RWA 資產受到加密貨幣世界的廣泛關注,既然是 RWA,所謂「現實世界資產」,就難免受制於現實世界的框架,特別是現實世界的法律體系和資產的確權結構。因此為解決相關問題,相比於以往直接在鏈上實現的代幣發行,RWA 代幣的發行框架和流程更加複雜。

RWA assets have received widespread attention in the world of encrypted currency, and since it is called “real world assets” it is difficult to avoid the framework of the real world, especially the legal system and the real world’s real estate structure. The RWA generation framework and processes are therefore more complicated to solve the problems involved than the ones that were directly realized on the chain.

區分資產發行模型非常關鍵。比如,同樣類型的國債代幣有近十個類似項目,提供幾乎一樣的收益,如何區分他們的優劣?特別是對於類似國債產品的這類固定收益類產品,往往都是理財類型的需求,配置比例往往不小,如何區分類似產品的風險點?

For example, there are nearly 10 similar items in the same type of national debt, providing almost the same kind of revenue, and how do they divide their advantages and disadvantages? Especially for such fixed-income products as national debt products, which are often financial-type requirements, are often well-positioned, and how are the risks of sorting them?

以國債類型代幣舉例,資產發行模型以及相關的法律文件決定了投資者購買的底層資產到底是什麼:是某投資於國債的公司的公司債務,還是某投資於國債的基金的基金份額,還是通過某個主體再包裝購買的國債ETF,抑或是真實的、最終能到美國財政部兌換的國債代幣?不同類型的底層資產,對應不同類型的風險,而這種風險在絕大部分時間裡都可能難以感知,直到黑天鵝事件的發生。

For example, in the case of state-debted currencies, the equity model and the related legal documents determine what the investor buys at the bottom: the corporate debt of a company that invests in state debt, the fund share of a fund that invests in state debt, or the purchase of state-debted ETFs through a major entity, or the real, and ultimately, government-debt currency that can be exchanged in the US Treasury? Different types of sub-prime assets deal with different types of risk, which may be difficult to understand for most of the time until the Black Swan event.

本文將整理和分析市場上常見的 RWA 代幣發行類型,希望讀者能從中進一步理解 RWA 資產發行框架,在加密世界和真實世界進一步融合的過程中,能有效識別風險。

This paper will collate and analyse the RWA currencies that are common in the market, and it is hoped that readers will further understand the RWA Property Development Framework and effectively identify the risks in the process of encrypting the world and the real world.

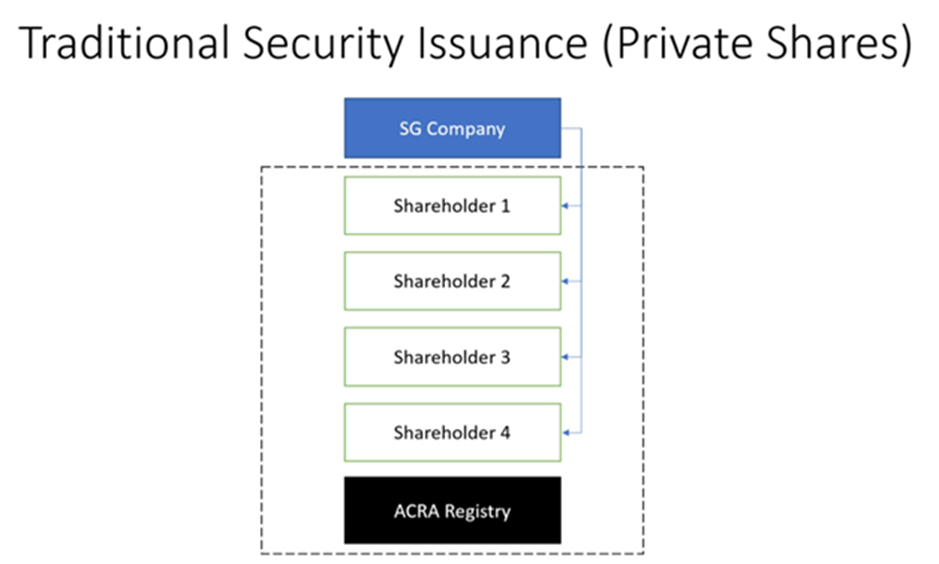

要理解 RWA 代幣發行模型,我們先回頭來看看傳統資產的發行模式,以證券為例,下圖為典型的新加坡公司股權的發行模型。

To understand the RWA currency issuance model, let's look back at the traditional asset issuance model, for example, a certificate, and the following is a typical model of Singapore corporate equity.

