在比特币的区块链系统中,每产生210,000个区块后,比特币就会经历一次名叫“减半”的过程。这种机制是由比特币的创始人中本聪写入到协议中的。当减半发生后,新比特币的供应量就会减少一半,同时矿工们的区块奖励也会减半。

In a block chain system at bitcoin, Bitcoin undergoes a process called “50-per-cent” for every 210,000 blocks generated. This mechanism is written into the agreement by the founder of Bitcoin. When half is reduced, the supply of New Bitcoin will be halved, while the incentives for the miners will be halved.

具体来说,比特币减半是指比特币区块奖励的减半。每次减半发生后,矿工们因为记账而获得的比特币奖励就会减少50%。

Specifically, the halving of bitcoin means the halving of bitcoin block incentives. Each time the halving occurs, miners get a 50 per cent reduction in bitcoins for bookkeeping.

比特币的总发行量上限为2100万枚,也就说,比特币最多只有2100万枚。那么为什么比特币会有发行上限呢?瑞波币的首席技术官David Schwartz认为有以下三点原因:

The total circulation limit for Bitcoin is 21 million, which means that Bitcoin has a maximum of 21 million. So why does Bitcoin have a ceiling? for three reasons:

法定货币都具有通货膨胀的自然属性。美联储控制着美元,每当他们想调整供给时,只要打开印刷机印更多的钞票就可以了。很多人认为这是一个非常缺乏职业道德的行为。这就是为什么中本聪在比特币系统中直接规定了一个发行上限,来确保没有人能按照他们的意愿随便增加比特币的供应量。比特币最初被设计出来时,它是否会被人们采用还是一件未知的事情。通过限量发行的方式,可以激励潜在投资者在发行完之前努力获取比特币。最后,我们需要一些方法来分配比特币。矿工们最初利用他们的计算机算力来获取比特币。当所有比特币都被挖出来之后,交易费激励能够继续维护比特币的运行,保证矿工仍然有提供算力的经济动力。比特币—理解挖矿和通货紧缩

The Fed controls the dollar, and whenever they want to adjust the supply, it's possible to print more money on a printing press. Many people think that this is a very unprofessional act. That's why Ben-Book directly imposed a distribution cap in the Bitcoin system to ensure that no one can increase the supply of bitcoins as they wish. When bitcoins were originally designed, whether they would be used or not. By means of limited distribution, potential investors could be encouraged to try to get bitcoins before distribution.

2100万枚的发行上限确保了比特币是一种通货紧缩型资产。理解比特币的核心在于理解挖矿的概念。在开始之前,我们必须确认你听过这个名词,并且对它在比特币世界中的含义非常熟悉。

Twenty-one million caps ensure that bitcoin is a deflationary asset. The core of understanding bitcoin is understanding the concept of mining. Before we start, we have to confirm that you have heard the term and are very familiar with its meaning in the world of bitcoin.

“挖矿”是一个过程。在这个过程中,节点——也被称为“矿工”,使用专门的挖矿设备来解决密码学的难题。

The term “mining” is a process in which nodes — also known as “miners — are used to solve cryptography problems using specialized mining equipment.

当你用比特币进行交易时,交易信息必须在一个叫“内存池”的地方排队等待。矿工们从内存池里选择交易并形成一个区块。如果矿工的解题答案满足系统的最低要求,这个区块就会被添加到比特币的区块链上,然后交易才会生效。必须记住的是,挖矿恰好是一件资源密集型的工作——它会耗费大量的电力和金钱。区块奖励就是为了从经济上激励矿工们参与到挖矿的工作中去。

When you trade in bitcoin, the transaction information has to wait in a queue in a place called the “repository pool.” Miners choose to trade from the memory pool and form a block. If the miners answer the minimum requirements of the system, the block will be added to the bitcoin block chain before the transaction becomes effective. It must be remembered that mining is a resource-intensive exercise -- it will cost a lot of electricity and money. Block incentives are designed to provide economic incentives for miners to participate in mining.

如果没有叫停的机制,那么理论上矿工们就会挖光世界上所有的比特币,完全扭曲整体的供需平衡。

In the absence of a stop-over mechanism, the theory is that miners will dig up all the bitcoins of the world and completely distort the overall balance of supply and demand.

