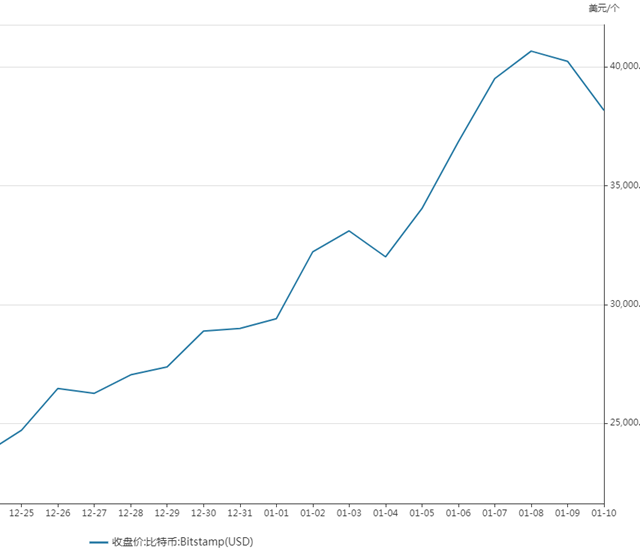

截至北京时间1月11日14点15分,一枚比特币的价格报34150美元(约合22.11万元人民币),相较于2020年3月疫情下的3800美元低位暴力上涨近8倍,令圈内人都感到魔幻。

As at 14.15 p.m. Beijing time on 11 January, a bitcoin price of $341.5 million (approximately 22.11 million yuan), nearly eight times higher than the low level of violence of $3,800 under the March 2020 epidemic, had made the circle magical.

此前一天,比特币一度触及40700美元。币圈人并不讳言称此为一场“巨型泡沫”,更不介意自称“赌徒”,剧烈的波动也时常令他们难以入眠,这背后也是一个个考验人性的故事。

The day before, Bitcoin touched $40,700. The currency circle does not pretend to call it a “big bubble”, let alone a gambler, and it is often difficult for them to sleep because of extreme volatility, which is also a test of humanity.

“我在2019年上半年订了50台矿机,托管在四川矿场,7月开始正式挖矿。当时比特币恰逢2018年大崩盘后的复苏期,币价大概在10000美元。但谁知2020年3月的暴跌直接导致我的资产缩水2/3,感觉对人生都绝望了——不但币在跌价,每个月还要倒贴近5万~6万元(人民币,下同)的电费,要是再碰到矿场停电,就等于不赚钱还赔电费,最惨的时候银行卡里一度只剩下1.8万元。”比特币矿工小古(化名)在接受第一财经记者采访时表示。

“I booked 50 mine machines in the first half of 2019, hosting the Sichuan mine, and began official mining in July, when Bitcoin was recovering from the 2018 collapse, at about $10,000. But who knew that the fall of March 2020 had directly caused me to shrink 2/3 of my assets, feeling desperate for life – not only that the currency was falling, but that the electricity bill would be close to $50,000 to $60,000 a month, and that if I hit the mine again, it would be like not making money and paying for it, at worst, leaving only $18,000 left in Bank Kari.

在极大的精神压力下,小古在2020年3月的3800美元低位选择了“割肉”(抛售挖矿所得的比特币),为了养家甚至换了一份工作。但在同年5月,他再度入场(当时币价约6000美元),直到今天。

Under severe stress, Koko chose “meat-cutting” at a low of $3,800 in March 2020 (the bitcoin from the mining) and even changed his job in order to support his family. But in May of the same year, he re-entered (at about $6,000) until today.

小古算了一笔账:刨去每个月固定的电费,这一轮50台矿机每个月为他赚得超10万元的收益。

Koo-goo made a payment of more than $100,000 a month for a round of 50 miners that took out the fixed monthly electricity bill.

目前,币圈的情绪仍然高昂,但这场“巨型泡沫”何时破灭也成了萦绕每个人心头的疑问。对于经历过巨震的小古而言,他坚定地选择定期、及时变现,落袋为安。

At present, the mood in the currency circle is still high, but the question of when this “big bubble” will break is also a question that haunts everyone. For a small ancient experience of a giant earthquake, he is determined to make it happen regularly and in a timely fashion.

