各位读者老爷们早上好,我是小牛,昨晚小牛提到:一旦比特币上行到了9160之后便会打开上行通道,小牛会直接上看9500附近,虽然在9400美金下方回调到了9250美金上方震荡运行,日内或仍有回撤风险,但是小牛认为不能盲目做空,以往常庄家的套路来说涨大都分段涨,涨一波再一波的涨。

Good morning, old readers, I am a calf. Last night the calf mentioned that once bitcoin had gone up to 9160, it would have opened up the upper route, and the calf would have gone straight up to the area of 9500. Although it would have moved back up to $9250 at $9,400, there might still be a risk of withdrawal in the day, the calf felt that it could not be blindly emptied, and that the road used to be full of ups and ups and ups and ups.

小伙伴们操作中严格带好止盈止损操作。

>. > > > > > > > > > > > > > > > > > > > > > > > > > > > > > >.

、

币圈早报:

bill:

外媒:BTC减半后,部分矿工已转向BCH和BSV

据Cryptonews 5月13日消息,文章分析称,部分矿工已从比特币转向BCH和BSV。Bitinfocharts数据显示,在比特币减半当天,BCH的哈希率几乎翻倍,BSV哈希率也在本周翻了一番。而在BCH和BSV减半后,两者的哈希率都出现了明显下跌。一些分析师指出,此前矿工从BCH和BSV转向BTC,试图补偿其收入损失。

According to Cryptonews , on 13 May, the article analysed that some miners had moved from bitcoin to BCH and BSV. Bitinfocharts showed that on the day BCH had been halved, the Hashi rate had almost doubled and the BSV Hashi rate had doubled this week. After BCH and BSV had been halved, there had been a marked decline in the Hashi rate. Some analysts had pointed out that the miners had moved from BCH and BSV to BTC in an attempt to compensate for their loss of income.

Cardano创始人:以太坊非营利性质是大多数创始人离开的原因

据Dailyhodl 5月13日消息,以太坊联合创始人、Cardano创始人、IOHK首席执行官Charles Hoskinson在接受采访时表示,以太坊的非营利性质是其大多数创始人离开的原因。据悉,以太坊由Vitalik Buterin、Anthony Di Iorio、Charles Hoskinson、Mihai Alisie、Amir Chetrit、Joseph Lubin、Gavin Wood和Jeffrey Wilke创立。只有V神仍然活跃在以太坊社区中,其他七位创始人最终已离开并建立了自己的公司。

Founder of

, according to Dailyhodl 13 May news news, based on the co-founder of Tai shop, founder of Cardano, CEO of IoHK, Charles Hoskinson, Mihai Alie, Amir Chetrit, Joseph & nbsp; Lubin, Gavin & nbsp; Wood and Jeffrey& nbsp; and Wilke. Only V. is still active in the community and has finally set up his own company.

在减半后,已有超2亿美元BTC从交易所转至个人钱包

据Cointelegraph 5月14日消息,在比特币第三次减半之后,投资者将23540枚BTC从交易所转移至个人钱包地址中,价值超2亿美元,这似乎表明他们对比特币的信心有所增强。Glassnode数据显示,两个月以来,交易所钱包中的BTC数量从2,634,574已下降至2,332,524。

After halving, more than $200 million has been transferred by BTC from the exchange to its personal wallet

; on 14 May, according to the news, after the third halving of Bitcoin, investors transferred 23540 BTCs from the exchange to their personal wallet addresses, valued at over $200 million, which seems to indicate an increase in their relative currency's confidence. Glasnode data show that the number of BTCs in the wallets of the exchange has declined from 2,634,574 to 2,332,524 for two months.

DAppTotal: Tether在波场网络增发1亿枚USDT

据DAppTotal稳定币专题页面数据显示:05月13日23时16分,USDT发行方Tether在波场网络增发1笔价值100,000,000美元的TRC20 USDT,块高度为:19706153。截至目前,Tether在波场网络上的TRC20 USDT总发行量已达1,983,395,020枚。

DAppTotal: & nbsp; Tether sent 100 million additional USDT

strange > according to DAppTotal Stable page: 2316 hours on 13/05, USDT issuer Teth sent an additional TRC20& nbsp with a value of US$ 100,000,000; USDT at an altitude of 19706153.

