各相關單位:

Associated units:

經市政府同意,現將《北京市促進金融科技發展規劃(2018年-2022年)》印發給你們,請遵照執行。

With the agreement of the municipality, the Beijing Plan for the Advancement of Financial Science and Technology (2018-2022) has now been published for you to follow.

中關村科技園區管理委員會

北京市金融工作局

北京市科學技術委員會

2018年10月22日

北京市促進金融科技發展規劃(2018年-2022年)

一、規劃背景

(一)金融科技的定義與特點

(i) Definition and Features of Financial Science and Technology

1.基本定義

1. Basic definition

金融科技(Financial Technology,FinTech)強調金融和科技的結合,是指新技術帶來的金融創新,落腳點在科技,它能創造新的業務模式、應用、流程或産品,從而對金融市場、金融機構或金融服務的提供方式造成重大影響。金融科技強調將技術創新作為服務金融産業發展的手段,以維護金融穩定和安全、防範金融風險為原則,在具體應用和發展過程中,仍需遵循金融市場的基本規律。金融穩定理事會(FSB)和巴塞爾委員會(BCBS)把金融科技活動分為:支付結算、存貸款與資本籌集、投資管理、市場設施等,並指出金融科技創新的供給側驅動因素是不斷演進的新技術和變化的金融監管,需求側影響因素則是不斷變化的企業與消費者偏好。隨著金融科技的發展,其應用正在向城市治理等領域加速拓展。

Financial Technology (FEST) emphasizes financial and technological convergence as a means of service finance development, based on financial stability and security, financial risk prevention, and the need to follow the basic rules of the financial market in the process of physical application and development. The Financial Stability Council (FSB) and the Bassel Commission (BCBS) divide financial and technological activities into: paying, financing, capital collection, investment management, market design, and so forth, and notes that the new drivers of financial science and technology are accelerating the development of new technologies and transformations in the financial environment.

本規劃中的金融科技範疇,主要圍繞新技術與金融功能的融合。在具體規劃路徑上,一方面積極推動影響金融科技功能應用的底層技術發展,完善各類技術市場設施,包括人工智慧、大數據、互聯技術(移動互聯、物聯網)、分佈式技術(雲計算、區塊鏈)、安全技術(量子計算、生物識別、加密技術)等。另一方面創造條件促進技術應用落地,創新金融産品和服務模式、改善客戶體驗、降低交易成本、提高服務效率,同時更有效地防範和把控金融風險。

The financial science and technology model of the scheme is mainly around the integration of new technologies and financial functions. On the one hand, the physical approach is to actively influence the development of technology at the bottom of the financial science and technology function, and to improve the technology market, including artificial intelligence, big data, interconnectivity (movement, network), distribution technology (correspondents, sector chains), safety technology (mass calculations, biological awareness, encryption) and so on. On the other hand, to create conditions to facilitate the deployment of technology, to create new financial goods and service models, to improve client experience, to reduce transaction costs, to improve service efficiency, and to prevent and control financial risks more effectively at the same time.

2.發展特點

2. Development features

金融科技産業的發展體現出以下規律特點。

The development of the financial technology industry has given rise to the following special features:

高創新性:金融科技是一個高度創新的行業,不僅僅是商業模式變化所帶來的金融創新,更多是指科技驅動所帶來的創新,技術創新與技術應用將為金融行業帶來全價值鏈優化。通過將各種前沿技術與理念在金融領域中的應用迭代,快速推出具有“重磅性”創新的産品,這已超越了傳統金融範疇裏市場與産品層面的“金融創新”。

Financial technology is a highly innovative industry, not only as a result of changes in business patterns, but also as a result of technological drive, technological innovation and technological applications that will result in full value chain appreciation for the financial sector. The “financial innovation” that is “heavy” beyond the traditional financial paradigm, by euphemisticizing the applications of cutting-edge technologies and ideas in the financial domain, has been rapidly launched.

輕資産性:金融科技公司只需要很低的固定資産或者固定成本就能展業,其成本隨著業務規模的擴大邊際遞減,使其能夠以低利潤率支援規模發展。另外,也正因其具有輕資産性,不像傳統金融那樣“笨重”,因此其戰略選擇、組織架構、業務發展更加靈活,易於創新創造。

Financial and technological companies need only low fixed capital or fixed costs to open their businesses, the costs of which are reduced by the expansion of their businesses, enabling them to support growth at low profit rates. Moreover, because of their lightness, which is not as “brain” as traditional finance, their strategic choices, organizational structures, and business development are more dynamic and open to new creation.

重體驗性:通過智慧手機等移動設備,金融科技公司開創了簡單易用、消費者參與度較高的産品或服務。金融科技公司非常注重用戶體驗,積極聽取用戶心聲,響應並預測用戶需求,簡化産品和服務流程,加快産品迭代,形成與傳統模式截然不同的服務體驗。

Retesting: With mobile devices such as smart phones, financial technology companies have developed simple, user-friendly products or services. Financial technology companies focus heavily on user experience, actively listening to users’ hearts, responding to and predicting user needs, simplifying product and service processes, accelerating product rotation, and creating service experiences that are distinct from traditional patterns.

強相關性:金融科技是高新技術産業與金融業的融合。底層技術是構建金融科技産業生態的基礎,為金融科技的發展創造了條件。隨著底層技術所處的生命週期階段的變化,金融科技發展也在不同時期根據技術發展成熟度和應用廣泛度呈現出不同發展特點,主要體現在技術與企業形態、市場份額與飽和度、競爭與壟斷、企業創新方式和所面臨的主要風險等方面。

As the life cycle of technology at the bottom evolves, the development of financial technology presents different developments at different times, depending on technological maturity and the broad range of applications, mainly in terms of technology and entrepreneurship, market composition and saturation, competition and fragmentation, new ways of generating business, and the major risks involved.

(二)北京發展金融科技的機遇與優勢

(ii) Opportunities and advantages of financial technology development in Beijing

1.新環境與新機遇

1. New environment and new opportunities

金融科技底層技術發展進入關鍵期。一方面,底層技術快速發展,助推主流金融機構的金融科技應用全面提升,並成為創新發展的重要推動力量;另一方面,移動場景時代的大發展將深入驅動金融科技的需求創新。金融科技衝擊更多地向基礎設施進行下沉,嚴格監管將在金融科技發展中呈現常態化,科技支援的金融安全與風險防範將成為最重要的藍海之一。

On the one hand, the rapid development of technology at the bottom of the financial system has contributed to the overall upgrading of financial technology applications in mainstream financial institutions and has become an important driving force for innovative development; on the other hand, major developments in the context of the move will drive the demand for financial technology into the ground. Financial science and technology has become more sank in the infrastructure, strict surveillance will become the norm in the development of financial technology, and the financial security and risk protection of technology support will be one of the most important blue seas.

我國改革與發展進入轉型期。黨的十九大報告明確指出,要著力加快建設實體經濟、科技創新、現代金融、人力資源協同發展的産業體系,要健全金融監管體系,守住不發生系統性金融風險的底線,同時強調要堅決打好防範化解重大風險、精準脫貧、污染防治的三大攻堅戰。在轉向高品質發展階段過程中,新經濟模式不斷涌現,金融需求更強調智慧與便捷,金融供給更重視合規與結構優化。依託新技術支援,原有金融服務難點更易得到緩解,金融改革更加“脫虛向實”,能夠全面提升數字普惠金融的服務能力。金融科技已成為國家金融安全體系的重要組成部分,成為實施創新驅動戰略、建設現代經濟體系的戰略支撐。北京作為國家金融戰略實施的重要載體,依託豐富的首都經濟金融功能,理應成為新技術、新金融轉型探索的“排頭兵”。

The Party’s 19th report clearly states that in the transition to high-quality development, the new economic model will continue to emerge, financial needs will become more intelligent and accessible, financial supply will be more responsive and structural. With new technology support, financial services will be less likely to be reduced, financial reforms will be “revealed out of reality” and will improve the ability to deliver digitally inclusive finance. Financial technology has become an important component of the country’s financial security system.

區域經濟金融發展進入協調期。我國區域經濟佈局不斷優化,京津冀、長三角、粵港澳大灣區成為三大增長極。作為環首都城市群和國家核心增長極,京津冀正在成為全球性資源交匯地、國際經濟政治交流的核心節點。其中,京津冀協同發展作為重中之重,已進入協調推動的關鍵期,其核心任務和關鍵環節,是有序疏解北京非首都功能。促進金融科技發展,涵蓋了人才集聚、科技驅動、金融提升、綠色發展等眾多要素,從全球來看都是首都功能不可或缺的重要部分。這要求北京以金融科技基礎研發與應用實踐為主線,利用首都資源稟賦,發揮比較優勢,有效服務京津冀協調發展與資源要素優化配置;在國家金融改革的頂層設計下,努力與其他兩大增長極形成互補共贏。

As a central source of growth for cities and countries around the capital, Kyoto is becoming an essential part of the capital’s global resource interface and international economic and political exchange. In this context, Kyoto’s central focus is on development, with its central mission and key link being the orderly defusion of non-capital functions in Beijing.

北京戰略定位與發展進入攻堅期。北京已定位為全國政治中心、文化中心、國際交往中心和科技創新中心。大力發展金融科技正是建設科技創新中心的重要支撐和組成部分,也能夠為其他三個中心建設提供資源保障。金融科技創新能有效實現技術與資本的互動,加快重要金融領域的前沿技術發展,進而應用於智慧城市、智慧産業、智慧生活等更多領域,成為解決發展超大型城市難題的重要抓手。在合規前提下,金融科技創新能拓展新業態與産業空間,有效拉動民間投資,促進北京經濟增長與社會發展。在首都功能的戰略調整中,金融科技創新有助於實現産業、空間、人才的結構性替代與優化。同時,北京作為國家金融管理中心,面對金融風險的現實性、複雜性,積極引領新技術應用於風險管理與安全防範,能夠為國家現代化金融管理制度建設提供重要支援。

The development of financial science and technology is an important component of the construction of new technology centers, and it can effectively boost public investment, promote economic growth and social development in Beijing. In the context of the capital’s capacity-building strategy, financial technology and technology have been instrumental in the development of modern industries, space, and human resources, and have become important players in the development of national financial management systems.

2.北京的基礎和優勢

2. Foundations and advantages of Beijing

科技創新水準在國際國內居於領先。在新一輪科技革命和産業變革條件下,新技術、新業態、新産品、新模式不斷涌現,成為帶動經濟發展的新動能。北京作為全國科技創新中心,是全球創新資源最為密集的區域之一,在知識技術資本和人力資本等創新資源方面擁有領先優勢,近年來技術創新與産業優化能力不斷提升,處於國際領先水準。目前已確定新一代資訊技術、積體電路、醫藥健康、智慧裝備、節能環保、新能源智慧汽車、新材料、人工智慧、軟體和資訊服務以及科技服務業等作為重點發展的高精尖産業,這為金融科技的底層技術研發及服務應用奠定了雄厚基礎。

In recent years, new technologies, new industries, new products, and new models have emerged under new technological revolutions and transformations. Beijing, as the nation-wide centre for innovation, is one of the most resource-intensive regions of the world.

