如果你有10个BTC,就可以从交易平台借20个BTC,用30个BTC进行交易,从而使收益或亏损增大3倍。加密货币市场的市场波动要大的多,特别是全天24小时不休市,并且缺乏健全的监管机制,庄家操盘、合约漏洞、机器人故障的情况更容易发生,可能一觉醒来就会发现已被爆仓,倾家荡产。

For example, if you have 10 BTCs, you can borrow 20 BTCs from the trading platform, with 30 BTCs, thereby multiplying the gains or losses. The market for encrypted currency markets is much more volatile, especially 24 hours a day, and there is a lack of sound regulatory mechanisms, which make it easier to build up the funds.

而在加密货币市场,年轻投资者居多,市场投机性重,惠轶在2018年4月份接受媒体采访时曾说过,“现在较大的问题是,这个市场的投机性非常重,它更像一个赌场,因此对一个投机属性较重的市场而言,怎么能够帮助与保护中间的玩家降低风险,让投资者变得更家加理性,正是我们当下要解决的问题。比特易要做的就是成为加密货币市场的同花顺。”

And in an interview with the media in April 2018, Huixiang said, “The bigger question is how to help and protect middle players in a market that is more speculative and more like a casino, and to make investors more rational, is what we need to do now. What Bittel is easy to do is to become an encrypted currency market 在这里,带你发现财富背后的故事! Here, take you to the story behind the fortune! 任正非能带领华为抵挡美国的“封杀”吗?王健林的万达是否度过了最危险时刻?奚梦瑶挤进赌王豪门背后,又有怎样的故事?刘强东12年前埋下的因果,是否会令京东走向歧途? What is the story of King Kenlin's Wanda after the most dangerous moment? Will Liu bury the causes and consequences 12 years ago lead the way ? 关注“苏说财经”(ID:su-caijing),我们给你详细解答,一起无限接近大佬的真实人设! Focusing on the "su-caijing" (ID:su-caijing), we'll give you a detailed answer. 独立视角、温度写作 Independent perspective, temperature writing 苏说财经(ID:su-caijing) Economics (ID:su-caijing) 长按识别二维码关注↑↑ Long press 2-D attention to the platinum. 宏观视角,微观叙事,财经逻辑并不复杂! Macro perspective, micro narrative, financial logic is not complicated!

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论