圖一:傳統股票發行模型,來源:DigiFT

一家公司會有多個股權持有者,這些股權的所有權都會在 ACRA 登記,其交易、轉移記錄也會需要在 ACRA 進行登記。

A company will have multiple equity holders, and the ownership of these shares will be registered at ACRA, and its transactions, transfers and records will also need to be registered at ACRA.

其中,ACRA 為新加坡的證券登記機構。若在其他國家的市場會有對應的機構,或有不同的市場機制涉及,比如美國的轉讓代理人,,他們在這裡的職能為證券持有人的註冊和登記。

ACRA is Singapore’s securities register agency. If there are offices in other countries’ markets, or if different market systems involve, for example, United States transfer agents, their jobs here can be registered and registered as bearers.

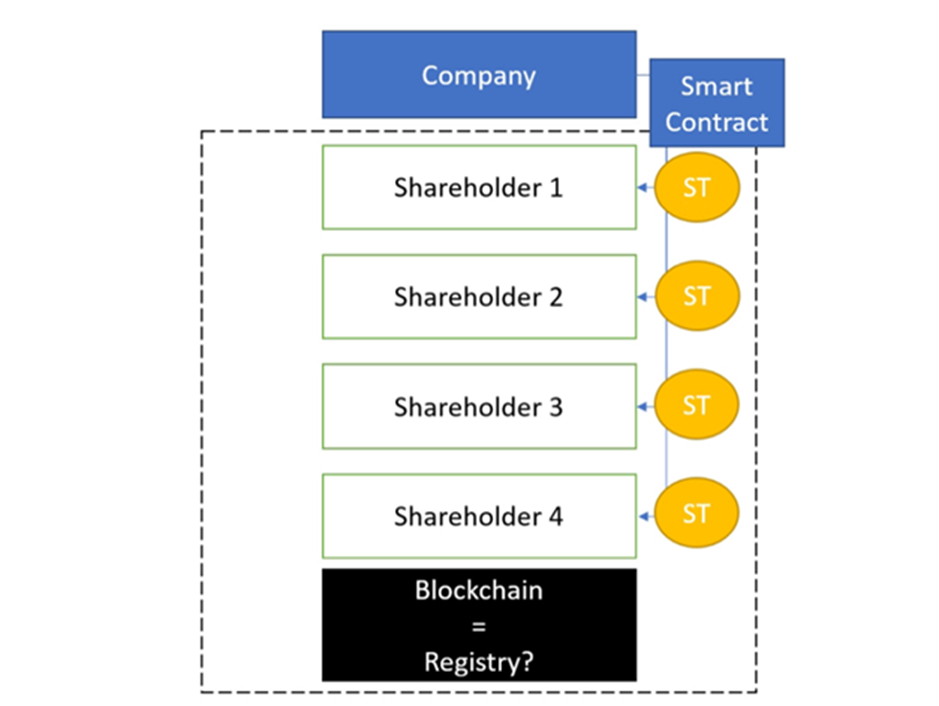

圖二:直接發行模型,來源:DigiFT

若要在區塊鏈上發行代幣,實際上是以區塊鏈作為賬本進行股權所有權的註冊和登記,並對每一筆轉移過程進行記錄。

In order to issue a currency on a chain, a chain is actually used to register and register equity rights as an account, and each transfer is recorded.

在少數國家和地區,金融創新相對前列,他們支持在區塊鏈上對證券進行直接登記,如瑞士的DLT 法案,因此在這些地區和國家,證券可以通過相關授權機構以區塊鏈作為賬本直接發行。而目前在其他主要的金融市場,如美國、新加坡、香港等,相關法律暫時不支持鏈上對證券進行直接的註冊和登記,因此大部分資產需要「繞路」。

In a small number of countries and regions, where financial innovation is at the forefront, they support direct registration of certificates on the chain, such as the Swiss DLT Act, so that certificates can be issued directly through the relevant authorized bodies as accounts. In other major financial markets, such as the United States, Singapore, Hong Kong, etc., the law does not support direct registration and registration of certificates on the chain for the time being, so that most of the assets need to be “circumstanced.”

