过去 24 小时,市场出现了不少新的热门币种和话题,很可能它们就是下一个造富机会

In the past 24 hours, there have been a lot of new hot currency and topics in the market.

昨日 BTC 在一个月内第三次突破 7 万美金压力位后小幅回调,BTC 现货 ETF 连续四日净流入,临近减半比特币和其生态项目有向上突破的迹象。ENA 在 TGE 后实现一周内币价翻倍,并成为上周盈利能力最强的稳定币项目,而 USDe 流通市值也达到了 20 亿美金排在稳定币市值第四位。其中:

Yesterday, BTC returned slightly after breaking the $70,000 pressure level for the third time in a month, and BTC spot ETF had four consecutive days of net inflow, close to halving the bitcoin and its ecological projects, showing signs of a breakthrough. The ENA doubled the price of its domestic currency in a week after TGE and became the most profitable and stable currency last week, while USDE was ranked fourth in the market value of its stable currency at $2 billion.

造富效应强的板块是:比特币生态(BRC20、ARC20、BTC Layer2 等)、Ethena(ENA)、nakamoto 升级相关代币(STX、T);

The powerful plates are: Bitcoin Ecology (BRC20, ARC20, BTC Layer2 et al.), Ethena (ENA), nakamoto Upgrade Related Currency (STX, T);

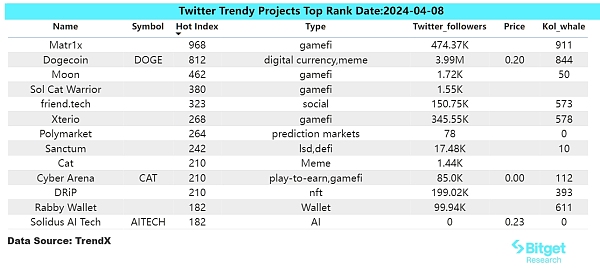

用户热搜代币&话题为:Pixels、Harvest Finance、Matr1x;

The topic is: Pixels, Harvest Finance, Matr1x.

潜在的空投机会有:Morph、TimeSwap;

The potential for empty speculation is: Morph, TimeSwap.

数据统计时间:2024 年 4 月 8 日 4:00(UTC+0)

Data Statistics Time: 2024 April 8:00 (UTC+0)

现货黄金价格短暂回调后再次冲高,突破历史新高达到 2353 美元 / 盎司。BTC 在一个月内第三次突破 7 万美金压力位后小幅回调,BTC Spot ETF 从 4 月 2 日至 4 月 5 日连续四天净流入,市场情绪开始好转。

The price of spot gold rose again after a short rebound, reaching a record high of $2353/ ounces. BTC made a small recovery after breaking the $70,000 pressure position for the third time in a month, and BTC Spot ETF began to improve its market mood for four days in a row, from 2 April to 5 April.

ETH/BTC 汇率走弱,过去一个月下跌 13%,过去 24h ETH 链上 gas 降至 10gwei 左右,ETH 主网上活跃度明显降低。Layer2 网络中,除 Base 近期 TVL 上升较为明显以外,Starknet、Optimism、Arbitrum 的 TVL 在过去一周中分别下跌了 10%、9%、5%。

The ETH/BTC exchange rate has been weak, falling by 13 per cent in the past month, and in the past, the 24h ETH chain gass has dropped to around 10 gwei, and the ETH main Internet activity has decreased significantly. In the Layer2 network, apart from Base’s recent increase in TVL, Starknet, Optimism and Arbitrum’s TVL have fallen by 10 per cent, 9 per cent and 5 per cent, respectively, over the past week.

主要原因:

Main causes:

(1)比特币减半临近,比特币生态项目最易吸引市场注意力经济,大量比特币资产发行协议和扩容协议都将预备在减半前后发布重要公告;

(1) The halving of bitcoin is approaching, the Bitcoin eco-projects are the most attractive to market-oriented economies, and a large number of Bitcoin asset-issuing and expansion agreements will be prepared to issue important announcements before and after the halving;

(2)Atomicals Protocol 的 ARC20 代币拆分解决方案 Beta 版本进入测试阶段;

(2) The ARC20 decoupled version of the Beta version of Atomicals Protocol is in the test stage;

上涨情况:过去 24h,ATOMARC 上涨 24%,MUBI 上涨 26%;过去一周,CKB 上涨 37%,BRC20、ARC20 其他头部资产也有明显上涨。

In the past 24h, ATOMARC rose by 24% and MUBI by 26%; in the past week, CKB rose by 37% and BRC20, ARC20 and other head assets also increased noticeably.

