原創| Odaily星球日報

The original Odaily Planet Daily.

作者| Azuma

Author: Azuma

加密貨幣市場今日再次遭遇重挫,雖然比特幣本身的跌幅現已收窄至不到1%,但山寨幣板塊卻隨著BTC 的短線出現了集體跳水行情,SOL、PEPE、ORDI、ARB、TIA 等不同賽道的代表級山寨幣均錄得了超10% 甚至是20% 的跌幅。

The encrypt currency market has again suffered a major setback today, and although the bitcoin itself has now shrunk to less than 1 per cent, the mountain coin plate has followed the BTC short lines with a mass dive, with SOL, PEPE, ORDI, ARB, TIA and other track representatives recording more than 10 per cent, or even 20 per cent, of the fall in mountain coins.

雖然目前的二級市場可謂是“腥風血雨”,但對於普通投資者而言,除了直接下場交易之外,其實還有著另一條相對緩慢但勝在穩健的操作模式—— 通過各大DeFi 協議,利用穩定幣去實現相對低風險、高收益的生息策略。

Although the current second-tier market may be called a “blown storm”, for ordinary investors, in addition to the immediate end of the deal, there is actually another business model that is slow but steady -- a strategy that uses stable currency to achieve low-risk, high-yield revenues through major DeFi agreements.

在下文中,Odaily 星球日報將結合自身操作經驗,為大家推薦多條網絡上的多個穩定幣生息策略,這些策略在操作層面雖然都相當簡單,但普遍都可實現10% 甚至20% 的穩健收益,且部分策略還可同步互動一些未發幣的底層網路或DeFi 協議,實現「一魚多吃」。

In the following, Odaily Planet Daily will combine its own operational experience and recommend a number of currency-stable strategies on multiple networks, which, while quite simple at the operational level, are generally 10 per cent, or even 20 per cent, of the steady returns, and some of the strategies will be able to interact with some of the undistributed bottom networks or the DeFi agreement to achieve "one fish eats more than one fish".

需要強調的是,任何DeFi 協議都無法完全避免合約風險,部分DeFi 協議因其業務模式還會面臨一定的流動性風險、組合性風險等等,因此大家在選擇執行具體某種策略之時,請務必事先了解各項具體風險,且應盡量做到不要「將雞蛋放在同一個籃子裡」。

It is important to note that none of the DeFi agreements at

推薦策略一:Ethena sUSDe

操作方式:在Ethena官網直接先行購入USDe,再透過質押兌換成sUSDe;

Operating method: At Ethena official network directly pre-empted USDE and replaced it with a sUSDE via a pledge deposit;

即時收益率:17.5%;

Immediate rate of return: 17.5 per cent;

收益構成(即可獲得的獎勵代幣類型):sUSDe 升值(可兌換更多USDe);

(a) Gains constructed (received reward type): sUSDE appreciation (for more USDE);

其他潛在收益:ENA 二期空投;

Other potential gains: ENA II airdrops;

