撰文:Captain BTC

Author: Captain BTC

編譯整理:0xzshanzhan

This post is part of our special coverage Egypt Protests 2011.

設計Token經濟模型很難

It's hard to design the Token economic model.

對於項目而言,Token的經濟學模型的設計至關重要,同時這也是項目裡最困難的事情之一。因為這實際上是在從頭開始創建一個完整的經濟系統,並且是在沒有任何現實經驗依據的情況下進行創建。 Token模型設計的一個細微錯誤可能會影響整個項目,即使該項目的其他設計都很好,智能合約的不可篡改性進一步強調了初始Token設計的重要性。一旦合約發布之後,需要進行分叉才能對協議進行更新。

The design of Token’s economic model is important for the project, and it is one of the most difficult things to do with it. This is because it is actually starting from the beginning to create a complete economic system, and is being created without any real experience.

儘管Token經濟學很複雜,但它仍然受制於經濟學的基本定律,即供求關係。簡單來講,Token經濟模型的設計都是設計影響短期和長期供需的方法。理想情況下,最好的設計是在鼓勵需求的同時減少供應,但這說起來容易做起來難。

Despite the complexity of Token economics, it is still subject to the basic law of economics, that is, supply and demand. In short, the Token economic model is designed to design ways to influence short-term and long-term supply and demand. Ideally, the best design is to reduce supply at the same time as demand is encouraged, but this is easy to say.

四大支柱

Four pillars

在深入了解“ve”Token設計的複雜性之前,本文將介紹Token經濟學的基礎知識。在我看來,每種加密貨幣都有四個基本的Token經濟學支柱,這是投資者在深入研究Token經濟學之前應該分析的第一件事。支柱上的任何設計缺陷都是Token經濟模型在未來的隱患,如果缺陷很嚴重,可能會導致整個經濟模型倒塌,或者導致項目慢慢流血,就像一座廢棄的建築物生鏽一樣。

Before understanding in depth the complexity of the “ve” Token design, this paper presents the basics of Token economics. It seems to me that each of the cryptographic coins has four basic Token economic pillars, the first thing investors should analyse before studying the Token economy in depth. Any design defect on the pillar is a future risk for the Token economic model, which, if serious, could lead to the collapse of the entire economic model, or to a slow bloodshed, like an abandoned building.

供應

Supply

沒有什麼比Token的數量管理更基礎更重要的了,Token的數量管理的一部分就是供應。我們可以將供應分為:

There is nothing more important than Token's volume management, which is part of supply. We can divide supply into:

流通供應量:

Circulation supply:

市場上流通的Token的數量

The number of Tokens in circulation on the market

最大供應量:

Maximum supply:

理論上協議所能產生的最大Token的數量

The largest amount of Token that could be generated by the theoretical agreement.

總供應量:

Total supply:

已發行的Token數量。這包括銷毀和鎖定的Token。即使這些Token不屬於流通供應。

The number of Tokens that have been issued. This includes the destruction and locking of Tokens. Even if these Tokens are not part of the flow supply.

供應量越高,價格越低。我相信你經常看到諸如“看看ADA,它只有1 美元,想像一下如果它只達到比特幣價格的50%,我會賺多少錢!”之類的言論。因為他們沒有意識到ADA的供應量為450億,而比特幣的供應量為2100萬。這就是為什麼市值是比只看Token價格更準確的指標,因為它會影響價格和供應。

The higher the supply, the lower the price. I'm sure you often see things like, “Look at the ADA, it's only $1, and imagine how much I would make if it reached only 50 per cent of the price of the Bitcoins.” And so on. Because they don’t realize that the ADA's supply is 45 billion dollars, compared to 21 million dollars. That is why the market value is a more accurate indicator than watching only the Token price, because it affects prices and supply.

