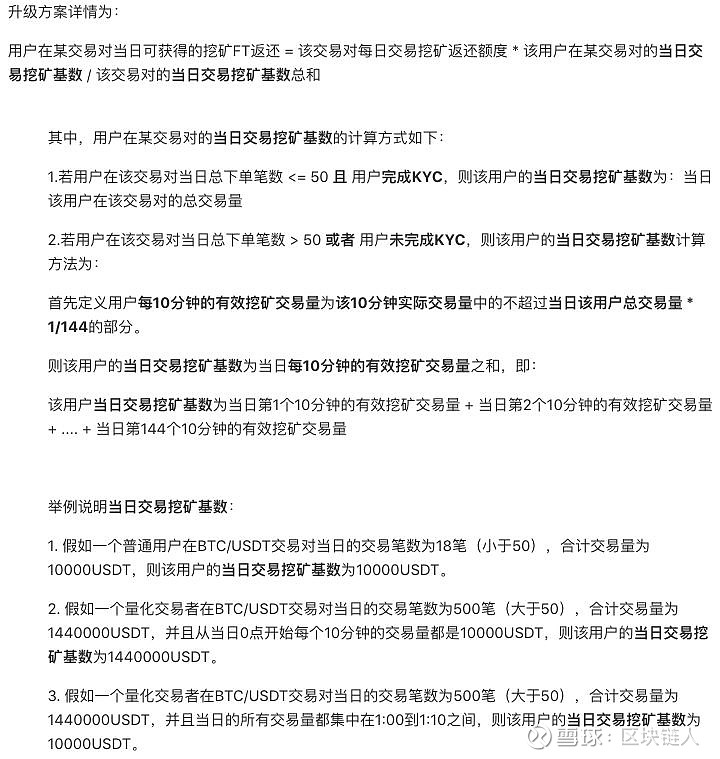

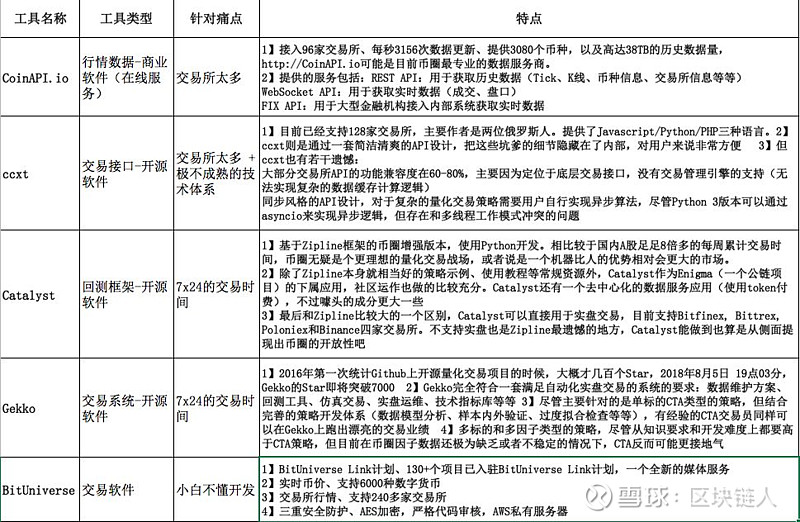

量化交易篇?

Quantified transactions?

简短提示:本文针对的是币圈小白,对比了传统金融量化交易和币圈量化的现状。本文讲目前各交易所量化交易的情况,进场的究竟是散兵游勇还是机构量化?带了点币圈真实的扒卦,还有也会告诉小白做量化交易该怎么做?该去哪儿做?有几条路可以选,各自利弊。并且示范了目前加密货币交易所API导入网格交易的基本步骤。关于量化交易的内容,仅作参考学习,不做投资建议。

Brief reminder: This paper is about the status of the traditional financial quantitative transactions and the monetary circle. This is about the current quantitative transactions of the various exchanges, whether they are in the field of soldiers or agencies. With a bit of genuine gossip about the currency circles, and also about what to do with the quantitative transactions. Where to go? There are a few options that can be chosen, and the advantages and disadvantages of each.

量化投资字面理解,把投资定量,通过一定的数据,在逻辑支撑下,运用各种不同的策略进行具有胜率优势的投资。

Quantitative investment is understood literally and investments are quantified, backed by data and supported by logic, using different strategies to make investments that have the advantage of success.

最重要的是,策略。量化策略就是建什么仓位(买什么),建多少仓位,什么时候建仓,什么时候平仓,按照建立好的策略进行执行。

Most importantly, the strategy. The strategy is to quantify where to build, how many to build, when to build, when to level up, and how to do it according to the strategy that has been established.

如果你问任何一个搜索引擎:“我今天买那个币能挣钱?”

If you ask any search engine, "Can I make money by buying that coin today?"

估计你除了搜到坑韭菜的广告,没有谁能回答你。

Guess you didn't have anyone to answer you except for the ads on the pottery.

但是,量化交易就可以告诉你今天该买什么、什么价位买进或者什么时候卖出?并且在别人睡觉的深夜,市场在出现突然震荡的时候,进行自动交易,替你熬夜获取利润。

But quantitative transactions can tell you what to buy today, what to buy, or when to sell it? And in the middle of someone's sleep, the market deals automatically in the event of a sudden shock, and you spend the night making profit.

听起来很神奇,的确,你可以把历史行情信息、基本面信息、宏观经济形势、新闻资讯等等都输入进量化模型,利用计算机统计学技术分析数据,产生交易信号进行交易决策。现有数据-建立模型,然后交易决策。建模就看八仙过海各自水平了。

It sounds amazing; indeed, you can enter historical information, basic information, macroeconomic situation, news information, and so on into quantitative models, using computer-statistical techniques to analyse data and generate transactional signals for decision-making. Available data -- modeling, then transactional decision-making. Modelling is done at the sea level.

还有一点,对于币圈的群众来说,24小时不设涨跌幅限制的数字资产市场,有些做短线的朋友常年熬夜,不该虚的地方都虚了。时刻盯盘,那酸爽,盯一年身体就垮了,量化交易可以将这部分无意义耗时耗力的工作取代,提前编写好的策略,帮你决定买入时机,帮你控制仓位、何时止盈合适止损都被规定好,交易者无需克服人性的弱点,也不必被打乱节奏,去实现交易。想象下,要你在每隔一分钟小量买入市值前一百的币种,人工可以实现吗?

On the other hand, for the people of the currency circle, the digital asset market, which is not capped by a 24-hour hike, and some short-line friends who stay up all the time, and who shouldn't be in vain. The time-watching, the acid, the year-long body collapses, quantitative transactions can replace this part of the meaningless, time-consuming work, well-prepared strategies to help you decide when to buy, control the position, and when to stop the loss, are all set, and the traders need not overcome their human weaknesses, nor are they required to break the rhythm to make the deal happen. Imagine, if you buy the first 100 coins of the market value every minute, can you do it by hand?