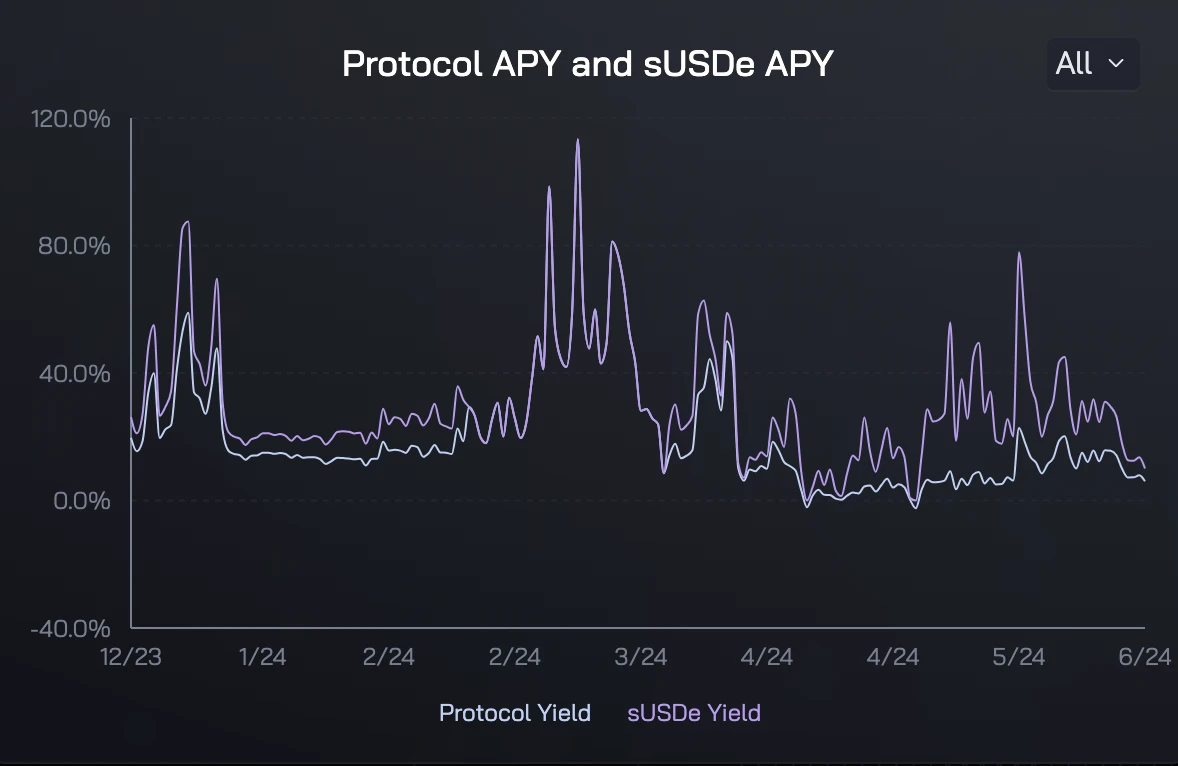

備註:Ethena 的sUSDe 是當前加密貨幣市場內成規模(數十億美元等級)的穩定幣礦池的中APY 最高的收益機會,遠高於MakerDAO 的sDAI 等代幣化國債產品。 sUSDe 的即時APY 會隨著市場的槓桿狀況而有所變化,但就過往波動記錄來看一直都穩定處於較高水平。此外,透過sUSDe 還可以累積Ethena 的二期空投憑證sats(累積效率較低,但勝在收益穩定),藉此取得ENA 的下一次空投。

Note: Ethena’s sUSDE is the highest yield of a stable currency pool in the former encrypted currency market (billions of United States dollars) and is much higher than the SDAI-based national debt product of MakerDAO. The sUSDE’s immediate APY will change with the market’s poles, but will remain stable at a higher level than in the past. In addition, through SUSDE, Ethena’s second-phase air-drop certificate sats (less efficient but more stable in return) will be able to build up Ethena’s next air drop.

