5月19日晚间,数字货币市场上演“大屠杀”,比特币、以太坊、狗狗币一众加密货币惨遭血洗,无一幸免。主要加密货币多数录得两位数以上的跌幅,比特币24小时的最大跌幅超过30%,而以太坊的最大跌幅更是超过43%。

On the evening of May 19, the digital money market was marked by the “Holocaust,” with the bloodbaths of Bitcoin, Ethay, and Dogcoins. Most of the major encrypted currencies recorded a double-digit drop of more than 30%, with Bitcoin falling by more than 30% in 24 hours, while the largest fell was by more than 43%.

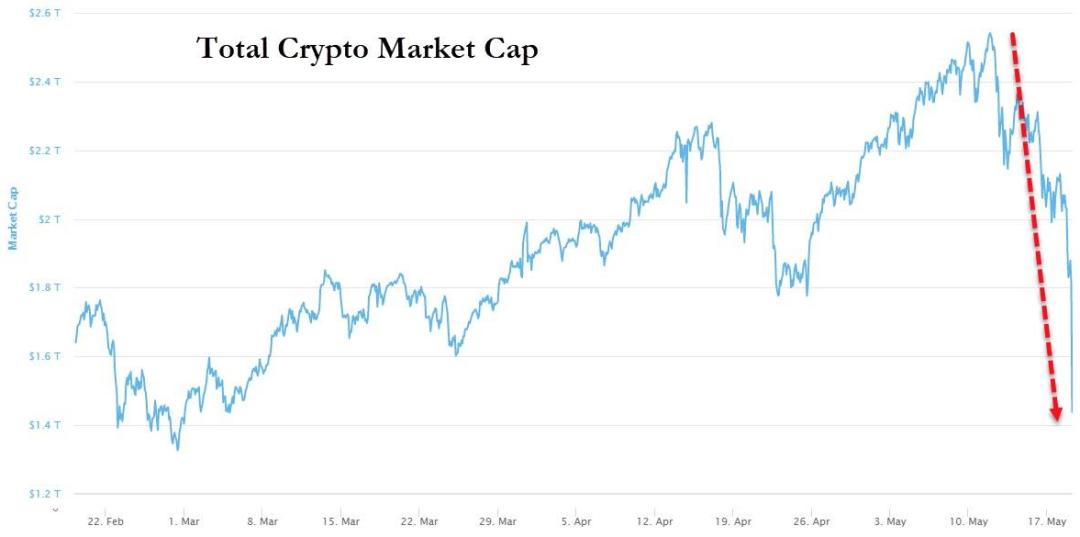

北京时间21:10,比特币最低一度触及30066美元,较2021年最高点时已“腰斩”。一顿暴跌下来,加密货币市场总市值较高点下降了1万亿美元。

At 21:10 Beijing time, Bitcoin reached a low of $3066 at the highest point in 2021, with a “blank beheading” that fell by $1 trillion when the total higher market value of the crypto-currency market fell.

而在大跌当中,“木头姐”Cathie Wood和特斯拉CEO马斯克都出来对市场喊话,表达了对比特币的力挺。

In the fall, Cathi Wood and Tesla CEOmask both came out to speak to the market, expressing the strength of Bitcoin.

此后加密货币反弹,跌幅收窄至此前一半,比特币重返4万美元。

The encrypt currency rebounded and fell to the half of the previous period, and Bitcoin returned 40,000 United States dollars.

01

一度逾43万人爆仓,Coinbase宕机

At one time, more than 430,000 people exploded and Coinbase crashed.