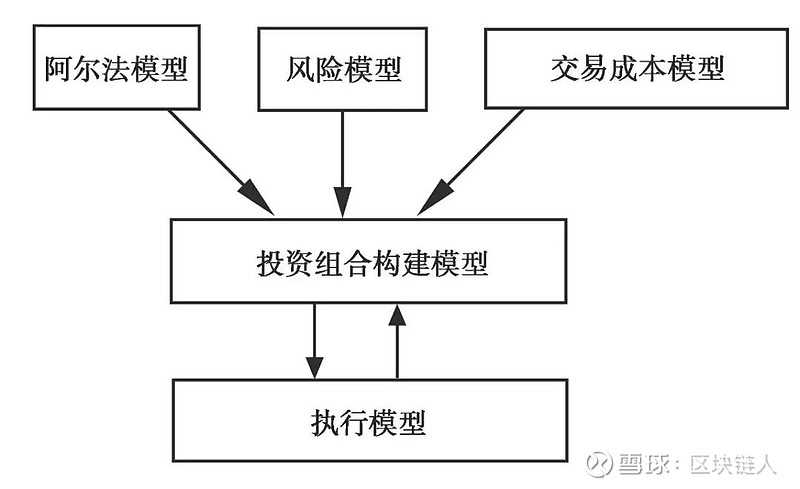

一个量化交易策略的基本结构是这样的:

The basic structure of a quantitative trading strategy is as follows:

简单的翻译下这个模型就是,假如你想挣钱,你先要想的是怎么在一场交易中挣钱,废话?不着急!这个阿尔法模型就是量化交易系统的第一个重要组成部分,为了盈利儿存在!即想要赚钱,先要想的是流入的水,然后,是别跑出去水,也就是风险点和止损。少亏点、多赚点。这就是风险模型部分。

The simple translation of this model is, if you want to make money, what do you think about making money in a deal, bullshit? No hurry. The Alpha model is the first major component of the quantitative trading system. To make money, it's the inflow of water, and then it's the risk point. It's the risk element.

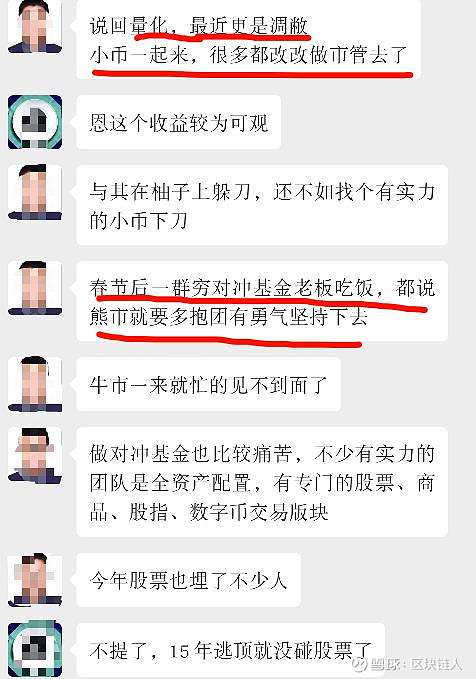

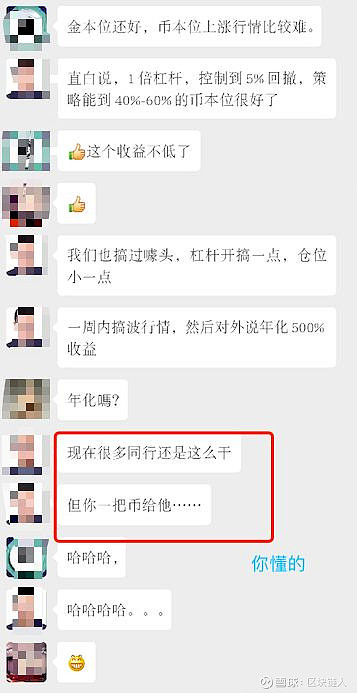

目前币圈已经陆陆续续进来了一些过去做股票市场量化的人,或团队或个人,比如我们那一个币圈的微信名片来举例,包括电报里也有不少代写量化策略的。

The currency circle has now entered into a number of former stock market quantifications, or groups or individuals, such as our micro-mail cards in that currency circle, including a number of proxy numeric strategies in telegrams.

这些人究竟具体是做什么的?为了避免广告嫌疑,我把这个人的信息抹去,就是给大家展示下,当然,找人写量化的风险我们后面会讲。

What exactly are these people doing? In order to avoid advertising suspicion, I'm going to erase this person's information and show it to you, and, of course, to find someone to quantify the risks we'll talk about later.

来继续了解一些基本概念,阿尔法模型是量化交易的重中之重,阿尔法是希腊字母表示盈利能力,也就是说得到的与市场波动无关的回报,必须扣除市场基准回报之后的投资回报率。比如,某币圈量化团队的回报率是80%,但是这波上涨行情是集体上涨的大牛市,大家在市场有个基准回报率是50%,那么个量化团队的阿尔法值就是30。量化交易要分清,究竟是自己牛, 量化策略带来的收益还是单纯的好运气带来的收益。这里有的量化交易者就偷奸耍滑说市场的运气全算做是交易策略的功劳,这也是需要自己去分辨的。因为所有的阿尔法模型,都有局限性。只在一定范围内对未来形势有精确预测效果。

To continue to understand some of the basic concepts, the Alpha model is the top priority of quantitative transactions, and Alpha is the Greek alphabet for profitability, which means that returns that are not related to market fluctuations must be deducted from the return on investment after the market benchmark returns. For example, a currency circle quantitative team has a return of 80%, but this boom is a collective rise in the bull market, with a benchmark return of 50% in the market, so that a quantitative team has an alpha value of 30.

其中,宽客就是制订策略的人。宽客来自于英语 quantum,叫法来源于最早一批从量子物理学家改行到华尔街做数量金融的人。在美国,绝大部分的宽客都是理工科出身,然后投入到金融业。这群人很神秘,因为让别人了解自己会对自己的量化策略被参透吧?宽客的立命根本是独创的“交易策略”,这也导致大家对暴露太多忌讳莫深。好的量化策略就像是武功秘籍,藏的越深知道的人越少越好。他们要观察市场,懂点人类交易心理学,采用市场客观数据研究来论证想法是否正确,为了得到一个满意的策略,他们会将其布置在量化系统中,他们需要排除情绪化的影响,克服人性的弱点,然后进入严格的测试。

In the United States, the vast majority of them are from science and technology, and then into finance. These people are mysterious, because they know that they are going to be involved in their own quantitative strategy. It is an original “trading strategy” that leads to a lot of taboos about exposure. Good quantitative strategies are like martial arts secrets, and the less well-known they are. They have to look at markets, understand human trade psychology, use objective market data studies to justify the correctness of ideas, and, in order to get a satisfactory strategy, they have to put them in the system, and they need to remove emotionalization, overcome human vulnerability, and then go to rigorous testing.