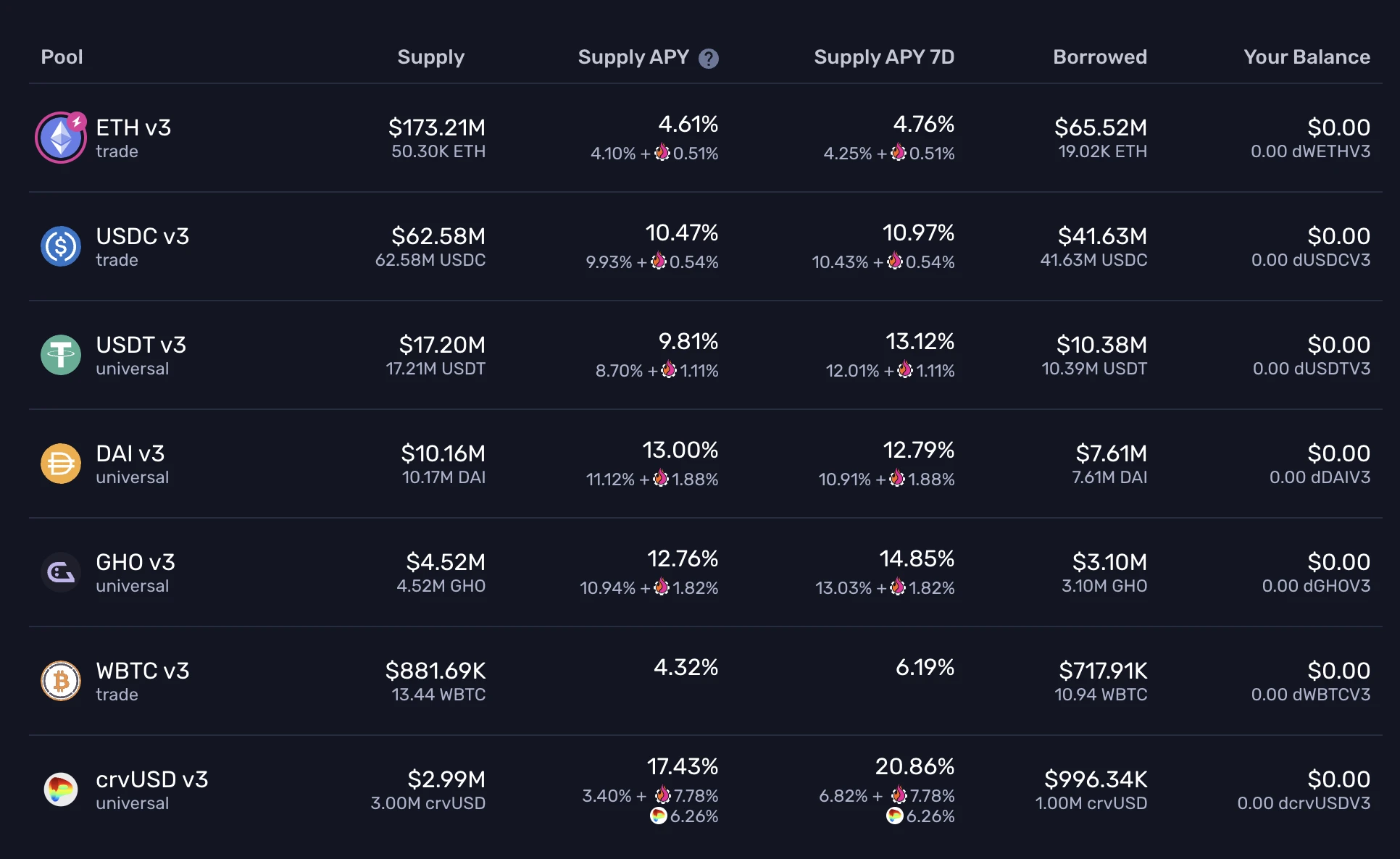

推薦策略二:Gearbox 借貸存款

推薦策略二:Gearbox 借貸存款

操作方式:在Gearbox官網透過Earn 存入各種類型的穩定幣;

Method of operation: deposit of stable currencies of all types through the Earn network at Gearbox.

即時收益率:除USDT 外,普遍大於10% ;

Immediate rate of return: generally greater than 10 per cent except for USDT;

收益構成:穩定幣為主,輔以少量GEAR 激勵;

(a) Revenue formation: a stable currency with a small number of GEAR incentives;

備註:Gearbox 作為槓桿型借貸協議,本身其實支援更高收益率的槓桿型玩法(Farm),但該操作對於普通用戶而言具有一定的操作門檻,所以在此更建議相對簡單的存款玩法(Earn ,本質上就是藉貸存款)。之所以推薦該礦池,是因為Gearbox 勝在收益構成係以穩定幣為主,因此其實際收益相對而言會更加穩定,不會出現因激勵代幣暴跌而導致的實際收益大幅縮水狀況。

Note: As a pole lending agreement, the Gearbox actually supports a higher rate of return, but the operation has some operational value for ordinary users, so it is more likely to be a simple deposit game (Earn, which is essentially a loan deposit). The pond is recommended because the Gearbox triumphs over a stable currency, so that the gains are more stable relative to each other and do not shrink the real gains that would result from a sharp fall in the incentive currency.