由此,目前市場上主流的發行模型可以歸類為兩類:直接發行模型(Direct issuance model)和資產支持模型(asset backed model)。本質上兩種發行模式都是在鏈上發行相關債券,但發行的形式和對應的權益完全不同。

As a result, the current mainstream distribution model in the market can be categorized in two categories: the direct issuance model and the asset backed model. Both of these modes are linked to the issuance of bonds on the chain, but the form of the issuance is quite different from the rights of the recipient.

要注意的是,私人證券若滿足一定條件,比如有限的出售金額,面對有限的投資人類型,對金融市場造成的影響非常有限,也可以在合規的前提下發行。這也是目前大多數 RWA 項目僅針對合格投資人的原因。

It is important to note that private securities, which meet certain conditions, such as limited sales, have a very limited impact on the financial market in the face of limited investment in human form, and can be issued in a rule-based manner. This is why most RWA projects currently target only qualified investors.

直接發行模型 Direct issuance model

直接發行模型(Direct issuance model)由資產發行方將區塊鏈作為記賬工具,對資產進行註冊登記,並發行對應的代幣在鏈上。其中,代幣即為底層資產本身。投資者購買並持有此類資產,能夠直接獲得歸屬於該資產對應的各項相關權益,如股票的投票權,債券的償還權等。

Direct distribution models, which are registered by equity developers as accounting instruments, issue the corresponding currency on the chain. In this case, the currency is the underlying asset itself. The investor buys and owns such assets, and can get the direct benefit of the rights that belong to the asset, such as the right to vote on the shares, the right to repay the bonds, etc.

但直接發行模式在當前的市場環境下還有很多限制,如該類證券是代幣化的,和當前的主流證券交易所結構(Nasdaq,SGX 等)無法兼容,或有一定的摩擦成本。目前,相關法律結構也並不完善,也暫時沒有足夠的法律案件可以作為未來判例的參考。

But there are many limitations to the direct distribution model in the current market environment, such as the fact that the certificate is monetized, and that the current structure of the mainstream securities exchange (Nasdaq, SGX, etc.) is not compatible, or has some friction costs. At present, the relevant legal structure is not perfect, and there are not enough legal cases available to refer to future jurisprudence.

案例分析

case analysis

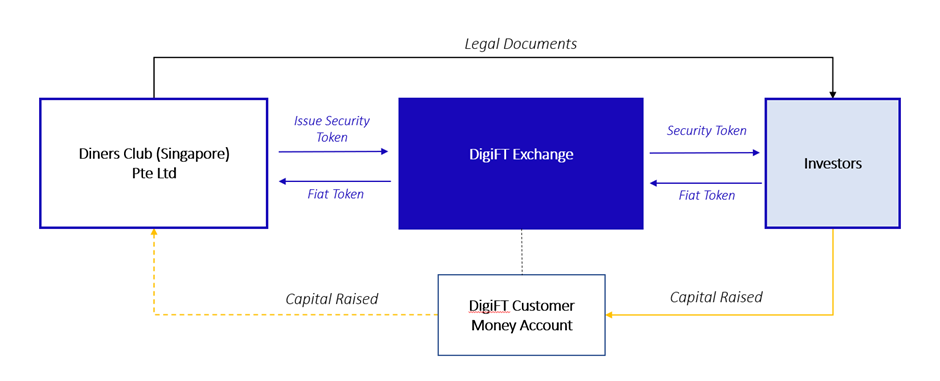

當前諸多 RWA 項目也是直接發行模型,比如採用債券的形式,來將現實世界的經濟權益引入鏈上。此前,DigiFT 發行的 Diners Club Debt Security Token 就是其中一個案例。其發行結構如下:

Many of the previous RWA projects were also direct distribution models, such as bonds, to bring the economic benefits of the real world into the chain. Prior to that, DigiFT’s Diners Club Debt Security Token was one such case. The results were as follows:

圖三:Diners Club Debt Security Token 發行結構 ,來源:DigiFT

Diners Club International Ltd. 是 Discover Financial Services 旗下的直接銀行和支付服務公司,是美國金融服務領域中最知名的品牌之一。

Diners Club International Ltd., a direct bank and payment services company under the banner of Discoverer Financial Services, is one of the most well-known brands in the U.S. financial services domain.