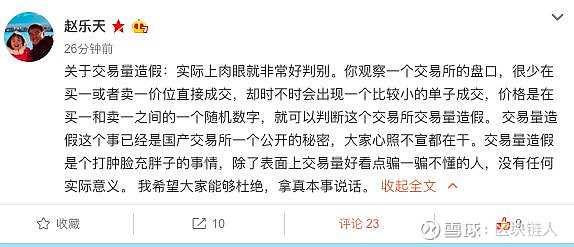

目前公认的加密资产交易所中,量化交易机器人普遍存在,比如交易刷单机器人以及币圈出现了很多自动交易软件、自动高频量化软件机器人。很多交易所的交易量也是机器人刷出来的。

Quantified trading robots are prevalent in currently recognized cryptographic asset exchanges, such as trading single machines and currency circles with a large number of automatic transactional software and automatic high-frequency Quantitative software robots. Many exchanges are also made up of robots.

而区块链量化搬砖套利软件开发,比特币量化策略交易的广告,也随处可见。

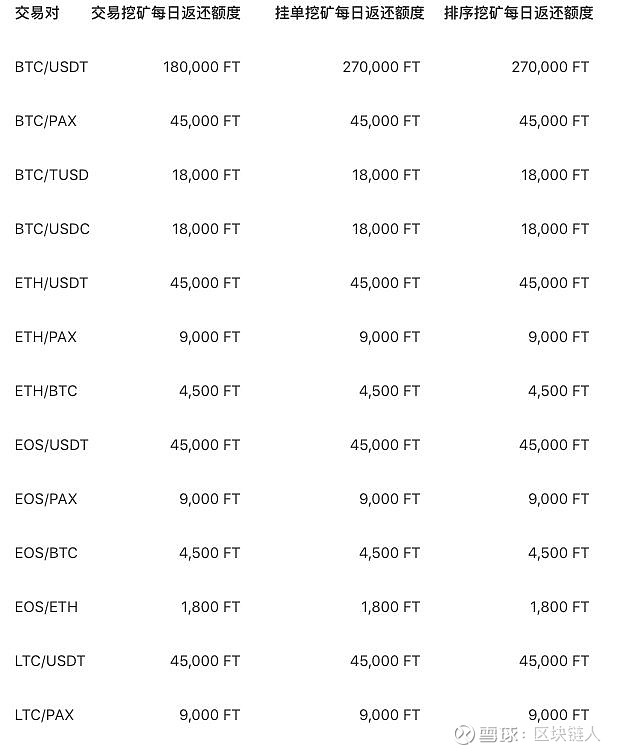

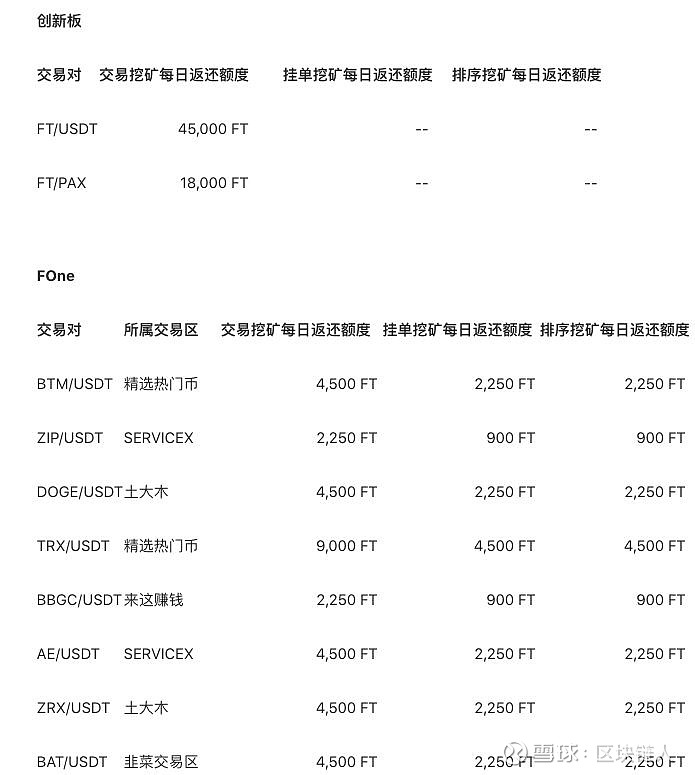

The development of the software 量化交易机器人是一种软件程序,它直接与金融交易所进行交互(通常使用API获取和解释相关信息),并根据市场数据代表您发出买卖订单。这些机器人通过监测市场价格走势,并根据一套预先设定和编程的规则作出反应,从而做出这些决定。通常,一个交易机器人会分析市场行为,例如交易量、订单、价格和时间,它们可以根据您自己的喜好进行编程。 Quantified trading robots are software programs that interact directly with financial transactions (usually API is used to obtain and interpret relevant information) and place purchase and purchase orders on your behalf on the basis of market data. These robots make these decisions by monitoring market price trends and responding to a set of predefined and programmed rules. 因为成本高的原因,传统金融的普通投资者无法使用交易机器人,而区块链的透明性,各交易所往往给予其投资人直接的市场准入,使用户有机会分析交易所的电子订单,这是一种传统上专供投资机构或者金融大户使用的访问权限。 Because of high costs, conventional financial ordinary investors are unable to use tradable robots, while the transparency of the block chain often gives direct market access to their investors by exchanges, giving users the opportunity to analyse the exchange's electronic orders, which are access rights traditionally reserved for investment agencies or large financial players. 其中,交易机器人策略的类型之一 - 就有上面赵东说的刷单,很多交易所或者项目方会通过机器人交易换取巨大的成交量,旨在向用户或者社区展示其巨大的流动性,从而吸引更多的交易所用户或更多潜在投资者进行投资。目前广为诟病,但是也不得不说一定程度上是交易所的刚需,也提供了一定的流动性,复制各大交易所主流币对的买卖深度和K线图,为新用户提供真实交易环境,利用智能机器人策略降低交易风险。要是没有交易机器人,恐怕交易深度是零,画面太尴尬不说,无法吸引交易。但是,虚假的成交量水分太大,也带有极大的欺骗和迷惑性。 One of the types of trade robotic strategy is that, according to Zhao Dong, many exchanges or project parties trade in robotic transactions in exchange for huge transactions designed to show users or communities their huge mobility, thereby attracting more exchange users or more potential investors to invest. There is a high degree of discomfort, but it also has to be said that the exchange needs a certain amount of liquidity, copying the sales depth and K-line maps of the main currency of the major exchange, providing a real trading environment for new users, and using smart robot tactics to reduce transaction risks. 其次,币圈交易机器人策略类型还有套利和做市两种,加密资产交易早期,许多交易员主要通过搬砖套利,在一个交易所低价买入,然后再在另一个交易所高价卖出,从中获利。虽然现在交易所之间的差距小得多,但它们仍然不时出现,交易机器人可以帮助用户最大限度地利用这些差异。此外,套利还可以用于那些希望将期货合约纳入其交易策略的交易员,他们可以通过考虑在不同交易所交易的期货合约,从期货合约与其标的资产之间存在的任何差异中获益。 Second, there are arbitrage and market arbitrage types of robotics for currency trading. Early on, many traders profit from this by moving brick arbitrage, buying it at a low price on one exchange, and then selling it at a higher price on another. 另外,对于有的项目方、小币种来说,交易量太少,或者恰逢熊市大家都不愿意交易,这时市场上就会很冷清,越冷清就越没有人交易,形成恶性循环。有了做市机器人,机器人就可以充当对应的买家或者卖家,在市场上交易盘活交易量。如果市场上没有交易,对投资者和交易所都不是好事,从这一点来说,做市机器人有其存在的价值。但是,有的做市方和项目方联合收割韭菜就是另一回事儿了,与项目方勾结,操控币价,洗劫韭菜,谋取血淋淋的超高收益,目的不纯。工具就是工具,没有邪恶之说,就看用它的人是谁。 In addition, there are projects where the amount of transactions is too small, or when the bear market is not willing to trade, the market is too cold, and the colder it becomes a vicious circle. With a municipal robot, the robot can act as a counter-buyer or seller, trading in the market. It is not good for investors or exchanges to do business. There is value in making a market robot if there is no deal in the market. 很多币圈的朋友特别想了解量化交易,希望能进入这个门槛。实际上,高频量化交易普通的人是可以学习的,注意要先学习,门槛就是编程基础,有一定编程基础,如Python、R语言、C++、Julia,量化交易的经典书籍等等,研究自己的策略。推荐csdn官网去了解一些零起点Python大数据与量化交易、比特币量化高频交易例子程序的帖子学习下。也可以去找找国内量化交易的平台,比如JoinQuant。 A lot of friends in the currency circles especially want to know about quantitative transactions and want to enter this threshold. In fact, HF quantitative transactions are generally accessible to people who learn first, and the threshold is a programming basis, with some programming bases, such as Python, R languages, C++, Julia, classic books on quantitative transactions, and so on, and study their own strategies. 推荐一个量化投资经典学习资料下载:网页链接 It is recommended that a Quantitative Investment Classic learning resource be downloaded: 主要包括以下内容的下载地址? Is there a download address that includes, inter alia, the following? 一、python for 量化? I. python for quantification? 1 像计算机科学家一样思考Python? 1 Think Python like 2 [Python标准库].Doug.Hellmann.扫描版? 2 [Python Standard Library]. Doug. Hellmann. Scanning version? 3《Python科学计算》.(张若愚)? 3 Python Scientific Calculus. 4 用Python做科学计算? 4 Scientific calculations with Python? 5 利用Python进行数据分析? 5 Using Python for data analysis? 6 Python数据分析基础教程:NumPy学习指南(第2版)? 6 Python Basic Curriculum for Data Analysis: NumPy Learning Guide (version 2)? 7 NumPy攻略 7 NumPy Attack 7 Python科学计算与数据分析? 7 Python scientific computing and data analysis? 8 A Practical Guide To Quantitative Portfolio Trading? 