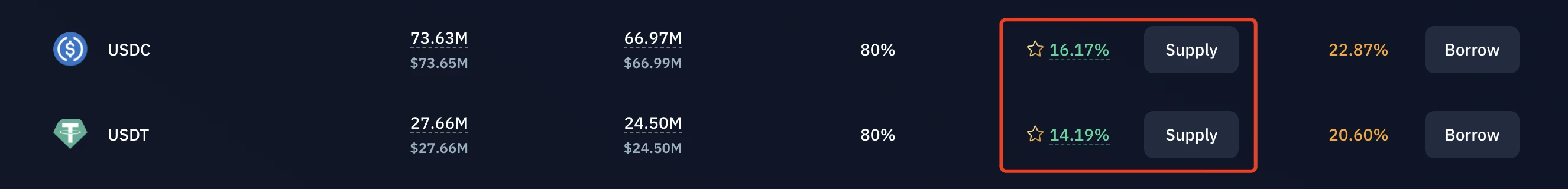

推薦策略一:marginfi 及Kamino 借貸存款

操作方式:在marginfi或Kamino上存入USDT 或USDC 生息;

Method of operation: deposited at or

即時收益率: 12% - 16% ;

Immediate rate of return: 12% - 16%;

收益構成:穩定幣;

(a) The income is structured as: a stable currency;

其他潛在收益:marginfi 空投及Kamino 二期空投;

Other potential gains: Marginfi airdrop and Kamino II airdrop;

備註:marginfi 和Kamino 分別是Solana 之上第一、第二的借貸協議,由於Solana 生態的交易較為活性,該生態之上的借貸需求也普遍高於其他生態,因此marginfi 和Kamino 之上的借貸收益率也會普遍高於其他生態的借貸協議。此外,marginfi 尚未TGE,Kamino 的二期積分活動也在進行中,二者都具備一定的潛在空投激勵預期。

Note: The difference between marginfi and Kamino is the first and second loan agreement on Solana, and since the biological deal on Solana is more active and the need for borrowing on that basis is generally higher than for others, the lending rate on Marginfi and Kamino is also generally higher than in other borrowing agreements. Moreover, the two stages of Marginfi, which are not yet TGE, Kamino, are also in progress, both of which have some potential for short-term incentives.

推薦策略一:Ekubo LP

推薦策略一:Ekubo LP

操作方式:在Ekubo官網利用USDT 與USDC 組成交易對,參與做市;

Operating method: Participation in the market using the USDT to trade with USDC on the network;

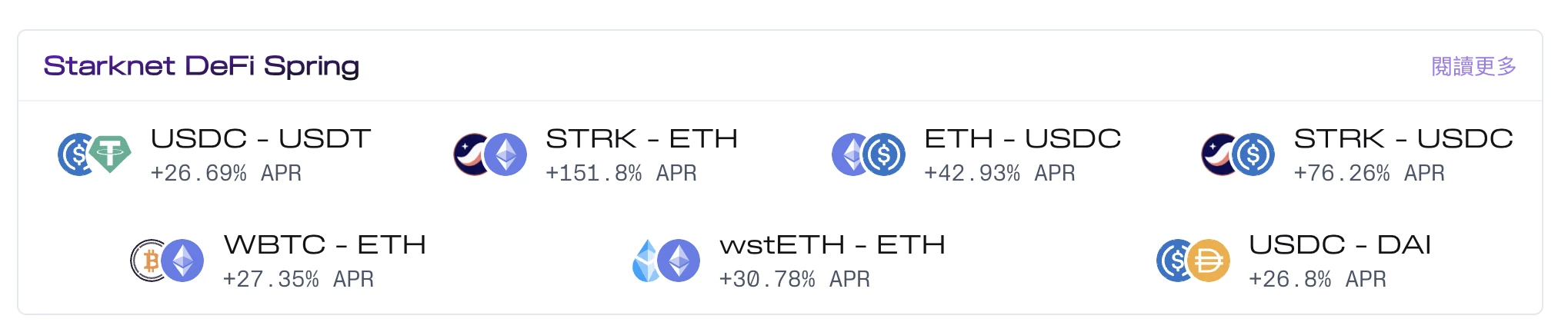

即時收益率: 26.69% ;

Immediate rate of return: 26.69 per cent;

收益構成:STRK 為主,原生做市收益為輔;

(a) The income is structured as: STRK is the main, and the original is the municipal income;

備註:受益於Starknet 的DeFi Spring 激勵計劃,目前在Starknet 上參與各項DeFi 協議的收益率都很可觀,其中Ekubo 作為當前該生態流動性及交易量最大的DEX 協議,在安全性及收益率的平衡方面會是較好的選擇。

Note: The DeFi Spring incentive program, which benefits from Starknet, is now participating in the DeFi agreement on Starknet with an impressive rate of return, in which Ekubo, as the DEX agreement that was the most dynamic and traded in the time, would be a better option in terms of balancing safety and return rates.