影响后市因素:

Post-municipal factors:

比特币减半前后比特币生态推陈出新的情况和效果,主力资金在这段时间内的动作都将直接影响整个板块的走势。目前,ARC20 板块的资产流动性较弱,利于资金拉盘,ATOMARC 和 QUARK 的市值也都不算高,值得投入精力关注板块异动,适时进行投入。

In the run-up to and after the halving of the Bitcoins, a new picture of the situation and the effects of the Bitcoins ecology will have a direct impact on the direction of the entire plate. At present, the ARC20 plate is less liquid than the money draw, neither the market value of ATOMARC nor QUARK is high, and it is worth devoting attention to the dynamics of the plate and investing in it at the right time.

主要原因:

Main causes:

(1)Ethena 在过去一周中协议费用达到了 830 万美金,排在稳定币协议 Top1,远超排名第二的 MakerDAO。USDe 的流通市值目前也迅速达到了 20 亿美金的量级。

(1) Ethena has reached $8.3 million over the past week, in Top1, far above the second-highest MakerDAO. The market value of USDE is now fast reaching $2 billion.

(2)Ethena 在社媒和行业头部 KOL 的讨论中热度非常高,一些人拿 Ethena 与 Luna 进行比较提示该项目的风险,也有一些人指出该项目和 Luna 的区别并赞扬其主动披露自身的潜在风险。在讨论和分歧中,Ethena 的社媒曝光量持续上升。

(2) Ethena was very hot during discussions in the media and industry head KOL, with some comparing Ethena with Luna suggesting the risks of the project, and others pointing out the differences between the project and Luna and commending it for voluntarily disclosing its potential risks. In discussions and disagreements, Ethena’s media exposure continued to rise.

上涨情况: ENA 在几日前 TGE 后,从大约 0.6 美金的开盘价格持续上涨,目前币价达到 1.2 美金,实现一周内翻倍。

Upgrade: A few days ago, after TGE, the ENA continued to rise from the opening price of about US$ 0.6 to the current value of US$ 1.2, which doubled within a week.

影响后市因素:

Post-municipal factors:

USDe 流通量的增长情况:目前 USDe 的市值为 20 亿美金,已经来到了稳定币市值排名第四的位置,如果 USDe 的流通市值能够步步逼近、甚至超过第三名的 DAI,那么 ENA 的币价想象空间将被极大程度地打开。

USDE circulation growth: The current market value of USDE is US$ 2 billion, and it has reached fourth place in the ranking of stable currency value. If the market value of USDE is able to move closer to, or even surpass, the third DAI, then the currency price of ENA will be opened up to a great extent.

Ethena 活动的收益率预期和外部合作项目方的实力:第二季 Ethena campaign 已开启,Ethena 与 Zircuit 等大量知名项目方合作,给 USDe 的质押增加更多重的收益,如果 Ethena 能够持续进行此类拓展,让持有 USDe 的用户拿到更多外部给予的超额收益,则项目将能够更快发展。

The rate of return expected from Ethena activities and the strength of external partners: The second quarter of Ethena campaign was opened, Ethena worked with a large number of well-known project players, such as Zircuit, to increase the value added to USDE's pledge. If Ethena were able to sustain such an expansion, the project would be able to grow faster if users holding USDE received more external excess benefits.

主要原因:Stacks Nakamoto 升级将于 4 月 15 日 -29 日之间开始推出,Nakamoto 升级所需引导合约已准备就绪。Stacks Nakamoto 升级是将 BTC 跨链桥升级为门限签名 threshold signet,而 Threshold Network 和其 $tBTC 是已经运行时间 5 年的 threshold signet 跨链 BTC 桥方案。

The main reason is that the Stocks Nakamoto upgrade will be launched between 15 and 29 April, and the guidance contract for the Nakamoto upgrade is ready. The Stacks Nakamoto upgrade is to upgrade BTC's cross-link bridge to a door-bound signature, which is the threshold signet, while Threshold Network and its $tBTC are the threshold signet cross-link BTC bridge program, which has been running for five years.