9 Data Structures and Algorthms Using Python? 10 Mastering Python for Finance? 二、R for 量化? II. R for Quantification? 1 R语言入门? 1R Introduction? 2 R语言编程艺术? 2R Language Programming Art? 3 R语言实战 中文版? 3R in action. Chinese? 4 使用R进行数据分析与作图? 4 Using R for data analysis and mapping? 5 Introduction.to.R.for.Quantitative.Finance? 6 Quantitative Trading with R Understanding Mathematical and Computational Tools from a Quant’s Perspective? 7 Mastering R for Quantitative Finance? 8 Mastering Predictive Analytics with R? 9 金融数据分析导论:基于R语言? 9 Introduction to Financial Data Analysis: Based on R Language? 等等…... Wait... 当然还有很多量化交易平台在同时竞争,有的说具有精准的回测功能、高速实盘交易接口、易用的API文档、由易入难的策略库,形成自己的量化策略。自己去做相关了解这里不做介绍。 There are, of course, a number of quantitative trading platforms that compete at the same time. Some say they have precise feedback features, high-speed real-disk interfaces, easy-to-use API documents, and easy-to-reach strategies that form their own quantitative strategies. 币圈的量化团队越来越多,小到一两人的组合,大到在大的量化团队也都进来争夺天下。但是,据我所知,有不少前年高调进场,什么华尔街量化大神等等的量化团队,去年甚至出现了公司接近倒闭,公司欠薪,员工还在微信群里讨薪的事件。具体哪家就不说名字了,这位大佬目前还在被各种邀请去参加演讲、圆桌、直播,但实际上,我们看着这家量化团队由盛到衰。可见所谓华尔街量化团队也不好做啊,很少的人能存活下来。活下来的倒是有,活得好的不多,去年一年寒冬,抱团取暖的也有。 But, as far as I know, there have been a lot of high-profile entrys from the previous year, some kind of Wall Street Quantified Gods, and so on, and there have even been company close-downs last year, companies are unpaid, and employees are looking for jobs in the microcombs. No names are given, and the big guy is still being invited to speeches, round tables, and live, but in fact, we see that the Quantified Team has grown up. So far, the Wall Street Quantities have been hard to do, and very few have survived. FCoin的交易挖矿、挂单挖矿,分红型交易,利用最简单的量化交易就可以从中获得不少利润。从而带动了很多相关业务,一些贩卖策略软件的个人或公司,拿着一些已过时或本就谈不上优秀的策略,出售给新手小白们。风险系数也很大,要知道策略被别人知道本身就是非常危险的事情,更别说获利,要知道在华尔街量化基金的投资策略是最高等级的机密,为了保持量化策略不被外泄,掌握策略的量化基金经理们也一直拿着全球最高的年薪。再好的投资策略,也是有时效性的,量化投资可以让你盆满钵满,也可以让你倾家荡产。可以说,量化策略一旦被公开,就基本可以说失效了,所以这也是为什么对于小白来说,随便抓个人给你写量化,或者完全不了解想要做量化,很可能是件危险且失效的事情。 FCoin’s deal digs mines, hangs mines, splits red-type transactions, and earns a lot of profits by using the simplest quantitative transactions. So many of the businesses involved, some individuals or companies involved in trafficking strategy software, carry out some of the best tactics that have become obsolete or could not otherwise be discussed, and sell them to new recruits. The risk factor is too high to know that strategies are known to be very dangerous, let alone profitable, to know that the investment strategy of the Wall Street Quantitative Fund is classified at the highest level, and that the managers of the Quantified Fund, who have the strategy, have the highest annual pay in the world in order to keep the Quantified strategy from being out of business. 我们拿一个不少量化交易大神出入的平台作为例子,从去年开始,fcoin的量化社群每天讨论的问题可谓是让小白们既想靠近又不明觉厉,2019年初的时候身处熊市,大部量化交易者利用市场的波动性,依托网格交易策略套取利益。而交易手续费总是会侵蚀量化者大部分的利益。Fcoin交易平台开启交易挖矿以来,单位时间撮合的交易量、交量额多次出彩,大额吃进或卖出,不像一部分交易所,在Fcoin基本不会产生除了手续费(如果是挂单成交还返手续费)以外的费用。 We take as an example a platform where a lot of quantitative transactions come and goes. Since last year, the quantifiers of the fcoin community have been discussing daily the issue of bringing whites closer and less aware, in early 2019 in Bear City, where most quantitative traders take advantage of market volatility and rely on grid-based trading strategies. 该平台执行挂单成交实时返回手续费的机制,让你可以额外,赚取手续费,每天会根据交易用户指定币种交易量占比瓜分平台币FT。而持有FT又可以获得平台分红,分红都是真金白银的主流币种等等,而这些分红主流币种,你又可以放到理财账户进行利润再生产。这不是重点,我们观察了一年,fcoin的量化交易社群,随着这种平台策略的推出,很多小白也开始关注起来量化,并且开始在社群里形成一种小白入门的讨论。过去,量化这个词,似乎和小散户没有关系,但是现在的确很多小散户开始咨询,python的报班学习,有人正系统的在往这个方向走。这一点算是币圈的一种新现象,也很有趣。 This is not the point, we've been looking at the quantitative trading community of fcoin for a year, and with the launch of this platform strategy, many whites are beginning to focus on quantifying and developing a little white discussion in the community. In the past, the word quantifying seems to have nothing to do with small diasporas, but it is true that many small diasporas are now starting to consult, and python’s journalism is going in this direction, and it is also interesting that some people are systematically moving in this direction. 说说币圈早期量化历史以及业内小结: This is the first time that a currency ring has been quantified in its history and in-house closure: 在2013年前后,一开始许多交易所没有api 直接写外挂,可以增加交易所开发api增加交易。也会很不稳定,程序后来才相对稳定,有一波早期做量化的能平均做到每天百分之三的收益。2013年年底的时候政策原因,暴跌,程序就出错,被迫持仓,平均价格四五千元,然后很多人发现程序没有控制好风险。OKCoin和火币从那之后,交易量下降很多,开始做期货产品,整个市场开始丰富起来,除了统计套利之外,也可以现货期货交易。写程序主要用Python写,用统计软件作分析。 At the beginning of 2013, many exchanges did not have api to write directly, thus increasing the exchange’s ability to develop api to increase transactions. It was also unstable, and the process was then relatively stable, with a wave of early quantification that would yield an average of 3% per day. By the end of 2013, the policy reasons fell, the procedure went wrong, the price was forced to hold the warehouse at an average price of $45,000, and many found that the process had not controlled the risk. 