作者:Frank,PANews

4月17日,Merlin Chain 宣布已開放Merlin's Seal 積分對應的空投查詢頁。據悉MERL 的20%將分發給質押Merlin's Seal 的用戶,以MERL總量為21億的數量來看,本次空投代幣數量約為4.2億枚。雖然MERL代幣仍未正式發行,但已有多個場外的MERL平台推出了交易對,4月18日MERL的價格約為1.74,以此價格計算。本輪空投的規模約為7.3億美元。

On April 17, Merlin Chain announced the opening of the Merlin & #39; s Seal credit check page for air drops. It was reported that 20% of Merlin & #39; s Seal's clients, in terms of their total MerL of 2.1 billion, were to be assigned to Merlin & #39. Although Merl's currency had not yet been officially issued, there were several outside MERL platforms offering transactions, with the price of MerL on April 18 estimated at 1.74, which is about $730 million.

綜合來看,在Merlin上透過質押擼空投的收益結果並不樂觀,PANews統計了主要的幾種質押資產結果來看,假如都是在最初質押了價值1個BTC的資產。到最後只有BTC、ETH、USDT、ORDI這幾種資產的綜合收益率為正,其他的幾種資產質押結果都為負值。其中,除了BTC綜合下來的殖利率達到82.25%,跑贏在此期間的最高現貨收益。其他的資產均不及持有現貨在高點賣出。

In Merlin, the outcome of the pledge was not positive, with PANews accounting for the main types of pledge product, if one BTC value had been initially pledged. Only BTC, ETH, USDT, or ORDI were at the end of the day positive, and several others negative. Of these, except BTC, which had a combined interest rate of 82.25 per cent, had won the highest yield in the period.

根據目前用戶回饋的積分與代幣兌換比例約為68:1,而本次空投的總量為4.2枚代幣,PANews換算得出積分總量約285億積分。

According to the current user feedback rate of about 68:1 and the current air drop of 4.2 tokens, PANews returns a total of about 28.5 billion points.

以此積分量計算,如果根據場外1.74美元的代幣價格計算,每個積分的價格約為0.025美元。

On this score, if based on an off-site currency price of $1.74, the price per fraction would be approximately US$0.025.

那麼在Merlin Chain進行質押所獲得的利益有多少呢?

So what are the benefits of the pledge at Merlin Chain?

依照上述的計算方法,1個比特幣每日可兌換的MERL的代幣數量約為146個,收益金額約255美元每天。如果用戶從2月8日開始質押,直到4月14日。 66天質押收益約16876美元。

According to the calculations described above, the number of MERLs that can be replaced by a bitcoins per day is about 146, with a return of about US$ 255 per day. If the user is to be held in custody from 8 February until 14 April, the 66-day pledge is about US$ 16,876.

如果你沒有參與Merlin 的質押活動,會賺的更多嗎?

Would you have made more if you hadn't taken part in Merlin's pledge?

2月8日,比特幣的收盤價為45,288美元,到4月14日期間最高上漲至7,3777美元。如果用戶A是交易高手,在這段期間選擇只是持有比特幣,在最高點出售,那麼用戶A的現貨的最高收益為28488美元,收益率最大為62.9%。

On 8 February, Bitcoins collected US$ 45,288, up to US$ 7,3777 on 14 April. If user A is a trader, during this period chooses to hold only bitcoins and sell them at the highest point, user A has a maximum yield of US$ 28488 and a maximum return of 62.9 per cent.

用戶B假設是在Merlin鏈上的忠實用戶,從質押的第一天就質押了1個比特幣,直到4月14日才選擇撤出(理論計算,實際上要等比特幣減半後才能撤出)。那麼該用戶的收益為比特幣持有的收益+ Merlin空投收益,這兩者的收益相加約為37,249美元,收益率最大為82.25%。

User B assumes to be a loyal user on the Merlin chain, with a bitcoin pledged from the very first day of the pledge, until April 14, when it chose to withdraw (the theory is that it actually waits for the bitcoins to be cut by half). The user then has a gain in bitcoin + the Merlin drop, which is approximately $37,249 plus a return of up to 82.25 per cent.