金融要素的集聚與輻射能力突出。北京是國家金融監管部門所在地,總部型金融機構集聚地,也是國際性金融資訊中心。2017年,金融業佔北京市經濟的比重達到17%,已成為第一支柱産業,並有效帶動優質資源配置到重點領域,引領北京産業結構的全面提升。2017年末,全市金融機構(含外資)本外幣存款餘額14.4萬億元,本外幣貸款餘額6.96萬億元;全年證券市場各類證券成交44.6萬億元;全年實現原保險保費收入1973.2億元。北京金融街作為北京金融資源的核心區,區域金融機構資産總規模達99.5萬億元,佔全國金融資産總規模的近40%,駐區商業銀行資産規模佔全國商業銀行的41%。北京擁有眾多私募股權、風險投資基金,數量超過1700家,還有大量科技創新相關的産業引導基金等。北京是國內資金清算結算中心,從中國人民銀行大額支付系統的數據看,北京近年來在資金流動總量、區域內部資金流動規模、地區間資金流動規模等方面,都位居全國首位,增速也居於前列。

In 2017, the financial sector accounted for 17 per cent of the economy of the city, which has become the first pillar of the economy, and effectively led to an overall upgrading of Beijing’s financial architecture. In 2017, the city’s financial institutions (including external resources) held an additional 1,440 million yuan in foreign currency deposits, a further 696 million yuan in foreign currency loans; a total of 4,466 billion yuan in securities; and a total of 1973.2 billion dollars in insurance revenues. The Beijing financial street, which is the core of Beijing’s financial resources, has a regional financial architecture of 99.5 billion yuan in capital, nearly 40 per cent of the country’s total financial capital, and nearly 41 per cent of the regional commercial bank’s commercial bank’s capital stock, and 41 per cent of the country’s capital stock, capital, capital, capital, capital, capital, capital, and capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, and capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, and capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, and other, capital, capital, capital, capital, capital, capital, capital, capital, capital, and other, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, and capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, and capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, and capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, and, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, capital, and

金融科技創新與發展基礎紮實。近年來,北京金融科技融資額快速增長,已成為全國金融科技投資最為活躍的地區之一。依託中關村國家自主創新示範區的創新優勢,以及金融街的總部金融機構優勢,吸引聚集了大量的金融科技企業。其中,人工智慧、大數據、區塊鏈等金融科技底層技術企業數量位居全國前列。截至2018年5月,北京的人工智慧企業有1070家,約佔全國的26%,獲得風險投資的人工智慧企業有431家,約佔全國的35%,中關村已成為我國人工智慧創新高地。此外,在移動支付、監管科技、供應鏈金融、網際網路保險、智慧投顧、企業徵信等應用領域也涌現出了一批領軍企業。北京連續兩年有20余家企業進入畢馬威發佈的“中國領先金融科技公司50強”,居全國首位。國內唯一的非銀行支付機構網路支付清算平臺——網聯清算有限公司已承擔越來越重要的基礎設施功能。百度、京東、小米等國內領先的在京總部型網際網路企業,也在金融科技方面加快佈局,基本形成了覆蓋金融科技服務各個領域的全業務版圖。金融機構紛紛在京設立金融科技子公司,民生銀行成立了民生科技有限公司、光大銀行成立了光大科技有限公司。中國網際網路金融協會等各類自律組織、支援金融科技創新創業的各類協會、聯盟、平臺已經形成規模效應。總體上看,北京已初步發展成為國內綜合優勢領先的金融科技創新區域。

In recent years, Beijing has seen a rapid increase in the number of financial and technological sub-soils. By May 2018, Beijing’s 1070 artificial and intellectual enterprises, accounting for about 26% of the country’s capital investment, and 431 capital and 35% of the country’s capital finance institutions, have attracted a large number of financial and technological enterprises.

開放環境和保障要素日益完善。北京作為國際交往中心,應當成為國家金融全面開放的前沿。北京還是全國服務業擴大開放唯一的綜合試點城市,一直堅持把金融業的雙向開放放在更加突出的位置,深化服務業擴大開放試點,整體商業環境開放程度較高。在教育、科研、人力資源方面,北京擁有國內絕對領先的優勢地位與豐富儲備。北京擁有大量高校和科研院所資源,創新能力突出,諸多高校院所發起設立金融科技研究機構和學術組織,已在金融科技研究方面處於領先地位,為發展金融科技提供了堅實的人才儲備和技術發展基礎:北京大學發起設立了金融科技研究中心、區塊鏈研究中心;清華大學發起設立了金融科技研究院,與螞蟻金服、阿爾山金融科技公司分別組建金融科技聯合實驗室和區塊鏈技術聯合研究中心;中國科學院大學發起設立金融科技發展中心;中國社會科學院發起設立國家金融與發展實驗室;中央財經大學金融學院設立了金融科技係,定位於培養金融科技複合型專業人才。同時,在城市發展水準方面,區位交通與基礎設施的比較優勢突出;在公共設施與服務能力方面,已經充分體現出國際化大都市的特徵;在政策與制度保障、區域金融生態環境建設等方面,不斷趨於成熟與完善。

In terms of education, research, and human resources, Beijing has an absolute pre-eminence and wealth within the country. Beijing is also the only co-opportunity city for the expansion of the country’s services sector. Beijing is also the only city where the country’s services sector has opened up.

二、總體思路

(一)指導思想

(i) Guiding ideas

以習近平新時代中國特色社會主義思想為指引,貫徹落實黨的十九大精神和習近平總書記關於金融工作的重要指示,緊密圍繞習近平總書記兩次視察北京重要講話和對北京工作一系列重要指示精神,充分發揮金融科技對推動首都“四個中心”建設特別是全國科技創新中心建設的重要作用。按照《北京城市總體規劃(2016年-2035年)》佈局要求,充分發揮北京金融資源、科技資源聚集的突出優勢,營造鼓勵金融科技創新的良好生態,著力為創新主體提供集聚空間和政策支援,聚集金融科技前沿要素,紮實推進金融與科技互動融合發展,引導形成推動首都發展的新動力,率先打造全國金融科技創新高地和金融安全示範區域,助力全國科技創新中心建設和超大型城市治理,努力推動首都經濟社會高品質發展,服務國家經濟轉型與金融改革。

Guided by the idea of China’s socialism of the recent era, and guided by the key directions of the Party’s 19-year-old General Secretary of Science and Technology on financial work, and guided by a thorough review of Beijing’s important speeches and a series of important instructions to Beijing’s work, the Secretary of Science and Technology has made full use of financial technology to promote the construction of “four centres” in the capital, especially in the country’s new centres for science and technology. In line with the Beijing Urban Master Plan (2016-2035), it has been called upon to give full effect to the outstanding advantages of the new geographical and financial security landscape of Beijing’s financial and technological resources, to encourage the creation of a new culture of financial science and technology, to create a new culture of excellence, to provide a space for the creation of new institutions and policy support, to bring together the cutting edges of financial technology, to promote the integration of finance and technology, to lead a new drive to the development of capital’s capital, and to spearhead the creation of a new financial and economic transformation of the country’s capital’s economic and social services.

(二)基本原則

(ii) Basic principles

1.堅持創新驅動。充分認識科技發展進步的內在規律,深入研究金融科技創新的生命週期特徵,建立開放融合的科技創新機制,以創新引領金融領域的技術突破與場景拓展,有效提升首都金融服務的深度廣度,促進金融與實體經濟更好地融合,著力解決區域金融發展中“不平衡不充分”的矛盾,助力於推動高精尖産業快速發展。努力實現技術創新與制度創新的“雙輪”驅動。以推動技術基礎研究為起點,以強化技術應用落地為保障,全面把握重大金融科技底層技術發展特徵,促進應用技術的金融標準化建設。構造前瞻性、包容性、開放性的規劃引導機制,積極擁抱發展中的前沿技術,給予適當的政策支援與探索空間,以理性態度避免發展誤區。

Increased awareness of the internal rules of technological development, an in-depth study of the new life cycle of financial technology, the creation of innovative and innovative mechanisms for open and integrated technology, the creation of new technological breakthroughs and the expansion of the landscape, the effective promotion of the depth of financial services in the capital, the promotion of better integration of financial and physical economies, and efforts to address the contradictions of “unbalancedness” in regional financial development.

2.堅持合規安全。把握好發展速度與效率的平衡,避免粗放式擴張和泡沫積累,夯實北京金融科技創新的基礎環節與要素,有效彌補行業發展中的短板。處理好科技創新與金融安全、個人數據與隱私保護的平衡,處理好創新與安全的邊界,牢牢守住不發生系統性風險的底線,積極防範非系統性風險的積累,明確金融科技創新的紅線與負面清單,實現規範創新與安全創新。在實現金融科技企業與創新項目快速健康發展的同時,積極服務於北京的金融安全與經濟社會穩步發展,有效助力國家經濟金融安全機制建設。

2. Keeping the balance between development speed and efficiency, avoiding the proliferation of rough and bubbles, and strengthening the foundations and elements of new financial technologies in Beijing, and effectively remedying the weaknesses in the development of industries. Addressing the balance between technological innovation and financial security, personal data, and privacy protection, addressing the boundaries of innovation and security, keeping firmly in place the bottom line of non-systemic risks, preventing the accumulation of systemic risks, establishing a clear list of new red lines and negative aspects of financial science and technology, and creating new and safer ones.

3.堅持市場主導。全面完善金融科技創新與應用的市場化機制,發揮市場在資源配置中的決定性作用,更好發揮政府引導作用。積極引導市場主體,協同培育金融科技應用的場景需求,增加金融科技創新的有效供給,構建多層次的金融科技市場體系。充分發揮金融科技産業鏈上各參與主體的主觀能動性,強化北京金融科技創新的內在市場動力。加快政府職能轉變,以營商環境改善激發市場主體活力,以關鍵環節改革提高公共服務能力。堅持以服務推動資源對接和資本融合,以政策保障市場創新的規範與熱情,以制度促進金融科技新生態建設,為金融科技創新與應用提供良好的規則環境。

3. To maintain market ownership. To improve the market ownership of financial technology innovations and applications, and to improve the decision-making role of the market in resource allocation, and to improve government guidance. To actively guide the market community in fostering the demand for financial technology applications, to increase the effective supply of financial technology, and to create a multi-layered financial technology market system. To make full use of the key players in the financial science and technology chain, and to strengthen the market dynamism of financial science and technology in Beijing.

4.堅持開放協同。深入研究全球金融與科技的創新趨勢,積極對標國外金融科技發展的領先城市,全面融入國家金融發展戰略,把握現代金融科技應用的産業特徵,厘清北京金融科技創新的實踐主力,實現創新路徑的多方佈局,引領我國掌握新金融、新技術全球競爭的制高點。以科技帶動首都金融的多層次對外開放,實現“引進來”和“走出去”;改變區域金融發展的空間局囿,以開放式的金融科技發展模式,服務於北京經濟社會的對外貿易轉型升級、利用外資和要素流動。促進京津冀的資源有效協同,與國內外核心城市形成合作共贏。

To take stock of the emerging trends in global finance and technology, to actively integrate into national financial development strategies the leading cities in the development of foreign and foreign financial technology, to take stock of current financial and technological developments, to identify new and innovative sources of finance and technology in Beijing, and to bring new and innovative ways to bear on the country’s global competition for finance and new technologies. The multi-layered opening of capital finance with science and technology has led to “introduction” and “outwards”; to change the spatial dimension of financial development in the region, to open up the model of financial and technological development, to serve the economy in Beijing as a catalyst for foreign trade, and to use external resources and elements.

(三)發展目標

(iii) Development objectives

1.總體目標

1. Overall objectives

努力把北京建設成為具有全球影響力的國家金融科技創新與服務中心,加快推動金融科技行業主體、重大項目的創新與發展,在推動金融科技服務於金融監管與安全、風險防範、經濟結構調整與産業發展、城市治理、區域協調等方面取得突破性進展,形成“首都特色、全國輻射、國內示範、國際標準”的金融科技創新示範體系。

Efforts have been made to establish Beijing as a national financial science and technology innovation and service centre with global impact, to speed up the creation and development of financial science and technology institutions and major projects, and to make breakthroughs in financial science and technology services for financial supervision and security, risk prevention, economic restructuring and development, urban governance, regional agreements, etc., and to create a new paradigm for financial science and technology for “capital characteristics, national radiation, national and international standards”.