50台矿机不怕币跌就怕停电

50 miners are afraid of losing power without fear of currency falling

除了大家熟知的比特币投资家或炒家,还有一个庞大但偏小众的群体就是“矿工”。比特币生产需要发挥计算机的算力,且极为耗电,这对于水电站而言是一笔巨大的财富机会。

In addition to the well-known Bitcoin investors or snobbers, there is a large but small group of “miners”. Bitcoin production requires computer computing and extremely power-intensive power, which is a huge wealth opportunity for hydroelectric plants.

在火爆行情的带动下,矿工的挖矿收益随之攀升,进而推动矿机需求激增,各大采矿公司纷纷加购高算力矿机,希望能够趁当前币价处于高位且挖矿难度增加的背景下,通过提高算力来获得更稳定的挖矿收益。

Driven by the fires, the miner's mining revenues have increased, contributing to a surge in the demand for mine machines, and major mining companies have been buying high-calculus machines in the hope of achieving more stable mining returns by increasing their capacity in the current context of high currency prices and increasing the difficulty of mining.

2019年,比特币迎来了十周岁的生日。也就在这一年,小古加入了矿工的行列。

In 2019, Bitcoin celebrated his tenth birthday.

回顾2018年,比特币从17157美元/枚跌至最低3733美元/枚,跌幅逼近80%,遭遇史上最大崩盘。随着挖矿成本超过彼时的比特币交易价格,有专业人士判定,比特币正陷入“死亡螺旋”,而作为底层技术的区块链技术仍面临发展瓶颈。整个2019年可以说是比特币在暴跌后慢慢“回血”的一年。小古进场时,比特币大约反弹至10000美元的水平。

In 2018, Bitcoin fell from $17157/me to a minimum of $3733/me, falling close to 80%, the largest collapse in history. As mining costs exceeded the price of the bitcoin at the time, it was determined by professionals that Bitcoin was falling into a “death spiral” and that block chain technology as a bottom technology was still facing development bottlenecks.

“2019年初我亲自去看了四川矿场,当时币圈大哥说‘现在买币、买矿机都很赚钱’,于是我就订购了50台矿机,矿机厂家比特大陆的S-19蚂蚁矿机当时成本约在1万元一台。一般矿机都托管在矿场里,不可能在家挖,不但太费电而且还有噪音。”他称。

“I went to Sichuan mine myself in early 2019, when the big brother of the ring said, ‘Now it's money for money, for machines,’ so I ordered 50 mine machines, and the miner’s S-19 ant miner on the continent of Bit was at a cost of about $10,000. It's usually held in the mine, it's impossible to dig at home, it's expensive and it's noise.” He said.

当时,四川省已成为全球比特币“挖矿”资本最聚集的地方,而电费成本是最主要的考量。出于节省铺设线路成本以及用电便利性方面的考虑,比特币“矿场”大多直接建在水电站内部。四川等地的水电资源非常丰富,丰水期电力更是富余。“矿场”主要选择在四川大渡河,据说世界每挖出100枚比特币就有5枚产自这里,电力即决定了算力。

At that time, Sichuan Province had become the largest concentration of the world’s “mining” capital, and the cost of electricity was the most important consideration. By saving the cost of laying lines and the ease of using electricity, Bitcoin “mines” were mostly built directly within hydroelectric plants.

比起直接买币的风险,过去几年挖矿是一个获利颇丰的赚钱方法。不少区块链技术企业早年是以挖矿发家,大部分是团队运作。简单来说,当用户发布交易后,需要有人确认交易,写到区块链中,形成新的区块。在一个去中心化、互相不信任的系统中,比特币网络采用了挖矿的方式来解决上述问题——中心化记账的权力分享给所有愿意记账的人,通过协助生成新区块来获取一定量新增的比特币。“挖矿”是计算机哈希(Hash)随机碰撞的过程,猜中了,就得到了比特币,而这一运算过程则由矿机完成。

In contrast to the risk of direct currency purchases, mining has been a lucrative way of earning money in the past few years. Many block-chain technology firms have operated in the early years as miners, mostly as teams. Simply put, when a user issues a transaction, someone needs to confirm the transaction, write it into the block chain, and form a new block. In a decentralized and trusting system, the Bitcoin network uses the same method of digging to solve the problem — centralization of accounts is shared with all who want to account for it, and by helping to generate new blocks to obtain a certain amount of bitcoins.