最早对量化的原始需求是出自于对冲,早期投资人把比特币和比特币现金作为1:1比例的配置。不会有风险。 The original demand for quantification was derived from a hedge, and the early investor used Bitcoin and Bitcoin cash as a 1:1 ratio. There was no risk. 另外,量化交易回撤,当亏钱的时候,通常比较好的策略,回撤低于百分之五到十,风险和收益的平衡。一般情况下,分析市场,通过大的流通性,不容易盘的选择,做策略分析,做假设模拟盘,在进行回撤,发现策略不错可以跑过大盘的话,就可以实盘操作。股票市场的回撤是很容易的,回撤系统完备,但是数字货币的回撤很难拿到过去交易的所有数据,需要自己爬虫下来,没人提供所有数据回撤,需要自己写程序,把交易所数据导出来,自己放数据库,回撤自己调接口做回撤。 In addition, quantitative transactions are withdrawn, and when they lose money, they usually have a better strategy, and they are less than 5 to 10% of the balance of risks and benefits. In general, analysis of markets, through large liquidity, not easy choice, strategy analysis, hypothetical simulators, and, in the process of retreating, if it is found that the strategy is good enough to run over the big one, it can be done in real terms. Stock markets are easily withdrawn, systems are complete, but the recovery of digital currencies is difficult to obtain all the data from past transactions, they need to crawl down, nobody has to provide all the data back, they need to write their own programs, they need to lead out the exchange data, they can put their own databases, and they withdraw their own interfaces for evacuation. 经典的方法:阿尔法收益前面讲过,以及风险模型是避免系统性风险,避险的方法。数字货币的策略和传统股票交易对比,有币圈自己的新特点,新的策略有: Classic approach: Alpha's earnings, and risk models are a way to avoid systemic risk and risk avoidance. Digital currency strategies and traditional stock exchange comparisons have their own new features, and new strategies include: 搬砖(交易所价格差)、各种币之间交易套利(币币三角套利等等)需要快速成交,这就需要程序来完成,因为机会稍纵即逝。现在搬砖不容易了,需要在各个市场有资金的充分准备,一般发生在某国家的政策改变。也有些搬砖发生在单个市场网络堵塞,备好现金通道,备好稳定币,等待时机,无法预测,只能随时待命。所以需要用程序来做,人力是无法达到这种能力。多币种的交易套利,成交过程或许发生币价波动,三五个币和五六个币会有套利空间存在, Bricks (bad exchange prices), arbitrage of transactions between currencies (triangular arbitrage, etc.) need to be done quickly, which requires procedures to be done, because opportunities are short-lived. It is not easy to move bricks, which need to be well prepared in each market, usually in a country where policy changes occur. Some of the bricks are blocked in individual market networks, cash corridors are set up, currency stabilizers are ready, waiting for an unpredictable moment, and only on standby. So it needs to be done using procedures, and manpower is unable to achieve this capability. Multi-currency arbitrage, with currency price fluctuations and three or five or six coins in a given country. 币圈对冲的策略: Currency-ring strategy: 选择币种做配置。 Select the currency to be configured. 比如: For example: 比特币vs 比特币现金 Bitcoinvsbitcoincash 以太币 vs 以太经典 Ether vs. Ether Classic 现货和期货买入卖出策略:保证锁定现有收益,比如购买比特币,保证了10万元收益,同样去期货市场卖出同等价值的期货,跌下来了,现货跌了,期货就会获得额外收益,一个月后可以保障收益不会降低。对长期持币者这是个好方法。 Current and futures buy-in strategies: guarantee that existing gains, such as Bitcoin, are locked in, guarantee 100,000 dollars, and sell futures of equal value on the futures market, fall, drop off, and futures will get extra returns, which will be guaranteed in a month. This is a good way for long-term holders. 现货期货除了保值,也有套利机会。现货和期货的差异,寻找大缺口,保证每期期货做到收益,币子数量也许会增加。 There are arbitrage opportunities for current futures, in addition to preserving their value. 高频交易,交易佣金高是个现实问题,高频交易主要赚的钱80-90%的利润都给了交易所了,高频交易是加速买卖,总有人下单不优化,高频交易就是吃掉这种订单,快速找机会卖出。服务器、网络优化,找机房、网络运营商优化等等,工作量比较大,目前交易所做得差,相应太慢,经常看到机会调API重新锁定买入卖出的时候。机会就已经没有了,也许交易所自己吃掉了。当然,高频交易的空间和机会还是很大的。高频交易每一笔几十美金一百美金小额的情况下,实现成交。额度上千美元,未必能成交。还是那个问题,交易费比较贵。 High-frequency transactions, high transaction commissions, are a real problem. The main profits from high-frequency transactions are 80-90% to the exchange. High-frequency transactions are fast-tracked. High-frequency transactions are not optimized. 高频交易的次数很多,有的时候每天交易上万次,主要的钱给了交易所作为交易佣金。另外,测试高频交易所会发现,很多交易所的api调用时间比较长,而且会对api做一些限制,高频的机会就很难了,高频交易很多时候需要和交易所联手做事情,关系变得非常重要。交易所现在的api需要做测试,因为不是所有交易所都很稳定,在多个交易所套利,其中一个交易所api出问题就game over了,经常会遇到交易所拥堵的时候,api是用不了的。 HF transactions are many, sometimes thousands of times a day, and the main money is given to the exchange as a commission for the transaction. Moreover, testing HF exchanges will find that many exchanges have longer api calls, that some restrictions will be imposed on api, that HF opportunities will be difficult, and that HF transactions often require joint work with the exchange, and that relationships become very important. 另外主流币和山寨币的对冲: In addition, there is a hedge between mainstream and bountiful coins: 比如数字货币市场,按照月或者年自己算一下,跑赢大盘没有。怎么配置? The digital money market, for example, calculates by month or year, does it win? How can it be configured? 分为主流币山寨币,山寨币的一些涨幅是有可能超过主流币涨幅的,会有对冲的收益保证。 It is divided into mainstream coins, some of which are likely to increase more than the mainstream currency, and there will be a guarantee of a countervailing gain. 对冲的风险点:当大趋势发生逆转,会有系统性风险存在。非极端情况对冲策略是保证利润的增长。 