力爭到2022年底,涌現5-10家國際知名的金融科技領軍企業,形成監管科技、智慧金融等3-5個具有國際影響力的金融科技創新集群,在金融服務、安全監管、生活服務和城市治理等領域開展10-15個金融科技重大示範應用項目,推動金融與科技深度融合發展,持續完善金融科技創新創業生態系統,不斷提升城市運作效率,為首都“四個中心”功能建設提供重要支撐,有效助推京津冀協同發展。

By the end of 2022, five to ten internationally recognized financial and technological companies had emerged, forming three to five innovative clusters of financial technology with international influence, such as regulatory and intellectual finance, launching 10 to 15 major demonstration projects in the areas of financial services, security supervision, life services and urban governance, promoting financial and technological integration, sustaining the development of innovative and innovative financial and technological systems, increasing the efficiency of urban operations and providing important support for the development of the “four centres” in the capital.

2.具體目標

2. Specific objectives

(1)金融科技監管創新呈現示範效應

(i) Financial technology regulatory innovation demonstration

金融科技相關法律法規在地方層面能夠進行探索與落地,針對金融科技的行業主體和應用項目,形成有效的地方金融監管與風險防範機制,打造金融科技規範發展的“首都樣板”。適應各類金融科技創新的規範需要,建設立體化的金融科技發展管理體系,充分發揮自律組織作用,構建與國家金融監管部門的高效協調機制。在監管科技創新方面取得重要進展,建立安全保障機制,推動金融科技健康有序發展,促進國家相關部門、其他地方政府借鑒和應用相關成果,在國家金融安全領域發揮核心作用。

The laws and regulations governing financial science and technology can be explored and laid down at the local level, creating effective local financial supervision and risk prevention mechanisms, and creating a “capital model” for the development of financial science and technology regulations.

(2)金融科技産業綜合優勢凸顯

(2) Financial science and technology co-opts are highlighted

金融科技底層技術國際一流。金融科技基礎技術和應用技術研發取得突破,人工智慧、大數據、互聯技術、分佈式技術、安全技術等領域取得一批國內外領先的專利,金融技術類創新呈現快速增長勢頭。全面推動新型的金融科技成果轉化應用模式探索,打造5-10家國際一流、國內領先的金融科技研究機構、實驗室和技術服務平臺。

Financial technology has emerged as a fast-growing financial technology. A breakthrough has been made in the development of financial technology infrastructure and applications, with artificial intelligence, big data, interlocking technology, distribution technology, safety technology, etc., gaining a number of national and foreign-led know-how.

金融科技服務形成核心競爭力。逐漸形成金融科技應用行業集聚互動發展新格局,涌現10家左右領軍企業和標桿企業。推動銀行、保險等主流金融機構大規模應用新技術,增強技術輸出能力,鼓勵其在京設立金融科技子公司。大中型網際網路企業積極應用金融科技,優化自身業務佈局,提升技術服務能力。推動提供金融技術服務與外包的新型企業不斷涌現,支援100家有影響力的初創企業發展。實現技術應用與資本的良性融合,金融科技領域風險投資、産業投資快速發展。

Financial science and technology services form the core of the competition. A new pattern of convergence and development of financial technology applications has emerged, with some 10 or so leading companies and brand companies.

(3)金融科技人才達到規模效應

(3) Financial technologists have reached the scale.

積極推動人才引進和培育,加強基礎教育和應用培訓,努力形成多層次金融科技人才涌現的格局。全面實施金融科技人才聚集工程,推動中高端人才形成規模集聚;構建輔助型人才良性培養的渠道。不斷提升技術人員在金融機構僱員中的佔比,部分標桿企業的佔比達到一半以上。

Actively motivated talent is being introduced and nurtured, with more basic education and training in applications, and efforts are being made to create a multi-layered pattern of financial and technological talent. The full-scale implementation of financial and technological talent-aggregation projects is driving middle- and high-level talent-aggregation; and the development of channels for the healthy development of support-based talent.

(4)金融科技應用及服務城市管理全面鋪開

(4) Full development of financial science and technology applications and service city management

金融科技應用場景創新取得突破。支援10-15個具有示範效應、成效明顯的金融科技應用項目,在金融基礎設施建設、引領和完善城市治理等方面,率先取得重大進展。圍繞支付清算、投融資、資源配置、風險管理、資訊提供等金融服務功能,全面推進各類技術應用場景,形成部分成熟模式並能夠加以推廣。各類金融行業服務主體的線上業務快速發展,全業務鏈條中應用新技術程度較高。

Financial science and technology has made a breakthrough. Support for 10-15 financial technology applications with demonstrated and proven results has led the way in the development of financial infrastructure, leadership, and improved urban governance. Financial services around liquidation, investment, resource allocation, risk management, and information provision have moved to a full range of technology applications, forming part of a mature model that can be promoted.

金融科技服務城市管理卓有成效。以底層技術為主線,金融場景為依託,將金融科技創新要素全面融入城市管理體系之中,在政務管理、公共服務、居民生活、城市設施、安全保障等各方面涌現一批標桿企業和創新案例。打造新技術、新金融、城市管理的“三位一體”創新協同機制,發揮科技企業與金融機構的自主創新動力,強化相關部門的改革動力與服務能力,深入發掘城市管理中的金融科技需求,全面推動城市管理的現代化、科技化發展。

Building new technologies, new finance, and a new three-tier system of urban governance, and developing innovative initiatives and initiatives in science and technology enterprises and finance institutions, strengthening the capacity of the relevant ministries to reform and service, and deepening the demand for financial science and technology in urban management, as well as promoting the modernization of urban governance and the development of science and technology.

(5)金融科技生態系統持續優化

(5) Financial science and technology systems continue to improve

金融科技創新的産業鏈初步形成。形成高效、持續的成果轉化模式,科研成果産業化應用能力快速提升,為底層技術研發提供市場支撐,從而實現成果應用的良性迴圈。打造完備的金融科技企業孵化體系,金融科技資源配置形成高效互動、融合共贏的佈局,金融科技監管者與公共服務提供者的定位清晰,管理和應用金融科技的能力全面提升,構建起高效的資金、資源等政策支援模式,有效助推金融科技企業做大做強。構建特色突出的金融科技産業培育模式與機制,推動金融科技的技術和業務標準化建設快速推進,數據治理與應用的良性機制初步形成,金融科技行業主體在內部管理、控制、組織架構等方面,自動化與科技化程度全面提升。初步形成以創新、敏捷為特色,兼顧效率、安全、合規三者平衡的金融科技行業文化。

The creation of a well-established financial technology incubator, the efficient interaction and integration of financial and technological resources into a win-win set, the clear positioning of financial and technological regulators and public service providers, the overall improvement in the capacity to manage and adapt financial and technological technologies, the creation of an efficient policy support model, such as capital, resources, and the effective promotion of financial and technological enterprises.

三、推動金融科技底層技術創新和應用,催生領先前沿技術

堅持技術推動與需求拉動相結合,加快推動金融科技底層關鍵技術的發展,加快新技術的應用推廣,形成良好的基礎技術研發生態,打造充滿活力的應用技術創新模式,為新技術與新金融的互動融合創造基礎條件,為金融科技應用向城市治理等領域的進一步拓展,提供基本支撐與探索空間。

To maintain the convergence between technological drive and demand, to accelerate the development of key technologies at the bottom of financial science and technology, to accelerate the diffusion of new technologies, to develop sound technology technologies, to create new models for dynamic applications, to create building blocks for the interaction between new technologies and new finance, to expand financial technology applications further to areas such as urban governance, and to provide basic support and space for exploration.

重點支援企業和研究機構為主體,開展底層關鍵技術、前沿技術研發,在新技術領域儘快形成一批知識産權和專利,打造金融科技前沿創新高地。以人工智慧、大數據為中心,全面推動研發與應用,爭取國內外創新領先地位;以互聯技術為核心,持續推動技術進步升級,夯實金融科技的基礎;以分佈式技術為重心,強化雲計算的廣泛應用,爭取區塊鏈的成熟應用;以安全技術為保障,為金融科技的創新與發展“保駕護航”。

The focus is on supporting businesses and research institutions, developing technological and technological advances at the bottom level, building knowledge and expertise as quickly as possible in the new technological field, and building new niches in financial technology. The focus is on artificial intelligence, big data, and comprehensive development and applications, seeking new leadership within and outside the country; inter-linkages technology is at the heart of continuous technological advancement and strengthening the foundations of financial science and technology; decentralized technology is at the heart of broad-based applications for cloud computing, competing for mature applications of regional chains; and safety technology is used as a guarantee for the creation and development of new and dynamic financial technologies.

(一)重點推動人工智慧技術的創新與應用

(i) Focus on innovation and applications of AI technology

支援人工智慧技術在身份識別與反欺詐、量化交易、投資顧問、客戶服務、風險管理、輔助監管等金融領域的應用。及時把握深度學習、類腦計算、認知計算等前沿趨勢,支援電腦視覺、機器學習、自然語言處理等關鍵技術研發,重點支援機器學習、模式識別、人機交互等技術的發展。積極探索人腦模擬、腦機融合等前沿領域。推動作為人工智慧基礎層的晶片技術發展,建設技術社區、開源産業、生態系統,更好地承載人工智慧創新。

Support for the use of AI technology in financial fields such as identity recognition and anti-fraud, quantification of transactions, investment, customer service, risk management, supervision, etc.

(二)全面推動大數據技術的創新與應用

(ii) Full roll-out of big data technology innovation and applications

支援大數據技術在客戶管理、信用與風險管理、證券投資、保險定價、資管理財、另類數據管理等金融領域的應用。重點支援大數據基礎技術發展,包括有監督的演算法與模型,無監督的演算法與模型,適用大數據場景的演算法與模型。探索大數據與高性能計算、邊緣計算等領域的融合,有效解決數據統計與分析中的難點。統籌推動大數據基礎設施建設與優化,包括數據中心設計、網路、計算存儲硬體、管理軟體與運維、大數據處理平臺系統、深度學習軟硬體框架、數據安全方案等。

Supports the applications of big data technologies in financial fields such as customer management, credit and risk management, securities investment, insurance pricing, asset management, alternative data management, etc. The focus is on supporting the development of large data base technologies, including monitored algorithms and models, unsupervised algorithms and models, suitable algorithms and models for large data scenes. Explore the integration of large data with high performance calculations, margin calculations, etc., to effectively address the difficulties in data accounting and analysis.

(三)著力推動互聯技術的創新與應用

(iii) Activating the innovation and applications of interoperability technologies

重點推動移動互聯、物聯網為代表的互聯技術創新。大力推動移動互聯技術發展,促進移動網際網路與金融功能的全面融合,更好地應用於公共服務領域。加快第五代行動通訊(5G)技術研發。加快移動晶片、移動作業系統、智慧感測器、位置服務等核心技術突破和成果轉化,推動核心軟硬體、開發環境、外接設備等系列標準制定,加快虛擬現實、增強現實、微機電系統等新興移動網際網路關鍵技術佈局。

Highlighting the new technologies represented by the Migration Interconnectivity, the Internet, and the Internet. Intensifying the development of the Migration Interconnectivity Technology, promoting the full integration of mobile Internet and financial functions, and making better use of public services. Accelerating the development of the fifth generation of mobile communication (5G) technologies. Accelerating the breakthrough and transformation of core technologies, such as moving crystals, mobile mobility systems, intelligent sensors, location services, and the development of standards such as core software hardware, the development environment, external devices, etc., and accelerating the roll-out of new mobile web-based technologies, such as virtual reality, enhancing reality, micro-electric systems, etc.

著力推動物聯網技術發展,支援物聯網技術在供應鏈金融、支付、信用體系建設、動産融資等金融領域的應用,鼓勵銀行、保險等金融機構充分應用物聯網。重點支援感測器技術、穩定傳輸技術、智慧處理技術的研發。積極關注物聯網與數字孿生技術的結合。推動感知製造、網路傳輸、智慧資訊服務在內的産業規模快速提升。

Support for the development of the animal network, and support for the use of the network in supply chain finance, payments, credit system construction, and banking, encourage banks, insurance, and other financial institutions to have adequate access to the network. Emphasis is placed on the development of sensor technology, steady transfer technology, and intelligent processing techniques. There is a strong focus on the integration of the network with digital technologies.