小古刚入挖矿这行时,矿工们的财富来源于每10分钟左右生成一个不超过1MB大小的区块(记录了这10分钟内发生的验证过的交易内容),串联到最长的链尾部,每个区块的成功提交者可得到系统12.5个比特币的奖励。

At the time of Siu Gu's entry into the mining industry, the miners'wealth was derived from the generation of a block of less than 1 MB size every 10 minutes (recording the proven transactions that had occurred in those 10 minutes), bound to the longest end of the chain, with successful submission of each block being rewarded by 12.5 bitcoins of the system.

“一个月50台矿机大概要花4万~5万元的电费(按照0.32元/度的恒定电价),2019年基本每个月都有几万元的稳定收入,”小古称,“其实矿工不太怕币价跌或波动,只要能持续挖矿就能有收益,最怕就是停电。”

“50 mining machines per month will cost 40,000 to 50,000 yuan (at a constant price of 0.32 yuan/degree) and in 2019 they will have a steady income of tens of thousands per month.” According to Ancient, “in fact, miners are less afraid of falling currency prices or fluctuations, and the most likely is power outages, provided they continue to dig.

每年5月时,四川进入丰水期。对于比特币矿工们来说,这是一个难得的机会。但小古回忆称,每次枯水期转丰水期时,矿场都会停电10天,而这段倒贴电费的日子总是令人倍感煎熬。

In May of each year, Sichuan enters the water-rich period. This is a rare opportunity for bitcoin miners. But ancients recall that every time a drying period turns water-rich, the mines are cut off for 10 days, a time that is always very painful for the price of electricity.

2020过山车行情考验人性

by 2020 to test humanity

但是,“不怕币跌、就怕停电”这句话还是说得太早了。

However, the phrase “not afraid of currency failure, not of power outages” is said too soon.

2020年3月,由于新冠疫情席卷全球引发金融市场巨震,在“美元荒”下,投资者抛售一切资产以换取美元流动性,到最后黄金、比特币也都被抛掉。2020年3月12日傍晚,比特币暴跌近50%,从近1万美元直接最低跌至3800美元,当时甚至有说法认为比特币可能会归零。

In March 2020, as a result of a global financial crisis, investors sold all their assets in exchange for dollar liquidity under the “dollar waste.” In the evening of March 12, 2020, Bitcoins fell by almost 50%, from nearly $10,000 to a direct minimum of $3,800, and there were even claims that Bitcoins could be zero.

“3月时心态一下子崩了,资产缩水了快2/3。挖矿要和矿场签对赌协议,即不管币价多少,都要挖下去。所以在币价跌到3800美元时,算上电费,我每个月要亏掉2万~3万元。”小古称。不胜重负的小古最终还是选择在3月的最低位抛售了比特币,时至今日,小古手机中还保存着当时币价崩盘的那张行情截图。

“In March, the mentality collapsed and the assets shrunk by about two thirds. Mining is about to enter into a deal with the mine, that is, to dig it down no matter how much money it costs. So, when the currency falls to $3,800, I'm gonna lose $20,000 to $30,000 a month.” An antiquary. The weightless antiquities eventually sold bitcoins at their lowest position in March, and today they still have a screenshot of the scenes of the currency collapse.

幸运的是,他在随后两个月比特币反弹至约6000美元时又补了仓。在这之后,比特币就像发了疯似的持续攀升。

Fortunately, he made up the warehouse the next two months when Bitcoin rebounded to about $6,000. After that, Bitcoin continued to climb like a madman.

第一财经记者梳理本轮比特币牛市的重要时间节点后也发现,两个时间节点值得关注——首先是2020年10月中旬,比特币站稳1万美元关口;二是2020年12月中旬,比特币突破2万美元大关,刷新历史新高。

After collating the important time nodes of the current round of Bitcoin, the first financial journalist also found two time nodes to be of concern — first, by mid-October 2020, when Bitcoin stood firm at the 10,000 dollar mark; and secondly, by mid-December 2020, when Bitcoin broke the 20,000 dollar mark, refreshing its history.