The risk point of a hedge: when a major trend is reversed, there is a systemic risk. The non-extreme hedging strategy is to ensure profit growth. 另外,还有波动套利(统计套利),一般多交易所做波动套利比较安全,一段时间之内围绕中心价格线,在单个交易所可以设立一个交易对,在某个点买入,某个点卖出。直接放交易所里面,价格波动时,就低点买入高点卖出,赚差价,但单交易所会出现问题,价格一路涨上去,卖出就追不上大盘了。单边状况发生,多交易所做套利是相对安全的。量化交易只要能确保再多交易所买入卖出可以实现。 In addition, there are arbitrage arbitrage (statistic arbitrage), which is more secure in general multi-exchange arbitrage, which can be organized around the central price line for a period of time, at a single exchange, where one buys and sells at one point or another. In a direct exchange, when prices fluctuate, one buys at a lower point and makes a difference, but the single exchange has a problem, and the price goes up, and the sale is not going to catch up. In a unilateral situation, multi-exchange arbitrage is relatively safe. Quantified transactions can be achieved by ensuring that more exchanges buy and sell. 币圈量化工具,开发工具的语言一般是Python和R语言为主, 统计工具、做数学建模,一般主要是用matlab(矩阵实验室),求解,画图,功能很强大, 比如matlab能有效地缩短金融建模周期,能有效地进行交易系统的回测,能有效地进行参数分布的 图形展示等等。 Currency circle quantification tools, the language in which the tools are developed, are typically Python and R languages, statistical tools, mathematical modelling, typically matlabs, solvers, drawings, powerful functions, for example, matlab can effectively shorten the financial modelling cycle, it can effectively take a look back at the trading system, it can effectively do graphic displays of the distribution of parameters, and so on. ?还可以参考股票量化的工具,国内的同花顺、大智慧等等,多市场行情分析、套利分析,目前还没有和数字货币市场对接,但是可以学习。要对接币圈,要自己去开发。目前,做程序化交易,传统机房做的虚拟机,计算能力就够了,做模拟统计问题不大,能快速把数据分析出来,优化算法,用亚马逊云计算的服务器,也是够了的。 You can also refer to stock quantification tools, domestic 小结: Summing up: 量化工具有区别,数字货币市场一般都是自己开发的,传统金融市场有:Progress Apama、同花顺、龙软DTS、国泰安量化投资平台、天软量化平台、飞创STP、易盛程序化交易、盛立SPT平台等等,这些都是比较常用的。 Quantitative tools differ, with digital money markets generally developed on their own, and traditional financial markets such as: 量化交易的建议: Proposal to quantify transactions: 永远不要满仓 Don't ever be full. 永远不要人为预测 Never make artificial predictions. 要设置止盈止损,除非你要长期持有睡大觉 You have to set up a break or break, unless you've got to have a long sleep. 严格按照程序实施,不能自己突发奇想的手工操作 It's strictly in accordance with the procedure. It can't be done manually on its own. 一个有趣的现象时,做量化的人对具体的股票、币子种类,很多时候其实并不了解,更多的是程序自行跑出来的。把币子分为大盘中盘小盘切割,传统的做法,比特币市场也可以这么做。 An interesting phenomenon is that those who quantify the specific types of stocks and coins do not always know what they are, more so that the process runs out of its own hands. Splits the coins into large plates, cutting them in small pieces, the traditional way, and the bitcoin market can do the same. 现在华尔街的人也在币圈做量化,未来会有更多专业的量化基金进来。 Now Wall Street people are quantifying in currency circles, and more professional quantitative funds will come in in the future. 另外,币圈也有了许多量化软件工具争抢用户,我们对币圈量化工具进行了对比,可以看出有的是针对小白的。我们对比了几家的优劣,对比表格如下: In addition, there are a number of quantitative software tools in the currency circle that compete with users, and we compare them with those in the currency circle, some of which are for small whites. We compare the advantages and disadvantages of a few, as shown in the following table: 我们用其中一家的网格交易作为范例,来演示下如何导入FCoin交易所的API。 We use one of the grid deals as an example to demonstrate how to import API from the FCoin Exchange. Tips:网格交易就是交易者设定价格区间形成一个自己判断的震荡区间,网格交易所需参数分别为最高点与最低点以及网格与购入数量,资金将依照设定之参数分配在区间内的价位执行挂买与挂卖,也就是低买高卖来赚取波动利润。 Tips: Grid transactions are those in which the dealer sets a price range to form a self-determinate shock zone, with the parameters for grid transactions being the highest and lowest and the grid and the number of purchases, respectively, and the funds will be allocated to the price and sale in the area in accordance with the parameters set, i.e., low and high sales to earn volatile profits. FCoin免官网:网页链接 第一步 Step one. 登录打开 Fcoin 官网,找到《设置》选项 Login to open the Fcoin official network and find Settings options 第二步 Step two. 找到《 API 设置》,点击创建密钥 Found API Settings, click to create keys 第三步 Step three. 填写备注,例如:BitUniverse;IP 填 0.0.0.0 Fill out comments, e.g. BitUniverse; IP fill 0.0.0.0 创建好API后,导入到BitUniverse即可 Import to BitUniverse after creating API 最后确认,将资产转划到交易账户,才能开启网格订单。 Finally, it was confirmed that no grid order could be opened if assets were transferred to a transaction account. 需要强调的是,量化交易当然需要对比交易平台的交易费用,上面我们说到了,高频交易的大多数利润被交易所的费用吃掉。那么对于量化分析师们来说,行情和策略固然重要,有了量化交易机器人还不够,必须熟知各交易所出台的公告以及规定。最后我们奉上各大平台手续费对比: It is important to stress that quantitative transactions require, of course, a comparison of the transaction costs of the trading platforms, as we have said, that most of the profits from high-frequency transactions are consumed by exchange fees. So, while it is important for quantitative analysts to have quantitative trading robots that are not enough, we must be familiar with the announcements and regulations put in place by the exchanges. ·?币安 .............................................................................. 