具体币种清单:STX(Stacks)、T(Threshold Network)

List of specific currencies: STX (Stacks), T (Threshold Network)

Pixels:Pixels 是一个基于 Ronin 网络的社交休闲 Web3 游戏,具有探索、农耕和创造的开放世界游戏环境。根据 DappRadar 数据统计,Pixels UAW 达到 74 万,用户规模量较大。Pixels 的一大特色是其结合了玩家赚取(play-to-earn,P2E)功能和农田 NFTs,旨在通过 PIXEL 代币提供一个全面的游戏环境,将货币使用和游戏玩法紧密结合,受到广泛玩家喜爱。

Pixels: Pixels is a Ronin-based social leisure Web3 game with an open world play environment of exploration, farming and creation. According to DappRadar data, Pixels UAW reaches 740,000 and has a larger user base. One of the main features of Pixels is its combination of player-to-earn, P2E functions and farmland, and NFTs are designed to provide a comprehensive game environment through PIXEL tokens that closely combines currency use and play methods and is favoured by a wide range of players.

Matr1x

Matr1x 是一个全球性的 Web3 娱乐平台,它结合了多集游戏。该平台的首款游戏,Matr1x Fire,是一个设置在元宇宙中的移动射击游戏,是 Web3 游戏行业中的第一款此类游戏。

Matr1x is a global web3 entertainment platform that combines multiple games. The platform's first game, Matr1x Fire, is a mobile shooting game set in the metaspace, the first such game in the Web3 game industry.

近期加密货币游戏赛道集体反弹。Matr1x 代币 FIRE 价格表现不错。影响 Matr1x 代币 FIRE 价格的主要因素包括其在游戏和 Web3 娱乐领域的独特地位、其旗舰游戏 Matr1x Fire 的成功和采纳,以及其平台的整体增长和参与度。

The main factors influencing the prices of the Mactr1x tokens are their unique position in the game and Web3 entertainment, the success and adoption of their flagship game Mattr1x Fire, and the overall growth and participation of their platforms.

从全球范围来看:

Globally:

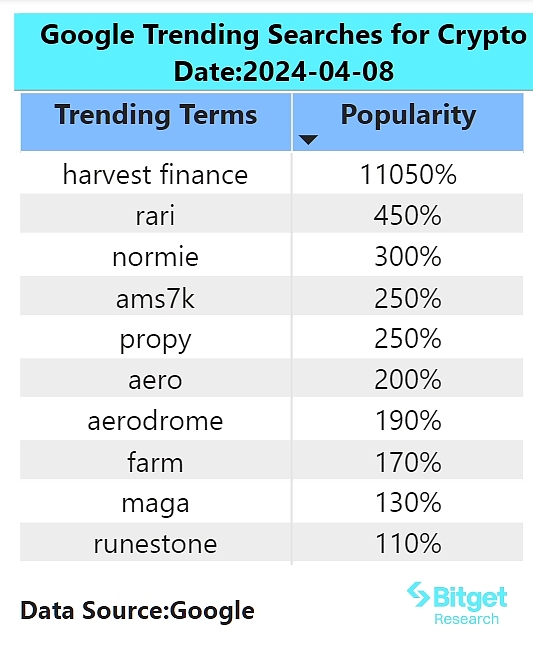

Harvest Finance

Harvest finance 是一个多链的 DeFi 收益查看看板项目。项目非常方便用户查看自己在多链部署的 LP,Yield Farming 等情况,并且方便用户快速 claim 收益。

Harvest finance is a multi-chain DeFi Proceeds Checking Board project. The project is very easy for users to view their LP, Yield Farming, etc., deployed in multi-chains, and for users to quickly project benefits.

该项目昨日代币价格最高涨幅约 160%,最终问鼎在 100% 涨幅,代币目前上线了 Coinbase,Kraken 和 Binance,由于币价上升所以社媒热搜较多。但是项目方并未公布突破性的功能或者特殊的合作信息,目前暂时不清楚该代币抬升的理由,投资者可以持续保持观察。

The project, with its highest price increase of 160% yesterday, ended up at a 100% increase, with Coinbase, Kraken, and Binance now on the line, with more social media research as a result of rising currency prices. But the project side has not published groundbreaking functional or special cooperation information, and the reason for the increase is not known for the time being, and investors are able to keep an eye on it.