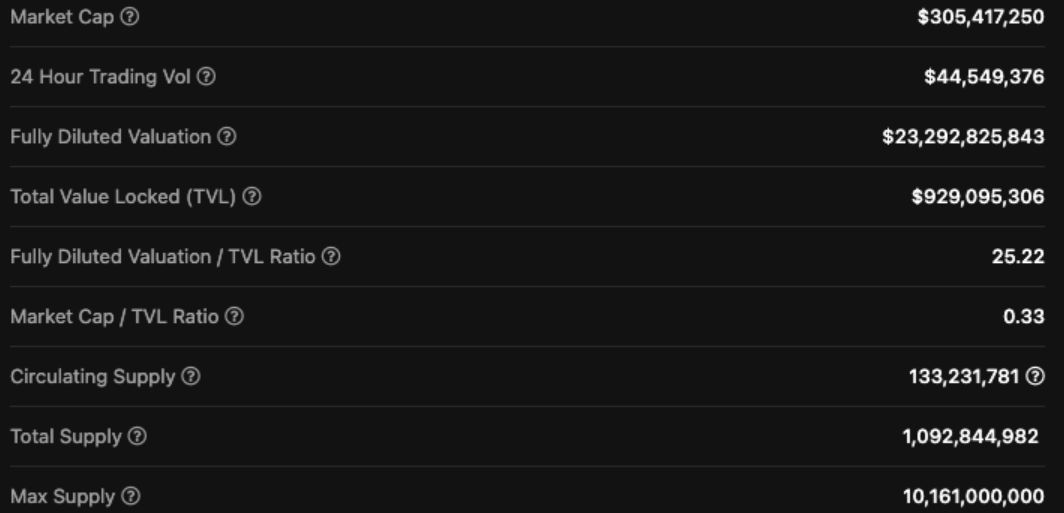

將流通供應量與總供應量和最大供應量進行比較會發現有趣的現象。比如,如果流通供應量低而總供應量和最大供應量高,這是一個巨大的危險信號,因為你的Token的價值將被稀釋,如下圖:

For example, if the flow supply is low and the total and maximum supply is high, it is a huge danger signal because your Token values will be diluted, as follows:

這個Token的流通供應量約為133M,最大供應量為10B。對於你的Token來說大約有8 倍的稀釋風險,這是一個重大問題。如果明天所有的Token都被釋放,你的Token價值將是昨天的1/8。假設您今天以3.05 億的市值買入,預計5 年內將達到100 倍。這將使市值達到30B(相當高,但在加密貨幣中並不罕見),但完全稀釋後的估值將達到2.3T(高於今天的加密貨幣市值)。

This Token has a circulation supply of about 133 M, with a maximum supply of 10B. This is a major problem for your Token, which is about eight times the risk of dilution. If all Tokens are released tomorrow, your Token value will be 1/8 yesterday. Assuming you buy it today at a market value of 305 million, it is estimated to be 100 times in five years. This will bring the market value to 30B (exceedingly high, but not rare in encrypted currency), but the value of total dilution will reach 2.3 T (higher than today's encryption currency).

此外,即使市值增加,這些Token的定期發行也會增加流通供應量,這將對價格造成下行壓力。這並不是說這個Token的一切都很糟糕,他們甚至可能有辦法抵消供應壓力,但這是長期投資者應該注意的風險因素。短期投資者不太擔心最大供應量,因為Token解鎖的時候他們可能早就跑了。

Moreover, even if the market value increases, these Token’s regular roll-out will increase the flow supply, which will put down pressure on the price. This is not to say that everything in Token is bad, that they may even be able to offset the pressure, but it is a risk factor that long-term investors should be paying attention. Short-term investors are less worried about the maximum supply, because they may have run away long ago when Token unlocks.