在完全竞争市场上,价格会自发调整到供求平衡的状态。如果矿工们被允许任意的挖掘比特币,那么比特币的流通供应量将呈指数式增长,在此过程中,其价格将大幅下跌。这就是为什么比特币减半机制被写死到协议中用于控制流通供给。

If miners are allowed to dig bitcoin at will, then bitcoin’s liquidity will increase exponentially, and prices will fall sharply in the process. That is why the Bitcoin halving mechanism is written down in agreements to control the flow.

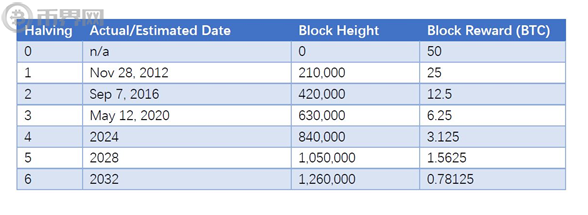

下图是比特币减半的时间线概览。

The figure below provides an overview of the time line for halving bitcoin.

据估计,最后一枚比特币会在第64次减半发生后被挖掘出来,而这大概会发生在2140年。到那时区块奖励将会减少到0,矿工们只能完全依赖交易费作为挖矿收益。

It is estimated that the last bitcoin will be excavated after the 64th reduction in half, probably in 2140. By then, block incentives will be reduced to zero, and miners will have to rely entirely on transaction fees as mining proceeds.

尽管与区块奖励相比,交易费是相当微不足道的,但在2017年12月到2018年1月之间的某个时间点,平均的交易手续费猛涨到了54美金。其中的原因非常简单。

Although transaction costs are quite insignificant compared to block incentives, the average transaction fees rose sharply to $54 at some point between December 2017 and January 2018. The reason for this is very simple.

考虑以下假设。当需求量上升时,在内存池中等待被记录的交易量也会增加。然后,比特币的区块大小被限制在1Mb,也就是说一个区块能记录的交易量是有限的。为了使自己的交易被及时记录生效,交易者可以增加他们提供的手续费,从而激励矿工们优先记录他们的交易。

Consider the following assumptions. When demand rises, the volume of transactions waiting to be recorded in the memory pool increases. Then the size of the bitcoin block is limited to 1Mb, which means that the volume of transactions that a block can record is limited.

所以基于以下原因,我们预计在2140年前后比特币的需求也会上涨:

So we expect that the demand for bitcoin will also rise around 2140 for the following reasons:

没有新的货币:首先,不会再有新发行的比特币流入市场。这会从根本上促使比特币升值,同时增加总需求量。交易费也会随之急速上涨。

There are no new currencies: first, there will be no more newly issued bitcoins flowing into the market. This will essentially lead to an appreciation of bitcoins, while increasing aggregate demand.

当判断减半的影响时,首先值得关注的是挖矿的稳定性。正如我们之前提到的,矿工在比特币的经济体系里扮演着至关重要的角色。除了挖掘新区块、记录交易信息之外,矿工们还负责整个区块链网络的维护。这里我们就要讲到“哈希率”的概念。

As we mentioned earlier, miners play a vital role in the Bitcoin economy. In addition to digging new blocks and recording trade information, miners are responsible for maintaining the entire network of blocks.

哈希率是一个用于描述网络算力的名词。哈希越高,网络的速度和安全性就越高。如果大量矿工突然决定离开网络,就会发生以下的事情:

Hashigin is a term used to describe network computing. The higher Hashi, the faster and safer the network is. If a large number of miners suddenly decide to leave the network, the following happens:

网络会变得拥堵。没有人挖掘新区块,交易信息无法被及时处理记录。一个强大的挖矿节点可以利用它占据优势的算力进行51%攻击、取代比特币已有的区块数据。

The network becomes congested. No one digs new blocks, and transactional information cannot be processed in a timely manner. A powerful mining node can use its superior arithmetic to attack 51% of the block data available in Bitcoin.

考虑到矿工们以区块奖励作为主要收入来源,他们会如何对待减半事件——是果断离开及时止损还是坚守阵地维护网络呢?让我们用事实的数据回答这个问题。

Given that miners use block incentives as their main source of income, how will they deal with the halving of the event — whether to leave positions in time or to maintain networks? Let us answer that with factual data.