从各区域热搜来看:

From the regional hot-searches:

(1)东南亚洲区对 AI 与 MEME 话题有着浓厚的兴趣:

(1) South-East Asia has a strong interest in AI and MEME topics:

东南亚用户对于 MEME 代币和 AI 代币的关注度显著提高。MEME 币方面例如 PEPE、WEN、SHIBA INU 等均大范围出现在东南亚用户搜索当中。MEME 意象简单可爱,广泛收到东南亚用户的喜爱。AI 方面 FET、WLD、ARKM 等均出现在搜索头部,由于 AI 代币是官方受到行业迭代升级影响,波动率较高,散户参与度较高。

Southeast Asian users have significantly increased their interest in MEME and AI currencies. MEME currencies, such as PEPE, Wen, SHIBA INU, are found on a large scale in South-East Asian user searches. MEME, which is simple and cute, is widely popular with users in South-East Asia. AI, FET, WLD, ARKM, etc., are found on the head search, and because AI is officially affected by industry iterative upgrading, with higher volatility and higher participation of dispersed households.

(2)欧洲和 CIS 地区对主流币关注度较高:

(2) The European and CIS regions have a high level of interest in the mainstream currency:

欧洲和 CIS 地区用户主要关注的代币是 SOL、FTM、TRON 等。近期主流行情在调整后重新回到高位,散户普遍关注主流币说明散户看好后市主流币行情,认为可能存在突破行情,普遍进行押注。同样近期 Solana 链上火热带动其他公链竞相模仿,在用户更愿意参与公链生态的前提下,用户对于该公链代币的需求也随之提高。

The main concerns of users in Europe and the CIS are SOL, FTM, TRON, and so on. In recent times, mainstream sentiment has been re-emerged.

Morph

Morph 是一个消费级别的区块链,通过 zkEVM 和响应式技术满足用户日常对于区块链需求。Morph 旨在为项目创始人提供一站式开发工具与解决方案。Morph 基于三大关键技术构建,分别为去中心化定序器、Optimistic zkEVM 集成和模块化设计。

Morph is a consumer-level block chain that meets the user’s daily needs for block chains through zkEVM and responsive technology. Morph is designed to provide project founders with one-stop development tools and solutions. Morph is built on three key technologies: decentralised sequencers, Optimistic zkEVM integration and modular design.

Morph 宣布完成 1900 万美元种子轮融资,由 Dragonfly Capital 领投,Pantera Capital 等参投。

Morph announced the completion of $19 million in seed rotation financing, led by Dragonfly Capital, with the participation of Pantera Capital and others.

参与方式:登陆 Morph 官网讲测试网 RPC 添加进入钱包软件,在官方水龙头领取测试 ETH,将测试 ETH 跨链到 Morph 测试网,参与 Morph 测试网链上项目。

Modalities for participation: Access to the Morph Officer's Net Talk Test Network RPC Adds Access Wallet Software, takes the ETH test at the official tap, tests the ETH cross-link to the Morph Test Network, and participates in the Morph Test Network project.

TimeSwap

Timeswap 是一个无清算的借贷协议使用自己风格的 AMM 模型和设计进行借贷。 用户可以将代币借入池中以赚取固定收益,借入代币或加杠杆而无清算风险。

Timeswap is a non-liquidated loan agreement that borrows using its own-style AMM model and design. Users can borrow money into the pool to earn a fixed gain, borrow money or leverage without risk of liquidation.

DeFi 借贷协议 Timeswap 完成种子轮融资,Multicoin Capital 领投,Mechanism Capital 和 Defiance Capital 参投。融资金额未公布。

DeFi loan agreement Timeswap completes the seed rotation finance, Multicoin Capital, and Mechanism Capital and Defense Capital participate. The financing amount is not publicly available.

参与方式:登陆 Timeswap 官网,选择拥有 TIME 补贴的 LP 池,组成对应 LP 添加部署后即可参与 TIME 代币预挖。

Modalities for participation: Access to the Timeswap official network, selecting a LP pool with a TIME subsidy, and making up the corresponding LP deployment to participate in TIME demarches.

原文链接:https://www.bitget.com/zh-CN/research/articles/12560603807882

Link to original language: https://www.bitget.com/zh-CN/research/articles/125660387882

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论