相較來看,如果MERL代幣的價格在上線後還能維持目前的交易價格,那麼用戶質押在MERL上或許可以避開牛市回檔的一定風險,但總體的差異不大。如果MERL的正式開盤價下跌至0.83美元以下,則結合MERL的空投收益和持幣收益則不如在高點賣出BTC。

By contrast, if the price of Merl’s currency maintains the current trade price when it is online, then the risk that the client’s pledge on the Merl may avoid the cowback file may be significant, but the overall difference is not significant. If the formal opening price of Merl falls below 0.83 US dollars, then the yield of the Merl’s airdrops and currency holdings would be better to sell BTC at a higher point.

由於Merlin的積分計算以BTC計價的等值資產計算(每BTC為10000積分每天),隨著最近大盤的劇烈波動,許多質押的非BTC資產都受到了對BTC匯率的影響,造成現貨價格下跌和積分數量減少的雙重傷害。

Since Merlin’s points are calculated as BTC equivalents (10,000 cents per day per BTC), many of the non-BTC holdings that have been pledged have been affected by BTC transfer rates, resulting in a fall in current prices and a reduction in the number of points.

對於那些質押RATS資產的用戶來說,可能在Merlin上質押則會錯失了最好的賣出時機。在Merlin質押期間,RATS的單純持幣的收益率最高為169%,而如果選擇Merlin質押獲取空投,則總體收益率則為-10.67%。

For those who hold RATS assets, it is likely that the pledge on Merlin will miss the best time to sell. During Merlin’s pledge period, RATS will have a yield of up to 169% of its sole currency, and if Merlin is selected for a drop-off, the overall rate of return will be -10.67%.

舉例來說,例如在初始質押的時候,A用戶選擇的是質押BTC,B用戶質押的是RATS,同樣都是價值1個BTC的資產,假設初始資金是45288美元。

For example, at the time of the initial pledge, the A user chose to take BTC, and the B client took RATS, which were also assets valued at 1 BTC, assuming that the initial amount was $45288.

對A用戶來說,他每日獲得的積分數量是一樣的,為10000點。

For A users, his daily score is the same, 10,000 points.

而B用戶因為RATS對BTC的匯率一直在變,整體呈下降趨勢,從2月8日至4月14日,RATS對BTC的匯率下降了56.79%,也就意味著B用戶每日的積分將少於10000積分,我們按照線性變化來估算這個下降過程的話,總體上質押RATS的B用戶獲得的積分比質押BTC的A用戶少了22萬個,換算為代幣數量約少2754枚MERL。

And because RATS has been changing to BTC, the overall trend has been downward, with RATS having dropped by 56.79 per cent from 8 February to 14 April, which means that B users will have less than 10,000 credits per day. If we estimate this decline by linear variations, the sum of the B clients holding RATS is 220,000 fewer than the A users holding BTC, which is about 2,754 less than the number of moles.

結合RATS價格自2月8日至4月14日下跌了約37.4%,即便算上透過質押獲得的26.6%的收益率,綜合這段時間的收益率也是-10.6%。

The combined RATS prices fell by approximately 37.4 per cent from 8 February to 14 April, and even if the 26.6 per cent rate of return through the pledge was calculated, the combined rate of return for the period was -10.6 per cent.

不過,上述所計算的僅為Merlin的質押空投獎勵收益,而沒有將Merlin生態的其他項目獎勵計算在內。如果結合生態內其他項目的空投獎勵,收益狀況會更好一些。

However, these are calculated only for Merlin’s pledge award, and not for other items of Merlin’s ethos. The benefits would be better if they were combined for other projects in the system.