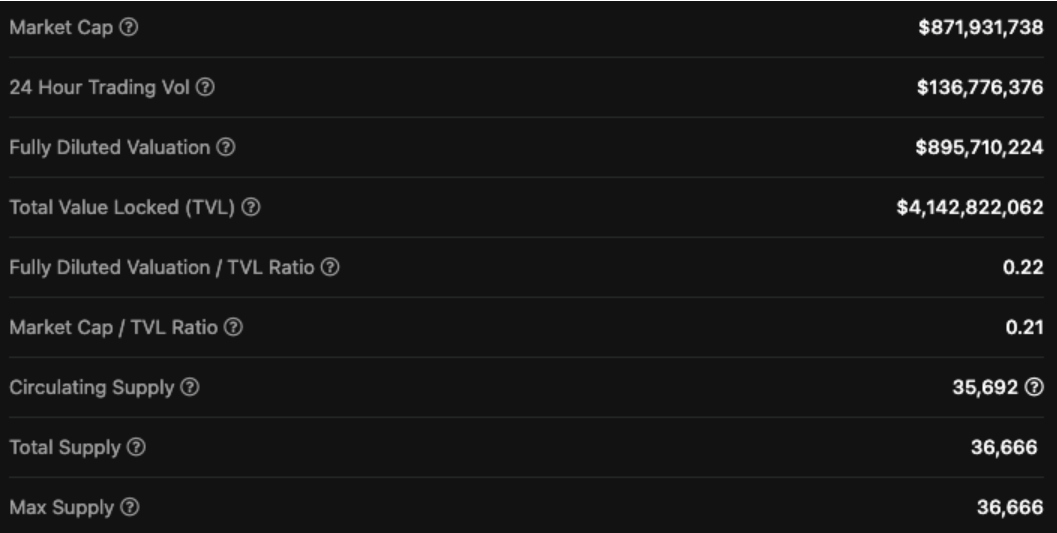

下面是一個相反的例子,流通供應量接近最大供應量。但這並不意味著這個項目是個可靠的項目,但是的確減少了投資者的風險。

The following is an example of the opposite, where the flow supply is close to the maximum. But this does not mean that the project is a reliable project, but it does reduce the risk to investors.

分發

Distribute

Token的分發是投資者應該注意的下一個Token經濟系統的支柱,這是一個非常簡單的支柱。分發是指每個錢包持有特定Token的百分比的分佈。你會想要1 個人持有70% 的代幣供應嗎?如果你想的話,那麼那個項目將非常集中,他可以無休止地拋售Token,讓我們這些散戶變得更窮,並且破壞了項目的前途。

Token's distribution is the next pillar of the Token economic system that investors should pay attention to, and that is a very simple pillar. It is the percentage distribution of a specific Token per wallet. Do you want a person to hold 70 per cent of the currency supply? If you want, the project will be very focused, and he will be able to sell Token endlessly, making our dispersed population even poorer and undermining the future of the project.

一個好的分發設計是盡量將token分配給更多人。這樣一來,如果有人想退出,他們的拋售不會對價格產生太大影響。查詢Token分佈的最佳方法是查看他們的白皮書中的Token分配圖表,並在區塊鏈瀏覽器上檢查錢包的分佈。

A good distribution design is to assign totoken as many people as possible. This way, if someone wants to quit, their selling will not have much impact on the price. The best way to check Token's distribution is to look at the Token distribution chart in their white paper and to check the distribution of the wallet on the sector chain browser.

貨幣政策

Currency policy

貨幣政策決定了Token是通脹還是通縮模型,並且還決定了通脹/通縮程度以及項目的整體共識機制。如前所述,高通脹會導致資產價格隨著時間的推移而下跌。低通脹率與POW(例如比特幣)相結合可能是一件好事,因為它可以在生態系統中創造生產力。以太坊2.0 和EIP 1559 允許在每筆交易中銷毀ETH,理論上應該會讓以太坊變得通縮。

Currency policy determines whether Token is a deflationary model or a condensed model, and also determines the degree of deflation/condensation and the overall common understanding of the project. As noted earlier, high levels of communication can lead to prices falling over time. A combination of low rates and Pow (e.g. bitcoins) may be a good thing, because it can create productive power in the living system. In Taipan 2.0 and EIP 1559, allowing the destruction of ETH in each transaction, the theory should make Tai Hoan less likely.

這引出了我的下一個想法,即應該如何一起分析Token經濟學的四個支柱中以及它們的相互作用。讓我們回看本文供應部分中高度稀釋的Token的示例。雖然它具有很高的FDV,但假設它的貨幣政策是每年消耗7% 的循環供應量和每年5% 的代幣釋放計劃,所以即使7/8 的供應被鎖定並且存在通脹壓力,這也導致通縮率同比下降2%。在這種貨幣政策下,token將不會面臨任何鎖定的通脹壓力,但實際上,由於流通供應的減少,因此存在負面的供應壓力。

This leads me to the next idea of how to analyse together the four pillars of Token's economics and their interactions. Let us look back at the example of Token, which is highly diluted in the supply section. Although it has a very high FDV, it assumes that its currency policy is a revolving supply of 7% per year and a 5% currency release plan per year, so that even if 7/8's supply is locked up and under stress exists, it leads to a 2% reduction in the contraction rate.

尋找各種Token經濟學支柱的相互作用能夠讓我們弄清楚Token經濟學的優點。單純只看一個支柱經常會被誤導。 (請注意,關於銷毀是否是資金的有效使用存在爭議,所以本文中僅使用Token銷毀作為一個簡化的示例來解釋這個概念。)

Looking for the interaction of the various Token economic pillars allows us to understand the advantages of Token economics. Looking at one pillar alone is often misdirected. (Please note that there is a controversy about whether destruction is an effective use of money, so this paper uses only Token destruction as a simplified example to explain the concept.)