在比特币从10月初突破1万美元时,可以观察到市场有机构开始入场的迹象。例如,10月8日,移动支付巨头Square突然宣布向比特币投资5000万美元;10月13日,管理着超过100亿美元资产的资管公司石脊控股集团(StoneRidgeHoldings)透露,该公司购买了1万多枚比特币,价值约1.14亿美元;10月22日,全球最大的跨境支付平台PayPal宣布将允许用户在平台上购买、销售和持有加密货币;10月27日,新加坡最大的商业银行星展银行宣布将提供加密数字货币交易。

For example, on 8 October, the mobile pay giant Square announced a sudden investment of $50 million in Bitcoin; on 13 October, the Stone Ridge Holdings, the capital company that manages more than $10 billion of assets, revealed that it had purchased more than 10,000 bitcoins, valued at approximately $114 million; on 22 October, PayPal, the world’s largest cross-border payment platform, announced that users would be allowed to purchase, sell and hold encrypted currency on the platform; and on 27 October, the largest commercial bank, Star show bank in Singapore, announced that it would provide encrypted digital currency transactions.

不过,经历过崩盘的小古也保守了很多,他表示在1.4万美元和2.7万美元分两次卖掉了手上的比特币。同时,矿工与矿场有两种利润结算方式(月结),一种是定期直接结算扣除电费后的现金,另一种就是拿币并支付电费。小古也自然选择了前者,实时落袋为安。

However, small ancients, which had experienced a collapse, were much more conservative, and he said that they sold the bitcoins in their hands twice at $14,000 and $270 million. At the same time, miners and mines had two ways of settling profits (monthly closings), one of which was to settle cash directly on a regular basis after deducting electricity, the other was to take money and pay electricity.

集体担忧巨型泡沫何时见顶?

随着比特币涨破3万美元,不少矿工和投资者也有了另一个“幸福的烦恼”——提币成了难题。

With the 30,000 dollars in bitcoin, a number of miners and investors also have another “happiness” — a difficult issue.

根据记者了解,早前部分交易平台可以顺利地转账到中国的银行卡或支付宝等,但在监管趋严后,目前主要的交易方式有两种——将比特币等加密货币抛出并换成USDT(泰达币,即挂钩美元的稳定币),或通过OTC(场外交易)来换取人民币等现金。

According to journalists, some of the earlier trading platforms could be successfully transferred to China's bank cards or payment treasures, but, following tighter regulation, there are currently two main modes of dealing — tossing encrypted currencies such as bitcoins and swapping them for USDT (Tedaco, a stable currency tied to the United States dollar) or cash such as renminbi in exchange for OTC (off-site transactions).

但通过OTC的取现之路也并不容易。“某些平台还支持OTC,即卖家在OTC平台挂单卖出比特币,买家通过银行卡或支付宝转账的方式付款,随后卖家将比特币转移到买家的数字货币钱包,但不少账户都会出现频繁被冻结的状况。”小古表示,对于币圈大佬,场外“大宗交易”成了解决取现问题的办法。

“Some platforms also support OTC, where the seller sells Bitcoin on the OTC platform, where the buyer pays for it by way of a bank card or payment of a treasure transfer, and then the seller transfers bitcoin to the buyer’s digital money wallet, but many accounts are often frozen.” Ancient has suggested that “big deal” off-the-shelf is the solution to the problem of taking cash.

常见大宗交易模式和流程包括——确定买卖双方信息、买/卖币总量;价格浮率(包含佣金在内的总浮率),例如卖家总下浮率4%,给到买家2.5%,代理人和中人1.5%,4:2:4分配;提供资产证明(POF),例如买家先给到POF,卖家先给出POC(验币证明,例如转1个BTC到指定钱包);确定能接受的交易模式,常见的交易模式包括银行同台面交、火币OTC、知名担保公司担保交易等。

Common bulk trading patterns and processes include - determination of buyer-solder information, purchase/sale total currency; price fluctuations (total float rate including commissions), such as 4 per cent for sellers, 2.5 per cent for buyers and 1.5 per cent for agents and China, 4:2.4 for distribution; provision of asset certificates (POFs), such as a buyer's first to POFs, and sellers' first to POC (money certification, e.g., transfer of a BTC to a specified wallet); and identification of acceptable trading patterns, common modes, including bank face-to-face exchange, gun currency OTC, secured transactions by prominent guarantee companies.