(四)積極推動分佈式技術的創新與應用

(iv) Innovative and innovative applications of positive push-distribution technologies

推動以雲計算、區塊鏈為代表的分佈式技術發展。鼓勵金融機構利用雲計算等技術手段加快産品和服務創新,加大金融機構在公有雲、私有雲及混合雲上的部署,實現集約化、規模化與專業化發展,有效降低金融機構IT成本。重點支援包括虛擬化技術、分佈式技術、計算管理技術、雲平臺技術、雲安全技術在內的雲計算共性技術研究應用。持續提升超大規模分佈式存儲、計算資源的管理效率和能效管理水準,推動“雲安全”和容器、微內核、超融合等新型虛擬化技術發展,實現縱深演化。推動完善由數據中心基礎設施、物理資源和虛擬資源組成的雲計算基礎設施,鼓勵發展超大規模數據中心、綠色數據中心、高密機櫃、超融合機櫃、伺服器定制化等。

To encourage financial institutions to use technology such as cloud computing to speed up the creation of products and services, to increase the deployment of financial institutions on public, private and mixed clouds, and to effectively reduce the cost of IT for financial institutions, including virtualization technology, partitioning technology, computing management technology, cloud control technology, cloud security technology within them.

支援區塊鏈技術的基礎層、中間協議層、應用服務層創新探索,支援區塊鏈技術在數字身份、資訊存證、公證確權、可信驗證、流程溯源、城市管理、精準扶貧等領域的應用,審慎探索區塊鏈技術在金融監管與風控、供應鏈金融、普惠金融、貿易金融、徵信、保險、眾籌等金融領域的應用。支援智慧合約等多維度的區塊鏈技術研發,積極鼓勵下一代分佈式技術的研究探索。重點支援技術領軍企業推動有國際影響力的開源組織建設,推動區塊鏈底層技術創新、産業應用創新和商業模式創新,積極構建産業生態系統。

Support for the development of infrastructure, middle-level agreements, and service-based innovations in sector-link technology. Support for the development of multi-dimensional sector-link technology, such as Wisdom, provides a strong incentive for the next generation of technology-based research. Highlighting support for the development of internationally influential start-up organizations by technocratic companies, and for the creation of new, innovative and business-based technological and business-based systems.

(五)深入推動安全技術的創新與應用

(v) Deep push for safety technology innovation and applications

著力推動以密碼技術、量子技術、生物識別技術為代表的安全技術發展。支援密碼技術在數字身份、身份驗證、欺詐管理、網路安全、數據加密等領域的應用。大力支援基礎密碼技術,進階密碼技術等底層密碼技術的研究,推動國家商用密碼標準系列的進一步完善。

Supports the use of cryptography in fields such as digital identity, identification, fraud management, network security, data encryption, etc.

支援量子技術在城市內部金融量子保密通信、異地數據加密傳輸等領域的應用。推動面向後量子時代的密碼技術研發,探索格密碼體制、多變數公鑰密碼體制和糾錯碼技術等抗量子攻擊特性的密碼技術,支援研究量子密鑰分配或者基於量子密鑰分配的密碼通信。

Supports the applications of quantum technology in areas such as financial volume secure communication within the city, off-site data encryption, etc.

支援生物識別技術在改善金融及支付機構效率、防範金融風險、促進金融創新,以及城市管理等領域的應用。重點支援指紋識別、虹膜識別、人臉識別、掌紋識別、聲紋識別、靜脈識別、步態識別等各類生物識別技術的研發和應用,鼓勵生物識別技術與人工智慧等技術的融合協作,提升自身的應用成熟度與輔助地位。

Support for the development and application of bio-awareness technologies to improve the efficiency of financial and payment institutions, to prevent financial risks, to promote financial innovation, and to manage cities.

四、加快培育金融科技産業鏈,打造創新生態系統

堅持全鏈條推進金融科技産業發展,著力構建金融科技企業的培育、孵化與提升機制,挖掘篩選潛力創新企業,全面推動産學研用一體化,加快重大基礎設施建設與平臺要素聚集,打造並完善金融科技全鏈條生態系統。

In keeping with the full chain, it has been able to promote the development of financial science and technology, build up the capacity to nurture, incubate and upgrade financial science and technology enterprises, explore the potential to create new ones, promote a holistic approach to technology development, accelerate the build-up of major infrastructure and matrix elements, and build and improve the whole chain of financial science and technology.

(一)支援高校院所基礎研究與人才培養

(i) Support for foundational research and human resource development in institutions of higher learning

支援高校院所加大金融科技領域的基礎研究投入,建設一批緊跟國際前沿、國內領先的跨學科金融科技研究基地,全面強化金融科技研究的理論支撐。支援和鼓勵在京相關院校組建金融科技院係或設立專業方向,推動技術與金融的跨學科課程設計,促使專業人才不斷提升研究能力和學術素質,培養一批金融科技人才。對現有高校院所、科研機構的金融科技研究平臺加大支援力度,鼓勵學術組織與社會力量合作,組建更多的金融科技專項研究團隊,形成重視基礎研究的良好環境。

To support and encourage the establishment of financial science and technology institutes in relevant schools in Kyoto, and to promote the design of cross-disciplinary courses in technology and finance in order to encourage professionals to continue to upgrade their research capabilities and technical skills, and to develop a pool of financial science and technology specialists. Greater support is being provided to the financial science and technology research stations of existing high schools, research institutes, and to encourage organizations and social forces to work together to create more research teams on financial science and technology and to create a favourable environment for research.

(二)發掘培育底層技術創新企業

(ii) Development of bottom-level technology to create new businesses

構建多元化、多層次、多渠道的金融科技服務體系,引導企業在金融科技産業園或功能區聚集,著力培育和引入底層技術創新型標桿企業和領軍企業,支援行業龍頭企業和有潛力的初創企業發展,為其提供健康成長的生態環境,從而滿足不同層次的金融科技應用需求。重點支援底層技術企業加強對金融機構的産品與服務創新,鼓勵各類底層技術企業開展合作,在合規前提下,共同推動技術研發與創新應用。

Building a diversified, multilayered and multichannel financial science and technology service system that brings together businesses in financial science and technology parks or areas of competence to foster and introduce technological innovation at the bottom, to support the development of leading firms and potential start-ups, and to provide them with a healthy environment that meets the needs of different levels of financial science and technology applications. The focus is on supporting bottom technology enterprises to enhance innovation in financial institutions, encouraging cooperative efforts among bottom-level technology and industry to develop and develop innovative applications in a rule-based manner.

(三)構建多層次成果轉化促進模式

(iii) Constructing multi-layered results-forwarding models

加快科技成果轉化、産業化,統籌加強創新設施建設和研發投入。重點激發高校院所科技成果轉化活力,發揮企業科技成果轉化主體作用,壯大科技成果轉化服務力量,提升中關村各分園科技成果轉化承載能力。強化金融機構需求拉動,圍繞金融科技重點領域,引導國內外知名機構在京設立研發中心、重點實驗室等,整合行業資源,深入開展産學研用協同創新,有效解決産業關鍵共性問題。支援企業、金融機構設立金融科技孵化器、加速器、創客空間等平臺,優化各類孵化載體功能,構建涵蓋技術研發、企業孵化、産業化開發的全鏈條服務體系,促進技術轉移和成果轉化。

To accelerate the transformation of technological achievements, to accelerate the development of technological innovations, and to strengthen the development and development of new institutions and institutions. Emphasis is being placed on stimulating the transformation of technological achievements in institutions of higher learning, promoting the transformation of scientific and technological achievements in enterprises, enhancing the capacity of technological services, and enhancing the carrying capacity of technological and technological achievements in the central and central villages. To strengthen the demand of financial institutions around the focal areas of financial science and technology, leading to the integration of industry resources into the Kyoto Research and Development Centre, the hard-core laboratories, and the development of technological research and innovation, and effectively addressing the key issues of innovation. To support businesses, financial institutions, financial incubators, accelerations, creative spaces, etc., and other equations such as incubators, and other types of incubating carrier functions, and to build up the architecture of technology, business incubators, whole-of-service systems for the development of industries and industries, and to promote the transfer of technology and results.

(四)支援搭建協同創新支撐平臺

(iv) Support for the creation of a new platform

支援企業、金融機構、高校院所加強合作,發揮各自優勢,形成多主體、多因素共同協作、相互補充格局。面向金融科技重大專項或重大工程的組織實施,整合各類科技與金融資源,爭取實現重點領域的創新突破。支援建設前沿金融科技創新研究院,吸引高端人才,實現技術突破。支援組建金融科技協會和聯盟相關組織,吸引各類金融機構、科技企業、科研院所加入,共同推動金融科技應用場景的對接與落地與標準化建設。積極探索與其他地區的協同佈局與合作創新,以開放視角推動京津冀區域內外的資源交流與協同創新,引領國家層面的金融科技産業新生態建設。

Support for companies, financial institutions, and institutions of higher learning by strengthening their cooperation to create multi-agency, multi-factoral and cross-fertilization structures. Support for the development of financial science and technology associations and associated organizations to bring together financial institutions, science and technology enterprises, research institutes, and co-sponsor the interface and landing of financial science and technology applications and standard-setting.

(五)推動金融科技領域重大基礎設施建設

(v) Promotion of major infrastructure in financial science and technology

圍繞支付清算、登記託管、徵信評級、資産交易、數據管理等關鍵環節,積極爭取金融科技重大基礎設施在京落地,支援現有國家金融基礎設施提升科技功能,在提供基礎服務、維護市場穩定、聚集要素資源、支援創新發展等方面發揮支撐作用。重點支援中央債券綜合業務系統、中國證券登記結算系統、全國中小企業股份轉讓系統、中證機構間報價系統、北京股權交易中心等金融市場基礎設施的新技術應用與升級,推動人民銀行支付系統子系統、農信銀資金清算中心等在京支付系統基礎設施的新技術探索,大力支援網聯清算系統等新興清算組織的建設。

The key features of paying settlements, bookkeeping, credit ratings, equity transactions, data management, etc., are being used in Kyoto to actively compete for major financial and technological infrastructure, to support new technology applications and upgrades in existing national financial infrastructure, and to support the provision of basic services, maintenance of market stability, pooling of factor resources, and support for new developments. The focus is on supporting the central bond management system, the Chinese credit register accounting system, the national equity transfer system for small and medium-sized businesses, the middle-credit institution reporting system, the Beijing equity trading centre, and other financial market infrastructure applications and upgrades, to promote new technology explorations in the People’s Bank payment system, the People’s Bank’s Bank payment system, the Agricultural and Silver Clearing Centre, etc., and to support the construction of new liquidation organizations such as the online clearing system.

五、拓展金融科技應用場景,發展現代金融服務體系

堅持以應用促進和激勵技術創新,加快推動新技術在金融領域的全面應用,充分滿足金融改革與創新的多層次需求,促進金融科技的業務場景落地與功能完善,實現金融業態的健康、高效發展,同時發揮金融科技創新的正外部性,努力探索在安全監管、生活服務、城市治理等領域的拓展應用。

To insist on the application of pro-development and technological innovation, to accelerate the full application of new technologies in the financial field, to fully meet financial reforms and to create new multi-layered needs, to promote the sound and efficient development of financial science and technology, and at the same time to create new positive externalities in financial science and technology, and to explore outreach applications in areas such as security oversight, life services, and urban governance.