價值捕獲

Value capture

最後一個支柱是協議捕獲了多少價值以及價值應該如何分配。在Web 2 中,所有獲得的價值都回到了Facebook、Google 和Twitter 等公司。他們從用戶的數據和社交媒體互動中賺取了數十億美元,而用戶則獲得了零美元的回報。用戶最多會得到一個藍色複選標記。 Web 3 顛覆了這一點,因為協議捕獲了它們提供的價值,並將其分配給Token持有者。您可以成為協議的用戶,並且同時獲得回報。

The last pillar is the agreement on how much value is captured and how it should be distributed. In Web 2, all the values are returned to Facebook, Google and Twitter. They earn billions of dollars from user data and social media interactions, and users get zero dollars. Users get at most a blue copy. Web 3 reverses this, because the agreement captures the value they provide and distributes it to Token holders.

並非所有協議都能有效地捕捉價值,我認為在我們擁有一個可以捕捉協議提供的100% 價值的Token架構之前,仍然需要大量的研究和實驗。

Not all agreements have been effective in capturing value, and I think a lot of research and experimentation is still needed before we have a Token architecture that captures 100% of the value offered by the agreement.

最簡單的比較例子是2020 年的Uniswap 與Sushiswap 之戰。 Uniswap 發布了他們的AMM(自動做市商),但沒有發布Token。當然,他們提供了具有大量價值的創新產品,但他們為網絡參與者獲取了0% 的價值。然後Sushiswap 分叉了Uniswap 並隨之創建了SUSHI Token。

The simplest example of comparison is the fight between Uniswap and Sushiswap in 2020, where Uniswap released their AMM (auto-market), but not Token. Of course, they provided a large number of innovative products, but they earned 0% value for their network participants. Then Susiswap split Uniswap and created SusHI Token.

SUSHI 持有者可以對治理問題進行投票,並將他們的SUSHI 質押為xSUSHI,並獲得協議產生的交易費用。雖然這種模式遠非完美,但讓Token持有者分享收入比Uniswap 的模式獲得的價值要多得多。如果Uniswap 在AMM 發佈時推出了一種能夠獲取價值的Token,那麼Sushiswap 獲得新用戶將更加困難。

SUSHI Holders can vote on governance issues, pledge their SUSHI to xSUSHI, and obtain negotiated transaction costs. Although this model is far from perfect, it will be much more valuable for Token Holders to share income than the Uniswap model. If Uniswap introduces a valuable Token at the time of the AMM launch, it will be more difficult for Sushiswap to get a new user.

VeToken經濟模型

VeToken Economic Model

以上是基礎知識,那麼Ve是什麼?

That's basic knowledge. So what's Ve?

Ve 是“voter escrowed”,自提出以來已經迅速成為一種流行的Token經濟學模型,採用更新的DeFi 協議。有趣的是,ve 模型是Curve Finance 發明的,它是“DeFi 1.0”。

Ve is "voter escrowed," which has rapidly become a popular Token economic model, using an updated DeFi agreement. Interestingly, the model was invented by Curve Finance, which is "DeFi 1.0."

它的工作方式是鎖定您的CRV 代幣,然後將其轉換為具有協議治理能力的veCRV。鎖定期不是固定的,Token持有者可以決定他們想要鎖定他們的CRV 多長時間,最長4 年。

The way it works is to lock your CRV coins and then convert them into a vCRV with the ability to negotiate governance. The lock periods are not fixed. Token holders can decide how long they want to lock their CRVs for as long as four years.

隨著時間的推移,持有者擁有的veCRV 數量在其鎖定期間線性衰減。這會激勵持有者定期為veCRV 重新鎖定他們的CRV,以最大限度地提高治理和獎勵。主要創新是如何創建加權投票和加權獎勵。此外,一旦您將CRV 轉換為veCRV,您就會被鎖定在指定的時間段內。不能像其他協議那樣提早解除鎖定。

With the passage of time, the number of VCRVs owned by the holder declines in its lock-up period. This encourages the holder to periodically re-lock their CRVs for the VCRV to maximize governance and reward. The main innovations are how to create voting and empowerment. Moreover, once you convert the CRV to VCRV, you will be locked in a specified time frame.