关于这个泰达币增发,小牛想说一下,泰达币项目方近段时间以来,无限印钞,其账目的不公开性造成的一些埋雷谁也不知道在哪天会突然被各国极客扒出。或许未来泰达币暴雷同样会造成各大币种爆拉(你手里的USDT不值钱了肯定是兑换成为等值的主流币以避险,这个只有等到未来才知道到底是怎么样的,行情没有走出来之前任何分析都是猜测)

"Strong" said about this increase in tidal currency, and the calf would like to say that in the near future, some of the mines caused by the inexhaustible nature of the accounts of the tidal currency project will suddenly be picked up by the country's guests. Perhaps the future Tydal storm would also cause the large currency to explode (the USDT in your hand is not worth it to be converted into the mainstream currency of equivalent value, which will only be known in the future, and any analysis will be guessed before it comes out).

各主流币行情分析与操作建议:

mainstream currency situation analysis and operational recommendations:

现阶段比特币重拾信心,市场情绪较为高涨,买入信号强烈,以太坊上行幅度也较大,其余币种大都观望,以比特币与以太坊马首是瞻。

At this stage, bitcoin regains confidence, market sentiment rises, buying signals are strong, and the Etherm has a larger line of movement, with most of the remaining currencies watching and looking at bitcoin and Ethera's head.

比特币行情分析:

bitcoincase analysis:

一小时级别图来看:MACD指标呈金叉态势,RSI指标下行态势平缓,布林带开口放大,币价从布林带上轨上方回落到现在的布林带上轨下方,MA5均线附近运行,

从四小时级别看来:MACD指标金叉态势延续,布林带缓慢张口,RSI指标已经再顶部运行一段时间了,暂时未有顶背离讯号,币价位于布林带上轨上方运行。

from the four-hour level: MACD indicator golden fork continues, the Bryn belt slows down, RSI indicator has been running at the top for some time, no deviations have been made for the time being, and the currency is running above Bryn's track. 日线级别看来:币价站稳在MA5/10/30/60日均线上方,下方支第一撑位移到了9000美金附近,第二支撑位仍在8200美金附近。 The 操作建议:在9000美金附近进场多单,止损50点,止盈200点, Operational Recommendations: More single, 50 points down, 200 points down, near $9,000 跌破了8950美金附近进场空单,止损60点,止盈180点, fell off the pass of $8950. 60 points, 180 points, 如日内多头发力则看到9550美金一线突破情况,未能突破反手空单,如果突破并企稳,进场多单,上看9800美金一线 "Strong" sees a quick break of $9550 in the day, fails to break through the counter-hand list. If you break through and steady, enter the field and look at the $9,800 line