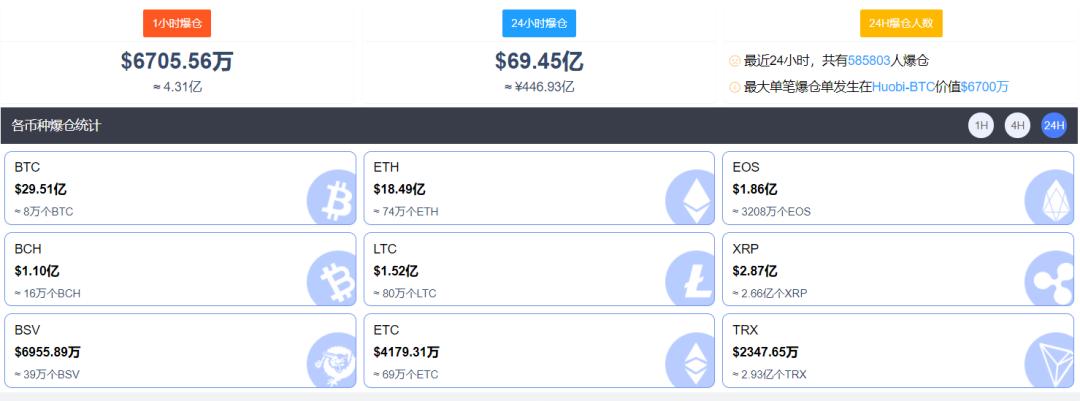

在暴涨暴跌下,投资者损失惨重。以比特币为例,据比特币家园,昨晚刚刚过去的一小时比较猛,投资者1小时内爆仓超60亿元,24小时内爆仓超187亿元,超43万人爆仓。

Investors are losing a lot of money when booms and falls. In Bitcoin, for example, according to Bitcoin’s home, last night was a rough one hour ago, when investors blew up more than $6 billion in an hour, 18.7 billion in 24 hours, and 430,000 in 24 hours.

最新数据显示,截止早上8时7分,最近24小时内,共有约58.58万人成为爆仓受害者,最大单笔爆仓发生在Huobi-BTC,价值高达6700万美元。而在此前的5月17日和19日,比特币已经经历过两次大规模爆仓。

The most recent data show that, as of 8.07 a.m., some 58.5 million people had been victims of the blast in the last 24 hours, with the largest single-blank explosion taking place in Huobi-BTC, valued at $67 million. This followed two large-scale explosions in Bitcoin on 17 and 19 May.

值得注意的是,币安表示暂停以太坊和ERC20的提款。而Coinbase也表示,正在调查平台宕机状况。

It is worth noting that Keane has indicated a moratorium on withdrawals from Ethio and ERC20, and Coinbase has indicated that the platform is being investigated.

有网友评论:“马斯克一觉醒来发现天塌了。”还有网友表示,怀疑自己“头晕还没好”。

There was a comment from the Internet: “Mask wakes up and finds the sky falling.” There was also a suspicion that he was “not feeling well”.

02

为何崩跌?

Why did you fall?

1) 国内监管趋严

1. Increased domestic regulation

比特币近日利空不断,持续下跌,除了此前为其背书的马斯克突然改变立场外,不断收紧的监管信号也给市场带来下行压力:

In addition to the sudden change of position of the Musketeer, who had previously endorsed it, the tightening of regulatory signals has put downward pressure on the market:

①5月11日,人民日报:警惕虚拟货币交易所OKEx阳奉阴违的生意经;

11 May, People's Daily: alerting the virtual currency exchange to the unbridled business history of OKEx;

②5月12日,特斯拉CEO埃隆·马斯克宣布将暂停使用比特币购车;

On 12 May, Tesla CEOEELON Mask announced that the use of Bitcoin for the purchase of vehicles would be suspended;

③5月15日,新华社:虚拟货币乱象丛生,“韭菜收割机”亟待整治;

Xinhua, 15 March: Virtual currency chaos and a “creak harvester” in urgent need of rehabilitation;

④5月17日,特斯拉CEO马斯克疑似暗示特斯拉可能卖出比特币持仓;

On 17 April, Tesla Ceomask suspected that Tesla might have sold bitcoin to hold the warehouse;

⑤5月18日,三大协会出台公告,提醒防范虚拟货币交易存在的风险;

On 18 May, the three associations issued a circular warning against the risks associated with virtual currency transactions;

⑥5月18日,内蒙古发改委设立虚拟货币“挖矿”企业举报平台;

On 1865, the Inner Mongolia Development Commission (NAMRC) set up a virtual currency “mining” business reporting platform;

⑦5月19日,内蒙古发改委称对“挖矿”的监管将持续呈高压态势。

On 19 July, the Inner Mongolia Development Commission (NAMARC) stated that the regulation of “mining” would continue to be high-pressure.