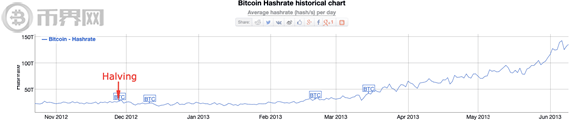

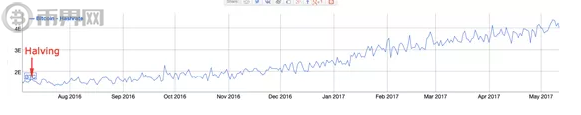

2012年的减半:

Halve by 2012:

图源:BitInfoCharts

这次减半之后发生了什么?首先我们来看看哈希率的变化。在两周内,比特币网络的算力从27.61THash/s下降到了19.98 THash/s。然而,在那之后哈希率一路稳步上涨,在六个月后更是达到了60 THash/s。因此,尽管最初有小幅的下跌,整个网络的算力最终仍然上涨了。

What happened after halving it? First, let's look at the change in the Hashi rate. In two weeks, the Bitcoin network fell from 27.61 THash/s to 19.98 THash/s. After that, however, the Hashi rate rose steadily, reaching 60 THash/s six months later. So, despite an initial drop, the entire network eventually went up.

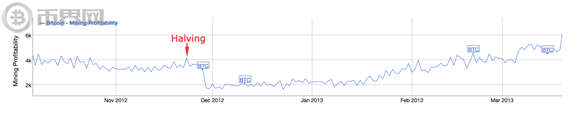

图源:BitInfoCharts

再来看看挖矿的收益。在减半发生后,挖矿收益直线下降,但是在四个月后恢复到了减半前的水平。

Let's look at the profits from mining. After halving, mining proceeds have declined in a straight line, but have recovered to their pre-half level four months later.

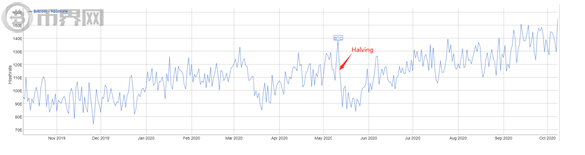

2016年的减半:

Halve by 2016:

图源:BitInfoCharts

首先关注哈希率。与2012年类似,2016年减半发生后,比特币网络的算力由1.56 EHash/s跌到了1.40 Ehash/s。然而,在七个月内算力又上涨到了3.85 Ehash/s。

Similar to 2012, the ability of the Bitcoin network fell from 1.56 EHash/s to 1.40 Ehash/s. However, it rose to 3.85 Ehash/s in seven months.

图源:BitInfoCharts

但是挖矿收益的变化趋势却没能像2012年一样乐观。在2016年减半发生后,比特币的挖矿收益明显减少了——直线下降后很长一段时间内都保持在低收益水平。

But the trend in mining revenues has not been as positive as in 2012. After halving in 2016, bitcoin mining revenues have declined significantly – and have remained low for a long time after falling in a straight line.

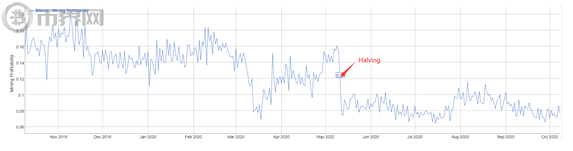

2020年的减半:

Halve by 2020:

图源:BitInfoCharts

首先关注哈希率。在2020年减半前,比特币网络的算力先是冲高的137 EHash/s,然后迅速回落,在减半后跌至87 EHash/s。在7月份后,算力稳定在120 EHash/s以上。

图源:BitInfoCharts

挖矿收益像2016年类似,在减半后,比特币的挖矿收益几乎减少了50%,这主要是因为挖矿产出的比特币减少一半,但币价没有明显的增加。

Mine mining revenues, similar to those in 2016, decreased by almost 50 per cent in Bitcoin after halving, mainly because of the halving of bitcoins from mining, but there was no significant increase in currency prices.

图源: Fitzner Blockchain in Medium

最后,所有人都关心的大问题是:减半发生后,比特币的价格真的上涨了吗?在2012年减半发生后,比特币的价格起初只是由11美元上涨到了12美元,然而在一年后火速涨到了1,038美元,上涨了9,336.36% 之多。

Finally, the big question for everyone is: did the price of Bitcoin really rise after halving it? After halving it in 2012, the price of Bitcoin initially rose from $11 to $12, but after a year, the fire rose to $1,038, up by 9,336.36 per cent.