时至今日,哪怕是顶级币圈大佬也感叹——比特币就是一个巨型泡沫,但流动性持续释放、通胀预期盘整,泡沫何时破灭谁都说不好。

To this day, even the top-coin conglomerates are astonished — bitcoin is a giant bubble, but it is not easy to say when the bubble will burst, as liquidity continues to release, inflation is expected.

“现在看到币圈群说过年准备去三亚包游艇庆功,”小古称,“目前会持续挖矿,但不会再投机比特币,及时提现,回归A股可能还是更让人踏实的选择。”

“Now seeing the currency circles say they're going to go to the Triabaku yacht to celebrate the year,” he says, “there will be no more mining, but there will be no more speculation on bitcoin, no more withdrawals in time, and return to A's may be a more elaborate option”.

稍早前,第一财经报道,比特币已成为负利率环境下的“博傻游戏”。一方面,受疫情的影响,未来一年里全球经济复苏减缓;另一方面,欧美央行推出极度宽松的货币政策推高金融市场的通胀预期。渣打此前提及,美、欧、日央行的资产负债表总规模已超22万亿美元,我们正在目睹二战以来最大规模的全球财政扩张。但这种扩表的态势或许要持续到2022年,因为债务负担过重,利率维持低位才不至于导致政府财政问题。

Earlier, the first financial report reported that Bitcoin had become a “breathing game” in a negative-interest-rate environment. On the one hand, the global recovery slowed in the coming year as a result of the epidemic; on the other hand, the European and United States central banks pushed inflation expectations in financial markets up with extremely liberal monetary policies.

“投资者开始担心,央行无节制地印钞是否会出现大规模的通胀风险,所以大家对法币的信心有所下降,自然会去寻求另类资产,包括比特币等,但我们并不认为比特币是一种资产类别,它更像是一种通缩商品。”全球公募巨头先锋领航投资策略及研究部亚太区首席经济学家王黔对记者表示。在比特币的区块链系统中,每产生210000个区块后,比特币就会经历一次名叫“减半”的过程,同时矿工们的区块奖励也会减半。比特币的总发行量上限为2100万枚。

“The investors are beginning to worry about whether central banks are running large-scale inflation risks by printing their banknotes, so confidence in the French currency has declined and will naturally seek alternative assets, including bitcoin, but we do not believe that bitcoin is an asset class, more like a deflationary commodity.” The chief economist of Asia-Pacific in the Global Public Fund-raising Pioneer Investment Strategy and Research Department, Wang Xiao, said to journalists. In Bitcoin’s sector chain system, with each 210,000 blocks generated, Bitcoin will experience a process called “half” and miners’ block incentives will be halved.

尽管如此,风险也在随着价格的暴涨而攀升。OKExResearch首席研究员威廉此前对记者表示,机构投资者在乎的是利润,而非“比特币信仰”或“区块链革命”这类情怀。在疫苗上市、疫情逐渐缓解后,随着经济的逐渐复苏,货币政策也将逐渐由宽松转为适度紧缩。届时,机构投资者很可能会抛售比特币;同时,随着币价越来越高,市场的波动也会逐渐放大,投资者加过高的杠杆很容易爆仓。

Even so, the risk will rise as prices soar. William, the top researcher of OKExResearch, previously told reporters that institutional investors cared about profits, not “bitcoin beliefs” or “block chain revolutions.” When the vaccine was introduced, the epidemic eased, and the economy recovered, monetary policy gradually shifted from easing to moderate austerity.

高坠随时可能发生。截至1月11日22:00,比特币已跌至31000美元附近,日内跌幅近20%。

The crash is likely to occur at any moment. By 2200 on 11 January, Bitcoin had fallen close to $31,000, with a fall of nearly 20% in the day.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论