5月18日,中国互联网金融协会、中国银行业协会、中国支付清算协会等三大协会联合公告,要求金融机构、支付机构不得开展与虚拟货币相关的业务:

On 18 May, the three major associations, the China Internet Finance Association, the China Banking Association and the China Payment Settlement Association, jointly issued a circular requiring financial institutions and payment agencies to refrain from carrying out business related to virtual currency:

开展法定货币与虚拟货币兑换及虚拟货币之间的兑换业务违反有关法律法规,并涉嫌非法集资、非法发行证券、非法发售代币票券等犯罪活动。金融机构、支付机构不得开展虚拟货币与人民币及外币的兑换等服务。

Financial institutions and payment agencies may not carry out services such as virtual currency and exchange of renminbi and foreign currency.

在分析人士看来,这一进展也反映出,在中国准备推出自己的数字货币之际,中国正在努力限制加密货币的机构活动。

According to analysts, this progress also reflects China's efforts to limit the institutional activities of encrypted currency as it prepares to introduce its own digital currency.

普华永道加密货币全球主管Henri Arslanian表示:“如果其他监管机构和政策制定者在未来几周效仿中国的限制措施,我不会感到惊讶,因为他们这是就投机交易和加密货币市场波动的风险向投资者发出警告。”

Henri Arslanian, Global Manager of Encrypted Currency of PricewaterhouseCoopers, said: “If other regulators and policymakers follow China's restrictions in the coming weeks, I will not be surprised because they warn investors about the risks of speculative transactions and the volatility of encrypted currency markets.”

2) 机构投资者撤离

2) Withdrawal of institutional investors

最近,加密货币的价格波动也引起了一些机构投资者对其价值的怀疑。比如,瑞银和太平洋投资管理公司就对加密货币能否作为一种资产类别持保留意见。

More recently, price fluctuations in encrypted currencies have also raised doubts among some institutional investors about their value. For example, Swift and Pacific Investment Management Corporation have reservations about whether encrypted currencies can be used as an asset class.

实际上,抛开三部门联手“抵制”加密货币,目前通胀不确定性也在促使投资者暂时削减高风险资产避险。

Indeed, the current inflation uncertainty is also prompting investors to temporarily cut high-risk assets out of a “resistance” of encrypted currencies, despite the combined efforts of the three sectors.

此外,机构投资者的撤离或许也是比特币崩盘的推手之一。

In addition, the withdrawal of institutional investors may be one of the pushers of the Bitcoin collapse.

摩根大通(JPMorgan)指出,机构投资者似乎正从比特币转向传统黄金,扭转了前两个季度的趋势。

According to JPMorgan, institutional investors appear to be moving from bitcoin to traditional gold, reversing the trend of the first two quarters.

在比特币遭受重创的同时,黄金再度受到追捧。摩根大通在给客户的报告中表示,基于比特币相对黄金的波动率比率在4倍左右,该行认为比特币目前的公允价值是3.5万美元。

At the same time that Bitcoin was hit hard, gold was re-renowned. In a report to clients, Morgan Chase stated that its current fair value was $35,000, based on a four-fold rate of volatility of bitcoin relative to gold.

另据Cointelegraph19日报道,俄罗斯国家杜马委员会一读通过了今年3月提出的一份法案草案,该法案要求选举候选人披露其加密货币持有、消费和购买的情况。该草案还要求选举候选人说明购买加密货币的收入来源,不仅仅是实际候选人,候选人的配偶和未成年子女也须出具在过去三年里的加密资产声明。此前消息,俄罗斯加密税法案在杜马委员会通过审议。

It was also reported on the 19th day that the Russian State Duma Commission adopted, on first reading, a draft bill introduced in March this year, which requires election candidates to disclose the possession, consumption, and purchase of their encrypted currency. The draft also requires candidates to indicate the source of revenue for the purchase of the encrypted currency, not just the actual candidate, but also the spouse and minor children of the candidate to produce an encrypted asset statement over the past three years.