假設Bill和Alice各有100 個CRV。 Bill 決定將他的CRV 鎖定2 年,而Alice 將她的鎖定4 年。即使他們一開始擁有相同數量的CRV,Alice 將獲得比Bill 多一倍的veCRV,這意味著她將獲得比他多一倍的治理投票和獎勵。

Bill decided to lock up his CRV for two years, and Alice for four years. Even if they had the same number of CRVs at first, Alice would get twice as many vCRVs as Bill, which means she will get twice as many governance votes and rewards as he does.

VeToken經濟模型的效果

Effects of the VeToken economic model

veToken經濟模型解決的主要問題之一就是1 token=1 vote 問題。在非ve 模型下,大鯨魚可以購買大量代幣進行短期治理並獲得回報,而無需在博弈中承擔除了短期價格之外的任何風險。因此一個同類協議可以購買數百萬美元的競爭者協議Token並投票支持糟糕的提議,然後拋售Token。

One of the main problems addressed by the veToken economic model is that 1 token=1vote. Under the non-ve model, large whales can buy large amounts of money for short-term governance and reward without having to take any risk in a game other than short-term prices.

在ve 模型下,這種類型的鯨魚操縱效果要差得多,因為他們的選票不會像長期持有者那樣有價值。如果一個協議或鯨魚想要對另一個協議產生重大影響,他們將不得不鎖定他們的Token一段時間。一旦他們的Token被鎖定,這就產生了以符合協議最佳利益的方式行事的動力。 CRV戰爭就是最好的例子。

Under the Ve model, this type of whale manipulation is much less effective, because their votes are not as valuable as long-term holders. If a deal or whale wants to have a significant impact on another agreement, they will have to lock their Token for some time. Once their Token is locked in, it creates momentum to act in the best interest of the agreement.

此外,選擇最長鎖定期的協議的鐵桿支持者將比在1 token=1 vote模型下擁有更大的發言權。與短期投機者相比,這些鐵桿的支持者獲得了更多的收益和被動收入。只要協議繼續推進,質押者就會明白,在可預見的未來,他們將獲得被動收入,而不是在不確定的情況下從一個協議跳到另一個協議。

Moreover, supporters of the iron poles that choose the longest-term locked-up agreements will have greater voice than under the 1 token = 1vote model. Supporters of these poles receive more revenue and income than short-term investors. As long as the agreements continue, the grantors will understand that in the foreseeable future they will receive income, rather than leapfrog from one agreement to another in uncertain circumstances.

最後,ve 模型對4 個支柱中的3 個有直接影響,分發是和Ve模型唯一關係較弱的支柱。

Finally, the v model has a direct impact on 3 of the 4 pillars, with distribution being the only pillar with a weaker relationship with the Ve model.

Ve模型通過Token的長期鎖定來影響供應。持有者被激勵長期鎖定他們的代幣,以最大限度地提高影響力和收益。當這些Token被鎖定時,它們會在很長一段時間內退出市場,從而減少拋售壓力。因為供應較少,隨著時間的推移,這應該會有機地導致價格上漲。與1 token=1 vote的模型相比,這個流通供應表現非常出色。

The Ve model influences supply through the long-term lockdown of Token. Holders are encouraged to lock their coins long enough to maximize impact and returns. When these Tokens are locked up, they exit the market for a very long time, thus reducing the pressure on sales. Because supply is low, and as time passes, this should result in a well-organized increase in prices. This is an excellent flow response compared to the model of 1 token=1vote.

VeToken的持有者是決定協議貨幣政策的人,就像在1 token=1 vote模型下一樣。不同之處在於veToken模型是一種升級,因為它將協議的長期激勵與質押者的激勵保持一致。如前所述,這會激勵擁有最多既得利益的持有者投票支持協議的有利貨幣政策,而不是讓潛在的惡意第三方或只考慮自己利益的第三方來支持損害協議的政策。

VeToken’s holders are those who decide to negotiate currency policies, as is the case under the 1 token = 1vote model. The difference is that the veToken model is an upgrade, because it aligns the long-term incentive of the agreement with that of the grantor. As stated earlier, it encourages the holders of the most vested interests to vote in favour of the negotiated favourable currency policy, rather than allowing the submissive third parties or third parties who consider only their own interests to support policies that undermine the agreement.

Ve模型產生巨大影響的最後一個支柱是協議如何將捕獲的價值分配給其持有者。該模型根據您被鎖定的時間來分配捕獲的價值。但是仍然還有大量空間可以創新以最大限度地獲取價值回報給用戶。

The last pillar of the Ve model’s impact is an agreement on how to allocate the capture value to its holders. The model distributes the capture value according to the time you have been locked in. But there is still plenty of room to create and return it to users for the maximum value.