(一)深入推動新技術應用於金融服務領域

(i) Deep push for new technology applications in the domain of financial services

金融科技的快速發展深刻改變金融服務模式,金融服務生態更加完善,使得金融服務更趨精準、自動和智慧。新技術應用於金融領域的共識和核心,旨在推動金融系統的安全穩定以及金融服務實體經濟效率的提升。

The rapid development of financial technology has profoundly changed the mode of financial services, improving their quality, making them more sophisticated, self-active, and intelligent. The new technologies are applied to the common understanding and core of the financial field, with a view to promoting the security and stability of the financial system and improving the efficiency of the financial services economy.

1.支付清算服務

1. Payment of liquidation services

鼓勵金融機構和支付企業利用大數據、雲計算、人工智慧等技術推動産業變革,推進支付服務向移動化、智慧化、場景化、電子化方向發展,增強客戶服務便利與改善體驗。加強支付標記化技術、智慧終端技術、生物特徵識別技術在網際網路支付中的研發應用。通過推動金融科技手段深度應用,全面提升支付結算産品創新活力、風控精準度、服務普惠程度和業務處理效率,促進完善支付服務産業鏈,打造支付行業新生態。重點支援支付系統類、證券結算類基礎設施發展,促使其更有效地運用新技術,改善市場基礎服務水準。把握創新與安全邊界,推動完善支付科技領域的規則及標準,引導行業機構加大對支付安全技術的應用,保障用戶的知情權、選擇權不受侵犯。

Financial institutions and paying companies are encouraged to use technology such as big data, cloud computing, artificial intelligence, and other technologies to transform their industries, promote the transfer of payment services, intellectualization, landscape development, electronicization, and enhance client service facilitation and improvement. More attention is paid to the development of labelling technologies, end-of-life smarts, bio-sensor technology for research and development in online payments.

2.融資産品與服務

2. Integration of goods and services

推動金融機構利用新技術,實現金融産品創新,加速智慧産品開發,更有效、更低成本、更快捷地滿足企業和居民的金融需求。支援智慧銀行建設,推動智慧網點建設,打造智慧化生態鏈,實現線上線下一體化的智慧金融服務。支援金融服務場景化建設,推動基於新技術的消費金融和産業金融創新,全面服務於居民各類消費活動中的融資需求,推動構建面向行業企業的綜合金融服務解決方案。鼓勵各類消費金融服務機構充分運用大數據、人工智慧等新技術,進行合理風險定價,為消費者提供更便捷高效的服務。

Financial institutions use new technologies to generate financial innovation, speed up the development of smart goods, and meet the financial needs of businesses and residents more effectively, at a lower cost, and more quickly. Support smart banks, build intelligent web sites, build intelligent bio-links, and deliver artificial financial services. Support financial services landscapes, and finance and finance innovations based on new technologies.

打造面向中小微企業的數字普惠金融服務體系。重點圍繞科技型中小微企業,探索應用大數據、區塊鏈等新技術,建立具有首都特色的大數據資訊共用與信用評價系統,構建線上線下相結合的擔保增信模式,開發有針對性的金融科技類服務産品,滿足企業融資需求,降低企業融資成本。鼓勵銀行、供應鏈核心企業有效運用區塊鏈等新技術,建立供應鏈金融服務平臺,為上下游中小微企業提供高效便捷的融資渠道。

To create a digitally inclusive financial services system for small and medium-sized enterprises. The focus is on technology-based micro and small enterprises, exploring new technologies such as large data and sector chains, building a large data sharing and credit rating system with capital characteristics, building up an online, online and secure credit system, developing customized financial and technological services, meeting the demand for corporate finance and reducing the cost of corporate finance. To encourage banks, core supply chains and other technologies to operate effectively, creating supply chain financial services to provide efficient and easy access to finance for small and medium-sized enterprises up and down the country.

3.智慧行銷與服務優化

3. Smart marketing and service optimization

鼓勵銀行、保險等金融機構利用人工智慧、大數據等技術,更加精準、批量地定位潛在客戶,降低獲客成本。支援銀行、保險等金融機構優化採集和處理數據流程,搭建數據分析模型,實現對用戶畫像的精準刻畫,加強對客戶的生命週期管理,有效開展實時行銷、交叉行銷、個性化推薦等多種精準行銷手段。

Financial institutions such as banks, insurance, etc. are encouraged to use techniques such as artificial intelligence, big data, etc., to better position potential clients, and to reduce the cost of acquiring clients. Support banks, insurance, etc., to optimize their data collection and processing processes, to build data analysis models, to produce accurate drawings of user images, to strengthen customer life cycle management, and to effectively develop a variety of precision marketing tools, such as marketing, cross-marketing, personalization and recommendation.

鼓勵運用人工智慧改革傳統客服行業,支援智慧坐席的推廣普及。支援建立基於智慧坐席的數據庫,切入貸前、貸中、貸後、行銷、回訪等業務環節,實現精準服務,提升服務效率。支援生物識別系統在智慧催收系統中的應用,推進智慧催收平臺在資訊驗核、還款通知、催收警告方面的功能,鼓勵利用大數據建立不同層次的催收模型,杜絕暴力催收,實現精準催收。

To encourage the use of artificial intelligence to reform the traditional customer service, and to support the promotion of intelligent seats. To support the creation of a database based on intelligent seats, pre-credit, loan, loan, post-lending, marketing, return, etc., to achieve precision and efficiency in services. To support the application of bio-awareness systems in intelligence-driven systems, to promote the use of intelligence-driven platforms in information-testing, repayment alerts, and alarm alerts, and to encourage the use of large data to create various layers of recovery models, to eliminate violence, and to improve efficiency.

4.保險産品與服務

4. Insurance products and services

以數字化轉型驅動保險運營與服務不斷升級,推動行銷模式逐漸從保險産品為主導向客戶需求為核心轉變。通過物聯網、大數據、雲計算、人工智慧等技術,實現保險産品個性化和保險定價的準確性,有效提升保險精算的水準和效率。助推保險承保核保、定損理賠、客戶服務、風控反欺詐等管理模式的創新變革。綜合提升理賠服務與管理效率,實現保險理賠的智慧化定損和數字化核賠,提高理賠數據處理的自動化、核賠理賠的高效化和準確化。

Through techniques such as networks, big data, cloud computing, and artificial intelligence, the personalization of insurance products and the accuracy of insurance prices can be achieved to improve the actuarial accuracy and efficiency of insurance policies. Support the innovation of management models such as insurance insurance, price fixing, customer services, and wind control and anti-fraud.

5.智慧投顧與智慧投研

5. Intellectual investment and intellectual development

鼓勵財富管理行業在投資者分析、資産配置、風險計量方面加強研發創新,探索人工智慧與投資者之間的互動學習,深度挖掘投資者的投資需求。充分發揮智慧投顧在降低理財成本、擴大服務人群、客戶畫像刻畫與優化投資建議方面的作用。積極發揮智慧投研在投資管理中的作用,利用新技術將數據、資訊、決策進行智慧整合,實現數據之間的智慧化關聯,提高投資者工作效率和投資能力。支援量化投資平臺運用大數據技術建立驅動模型;支援運用人工智慧演算法和程式化模組,減少團隊運營成本,防範非系統性風險。建立健全智慧投顧人工干預機制,防止因演算法同質化、編程設計錯誤、對數據利用深度不夠等智慧投顧演算法模型缺陷或者系統異常等情況,影響金融市場穩定運作。

The financial management industry is encouraged to develop innovative ideas in investor analysis, investment allocation, risk measurement, exploring the interaction between artificial intelligence and investors, and deep-seated investment needs of investors. Full intellectual investment is encouraged in reducing the cost of finance, expanding the service community, drawing from clients, and prioritizing investment advice. There is a strong intellectual investment in the role of investment management, using new technologies to integrate data, information, decision-making, intellectual alignment between data availability, and improving the efficiency and investment capacity of investors. Support for quantitative investment platforms to build driving models using large numbers of technology; support the use of artificial intelligence algorithms and programming modules to reduce team costs, prevent unsystemic risks.

(二)大力支援金融科技應用於安全與監管領域

(ii) Strong support for financial science and technology applications for security and regulatory areas

1.安全與監管科技

1. Security and supervisory technology

全面推動新技術在金融風險防範和金融機構合規中的應用。督促銀行業、保險業、證券業等金融機構及新技術企業健全風險預警指標體系。監控重點區域、特定客戶群等風險變化趨勢,及時發出預警信號。關注社區、論壇和社交媒體上的相關資訊,充分利用大數據等技術進行正負面判斷,及時發現和處理問題。支援各類機構充分利用金融科技構建合規系統,優化合規管理機制,降低合規成本。

Monitoring changes in risk areas, specific client groups, etc., and issuing alerts in time. Focusing on information related to communities, forums and social media, making full use of technology such as large data sets for positive and adverse determinations, and identifying and addressing problems in time. Supporting institutions to make full use of financial science and technology systems to optimize regulatory regimes and reduce compliance costs.

加強監管科技在風險防範和處置方面的應用與落地,助力各級金融監管部門,有效防控金融風險。重點推進監管科技在監管資料數字化、預測編碼、模式分析與機器智慧、大數據分析等方面的應用,系統構建基於大數據技術和雲計算技術為核心的數字化監管體系,實現即時、動態監管和全方位監管。支援金融科技企業運用自身技術優勢,加強與監管部門和金融機構的合作,共同建設監管科技的創新與實驗機制。推動監管科技的體系化、機制化、應用化發展,全面服務於監管部門、市場主體、終端用戶的多重需求。

Increased monitoring of the applications and location of technology in risk prevention and management, and effective financial risk management at all levels of financial supervision. Emphasis is placed on monitoring technology applications in monitoring data digitization, predicting codes, model analysis and machine intelligence, and big data analysis. System architecture is based on digital surveillance systems with large data technology and cloud computing technology at their core, with immediate, operational and full-scale supervision.

推動市區金融監管部門充分利用金融科技改善管理與監督體系,豐富城市信用狀況監測預警指標系統,打造智慧型風險監控、行為監督、企業服務機制。圍繞各類金融産業園區,打造智慧園區AI系統,實現智慧決策與管理。積極推動“刷臉認證”等生物識別技術在地方金融業日常管理中的應用,有效落實身份識別、反洗錢、風險管理的多重目標,及時監測市場主體、金融消費者的潛在風險萌芽,有效維護首都金融安全與穩定。

The Department of Financial Supervision in the city makes full use of financial technology to improve management and oversight systems, rich in urban credit monitoring and warning systems, and creates smart risk surveillance, behavioral surveillance, and corporate services. It surrounds financial parks of all kinds, builds smart parks of AI systems, realizes smart decisions and management. It actively promotes the application of bio-awareness techniques such as “face proof” in the daily management of the local financial sector, effectively fulfils the multiple objectives of identity recognition, anti-money laundering, risk management, and, over time, monitors the potential risks of market owners, financial consumers, and effectively defends financial security and stability in the capital.

2.身份認證、風控與反欺詐

Identification, wind control and anti-fraud

依託人工智慧、大數據、區塊鏈和生物識別技術,進一步推動身份認證在金融服務領域的應用。加快促進新技術在金融風險管控中的運用探索,不斷優化現有各類風控系統,收集更多線上線下數據、更有效地挖掘數據價值、提升業務決策效率、進一步提升數據偽造難度,更好地保障數據使用過程中的安全隱私性。鼓勵金融機構利用大數據挖掘方法,引入有價值的外部數據,與行業內資訊實現有效整合,進行貸款風險分析,量化企業的信用額度。支援金融機構反欺詐系統的建設,加強身份評估和信用評估在反欺詐領域的運用,有效評估與客戶相關的欺詐風險。

Promote the use of new technologies in financial risk management by accelerating the exploration of new technologies for financial risk management, improving the availability of various types of wind control systems, collecting more online data, more efficient data mining, improving the efficiency of business decisions, further improving data forgery, and better safeguarding the safety and privacy of data use. Encourage financial institutions to use large data mining methods, introducing valuable external data, effectively integrating with intra-business information, undertaking loan risk analysis, and quantifying the creditworthiness of businesses.