手续费0.1%,使用BNB算手续费7.5折,折后手续费 0.075% 0.1 per cent of fees, 7.5 per cent discount using BNB, 0.075 per cent after settlement ·?火币 ♪ That's it ♪ ♪ that's it ♪ ♪ that's it ♪ ♪ that's it ♪ ♪ that's it ♪ ♪ that's it ♪ ♪ that's it ♪ ♪ that's it ♪ ♪ that's it ♪ ♪ that's it ♪ ♪ that's it ♪ that's it ♪ 正常手续费0.2%,火币点卡折扣2.3折使用火币点卡抵扣手续费,折后 0.06%(当前显示以3.0折计算,点卡折扣随价格波动,以目前价格为准) Normal fees of 0.2 per cent and discounts of 2.3 per cent on points in military currency offsets of 0.06 per cent on points in military currency cards (currently shown at 3.0 per cent discounts with price fluctuations, whichever is the current price) ·?BitMax 手续费0.04% Fees 0.04 per cent ·?KuCoin 手续费0.1%(GGC交易对基础交易费率除外,其费率为0.25%) KuCoin现已上线交易手续费等级制度。 The fees were 0.1 per cent (except for the GGC transaction-to-fund rate, which was 0.25 per cent) and Kucoin now has a system of ranking fees for online transactions. ·?Bittrex 手续费0.25% Payment of 0.25 per cent ·?Fcoin 1-FCoin主板A交易Taker(主动吃单)0.05%手续费,Maker(挂单被动成交)赚取0.05%手续费,手续费实时扣减或返还。(网格属于Maker) The 1-FCoin Mainboard A transaction rate of 0.05 per cent for Taker (active purchase) and the Maker (passive hand-off) earns 0.05 per cent for real-time deductions or refunds. (The grid belongs to Maker) 2-主板B: Taker(主动吃单)支付0.05%手续费,Maker(挂单被动成交)赚取0.04%手续费。 2- Mainboard B: Tucker (active billing) paid 0.05 per cent of the fees and Maker (separated passively) earned 0.04 per cent of the fees. 3-创新版:,Taker(主动吃单)支付0.2%手续费,Maker(挂单被动成交)赚取0.15%手续费,手续费实时扣减或返还。 3-Innovation version: Taker (active billing) pays 0.2 per cent of the fee and Maker (passive transaction) earns 0.15 per cent of the fee, which is deducted or returned in real time. 4-FOne不收取买方手续费,收取卖方0.2% 4-FOne charged 0.2 per cent of the seller without charge of the buyer's fee ·?Okex 没点卡0.1%,有点卡0.015%(当前显示以1.5折点卡计算,点卡折扣随价格波动,以目前价格为准) No card 0.1 per cent and a little card 0.015 per cent (currently shown at 1.5 discount cards, subject to price fluctuations, at current prices) 如果是月交易额大于500BTC请查看下方链接 If the monthly transaction is more than 500 BTC please check the link below ·?Poloniex maker手续费0.08%,taker手续费0.2%(网格属于Maker) Maker fee of 0.08 per cent and Tucker fee of 0.2 per cent (grid belongs to Maker) 如果月交易额大于 100万美元可以查看下方链接 If the monthly transaction is more than $1 million, you can see the link below. 详细:网页链接 ·?Gate.io 手续费0.2% Fees 0.2 per cent cnyx/usdt 为 0.02% cnyx/usdt 0.02% Gate点卡大约2折,折扣手续费0.04% Gate card is about 20% discounted at 0.04% fee. 上述为无gate vip手续费 随着网格运行,gate vip等级提升,手续费会减免 There's no gate vip fee. As the grid runs, the gate vip level rises, the fees are reduced. 手续费月交易额大于 3BTC Charge monthly transaction greater than 3BTC ·?CoinTiger 交易手续费:taker为0.15%,maker为0.08% Transaction fees: 0.15 per cent for taker and 0.08 per cent for Maker Maker(挂单):挂单指的是以您指定的价格(挂买单时低于市价或高于市场价格)下单时不会立即与深度列表里的其他订单成交,而是进入深度列表等待对方主动来跟您的订单成交,这样的行为叫挂单。 Maker (checklist): The list refers to the fact that you place the order at the price you specify (lower than the market price or higher than the market price at the time of the purchase) and do not immediately deal with the other orders in the depth list. Instead, you enter the depth list and wait for the other person to take the initiative to make the deal with your order, which is called the list. Taker(吃单):吃单指的是以您指定的价格(与市场深度列表中的订单有交叉)下单时立即与深度列表里的其他订单成交,您主动与深度列表中的订单成交,这样的行为叫吃单。 Taker: The menu refers to the transaction of other orders in the depth list when you place the order at the price you specify (a cross with the order in the market depth list). You make a deal with the order in the depth list on your own initiative, which is called the order. 对比来看,目前fcoin对交易挖矿、挂单挖矿、以及FT返还、锁仓分红、理财分工等一系列的措施,明显是比别的交易平台更加让利用户。 In contrast, the current set of measures in fcoin for trade mining, for single mining, and for FT return, for locking down of silos, and for financial division of labour are clearly more profitable for users than for other trading platforms. 在近期2019年6月11日的公告中,交易挖矿、挂单挖矿、排序挖矿各交易对FT返还额度,均按比例下调10%。理财挖矿FT返还额度,下调10%。 In a recent announcement of 11 June 2019, the amount of the FT to be returned was reduced by 10 per cent on a pro rata basis in transactions involving mining, single mining and sorting of mining. 杠杆利息挖矿、锁仓挖矿、推广挖矿返还额度不变。理财挖矿调整为每周返还90万FT。对于量化团队来说,这些特有的新玩法,值得解锁。毕竟,量化交易的手续费以及和交易所之间的关系,是我们上文着重讲到的关键因素,毕竟币圈还很年轻,选择哪个交易所就变得很重要了。 For quantitative teams, these unique new games are worth unlocking. After all, quantifying transaction fees and the relationship with the exchange is a key factor that we have highlighted above, after all, the currency circle is young, and choosing which exchange becomes important. 这个号称全宇宙最烧脑公告的交易所,在区块链领域的创新引发了2018年熊市中的一把火,目前我们了解到,不少高级量化分析师也是不是出入fcoin社区。下图是部分主板A交易、挂单、排序挖矿等各挖矿类型的FT返还额度: This exchange, known as the most inflamed in the universe, has created a fire in the Bear City in 2018 as a result of innovations in the area of block chains, and it is now known that a number of senior quantitative analysts are not in or out of the fcoin community. The figure below is the amount of FT return for some of the mining types of board A trades, listings, sorting mining, etc.: 究竟币圈的量化交易现在和未来如何? What are the quantitative transactions in the currency circle and what are they going to be? 