证券时报-e公司 消息,今日,比特币跌破2万美元(约13.42万元人民币)关口,为2020年12月以来首次。

According to the Securities Times-e, today Bitcoin has fallen to the point of $20,000 (approximately RMB 134.2 million) for the first time since December 2020.

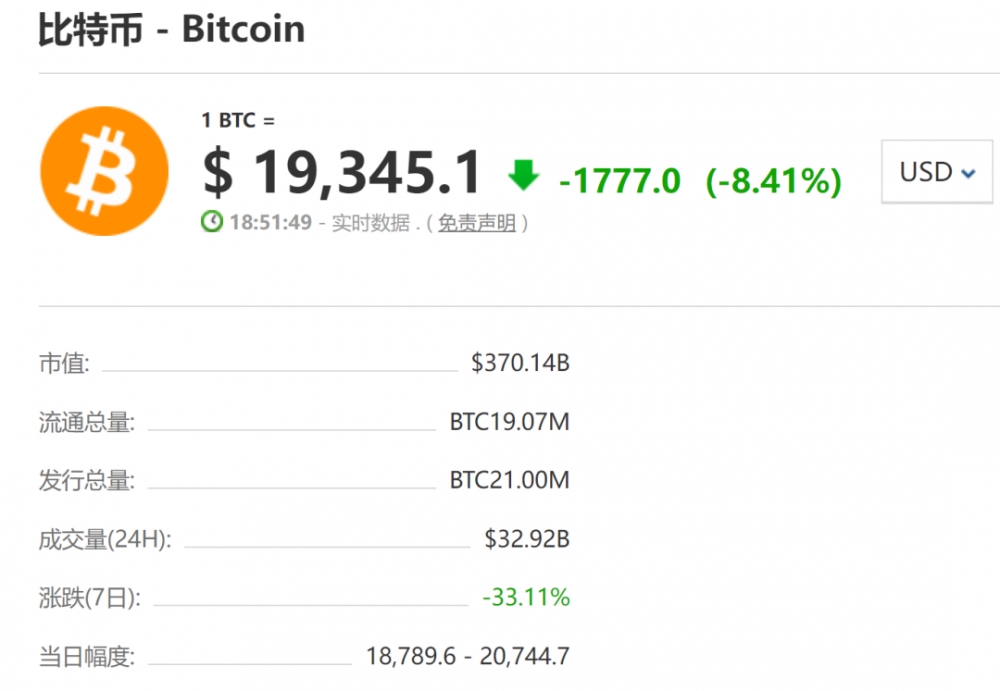

截至发稿时,比特币报 19345.1 美元(约 13 万元人民币) / 枚。

At the time of publication, the Bitcoin newspaper had reported US$ 19345.1 (approximately RMB 130,000)/mines.

比特币价格跳水

Bitcoin Price Skipped

比特币和以太坊分别在2020年12月中旬和2021年1月首次突破2万美元和1000美元,此后持续在上方震荡。

Bitcoin and Ether were able to break through $20,000 and $1,000 for the first time in mid-December 2020 and January 2021, respectively, and continue to vibrate above.

2022年开年,比特币价格尚在47000美元上方,一季度最低价格在31000美元左右。自4月起,比特币震荡下行,并在5月告别4万美元关口,一路跌破3万美元。以太坊同样经历震荡,并在5月接连跌破3000美元和2000美元关口,6月10日起,以太坊价格也一路直线走跌。

In the beginning of 2022, the price of Bitcoin was above $47,000, with a minimum price of $31,000 a quarter. Since April, Bitcoin has gone down, and in May it said goodbye to $40,000.

本周一(6月13日),虚拟货币市场“大血洗”,比特币和以太坊的单日下行震幅均超过15%。比特币和以太坊连日下跌,已破1.9万美元和1000美元关口,较2021年11月创下的历史高位68700美元和4890美元分别跌超72%和79%。

On Monday, June 13, the virtual currency market was “breededed” by more than 15% in Bitcoin and Ether. Bitcoin and Etheria fell by more than $19,000 and $1,000, down from the historic high of $68,700 and $4890 in November 2021, respectively, by more than 72% and 79%.