3.金融徵信與社會信用服務

3. Financial credibility and social credit services

探索大數據時代的信用科技應用模式,拓寬和規範信用資訊數據的採集機制,優化信用資訊管理與評估評價模式,推動徵信産品與服務的創新和完善。加快推動新技術應用於重點民生領域的信用體系發展,引導社會力量參與信用建設,發展第三方徵信服務。規範公共信用資訊的歸集、披露、使用和監督管理,鼓勵徵信機構運用人工智慧、大數據、區塊鏈等技術完善徵信體系服務模式。打造信用資訊共用平臺,打破徵信資訊孤島,積極推動符合條件的金融科技企業接入人民銀行徵信系統,促進信用數據共用。

To explore the use of credit technology in large-scale data generation, to expand and regulate the use of credit information data, to optimize credit information management and evaluation models, and to promote the creation and improvement of credit products and services. To accelerate the development of new technologies that focus on local credit systems, to lead social forces to participate in credit creation and to develop third-party credit services.

(三)積極促進金融科技應用於生活服務領域

(iii) Actively promoting the use of financial technology for life-service applications

1.智慧醫療

1. Wisdom medical care

通過技術的深度應用,逐漸改變醫療服務的價值鏈,探索智慧便捷的金融科技服務模式,促使新型支付、保險模式更有效地融入醫療場景。加快分期付款與醫療保險等金融服務創新,結合大數據、區塊鏈等新技術,實現醫療保險自動核保、智慧理賠,助力降低居民醫療成本、優化醫療資源配置。探索利用區塊鏈等新技術,保證藥品追溯數據的可信任性,改善醫藥行業協同效率。基於人工智慧與生物識別技術,探索構建基於常見病診療指南的專家系統,完善居民日常的智慧健康服務。推動完善居民電子健康檔案,有效分享醫療數據,防範醫療科研數據造假,加強處方藥電子監管。

Through the in-depth application of technology, the value chain of medical services has been gradually changed, and intelligent and easy-to-use models of financial and technological services have been explored to promote a more effective integration of new payment and insurance models into the medical landscape. New technologies, such as speeding up the innovation of financial services, such as instalments and medical insurance, combining large data and grids, implementing medical insurance self-insurance, Wisdom compensation, helping to reduce the population’s medical costs and the allocation of medical resources.

2.智慧生活

2. Smart life

推動以移動支付為核心的金融科技場景拓展,全面融入居民生活與日常需求,提高生活便利性。重點支援中老年人群學習運用移動支付工具,增加各類公共事業繳費便利程度。推動包括手環在內的各類移動設備創新,提供安全、簡單、方便、靈活的便民金融服務。運用金融科技手段,積極推動智慧社區建設,打造更多的無人超市、便利店。探索利用數字技術手段,引導居民的節能、低碳生活。推動金融科技應用於文化旅遊産業,為休閒、旅遊、娛樂、健身等提供更加便利的融資與支付服務。探索運用區塊鏈、生物識別技術等,打造智慧政務服務體系,實現企業與居民網上辦事“一次認證、多點互聯”,提升城市管理和便民服務運營效率。

It is important to support older people in learning to use mobile payment tools and to increase the cost of various types of public services. It includes innovative mobile devices in hand circles that provide safe, simple, easy, and lively financial services. Using financial technologies, the creation of smart communities and the creation of more supermarkets and convenience stores. It explores the use of digital techniques to guide residents to conserve their energy and low-carbon lives. It is important to use financial technologies to promote cultural tourism to provide more convenient integration and payment services for layoffs, travel, entertainment, fitness, etc.

(四)著力探索金融科技應用於城市治理領域

(iv) Strive to explore the use of financial science and technology for urban governance

1.智慧交通

1. Smart traffic

充分利用移動互聯技術和新型支付工具,對交通管理、交通運輸、公眾出行等交通領域全方面進行優化,改善交通出行管理與保障能力。推進交通大數據共用及交通雲應用,搭建出行平臺,採用人臉識別、無感支付等新技術,使居民獲得便捷、綠色、快速、經濟的出行服務。全面提升智慧交通管理水準,構建智慧交通安全體系,減少交通事故。依託移動支付平臺,不斷完善智慧停車、共用停車模式。以支付端為場景切入,圍繞汽車購買、使用、租賃等居民消費環節,大力促進科技與金融需求場景的融合,推動構建面向交通出行企業的金融科技綜合服務解決方案。

Make full use of mobile technologies and new payment tools to improve traffic management, transportation transport, public travel, etc., and improve traffic management and safety. Promote the sharing of traffic data and traffic cloud applications, set up mobility platforms, and introduce new techniques such as human face recognition, rapid and economic mobility. Improve the integration of science and technology with financial needs.

2.智慧社保

2. Wisdom Social Security

充分利用資訊處理、客戶畫像、身份識別等金融科技手段,改善流程服務品質,提升社會保障、養老服務的運作效率。以智慧養老、社區居家養老和整合性養老服務為主線,積極融入新技術支援和商業模式創新,推動金融科技在養老保險、消費、投資領域的應用。利用新技術提升特定人群的身份認證準確性和及時性,改善住房保障實施流程和效果;及時精準把握特定住房狀況,促進基於房屋財産的保險科技創新應用,有效服務於住房保障體系的完善。

Financial technologies such as information processing, client drawings, identity recognition, etc., are used to improve the quality of process services, social security, and the efficiency of the operation of care services. On the basis of wisdom, community-based old-age care and integration services, active integration into new technology support and business models is being developed, financial technology is being promoted in the field of old-age insurance, consumption, and investment. New technologies are being used to improve the quality and timeliness of identification of specific groups of people, and to improve the process and effectiveness of housing security.

六、優化金融科技空間佈局,形成協同發展格局

VI. Estimating the financial science and technology space to form a coherent development pattern

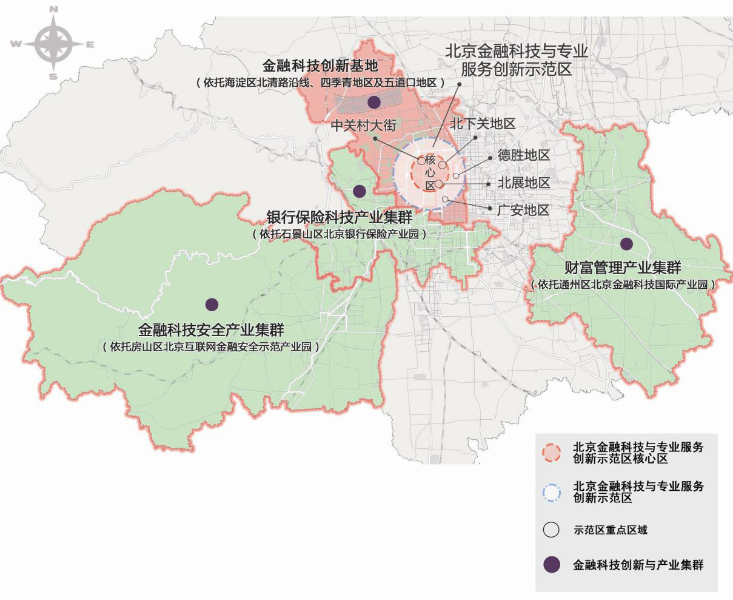

根據《北京城市總體規劃(2016年-2035年)》,結合金融科技産業發展基礎和重點區資源稟賦,以“一區一核、多點支撐”為抓手進行空間佈局,支援金融科技企業在特定區域和樓宇聚集,並實施全面監管,形成“各具特色、互動協同”的北京市金融科技發展格局。

According to the Beijing Master Plan for Cities (2016-2035), the foundation and focus of financial science and technology development is integrated into the regional resource base, with “one-size-fits-all support” as a handout, supporting financial science and technology enterprises to gather in specific areas and buildings, and providing comprehensive supervision to shape the development of financial science and technology in the city of Beijing, which is “specific, interactive and mutually supportive”.

(一)一區一核:建設北京金融科技與專業服務創新示範區及核心區

(i) A region-by-region approach: building new demonstration and core areas of financial science and professional services in Beijing

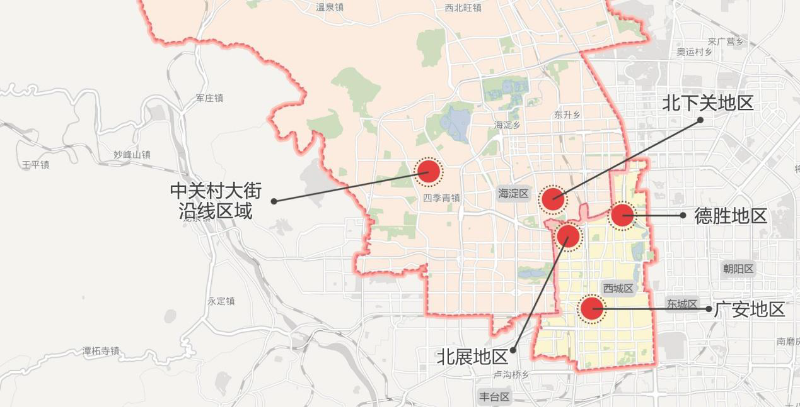

1.北京金融科技與專業服務創新示範區:以西城區北展地區、德勝地區、廣安地區和海澱區北下關地區、中關村大街沿線區域為主體建設北京金融科技與專業服務創新示範區,面積約15平方公里,聚焦金融安全與監管、支付清算服務、融資産品與服務、智慧行銷與服務優化、身份認證、風控與反欺詐、保險産品與服務、智慧投顧與智慧投研、金融徵信與社會信用服務等重點領域,支援相應金融科技企業在特定樓宇集聚。著力建設金融科技的創新業態和創新平臺,吸引培育一批技術研發和場景應用能力較強的金融科技企業,支援建立金融科技基礎設施機構,積極引進法律規範、信用評價、知識産權、人力資源、創業孵化等國內外知名專業服務機構以及金融科技頂尖研究機構、行業組織,形成佈局清晰、功能明確、協同聯動的産業空間發展格局,適時爭取創建“國家金融科技創新試驗區”。

New demonstration areas for financial science, technology and professional services in Beijing: in the north of the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the south, in the south, in the south, in the south, in the south, in the south, in the south, in the south, in the middle and in the south, in the south, in the south, in the south, in the south, in the south, in the south, in the south, in the south, in the south, in the west, in order to support the formation of a new demonstration area for financial science, technology and professional services for the main, in the 15 square kilometres, focusing on financial security and supervision, in the south, in the south, in the west, in the west, in the west, in the west, in the west, in the west, in the north, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the north, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in the west, in

示範區發揮連接金融街、中關村科學城、麗澤金融商務區的區位優勢,促進金融要素與科技要素的深度融合,輻射帶動相關區域發展,旨在成為我國金融科技與專業服務發展示範高地和金融科技監管體系創新引領者。

The demonstration is aimed at becoming a new leader in the development of the Financial Highlands and Financial Science and Technology Supervisory System of our country’s financial and professional services.

