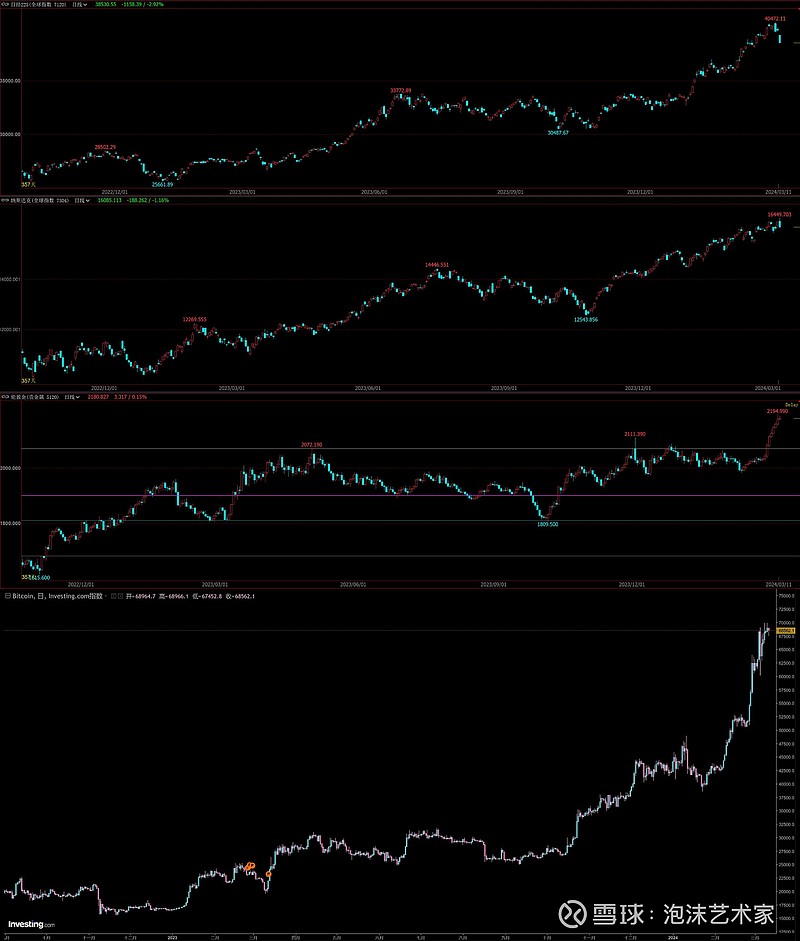

日经、纳指、黄金与BTC的品种相关性 好多人不看品种相关性,看这张图是从22年底到现在的走势,从上到下分别是:日经、 纳指 、黄金、BTC所以有啥差别吗?没有...

资讯 2024-06-22 阅读:157 评论:0好多人不看品种相关性,看这张图是从22年底到现在的走势,从上到下分别是:

Many people do not see the relevance of the species. This is the trend from the end of the 22nd to the present, from the top to the bottom:

日经、纳指、黄金、BTC

Sunshine, , gold, BTC

所以有啥差别吗?没有,明显超强相关性,就是有的波动性高,更能炒罢了。

So what's the difference? No, it's obviously super-relevant. It's more volatile.

而且去年品种波动时还有日线级的轮动滞后了,可到了今年前两个月开始一块加速冲顶了。

And last year, when the variety fluctuated, there was a lag in solar-class rotations, but by the first two months of the year, an accelerated rush had begun.

啥意思呢?

What do you mean?

这是一种典型的美元资产泡沫的跨市场共振走势,所以管你叙事是AI,日元贬值,还是美元债务周期,只要有其中一个见顶,其他就会极大概率同时共振见顶。因为其背后本质不是炒作的故事,而是美元流动性泡沫溢价,拿价格讲的故事。

This is a typical cross-market resonance of the dollar asset bubble, so it’s either AI, the yen, or the dollar’s debt cycle, one of which is the best, and the other is likely to be the best at the same time. Because the essence of this is not a story of fiction, but a dollar’s liquidity bubble premium, a story of prices.

但高息环境下充当其流动性垫子的O/N RRP已经从2万多亿耗到4400多亿美元了,以这个速度再过两个月就会彻底枯竭。本轮美债史诗级深度倒挂也是推动这些资产泡沫的推手,明显也是不可持续的。

But O/N RRP, which serves as its liquidity cushion in a high-interest environment, has already consumed more than $440 billion from over $2 trillion, at a rate that will completely dry up in two months. The downside of this round of American debt history is also the driving force behind these asset bubbles, which are clearly unsustainable.

而且美股7姐妹现在极度分化内卷,大市值边缘的AI品种走的跟彩票一样,乱七八糟的游戏币跟着炒AI飞天,而英伟达爆了个应该是人类股市历史上的天量。

And the seven sisters of the United States are now extremely divided between the insides, with the A-races on the edge of the big market playing like lottery tickets, and the is supposed to be a natural mass in the history of the human stock market.

你不觉得这就是典型的牛市快到顶的特征吗?

Don't you think that's typical of a cow market that's getting to the top?

而唯一与他们近一年多强负相关的就是A股了,现在全球市场中上证50与沪深300位置那么低的蓝筹品种,你都找不到的。

And the only thing that is relevant to them for nearly a year is the A share, which you can't find in the global market and 而他们一旦见顶,人民币资产相对美元资产就是避险资产,所以很可能随着这些美元资产疯怼后见顶,今年走出东升西降走势的。 Once they do, the renminbi assets are hedged against the United States dollar, so it is likely that they will emerge from the east-westward trend this year as these dollar assets rise to the top.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论