操作方式:在zkLend及Nostra上存入USDT 或USDC 生息;

Operating method: deposited on and

即時收益率: 20% 左右;

Immediate rate of return: around 20 per cent;

收益構成:STRK 為主,穩定幣原生收益為輔;

(a) Revenue construction: STRK is predominant and the currency is stable;

備註:基礎款借貸協議,類似Solana 上的marginfi 和Kamino,但收益構成卻主要由STRK 的激勵構成(這點與Ekubo 類似),看好STRK 後市表現的用戶可酌情參與。

Note: The base loan agreement, like marginfi and Kamino on Solana, is largely structured into STRK incentives (like Ekubo), and users who look after STRK after the city can participate as appropriate.

推薦策略一:DODO LP

推薦策略一:DODO LP

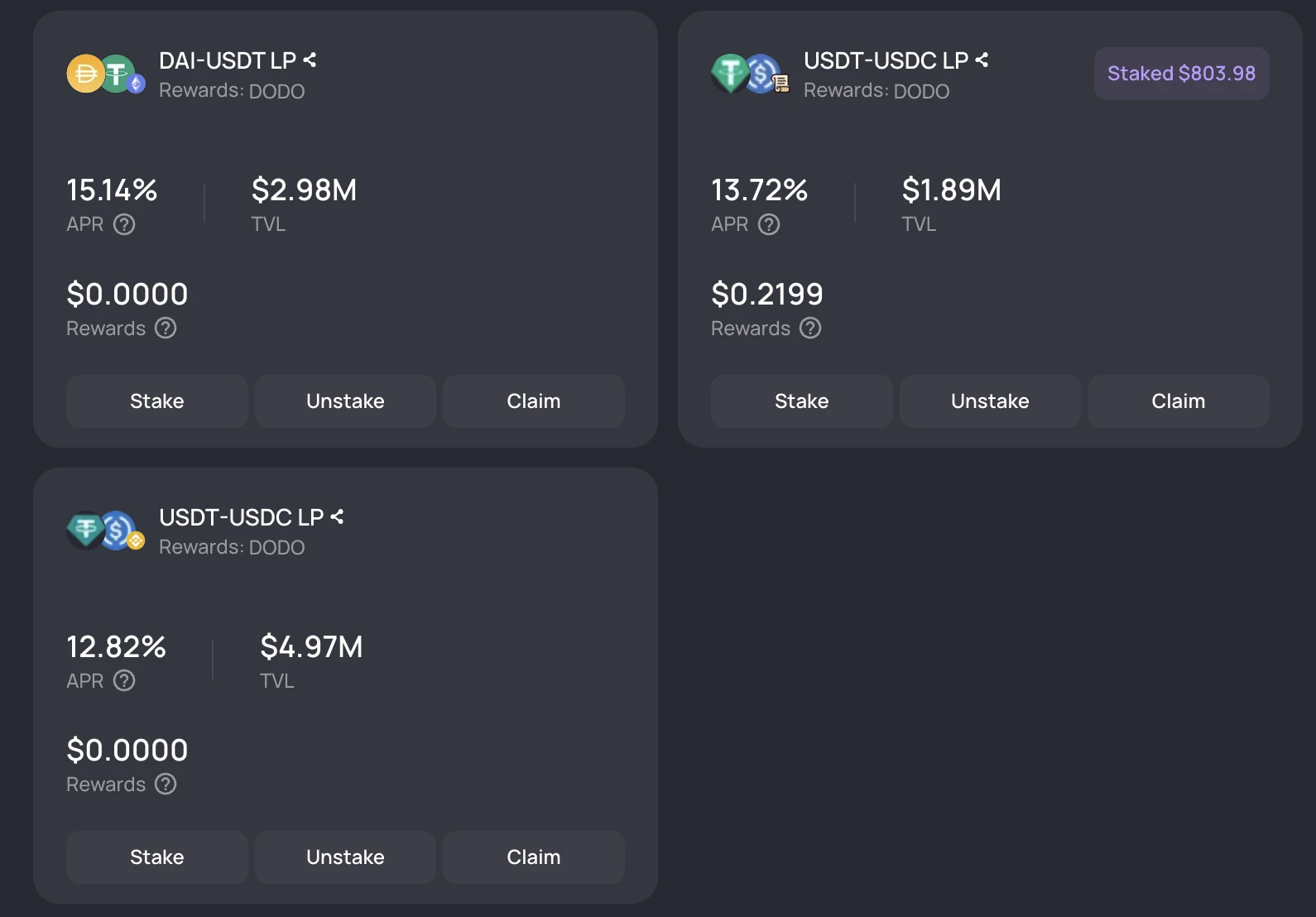

操作方式:在DODO官網利用DAI、USDT、USDC 等組成交易對,參與做市;

Operating method: At DODO officials network using DAI, USDT, USDC, etc. as trade pairs to participate in the market;

即時收益率: 12% - 15% ;

Immediate rate of return: 12% - 15%;

收益構成:DODO 為主,穩定幣原生收益為輔;

(a) Income construction: DoDOs are the main source of income and stability of income derived from the currency;

其他潛在收益:Scroll 空投激勵;

Other potential gains: Scroll Air Investment Incentives;

備註:隨著各大Layer 2 接連發幣,尚未發幣的Scroll 也迎來了更多的關注及流動性。綜合Scroll 上的各大DeFi 協議來看,DODO 作為老牌DEX 在安全性方面相對值得信賴,且受益於DODO 自身的流動性激勵計劃,其穩定幣交易對也有著較高的APY 表現,因此推薦用戶將其作為交互Scroll 的一大陣地。

Comment: With the large Layer 2 serial currency, Scroll, who has not yet issued the currency, has gained more attention and mobility. The major DeFi agreements on the convergence of Scroll suggest that DoDO, as the old DEX, is credible in terms of safety and benefits from DoDO’s own dynamic incentive scheme, with steady currency transactions showing higher APY performances, and therefore recommends that users use it as a large cross-section of Scroll.