03

后市怎么走?

Where's the city?

加密货币投资者Mike Novogratz表示,比特币崩盘不会很快结束,而19日比特币的暴跌感觉是整个市场缴械投降了。Novogratz表示,这是一个“清算事件”,当市场出现暴跌时,不会很快恢复,需要一段时间。

An encrypted currency investor, Mike Novogratz, said that the Bitcoin collapse would not end soon, and that a 19-day collapse in bitcoin felt like the entire market had surrendered. Novogratz said that it was a “liquidation event” and that when the market collapsed, it would not recover quickly and it would take some time.

当被问及他认为哪个水平是比特币的买入机会时,Novogratz说,"我会在4万美元水平买入。"

When asked what level he thought was Bitcoin's buy-in, Novogratz said, "I'll buy at $40,000."

加密货币对冲基金ARK36执行董事Ulrik Lykke认为,加密货币市场目前正在经受一大串负面消息,而这些消息助推了价格暴跌:

Ulrik Lykke, Executive Director of the encrypt currency hedge fund ARK36, argues that the encrypt currency market is currently experiencing a series of negative news that has contributed to the price collapse:

仅上周就有超过2500亿美元从比特币市场蒸发。虽然这个数字看起来是‘天文数字’,但这在动荡的加密货币市场并不罕见。就比特币的前景而言,现在的情况可能看起来很严峻,但从历史上看,这只是比特币需要克服的又一个障碍,与它过去跨越的障碍相比,这不算什么。

Last week alone, more than $250 billion evaporated from the Bitcoin market. Although this number appears to be ‘astronomy figures’, it is not uncommon in the volatile market for encrypted currencies.

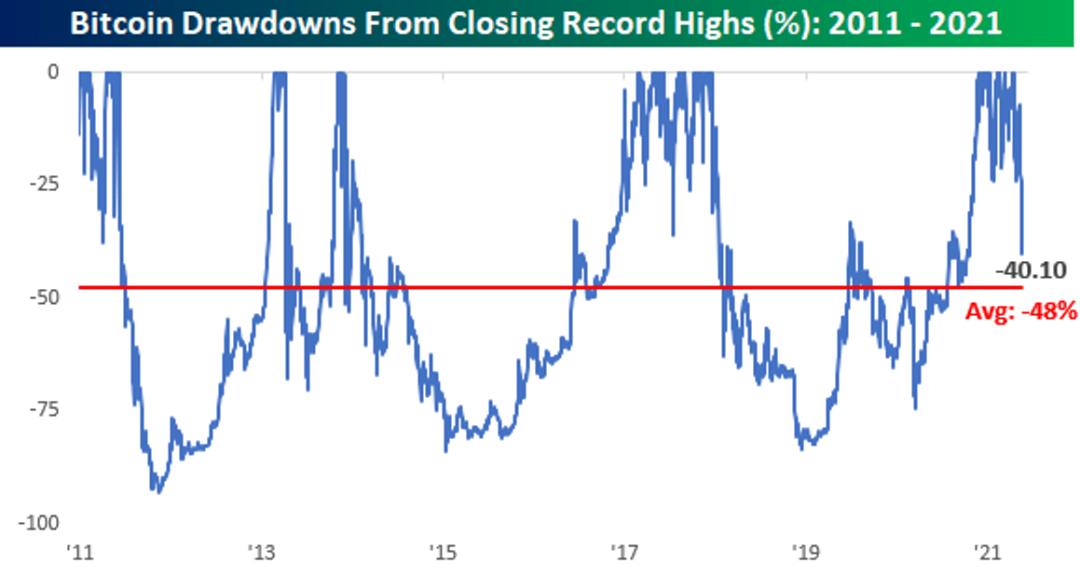

Bespoke Investment Group分析师认为,暴跌40%在比特币市场稀松平常。“虽然跌势很猛,但过去十年里,比特币从历史高点回撤的平均幅度都接近50%。”

According to Bespoke Investment Group analysts, a 40 per cent drop is common in the Bitcoin market. “Although the drop has been strong, the average size of Bitcoin's withdrawal from historical heights has been close to 50 per cent over the past decade.”