6月18日17时,比特币价格反弹至19000美元上方,以太坊约1000美元。

On 18 June, at 1700 hours, the price of Bitcoin rebounded to over $19,000, and in Ethio it was about $1,000.

欧易研究院高级研究员赵伟分析,影响近期行情下行的因素有很多,其中主要的影响因素之一还是上周公布的美CPI指数创下了40年来的新高,超出了市场预期。赵伟表示,加息对于投资市场意味着资金流出,而体现在加密市场上就是整体币价的持续下跌;同时也代表加密市场等其他次级投资市场需要继续消化CPI超出预期而带来的美股下跌的后果。从目前来看,加密市场作为美股的次级市场难以逃脱相关因素的影响。此外,加密货币市场正受到Lido旗下stETH等项目暴雷的负面影响。

Zhao Wei, a senior researcher at the OEE Institute, analysed the many factors that have affected the recent downturn, and one of the main factors influencing this is that the US CPI index, which was published last week, has reached a 40-year high, exceeding market expectations. Zhao Wei said that interest hikes on investment markets mean capital outflows, and are reflected in the continuing decline in overall currency prices in the crypto market; and that other sub-investment markets, such as the encryption market, need to continue to absorb the consequences of the decline in the United States stock market, which exceeds expectations.

特斯拉“看走眼了”

近期,由于受市场大环境的影响,以比特币为首的虚拟货币价格不断跳水,这也让此前看好比特币的特斯拉很“受伤”。 Recently, as a result of the prevailing market environment, virtual currency prices, led by bitcoin, continued to jump, which also left Tesla, previously regarded as Bitcoin, “injured”. 根据追踪全球拥有比特币企业的公司比特币国债的数据,特斯拉目前拥有 43200个代币,在持有比特币最多的企业中排名第二。领先的是MicroStrategy。以目前每枚 19000+美元的价格计算,特斯拉拥有的代币数量不到9亿美元。与 2021 年初花费 15 亿美元购买比特币相比,特斯拉在投资这种数字货币时损失了近 6 亿多美元。特斯拉此前曾表示,投资比特币的目的是让流动性来源多样化,让资产配置更加灵活,而其CEO马斯克也曾多次为比特币、狗狗币等虚拟货币站台宣传。在特斯拉买入比特币的最开始几个月,由于比特币价格的一路走高,特斯拉并未亏损,反而还赚了不少钱,尤其是在去年11月10日比特币触及69044.77美元的历史高点时,特斯拉更是赚得盆满钵满。此前,特斯拉在向美国证券交易委员会 (SEC) 提交的文件中表示,到 2021 年底,它将持有价值 19.9 亿美元的比特币。在公司持有比特币期间,该代币持续大幅波动,2021 年 5 月达到 66000 美元,2021 年 7 月下跌 28000 美元,2021 年 11 月达到 68000 美元的历史新高。去年购买比特币后,埃隆马斯克表示,特斯拉将让客户使用加密货币购买汽车。然而,到了年中,由于担心比特币开采对环境产生负面影响,导致气候变化,他撤回了声明。然后他透露了如果矿工使用清洁能源开采,特斯拉仍然可以接受的可能性。 According to data tracking the world’s Bitcoin debt, Tesla now owns 43,200 denars, the second largest company in Bitcoin. The leader is MicroStrategy. At the current price of $19,000 + dollars, Tesla owns less than $900 million. Compared with the $1.5 billion spent at the beginning of 2021, Tesla lost nearly $600 million in investing in this digital currency. Tesla had previously stated that the purpose of investing Bitcoins was to diversify its liquidity sources and to make its assets more flexible, and its CEOmask had been promoting virtual money stations such as Bitco and Dogcoins on a number of occasions. 原标题:大跳水!比特币跌破2万美元,创18个月以来最低价;特斯拉炒币浮亏6亿美金,马斯克看走眼了? Original title: Big jump! Bitcoin fell by $20,000, the lowest price in 18 months; Tesla's coin lost $600 million. 【免责声明】上游新闻客户端未标有“来源:上游新闻”或“上游新闻LOGO、水印的文字、图片、音频、视频”等稿件均为转载稿。如转载稿涉及版权等问题,请联系上游。![]()

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论