Diners Club (Singapore) Pte Ltd. (DCS) 是Diners Club International Ltd. 的特許經營實體,成立於1973 年,是一家在新加坡註冊的有限責任私人公司,其主要業務是在新加坡以「Diners Club」品牌名義提供信用卡和借記卡服務。 DCS 在 DigiFT 上發行了為期一個月的代幣化票據,作為其財務管理計劃的一次嘗試,採用了直接發行模型。

Diners Club (Singapore) Pte Ltd. (DCS) is a chartered entity of Diners Club International Ltd., established in 1973 as a limited liability private company registered in Singapore, whose main business is to provide credit and debit card services in Singapore under the name of Diners Club. The DCS issued a month-long billing on DigiFT, using a direct issuance model as a pilot for its financial management plan.

其中,DCS 為資產的發行方,發行的代幣即為其公司的票據。任何持有該代幣的用戶能夠在到期之後在 DCS 處贖回對應的資產。

Of these, DCS is the issuer of the asset, and the issue of the currency is the company’s ticket. Any user holding the currency can redeem the property at the DCS after expiry.

資產支持模型 Asset-Backed Model

由於當前法律的不完善,並且鏈上資產非常有限的情況,不少項目也選擇採用資產支持模型進行發行。本質上,該類代幣是一個新的證券,來代表底層資產的經濟權益。資產發行方將資產發行和登記在區塊鏈以外的系統,由第三方購買資產後,按照對應的比例關係發行代幣,對手方風險為資產發行方(asset issuer)和代幣方(asset- backedtoken issuer)。

As a result of the imperfection of the previous law and the very limited assets on the chain, a number of projects have also opted for the adoption of asset support models. At this level, the currency is a new certificate representing the economic rights of the underlying asset.

資產支持模型是目前比較常見的RWA 模型,能夠將真實世界的收益引入鏈上,但會引入額外的風險,並且發行的代幣雖然能夠包含底層證券資產的經濟價值,但權益和真實的證券權益可能有所差異。

The asset support model is the RWA model that is now commonplace and can bring the benefits of the real world to the chain, but it can introduce additional risks, and the issuing currency may differ from the real security interest, although it can include the economic value of the underlying securities asset.