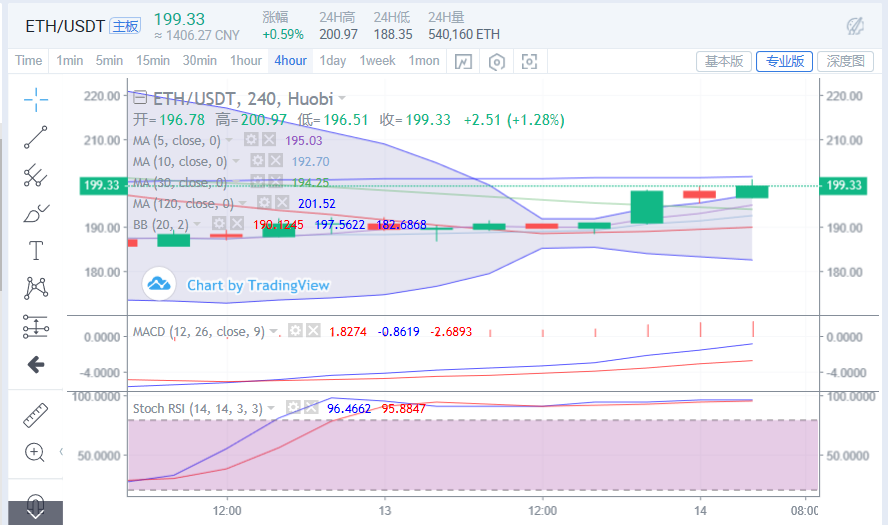

一小时级别:币价稳定在MA5均线上方运行,MACD指标仍保持上行态势,RSI指标呈平缓状态,

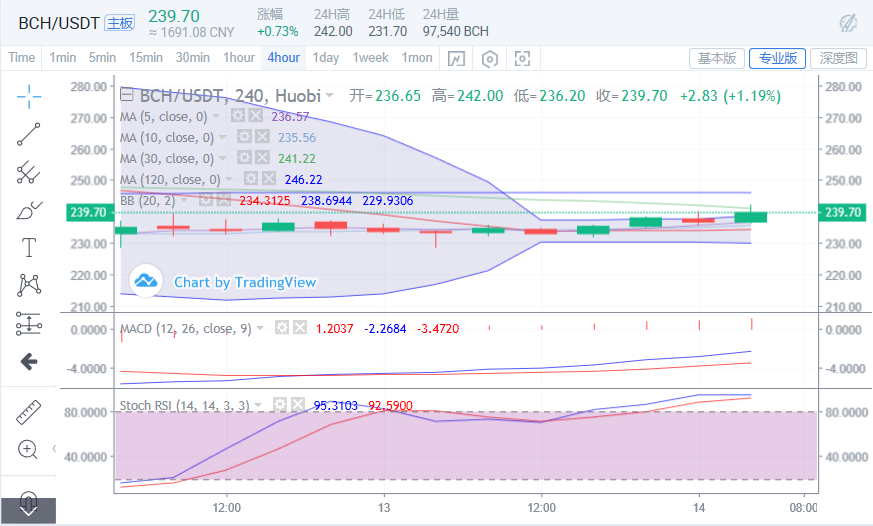

四小时级别图:上方MA120均线是一个短线较大的压力位,如未能突破可在其附近进场空单,MACD指标呈金叉态势,现在币价在MA5均线上方也在布林带上轨上方,有一定回撤需求,只要未能跌破194.5美金一线则仍会有上行需求。 4-hour scale map: The above-line MA120 is a short-line, high-pressure position, with a gold fork position for the MACD indicator if it fails to break through the entry list in its vicinity, and now the currency is on the rail above the MA5 line, with a certain demand for withdrawal, as long as it does not break the line of $194.5. 日线级别图MACD指标在布林带中轨下方,日内未能突破,与四小时级别的MA120均线相呼应, The 日内操作建议:在201附近进场空单,止损1.5个点止盈看到196美金附近。 day of operation proposal: A stop list near 201, with 1.5 points to see $196 in excess. 在192附近进场多单,止损1.5个点止盈看到199美金附近。 sees around $199 at 1.5 points near 192. 等局势明朗再做单,不要盲目而为,及时带好止盈止损,不要逆势扛单,该止损就止损。 and so on, do not lose sight of the situation, bring the loss to an end in a timely manner, do not carry the loss in reverse, and stop the damage. BCH比特现金: BCHbit cash: 四小时级别图来说:比特现金在上方MA120美金附近很难有上行空间,布林带开口并未放得特别大,MACD指标虽然呈金叉态势,但RSI指标来看或有顶背离需求。 The four-hour scale map for 日线级别来说:现在币价稳企在MA5日均线上方,短时上探突破了MA30日均线,MACD呈死叉态势,RSI指标未能有足够量能支撑上行。 操作建议: Operational Proposal: 在235附近进场多单,止损1.5美金,止盈4美金 在242下方进场空单,止损1.5美金,止盈4美金。 leaves an entry list below 242 for $1.5 and $4. . 日内或仍有大幅波动风险,注意严格带好止盈止损,控制仓位。 There may still be a risk of significant fluctuations during the day of

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论