加密货币对冲基金ARK36的执行董事Ulrik Lykke认为,对于当前的加密货币市场,重要的是区分消息的真实影响,以及人们所认知的影响:

Ulrik Lykke, Executive Director of the encrypt currency hedge fund ARK36, argued that it was important to distinguish between the true impact of information and the perceived impact of the current cryptographic currency market:

关于马斯克的推文,和中国互联网金融协会、中国银行业协会、中国支付清算协会的联合公告,要求金融机构、支付机构不得开展与虚拟货币相关的业务,类似的新闻很容易搅动市场情绪。但从长期来看,它们往往被证明意义不大,因为加密货币市场是极其情绪化的,市场参与者很容易对他们认为是负面的事件做出过度反应。

With regard to Musk’s tweets, and a joint announcement by the Chinese Internet Finance Association, the Chinese Banking Association, and the China Payments Clearing Society, requiring financial institutions and payment agencies to refrain from doing business related to virtual money, similar news can easily stir up market sentiment. But, in the long run, they often prove to be of little significance, because the encrypted currency market is extremely emotional, and market participants can easily overreact to what they consider to be a negative event.

加密货币对冲基金BitBull Capital的首席执行官Joe DiPasquale表示,去年今日,比特币收于9,927美元,但它现在的价格超过3万美元。“虽然比特币确实从6.5万美元的高点腰斩,但同比去年仍然是300%的涨幅。价格下跌是一个自然的盘整,是塑造未来上涨支撑线的必要形成。我们仍然看好比特币,并有信心在未来看到比特币达到10万美元。”

Joe DiPasquale, Chief Executive Officer of the encrypt currency hedge fund Bitbull Capital, said that Bitcoin received $9,927 today last year, but its current price is more than $30,000. “Although bitcoin did cut off from a high point of $65,000, it was 300% more than last year. Price falls are a natural pane that is necessary to shape the support line for future increases. We still look at bitcoin and are confident to see bitcoin reach $100,000 in the future.”

与加密货币届分析师们的乐观有所不同,传统投资经理们仍然对比特币持谨慎态度。

Contrary to the optimism of encoded currency analysts, traditional investment managers remain cautious about Bitcoin.

太平洋投资管理公司(Pimco)的大宗商品投资经理近日Nicholas Johnson对比特币作为对冲通胀的属性提出了质疑:“每当加密货币上涨而黄金下跌时,比特币的拥护者都称其为更好的对冲通胀资产。但这属于事后诸葛亮。”

The major commodity investment manager of the Pacific Investment Management Corporation (Pimco) recently questioned Nicholas Johnson's approximation of inflation: “Every time the encoded currency rises and gold falls, Bitco's supporters call it a better hedge inflation asset. This is after all.

普信集团 (T. Rowe Price)总裁兼投资主管Rob Sharps表示,加密货币和整个资本市场息息相关,但其最终还是不建议客户投资加密货币,因为它属于高投机性资产。

Rob Sharps, President and Chief Investment Officer of the Group of Puss (T. Rowe Price), stated that encrypt currency was closely related to the capital market as a whole, but ultimately he did not recommend that clients invest in encrypt currency because it was a highly speculative asset.

04

马斯克和木头姐喊话,比特币大反弹

Muskell and Woody. Bitcoin bounced back.

不过两位灵魂人物都出来喊话:木头姐高呼比特币仍将涨至50万美元,而马斯克则称特斯拉有钻石手,这意味着特斯拉将持有仓位直到目标。此后加密货币反弹,跌幅收窄至此前一半,比特币重返4万美元。

But both soul characters came out and shouted: Woody called out bitcoin to half a million dollars, while Mask called Tesla had a diamond hand, which meant that Tesla would hold a warehouse until the target was reached. After that, the encrypted currency rebounded, falling to half the previous harvest, and Bitcoin returned to 40,000 dollars.