目前量化交易团队大概分了两类:一类主要是为交易所或者项目方做市值管理;另一类就是做量化投资赚钱。 Currently, there are probably two types of quantitative transaction teams: one is primarily market value management for the exchange or the project party, and the other is making money by making quantitative investments. 大部分是小团队,2018年之前行情好的时候有大规模的交易所,目前效益不好,基本都变成小团队。广为诟病的,也就是前面提到的交易所成交量大部分是被刷出来的,甚至有100%都是。现在市场里的交易量已经是程序化占大多数,提供了流动性,抑制不同交易所差价,是市场的重要部分。而虚拟货币市场的好处就是门槛低,可以先拿拿一点小钱试水练手,策略的成本是很低的,服务器的开支一天也就1元左右,如果在BotVs写策略,机器人的费用每天3元,硬性的成本只有这些。 Most of them are small groups, with large-scale exchanges before 2018, which are not working well at all, and which are now largely small. Most of the trade transactions mentioned earlier, i.e., most of the transactions are expunged, or even 100%. The market now has a majority of programmed transactions, which provide liquidity, discourages different exchange differentials, and is an important part of the market. And the advantage of virtual money markets is that they have a low threshold, that they can test a small amount of water first, that the cost of the strategy is very low, that the server costs around $1 a day, and if the BotVs strategy is written, the cost of robots is three dollars a day, that is the only hard cost. 交易所的api会有一定风险,有一个量化团队的创始人就说过,由于API接口的一些问题直接出现了较大亏损。他觉得从传统金融过来之后发现币圈的一些基础设施建设比较欠缺,包括风控软件,交易的账户管理等等。 The exchange’s api would be at risk, as the founder of a quantitative team said, with some API interface problems directly leading to significant losses. He felt that some of the infrastructure in the currency circle, including wind control software, account management of transactions, etc., was less well developed after traditional finance. 甚至有量化圈的大神提醒过投资人,跑过了全国三十多个量化团队,也做过将近十年的商品期货。他认为,市面上百分之九十的团队都不靠谱。不要听到年化百分之百月化百分之十就很激动。一定要问清楚,杠杆多少?仓位怎么设计?中间怎么加减仓?一切脱离风险谈收益的都是耍流氓。真正牛逼的量化团队对投资人的要求非常高。 Even the gods of quantitative circles have reminded investors that they have run past more than 30 quantitative teams across the country, and have been doing commodity futures for almost a decade. He argues that 90% of the teams on the market are not reliable. Don't get excited to hear 100% annualization. 当然,在传统的股票期货市场可能一天只有四五个小时的交易时间,但是在数字货币市场是7*24小时无眠交易。所以人肯定是很难去适应这么高强度长时间的交易的,必须要有量化策略、机器人来进行交易。所以量化交易在区块链在数字货币的应用前景是非常广泛。 Of course, there may be only four or five hours of trading time in the traditional stock futures market, but 7* 24 hours of insomnia in the digital money market. So it must be hard for people to adapt to such high-intensity, long-term transactions, and there must be a quantitative strategy, robotics, to deal. 应当理性的对待量化交易,它不是万能救星也不是可怕的陷阱,优秀策略的量化交易相当于是币圈的“黑科技”,同时也是对普通投资者的降维打击,自然会吸引很多机构和大佬们加入其中。早些时候就有业内人士透露,华尔街体量最大的对冲基金和信托基金正在考虑进入加密货币市场,如果万亿级的资金进场,即使只有整个规模的0.5%-1%,市场也会跨越式发展。 Quantified transactions, which should be treated rationally, are neither a panacea nor a terrible trap. Quantified transactions with excellent strategies amount to a “black technology” of currency circles, as well as a downscaling blow to ordinary investors, naturally attracting many institutions and big players. Earlier, it was revealed that Wall Street’s largest hedge funds and trust funds were considering entering the encrypted money market, and that if trillion-dollar funds came in, the market would cross the line, even if only 0.5 to 1 per cent of the total size. 学习专业的知识,不要被忽悠;寻找安全的工具,帮助自己;并且理解业内的规则,寻找可以让利给用户的交易平台,给自己做风控,再多加了一层保障利益的大门。 Studying professional knowledge, not being manipulated; finding safe tools to help themselves; and understanding the rules within the industry, finding a trading platform that can give benefits to users, giving them control over themselves, adding a new layer of protection of interests. ?“做一个交易的旁观者” ? "The bystander of a transaction" 这是华尔街古老的名言。 That's an old saying on Wall Street. 因为只有旁观者, Because only bystanders, 才可以让自己处于市场波动之外,冷静的观之,待到时机出现,果断的致命一击; to keep yourself out of market volatility, calm and wait until the moment comes, a decisive and deadly blow; 才可以腾出手和眼镜来观察,交易的真相,以及区块链行业的未来。 Only hands and glasses can be set free to observe the truth of the deal and the future of the block chain industry. 区块链人小程序 Block Chain Man Applet 世事难料!为防止失联,你还是把备用号都扫了吧?你看,我们也有Pro版了,另外也可到新浪微博“始源科技-区块链人”找我 I don't know what's going on. You're gonna have to clean up the backup number in case it doesn't work out? You see, we've got the Pro version, and we can find me at Sina Weibo. 如果还没关注“区块链人BlockChainer” 姊妹公众号(非备用号) If you haven't noticed Block Chainer, sister public. 如果还没关注区块链人-小程序 If you don't pay attention to block chain people - small program 如果你还没关注公众号 If you don't pay attention to the public, 打赏小编 to reward editor-in-chief 关注新钛资本官网-区块链基金TMF FUND Focus on New titanium Capital Officer Network - Block Chain Fund TTF FUND 区块链人小程序 Block Chain Man Applet

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论