案例分析

case analysis

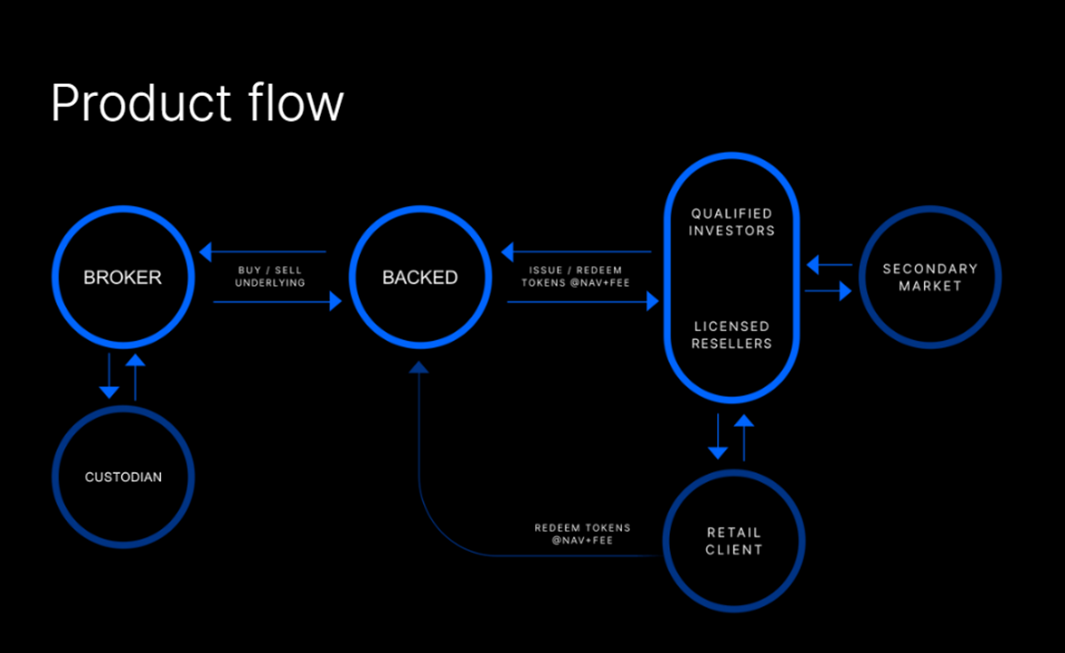

Backed Finance 是總部位於瑞士的受監管機構,在瑞士的 DLT 法案下,能夠將現實世界的證券通過包裝的形式上鍊,賦予代幣經濟權益。在資產支持模型的框架下,購買其代幣僅能獲得代幣對應的經濟權益,Backed Finance 在其法律文件中也表明,其代幣化資產僅是追踪底層資產價格的代幣,而不包含包括投票權等一系列傳統證券所擁有的權益。其發行結構如下:

Backed Finance, a Swiss-based and supervised agency, is able, under the DLT Act in Switzerland, to package the certificates of the real world into the economic interest of the currency. Under the asset support model, the purchase of its currency will only benefit the economic rights of the currency to which it corresponds, and the Backed Finance has indicated in its legal documents that its monetized assets are simply tracers of the currency at the bottom of the asset price, and do not include the benefits of a series of traditional certificates, including the right to vote.

圖四:Backed Finance 產品運行流程,來源:Backed Finance

Backed Finance 通過第三方機構買入對應的資產,在持牌的託管機構託管後,通過Backed Finance 發行對應的代幣,每一個代幣通過鏈上鍊下的數據打通追踪底層資產的價格,但不會涉及股票投票權等其他權益。目前其發行的資產包括如 Coinbase 股票,和 Blackrock iShares ETF 等資產。其中資產發行方為底層資產對應的發行方,如 Coinbase 的股票,發行方即為 Coinbase,代幣發行方為 Backed Finance,在這裡就有至少兩層對手方風險,分別來自於 Coinbase 和 Backed Finance。 Backed Finance 是典型的採用資產支持模型發行對應代幣的項目,其在法律文件中也明確表明,該代幣僅僅追踪底層資產的價格(tracker of the underlying),而並沒有持有證券的其他權益。

Backed Finance buys the right assets through third-party institutions, and issues the right money through the licensed agency, through the Backed Finance, which tracks the price of bottom-level assets through data from the chain, but does not involve other rights, such as the right to vote. The assets that it currently produces include such assets as Coinbase and Blackrock iShares ETF. The assets issuer is the bottom-level issuer, such as Coinbase, and the shares of Coinbase, which in legal documents clearly shows that there are at least two levels of risk to the bottom, not only from Coinbase, but also from the Blackstock Fund.

直接發行模式發行的代幣即為底層資產,能夠為投資者提供直接的相關權益,是更健康的發行模式。由於當前的法律並不完善,且暫時沒有足夠的法院案例作為參考,採用直接發行的 RWA 資產法律風險較大。資產支持模型則是信任映射資產的代幣發行方。這種模型有非常高的信任成本,項目方通過各種形式,比如獲取牌照,採用預言機做儲備證明,定期公開銀行賬目等,提高自己的信任度。若有完整的法律文件、完善的運作流程和足夠的信息披露,資產支持模型發行的代幣也能給投資者相對完整的權益,並且有相對較高的靈活性。但資產包裝模型是在現有框架下的「繞路」,我們更期待直接發行模型的大規模應用。

The currency of direct issuance is the bottom-level asset. This model has a very high trust cost, and the project will increase its trust through various forms, such as taking a license, using a predictive recorder, regularly opening bank accounts, etc. If there is a complete legal document, a well-developed operating process, and sufficient disclosure of information, the currency of the asset support model will also give investors a full benefit to their rights and a relatively high level of intellectual activity. But the capital packaging model is a "circumstance" in the current framework, and we look forward to a larger model for direct circulation of the model.

在過去的數百年時間,金融證券從紙質證券到電子化證券。但區塊鏈作為新的金融記賬工具,我們相信未來會有更完善的法律和相關基礎設施,將證券代幣化,來進一步提高效率和降低成本。

For hundreds of years, financial certificates have ranged from paper to electronic. But the chain is a new financial accounting tool, and we trust that there will be better laws and related infrastructure in the future to monetize the certificates, further improving efficiency and reducing costs.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论