1)Cathie Wood:比特币仍将涨至50万美元

1. Cathy Wood: Bitcoin will still rise to $500,000

“木头姐”Cathie Wood表示,比特币在溃败之后处于“抛售”状态,但不一定处于底部。而在目标价方面,她仍然坚持了此前的观点,认为比特币将涨至50万美元。

Catsie Wood said that Bitcoin was “saled” after the collapse, but not necessarily at the bottom. In terms of the target price, she maintained her previous argument that Bitcoin would rise to $500,000.

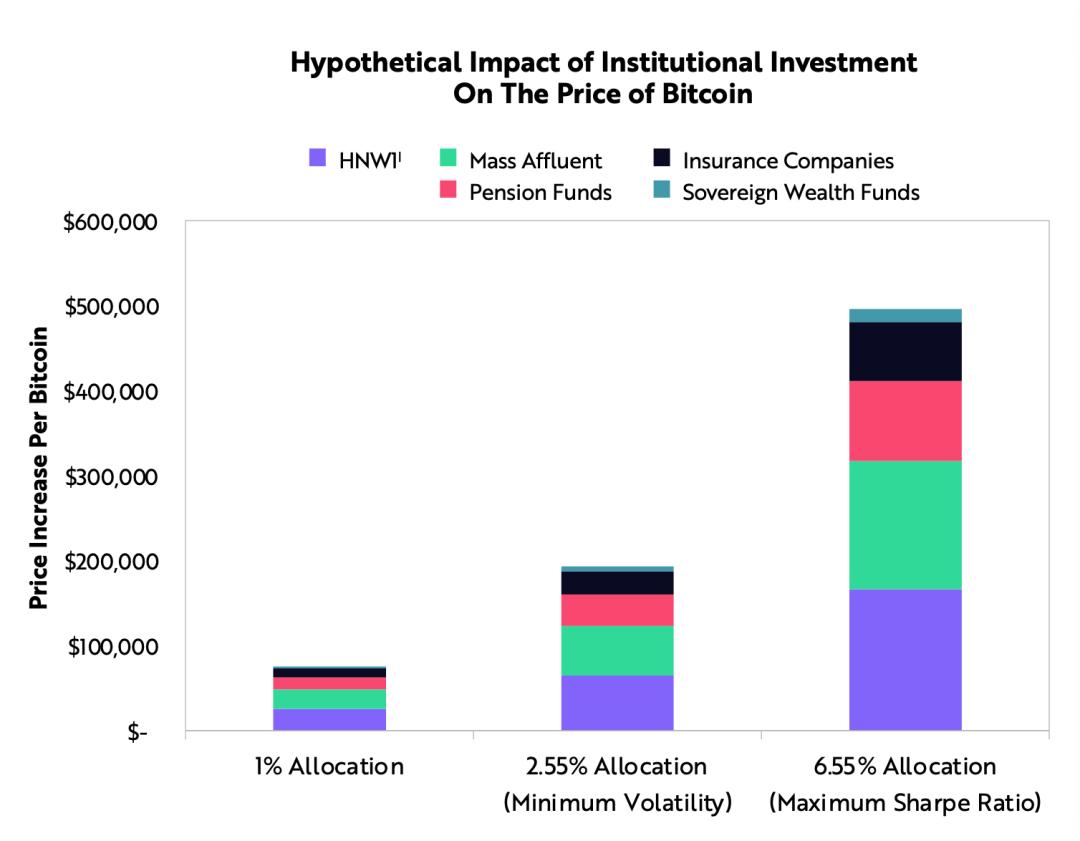

在2021年Big Ideas年度报告中,“木头姐”的ARK公司就提到,如果标普500成分股公司都拿出资产负债表里1%的现金来配置比特币,比特币单价将上涨4万美元;若配置比例变为10%,则单价将相应上涨40万美元。此外ARK还表示,如果机构投资者配置比特币的比例达到6.55%,比特币的单价将因此上涨50万美元。

In Big Ideas' annual report of 2021, ARK stated that the unit price of Bitcoin would increase by $40,000 if the standard 500-component stock company were to pay 1 per cent of the balance sheet; the unit price would increase by $0.4 million if the allocation rate was 10 per cent. Moreover, ARK stated that if institutional investors were to allocate bitcoin by 6.55 per cent, the unit price of bitcoin would increase by $0.5 million.