接着,在420,000的新区块产生后,2016年7月,比特币经历了第二次价格的飞跃。在减半发生前一个月内,比特币的价格从576美元涨到了650美元,因为投资者们都在大量买入比特币,期待着减半之后价格的飞升。果不其然,减半发生一年后,在2017年7月9日,比特币的价格涨到了2,526美元,涨幅达288.60%。

Then, in July 2016, after 420,000 new blocks were created, Bitcoin experienced a second leap in prices. In the first month of halving, the price of Bitcoin rose from $576 to $650, because investors were buying in bitcoins in large quantities and looked forward to price hikes after halving. One year after halving, on 9 July 2017, the price of Bitcoin rose to $2,526, an increase of 288.6 per cent.

在2020年5月12日比特币第三次减半时,比特币价格为8800美元,到今天为止,比特币价格为10880美元,上涨了24%,这与前两次的涨幅相比微不足道。而前两次的比特币巨额涨幅都是在减半一年后发生的,而目前距离减半过去也才仅仅4个月时间。

By the time Bitcoin was halved for the third time on 12 May 2020, the price of Bitcoin was $8,800, and by today it was $10880, an increase of 24%, which is insignificant compared to the previous two increases. The first two large bitcoin increases occurred one year after the halving, which was only four months from now.

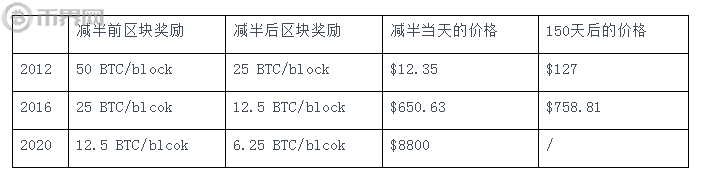

下面是三次减半事件的影响速览图:

Below is a quick picture of the impact of the three halved events:

减半前区块奖励减半后区块奖励减半当天的价格150天后的价格

Pre-half block incentives after half the price after 150 days on the day of halving the price of the block

我们对比发现,比特币的价格在2016年减半后的确经历了上涨,但是涨幅却远不如2012年。我们认为,这是由于比特币总体体量增大导致的增幅降低。我们推测,2020年比特币减半后比特币币价增幅小于2016年的币价增幅。

In comparison, we found that bitcoin prices did rise after halving in 2016, but they did not rise as much as in 2012. We believe that this was due to a decrease in the overall volume of bitcoins.

当然,有一些反对的声音认为,减半将不会影响比特币价格。让我们来看看他们的观点。

Of course, there are some opposition voices that say that halving will not affect bitcoin prices. Let's look at their point of view.

比特币现在的市场状况远远不同于2012和2016年。为了理解将来减半或许不会再对比特币的价格产生如此重大的影响,我们必须考虑这几个具体的问题:

Bitcoin’s current market situation is far different from those of 2012 and 2016. To understand that halving the price of bitcoin in the future may not have such a significant impact, we must consider these specific issues:

当行情上涨时,矿工们可能会抛售他们的区块奖励而不是持有它,这将增加比特币的供应量。比特币现在有了期货交易的模式。期货交易者不需要持有真正的比特币来进行他们的交易,这使得比特币的流通量没那么重要了。 比特币的流通量与整体的交易量相比已经微不足道。回到2012或者2016年,这个比例还没有如此扭曲。但现在,每天都有数百万枚比特币被交易。即使区块奖励减半,对这个比例也不会产生很大影响。市场上新出现的各种交易机构空前的增加了比特币的交易量。

When the situation rises, miners may sell their block incentives rather than hold them, which will increase the supply of bitcoins. Bitcoin now has a pattern of futures transactions. Futures traders do not need to hold real bitcoins for their transactions, which makes the amount of bitcoins less important.

比特币减半是协议的核心。想想看,减半保证了比特币的通货紧缩特性,这使得它从形态上区别于具有中央控制、通货膨胀特性的法定货币。甚至在所有比特币都被开采完之后,内在的经济学逻辑仍能维护比特币网络的稳定运行。至于随着减半的发生,比特币是会像先前一样一路增值,还是可能出现新的因素抑制其价格的上涨,现在下结论还为时过早。

Even after all bitcoins have been extracted, the underlying economic logic can maintain the steady functioning of the Bitcoins network. It is too early to conclude whether Bitcoins will add as much value as before, or whether new factors may be introduced to curb price increases.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论