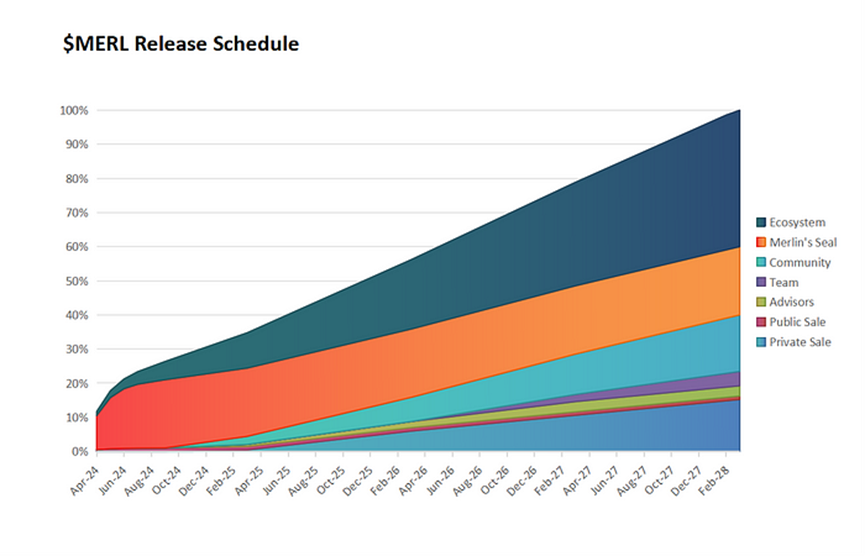

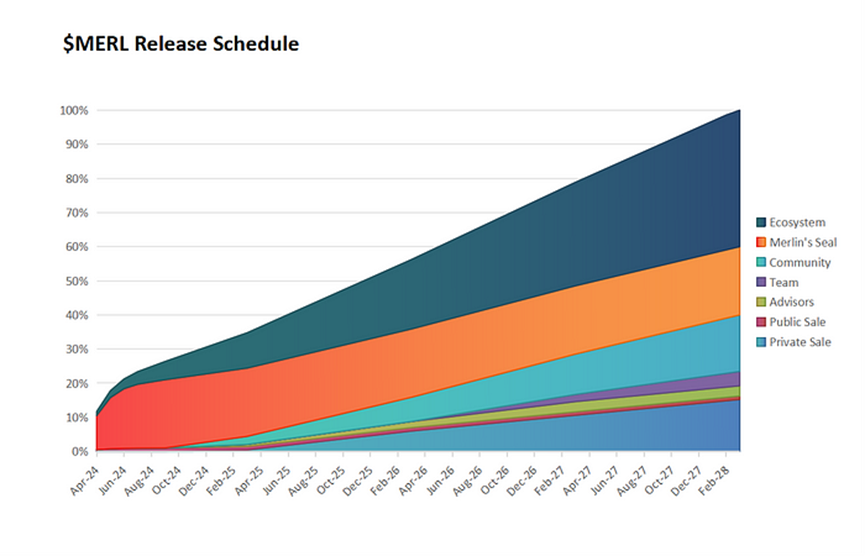

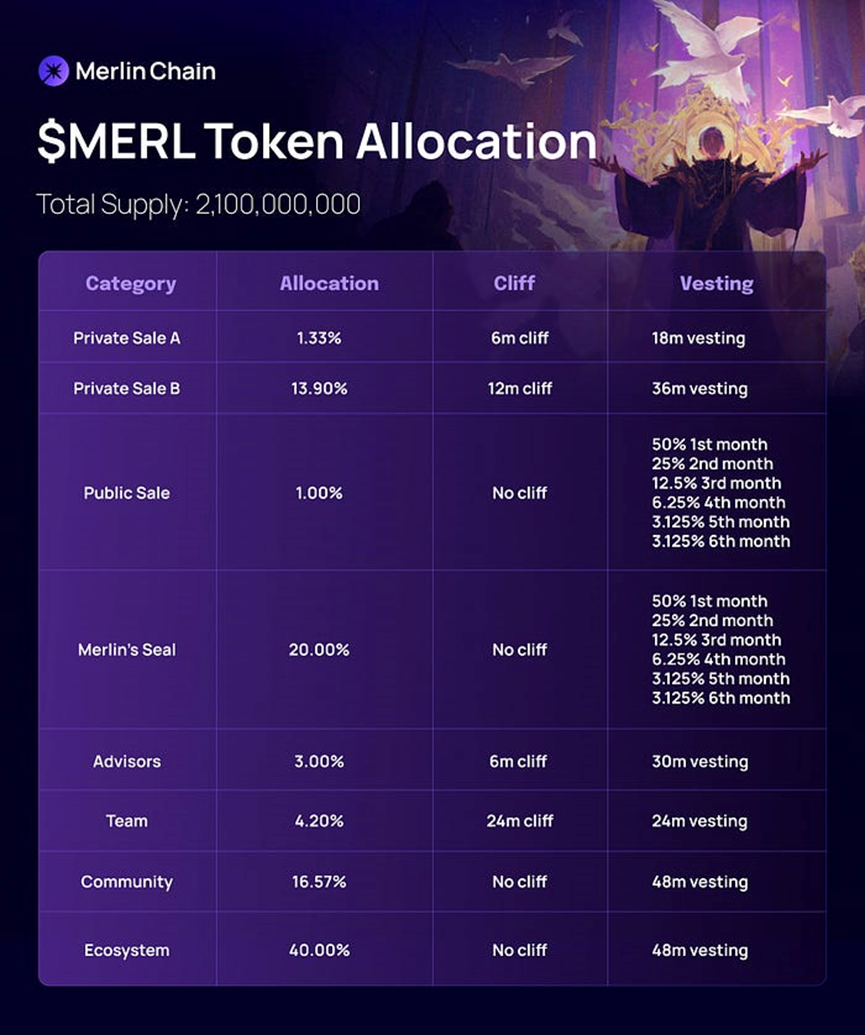

MERL的總供應量為2,1億枚,將於4年內線性釋放。本輪空投的20%代幣將在第一個月釋放50%,隨後分6個月逐步解鎖。以目前場外價格1.74美元計算,完全稀釋市值約36.54億美元。

The 20% of this round will be released 50% in the first month, and then unlocked in six months. At the current extravagant price of $1.74, the market value will be completely diluted by about US$ 3,654 million.

另根據官方公告顯示,MERL代幣將於4月19日10:00 UTC時間開始在OKX、Hashkey Global、Bitget等多家CEX上開啟交易。

According to the official announcement, on April 19th, at 10:00 UTC time, Merl will start trading on several CEXs, including OKX, Hashkey Global, Bitget, etc.

官方公佈的數據顯示,這輪空投活動期間。 91%來自比特幣原生社群(其中17.5 億美元的BTC和9.8億美元的BRC-20資產)。就此來看,大多數的用戶仍選擇了採用BTC進行質押,這也是目前在Merlin鏈上擼空投的最優選擇。

According to official sources, 91% came from the Bitcoin native community (of which $1.75 billion is BTC and $980 million is BRC-20). As a result, most users still chose to use BTC as a pledge, which is now the best option for airdrops on the Merlin chain.

整體而言,對於那些希冀於透過空投取得收益的用戶來說,上一個大空投StarkNet持續陰跌,自高點已下跌85%。而用真金白銀質押換空投的時候,或許還要考慮對沖市場行情的變化,以及學習更多巧妙的操作手法,擼空投早已不是無腦沖的撿錢賽道了。

As a whole, for those who hope to reap their gains from airdrops, the last large drop in StarkNet has fallen by 85% since its height. When swapping real silver for airdrops, it may be necessary to consider changes in market behavior and learn more subtle ways to do it.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论