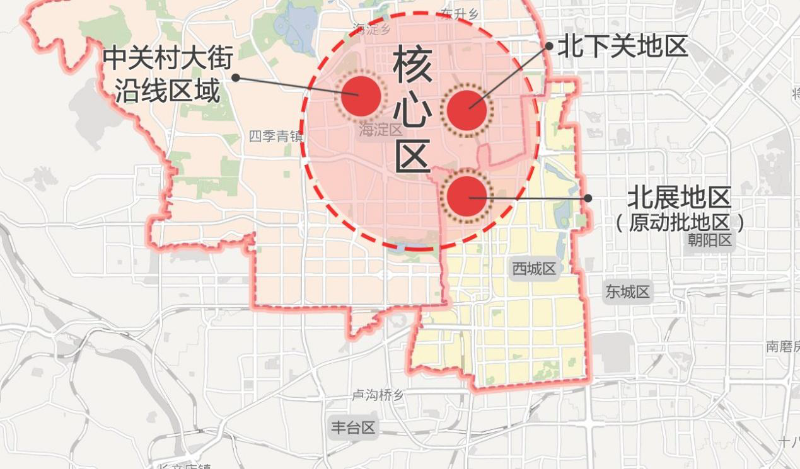

2.北京金融科技與專業服務創新示範區核心區:以西城區北展地區(原動批地區)、海澱區北下關地區和中關村大街沿線區域為主體建設北京金融科技與專業服務創新示範區核心區,選擇60萬平方米特定樓宇,重點聚焦監管科技、風險管理、金融安全和專業服務四個領域發展金融科技産業,建設金融監管實驗區。核心區發揮與金融街綿延相接的區位優勢,與國家金融管理中心相互支撐、相互呼應,構築科技資源為金融機構賦能、金融要素助力科技創新的良好格局。

2. Beijing's Financial Science, Technology and Specialized Services (FIS) Innovative Zones (FIS) are located at the heart of the West Side Zone (the original batch area), the lower-north and central village streets of the Bay Area, where a Beijing FTSD core area is being built for the main sector, with a specific area of 600,000 square metres selected, with a focus on monitoring four domains of technology, risk management, financial security and professional services for financial development, and setting up financial monitoring and testing areas. The centre's locational advantages, which are linked to the financial street, are mutually supportive and responsive with the National Financial Management Centre, and are based on a new set of good patterns for financial institution development, risk management, financial component support and technology.

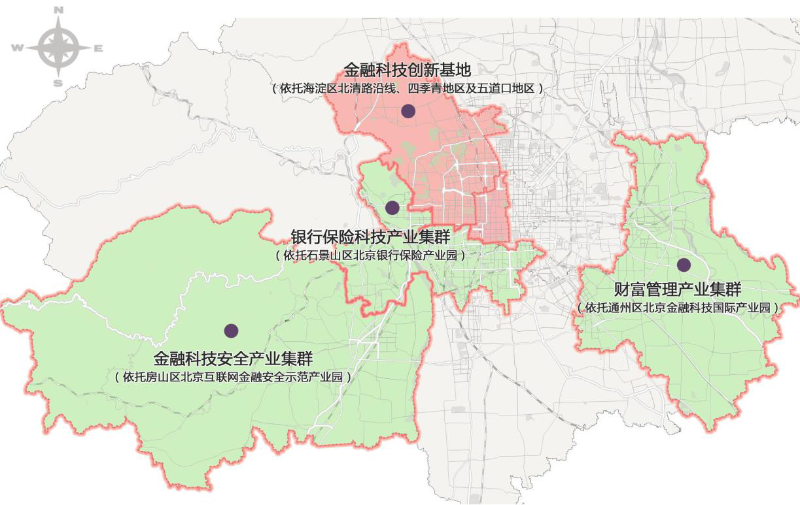

(二)多點支撐:打造各具特色的金融科技創新與産業集群

(ii) Multi-purpose support: building clusters of innovative and innovative financial technologies

1.金融科技底層技術創新集群。依託海澱區北清路沿線區域、四季青地區及五道口地區豐富的科技、智力、金融要素資源,重點發展金融科技底層技術,吸引持牌金融機構金融科技專業子公司、網際網路企業金融科技子公司聚集,建設金融科技協同創新平臺、硬科技孵化器、加速器等,重點培育和聚集人工智慧、大數據、雲計算、區塊鏈、生物識別等金融科技底層技術企業。

1. The Financial Science and Technology Sub-Technology Network (FST) is a new cluster of financial technology. It is based on the wealth of technology, intelligence, and financial elements in the North Road Clearing Zone, the Quantities of the Quantities and the Five Passage, focusing on the development of financial science and technology sub-Technology, attracting the financial science and technology professional subsidiaries of licensed financial institutions and the financial science and technology subsidiaries of Internet-based enterprises, building financial science and technology alliances and creating new platforms, hard technology incubators, accelerators, etc., focusing on the development and gathering of technology sub-Technology, big statistics, cloud computing, sector chains, bio-awareness, etc.

2.銀行保險科技産業集群。加快建設石景山區北京銀行保險産業園,聚焦産業核心區、輻射區和拓展區,充分發揮示範引領作用,推動創新政策在銀行保險産業園先行先試。積極引導創新型銀行保險業態發展,聚焦銀行保險精準行銷、大數據精算定價、人工智慧核算和管理等領域,吸引銀行保險機構的金融科技子公司,以及為銀行保險機構提供軟體開發、大數據應用、雲計算服務等新技術服務的領軍企業入駐,拓展前沿科技在銀行保險行業的應用與實踐,打造國家級銀行保險産業創新試驗區和銀行保險文化引領區。

2. Bank insurance technology cluster. Speed up the construction of the Beijing Bank Insurance Park in Shizhen Hill, with a focus on core, radiation and outreach areas, and fully demonstrate the role of leading the way by promoting innovative policies that pre-empt the Bank Insurance Park. Accompanies the development of a new banking insurance industry, focusing on such areas as bank insurance accuracy, high-value actuarial valuations, artificial intelligence accounting and management, attracting financial science and technology subsidiaries of bank insurance institutions, and providing new technology services such as software development, big data applications, cloud computing services to bank insurance institutions, expanding the use and implementation of cutting-edge technology in the banking insurance industry, building new pilot zones in national banking insurance companies and leading to bank insurance culture.

3.金融科技安全産業集群。依託房山區北京網際網路金融安全示範産業園,鼓勵金融科技安全核心技術研發,充分發揮科研院所與企業創新互為生態的聚集放大效應,著力佈局金融安全相關網路、晶片、交換系統、數據中心等基礎設施,重點發展合規科技,吸引數據安全、網路安全、資訊安全、系統安全等方向的金融科技企業集聚發展,打造新安全的産業生態,推動金融科技安全技術在風險防範和金融機構合規領域的應用。規劃建設金融科技小鎮,搭建智慧金融監管科技平臺,重點發展人工智慧驅動的反欺詐、反洗錢業務,金融交易與經營狀況的合規排查,監管數據與企業上報數據的可信共用計算,數字金融資産登記合規系統,監管規則的數據與標準化,以及個人與企業徵信穿透交叉系統等業態,打造集産城人文為一體融合發展的新型城鎮綜合體。

3. Financial and technological safety clusters. Based on the Beijing Internet security demonstration park in the housing sector, which encourages the development of new and secure financial and technological safety cores, the full scale-up of the convergence of research institutes and business innovations, the development of financial security-related networks, crystals, exchange systems, data centres, etc., and the development of appropriate technologies to attract data security, network security, information security, system security, etc., and the development of new and innovative financial and technological safety technologies, the development of new and innovative technology and innovation technologies, the development of financial and technological safety technologies, the creation of financial and technological infrastructure, the development of smart financial security networks, crystallization, exchange systems, data and technology, the development of smart-driven anti-fraud, anti-money laundering, financial transactions and business systems, the development of new rules and procedures, the development of credible statistics sharing in statistics and corporate statistics, the introduction of financial and technological safety techniques in risk prevention and the use of financial institutions.

4.財富管理産業集群。依託通州區北京金融科技國際産業園,營造更加開放的投資環境,構建科技、金融等機構有機統一、互動發展,先進資訊技術産業和高效金融資本流動相輔相成的金融科技生態圈,鼓勵金融機構拓展金融增值服務,在投資者分析、資産配置、風險計量方面加強研發創新,推進智慧投顧、智慧投研平臺的規範發展,吸引集聚一批資産管理、基金、信託、投資等財富管理類機構。

4. Finance management cluster. Building a more open investment environment based on the Beijing International Finance Science and Technology Park in the state, building a coherent and interactive development of institutions such as science and technology, advanced information technology and efficient financial capital flows, encouraging financial institutions to expand their financial value-added services, and developing innovative and innovative investments in investor analysis, capital allocation and risk measures, and promoting the development of intellectual investment, intellectual investment and investment platforms to attract a pool of financial management institutions, such as capital management, funds, trust, investment, etc.

七、開展金融科技制度創新,保障金融科技産業健康發展

堅持技術創新與制度創新雙輪驅動,積極優化金融科技創新與發展的制度環境,努力彰顯北京金融科技創新的安全示範效應,把握金融科技創新的發展路徑,優化金融科技創新的數據資訊“生産要素”,為金融科技創新的國際化互動合作創造條件。

In keeping with the technological innovation and institutional innovation two-wheel drive, promoting a favourable environment for the creation and development of financial technology, trying to highlight the new safety demonstration of financial science and technology in Beijing, taking advantage of the new development path of financial science and technology, and improving the “Big Elements” of financial science and technology in digital information, creating conditions for new internationalized and interactive cooperation in financial science and technology.

(一)推動監管創新與風險防範體系構建

(i) Promotion of the development of a new and risk-resistant system of supervision and management

打造多層次金融科技風險防範體系。堅持一切金融活動持牌經營的原則,依法依規將各類金融科技活動納入監管。深入研究金融科技活動可能帶來的潛在風險,有效識別和防範技術自身的風險,以及對系統性和非系統性金融風險的影響。加強與金融監管部門對接,引導金融科技創新示範應用,加強跨行業、跨市場交叉性金融産品的監管。建立風險預警、防範和處理機制,不斷完善應急預案,提升應急響應水準。統籌推動金融安全與網路資訊安全建設,推進包括法律約束、行政監管、行業自律、機構內控、社會監督五位一體的多層次金融科技風險防範體系。

Increased interaction with the financial regulatory department to guide the application of innovative financial science and technology models and to strengthen the supervision of cross-practice, cross-market and cross-border financial instruments. The establishment of risk alerts, precautionary measures, and coping mechanisms to improve emergency preparedness and improve emergency response standards.

探索推動以“監管沙盒”為核心的金融科技監管創新試點落地。全面推動金融科技應用於金融安全與風險防範,鼓勵科技企業面向金融安全增加技術研發投入,支援其為監管部門、各級政府、金融機構提供風險管理解決方案。積極爭取監管部門監管科技相關政策試點。推動在北京金融科技與專業服務創新示範區探索“監管沙盒”試點和“金融風險管理實驗區”,吸引監管機構、地方政府、技術企業、高校與研究機構、行業組織等參與,有效探索金融科技的安全邊界與創新路徑。積極推動新技術應用於監管活動的全流程,緩解現有監管工作中的資源約束,助力監管效率與效益提升;支援金融機構合規科技的發展,推動風險管理的行業基礎設施建設;依託新技術推動風險管理類産品創新,滿足企業和居民的需求。

To promote new opportunities for financial technology management, with sandboxing as its core. To promote financial science and technology applications for financial security and risk prevention, to encourage science and technology enterprises to invest in financial security, and to support them in providing risk management solutions for regulatory departments, governments, financial institutions, etc.

(二)促進金融科技標準化建設

(ii) Promotion of financial technology standards and infrastructure

推動金融科技標準化建設。啟動北京金融科技標準化工程,圍繞國家金融業標準化體系建設總體思路,支援相關行業協會、産業聯盟和專業機構打造專業化金融標準服務平臺,開展金融科技核心標準研究探索,積極推動金融科技業務與産品的標準化建設,以團體標準和企業標準為重點,創新標準服務模式提升服務品質,努力形成一批有影響力的金融科技行業核心標準,在風險較大領域探索制定強制性標準。爭取優先推出北京金融科技創新應用指引,用於衡量重要金融場景的技術應用可行性,更好地評價金融機構技術服務外包效果,促進金融科技創新場景的落地。

Initiation of the financial technology benchmarking project in Beijing, around the idea of creating a central body of financial industry standards in the country’s financial industry, support for the creation of a professional financial standards service platform by relevant industry associations, coalitions of industry and professional institutions, the launching of a core financial technology standards research programme, the promotion of the financial science and technology industry and quality standards architecture, with a focus on group standards and corporate standards, the creation of a new standard service model to upgrade the quality of services, the development of a core set of influential financial science and technology industry standards, and the development of strong standards in risk-oriented areas.