推薦策略一:Echelon 借貸存款

操作方式:在Echelon上存入各種穩定幣生息;

Operating method: deposited on Echelon into various stable currencies for a living;

即時收益率: 11% - 17% ;

Immediate rate of return: 11% - 17%;

收益構成:穩定幣原生收益加APT 激勵收益;

(a) The income is constructed as a stable currency income plus the APT incentive income;

其他潛在收益:Echelon 空投收益;

Other potential gains: Echelon air drop earnings;

備註:Echelon 是目前Aptos 上TVL 排名第二的借貸協議,僅次於Aries Markets,但或許是由於入選了Aptos 激勵計劃,當前平台的綜合APY 要顯著高於後者。此外,Echelon 目前已上線了積分計劃,這也意味著當下參與協議還有著一定的潛在空投預期。

Note: Echelon is currently the second-largest loan agreement on the Aptos TVL, after Aries Markets, but perhaps because the Aptos incentive program was selected, the former platform's merger APY is much higher than later. In addition, Echelon is now on track to the build-up plan, which means that there is still some potential for air drop.

推薦策略一:Cetus LP

推薦策略一:Cetus LP

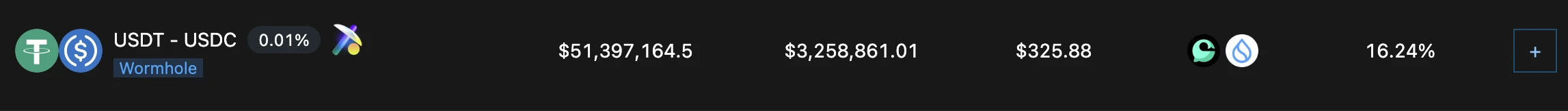

操作方式:在Cetus 上利用USDT、USDC 等組成交易對,參與做市;

Method of operation: participation in the market using a combination of USDT, USDC, etc. on Cetus;

即時收益率: 16.28% ;

Immediate rate of return: 16.28 per cent;

收益構成:SUI 激勵為主,CETUS 和穩定幣原生收益為輔;

(a) Income construction: SUI incentives, CETUS and stable currency revenues;

備註:Sui 之上最大的DEX 協議,收益主要來自於Sui 給予的生態激勵。

Note: The biggest DEX agreement over Sui, the main source of revenue comes from the inspiration given by Sui.

发表评论