創新

Creative

DeFi 領域的很多協議都在努力實現veToken經濟模型,這很棒!與傳統的token經濟模型相比,這是一個進步,但veTokenomics 不會成為token設計的巔峰之作。本節將介紹一些項目正在使用veToken經濟模型作為基礎構建的創新設計。 (注意,我並不是說要把你的全部淨資產投入我在下面討論的Token中,我只是在討論他們正在研究的veToken經濟模型的創新,它仍然是一個未知的實驗。)

Many of the agreements in the DeFi field are trying to implement the VeToken economic model, which is great! This is a step forward from the traditional Token economic model, but vTokenomics will not be the culmination of the Token design. This section will introduce items that are using the VeToken economic model as an innovative design for the foundation. (Note, I am not talking about investing all of your clean assets in Token, which I'm talking about, but I'm just talking about the creation of the VeToken economic model that they're working on, which is still an unknown experiment.)

Cartel 目前正在為他們的BTRFLY 代幣創建一個ve 版本,但有一點不同。他們計劃發布blBTRFLY 和dlBTRFLY 代替veBTRFLY,分別代表賄賂鎖定和DAO 鎖定BTRFLY。 blBTRFLY 是面向零售的Token,可為持有者最大化收益,而dlBTRFLY 專注於希望最大化其DeFi 治理的DAO 和協議。簡化理解:

Cartel is currently working on a Ve version for their BTRFLY tokens, but it's a little different. They're planning to publish blBTRFLY and dlBTRRFLY instead of veBTRFLY, which represents a bribe locking and a DAO locking BTRFLY. blBTRFLY is a retail Token, which maximizes the benefits for the holders, while dlBTRFLY focuses on the DAOs and agreements that want to maximize its DEFI governance.

blBTRFLY=更高的產量

blBTRFLY = higher output

dlBTRFLY=更高的DeFi 治理權

dlBTFLY = Higher DeFi Governance

這是一個以veToken經濟模型為基礎的有趣設計,我將關注它在實踐中的運作方式。

It's an interesting design based on the veToken economic model, and I'll focus on how it works in practice.

下一個創新協議是Trader Joe。他們發布了新的Token經濟學模型,引入了三個Joe 衍生品來替代xJOE,分別是: rJoe, sJoe, veJoe。

The next initiative is Trader Joe. They published a new Token economic model and introduced three Joe derivatives to replace XJOE: rJoe, sjoe, veJoe.

為rJOE 質押JOE 讓rJOE 持有者可以在JOE 生態系統中參與項目的launch。 (Rocket Joe 比這更微妙,但這超出了本文的範圍)為sJOE 質押JOE 讓sJOE 持有者從平台支付的收入中分得一杯羹。這筆收入以穩定幣的形式支付,這讓用戶可以獲得被動收益。為veJOE 質押JOE 讓veJOE 持有者在Joe 農場中獲得更高的獎勵,以及治理權。

(Rocket Joe is more subtle than this, but this is beyond the scope of this paper) to secure a share of the income that the SJOE holder has paid from the platform. This income is paid in the form of a stable currency, which allows the user to gain an active gain. For vJOE to secure a higher reward for the JOE holder in Joe's farm, as well as governance.

veToken經濟模型目前處於發展期。我們看到協議開始創建其主要Token的多個衍生品,每個衍生品都有一個特定的用例。這允許用戶在他們最想參與的協議部分上最大化他們的投資策略。

The veToken economic model is currently under development. We see that the agreement begins to create several derivatives of its main Token, each with a specific example. This allows users to maximize their investment strategies on the part of the agreement they most want to participate in.

結論

Conclusion

總之,Token經濟學很難,協議需要確保四個支柱與經濟系統的正確搭配。此外,他們還需要在這四大支柱之上進行創新,以保持競爭力。 VeToken經濟模型向前邁出了一大步,是對以前的Token經濟系統的巨大改進。它減少了供應,獎勵長期投資者,並將協議和投資者激勵措施結合在一起。 2022 年,更多協議將繼續將veToken經濟模型添加到其設計架構中,並以veToken經濟模型作為四大支柱之上的中間件基礎進行創新以創建獨特的經濟系統。

After all, Token’s economics is difficult, and the agreement needs to ensure the right mix between the four pillars and the economic system. Moreover, they need to build on these four pillars in order to remain competitive.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论