(三)構建資訊數據治理與價值發掘機制

(iii) Development of information data governance and value extraction schemes

構建資訊數據治理體系。夯實金融科技創新的生産要素基礎,支援金融科技企業對數量巨大、來源分散、格式多樣的數據進行採集、存儲和關聯分析,為精準開展金融業務、加強風險防控提供支撐。完善大數據發展協調機制,加強數據治理與個人資訊安全維護,推進數據産業協同規劃、基礎設施建設、數據標準規範體系、數據共用機制建設等制度體系建設。建設北京大數據合作發展生態圈,推動合法使用數據,促進大數據整合,構建各方參與並受益的數據交換與信任機制。

To support financial technology enterprises in collecting, storing, and analysing data in a variety of formats, and to provide support for the development of accurate financial services, risk prevention and management. To improve large-scale data development agreements, enhance data governance and personal information security, and promote systems such as data management agreements, infrastructure implementation, data standard specifications, data sharing systems, etc.

完善價值發掘機制,重點構建資訊數據運用的共贏模式。在數據的採集、存儲方面,既堅持企業、居民資訊保護原則,又致力於打通數據資訊割裂,增強數據整合能力,促進數據資源開發。進一步推動北京公共數據系統建設,重點支援企業數據的統籌共用,配合金融數據、業務數據的完善,有效支援企業信用體系建設。推動居民數據的合法有效運用,優化數據生産與消費的産業鏈。合理支援新型數據資訊服務産業,區分徵信與數據服務的邊界,為社會信用體系建設和商業活動拓展創造條件。

In terms of data collection and storage, both business and residential information protection principles are maintained, and efforts are made to sever data, increase data integration capabilities, and promote the development of data sources. Further work is being done on public data systems in Beijing, focusing on supporting the sharing of business data, together with improved financial and business data, and effectively supporting the establishment of corporate credit systems.

(四)搭建金融科技國際交流與合作機制

(iv) Establishment of mechanisms for international exchange and cooperation in financial science and technology

建立全方位的金融科技國際交流渠道。推動金融科技底層技術研發的國際交流,促進金融科技與資本的國際化融合。鼓勵全球知名金融科技企業和服務平臺在京設立各類分支機構和創新平臺,促進外資金融機構、科技企業與國內相關機構開展業務交流。鼓勵國內金融科技企業開展國際化業務探索,有效服務於跨境金融領域的科技創新需求,在海外積極拓展市場,佈局離岸創新平臺與孵化器,努力爭取業務場景落地。支援相關機構參與、引領國際金融科技標準化工作,推動金融科技標準建設國際化,在全球金融科技競爭中提升話語權。

To encourage financial science and technology enterprises in the country to open up international research, effectively serve the new demand for technology in the cross-border financial field, set up new branches and incubators in high-level overseas markets, and strive to find a place for business. To support the involvement of financial institutions, lead international efforts to standardize financial technology, promote internationalization of financial science and technology standards, and promote language rights in global financial science and technology competitions.

全面豐富金融科技國際合作模式。建立北京市與紐約、倫敦、巴黎、法蘭克福、新加坡、東京等國際金融中心城市在金融科技領域的交流磋商機制,建設北京-巴黎創新中心,打造促進城市間合作創新的空間載體。支援舉辦北京金融科技全球峰會,同時面向全球舉辦金融科技前沿技術創新大賽,積極鼓勵創新創業活動。發佈北京金融科技發展報告,面向海外展示北京金融科技創新的成果與模式。依託具有國際影響力的智庫機構研究推出北京金融科技中心創新評價指數,對全球主要城市的金融科技核心競爭力進行評估,努力掌握國際話語權。

To support the Beijing Global Summit on Financial Science and Technology, a global competition for financial science and technology has been launched to encourage innovative initiatives. A Beijing financial science and technology development report has been launched to demonstrate the new achievements and models of financial science and technology in Beijing abroad.

八、加強重點政策支援,營造良好創新環境

8 with enhanced focus on policy support to create good creative environments

統籌協調全市金融和科技創新資源,建立涵蓋金融科技發展各個關鍵環節的綜合政策支援服務體系,並在中關村開展先行先試。

The project is aimed at bringing together financial and technological innovation across the city, creating a system of policy support services covering key aspects of the development of financial technology, and launching a pilot project in Nakamura.

(一)支援金融科技研發、産業化和重大示範應用

(i) Support for financial science and technology development, privatization and demonstration applications

支援金融科技底層關鍵技術研發、知識産權和標準創制。支援企業為主體開展底層關鍵技術、前沿技術研發,聯合産業聯盟、行業協會創制行業技術標準、知識産權和專利,推進重大前沿原創技術成果轉化和産業化,打造金融科技前沿創新高地。

Support for the development of key technologies, knowledge rights and standards at the bottom of financial technology. Support for the development of bottom technologies, forward technological development, and the creation of technical standards, intellectual rights and know-how by the Alliance of Industries, the Association for the Creation of Business Associations, the transformation and privatization of major front-line technologies, and the creation of new high-rises in financial science and technology.

鼓勵面向金融服務、金融監管、城市管理等領域開展重大項目示範應用,對金融科技關鍵核心技術研發和重點示範應用項目加大支援力度。研究設立北京金融科技創新獎勵機制,全面推動金融科技應用場景的建設與完善,加快場景試驗與推廣。

To encourage the development of major pilot projects in such areas as financial services, financial supervision, and urban governance, and to increase support for core technology development and priority demonstration projects on financial science and technology. A new incentive system for financial science and technology creation in Beijing is being developed to promote the development and improvement of financial science and technology applications across the board, and to speed up the testing and promotion of the scene.

(二)支援金融科技基礎設施和服務平臺建設

(ii) Support for financial science and technology infrastructure and service platform construction

結合金融科技發展趨勢,統籌社會資源,支援企業、金融機構、中介機構等創新主體圍繞金融科技關鍵環節,建設信用資訊、數據交易、金融資産交易、融資資訊對接、行業預警監控等基礎設施,完善金融科技應用環境。鼓勵依託企業、高校、科研院所等機構搭建共性技術、協同創新、公共服務等各類金融科技服務平臺,提供技術研發、創業孵化、標準創制、成果轉化、檢測認證等服務,結合服務績效給予基礎設施建設和服務平臺運營經費補助。

To complement the development of financial technology, to mobilize social resources, to support innovative players such as businesses, financial institutions, intermediaries, etc., around key financial science and technology issues, to set up infrastructure such as credit information, data trading, financial transactions, information exchange, banking surveillance, and financial science and technology applications, and to improve the financial science and technology environment. To encourage companies, universities, research institutes, etc., to build common technology, to co-operate with innovation, public services, etc., and to provide services such as technology research and development, business incubatoring, benchmarking, product conversion, testing and certification.

(三)支援金融科技高端人才引進和培養

(iii) Support for the development and development of high-quality people in finance and technology

在海聚工程、高聚工程、北京學者等人才計劃中,加大對金融科技人才的吸引、培育和支援。強化北京“人才友好型城市”的形象。研究設立政府與企業、科研院所、大學1:1齣資的配套支援資金,鼓勵其引進國內外金融科技領域頂尖人才,引導優秀人才服務北京金融科技發展。重點針對相關金融機構、科技企業的高級管理人員和核心業務骨幹,以及科研機構和組織的學術帶頭人,完善金融科技人才的認定和評價標準,構建人才的持續評價機制,圍繞獎勵優惠、戶籍辦理、子女入學、醫療保障、人才公寓等方面制定便利化支援政策。支援市場化培訓機構開展金融科技人才培訓。

In China, China, China, China, China, China, China, and China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, China, the Philippines, China, China, the Philippines, the United Kingdom, the United Kingdom of Great Britain and Northern Ireland, the United States of America, the United Kingdom of Great Britain and Northern Ireland, the United States of America, the United Kingdom of Great Britain and Northern Ireland, the United States of America, the United States of America, the United States of America, the United States of America, the United States of America, the United States of America, the United States of America, and the United States of America.

(四)建立完善多渠道融資服務體系

(iv) Establishment of a well-developed system of multi-channel financing services

發揮北京市科技創新基金引導作用,與相關區、投資機構、領軍企業等合作設立金融科技産業投資基金,聯合社會資本投資擁有自主知識産權或關鍵核心技術的初創型金融科技企業,促進科技成果轉化和産業化。對聚焦投資金融科技企業的優質投資機構(基金)加快登記註冊,按照其實際投資額的一定比例給予風險補貼,引導投資機構開展早期投資和價值投資。支援各區建設金融科技創投産業園或特色小鎮,吸引全球金融科技創新成果落地轉化。

In collaboration with relevant communities, investment institutions, military enterprises, etc., a financial investment fund has been set up to combine capital investment in innovative financial technologies with autonomous knowledge rights or critical core technologies, and to promote the transformation and diversification of technology outcomes. The capital investment facility (the Fund) that focuses on investing in financial science and technology has stepped up its registration process, providing incentives to invest in a proportion of its investments, and directing investment institutions to invest in early investment and value investments.

引導銀行擔保機構根據金融科技企業特點研發有針對性的科技信貸産品和服務。完善企業改制、掛牌、上市聯動培育機制,支援金融科技企業利用多層次資本市場做強做大,通過橫向和縱向並購整合資源。

To guide banks to develop science and technology-based products and services based on the special features of financial and technological enterprises. To improve business transformations, listings, listings, and marketing schemes, to support financial and technological enterprises in making use of multi-layered sub-prime markets and integrating resources across and across the world.

(五)強化金融科技消費者教育與保護機制

(v) Strengthening the education and protection mechanisms of financial and technological consumers

加強金融科技領域的知識普及教育,使金融科技消費者充分了解金融科技産品與服務的特點與風險,同時提升對新技術的包容性、認同感、接受感,積極而理性擁抱金融創新。

Increased awareness of financial science and technology is universal, making financial science and technology consumers fully aware of the special features and risks of financial technology and services, and at the same time increasing the inclusiveness, sense of acceptance and acceptance of new technologies, as well as an active and rational embrace of financial innovation.

努力探索構建地方層面的金融科技消費者保護機制,根據不同類型消費者的特徵,依託技術創新,完善相關制度規則,建立監管部門、行業組織、領軍企業等多方配合的保護模式。針對金融科技應用産生的大量數據,加強對個人數據流通的隱私風險進行評估,探索通過立法等方式推進市級層面個人數據隱私保護工作,平衡好個人數據合理使用與隱私保護的關係,確保個人數據處理和服務符合數據隱私保護要求。

Efforts have been made to explore mechanisms for the protection of financial and technological consumers at the local level, by creating new technologies based on the characteristics of different types of consumers, improving the rules of the relevant system, and establishing a model of coordinated protection for regulatory departments, business organizations, military enterprises, and so on. Consider the large amounts of data available for financial and technological applications, strengthen the assessment of the risks of personal privacy in the flow of personal data, and explore legislative and other ways to move into personal data privacy protection at the municipal level, balance the rational use of personal data with privacy protection, and ensure that individual data processing and services comply with data privacy protection requirements.

(六)建立重點金融科技企業協調服務機制

(vi) Establishment of a financial science and technology industry coordination system

實施北京金融科技領軍企業計劃,支援新一代金融科技底層技術企業發展,鼓勵金融科技服務輸出。培育金融科技領域的高成長初創企業,給予相應的扶持與保障政策。探索建立金融科技企業持續跟蹤評估機制,促進企業可持續健康發展。

To support the development of a new generation of financial and technological sub-level technology enterprises, and to encourage financial and technological services to come out. To foster financial and technological excellence, and to provide appropriate support and security policies. To explore the establishment of a continuous tracking and evaluation mechanism for financial and technological enterprises, and to promote sustainable growth in their health.