而在2月接受雅虎财经的访问时,Cathie Wood从两方面解释了为何她会看好比特币。一方面,比特币的投机成分不像过去那么高,投资群体越来越成熟。在特斯拉之前,已经有MicroStratey和Square等公司宣布持有比特币。另一方面,在过去十年中,比特币是唯一与其他传统资产有着较低相关性的投资选择。这意味者,它对机构投资者来说是一个很好的多样化投资选择。

On the one hand, the speculative composition of Bitcoin is not as high as it used to be, and the investment community is becoming more mature. Prior to Tesla, MicroStratey and Square had announced that they held bitcoins.

2)马斯克:特斯拉有钻石手

2) Mask: Tesla has a diamond handler.

同日,在市场暴跌之际,特斯拉CEO马斯克在个人社交媒体账号上发布了“特斯拉有钻石手(Diamond Hand)”的消息。按通常的意思,有“钻石手”的意思是不畏市场波动,持有仓位直到目标。市场观点将其解读为特斯拉不会抛售手中已有的比特币。这条消息也让比特币的24小时跌幅从之前的超过30%收窄到大约14%,价格重返4万美元。

On the same day, when the market collapsed, Tesla CEOmask published a message on his personal social media account, “Tiammond Hand.” As usual, the word “diamond” meant that there was no fear of market volatility, holding a warehouse until the target. Market views interpreted it as Tesla would not sell the bitcoins that already existed. The news also led to a round-the-clock decline in Bitcoin from more than 30 per cent to about 14 per cent, and the price returned to $40,000.

此前马斯克在5月12日美股盘后表示,特斯拉已经叫停用比特币购车,因为担心比特币挖矿和交易导致化石燃料、尤其是煤炭的耗用飞速增长。虽然他补充称特斯拉不会出售任何比特币,只要比特币挖矿过渡到使用可持续能源,特斯拉就有意用比特币做交易,但上述表态还是让比特币大跌。

Earlier, Mr. Musk said, after the May 12 US share plate, that Tesla had stopped buying in bitcoin, fearing that Bitcoin mining and trading would lead to a rapid increase in the consumption of fossil fuels, especially coal. Although he added that Tesla would not sell any bitcoins, Tesla intended to trade in bitcoins as long as Bitcoin was mined for sustainable energy.

而在最新过去的周末,马斯克在推特上暗示特斯拉可能已卖出比特币,导致比特币进一步下挫。虽然他随后又更新称特斯拉并没有卖出,但提振作用有限。

On Twitter over the last weekend, Musk suggested that Tesla might have sold bitcoin, causing bitcoin to fall further. Although he subsequently updated that Tesla had not sold, the boost was limited.

需要注意的是,虽然比特币出现暴跌,但特斯拉手中比特币的买入成本或仍低于市价。根据财报计算,特斯拉截至3月31日持有比特币的公允市场价值为24.8亿美元,这意味着如果该公司将该数字货币变现,有望获利约10亿美元。再考虑到3月31日的比特币价格约59000美元,上述数据意味着特斯拉的比特币平均持仓单价不到25000美元,按目前市价计算仍有超过50%的盈利。

It should be noted that, despite a sharp fall in bitcoin, the purchase cost of bitcoin in Tesla’s hands is still lower than the market price. According to the financial statements, Tesla held Bitcoin at a fair market value of $2.48 billion as at 31 March, which means that the company could potentially profit about $1 billion if it cashed that digital currency. Considering also that the price of bitcoin on 31 March was approximately $59,000, the above data mean that Tesla’s Bitco had an average warehouse unit price of less than $25,000, and that more than 50 per cent of the profit is still available at the current market price.

作者: 高星、朱希、叶桢、涂子君、于旭东

Authors: High Star, Zhushi, Ye Xing, Tamiko, Yu Xudong

原标题:《昨晚,数字货币惨遭血洗后,美国散户两大股神拯救币圈》

Original Title: Last night, after the bloodbath of the digital currency, the two great powers of the American diaspora saved the currency.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论