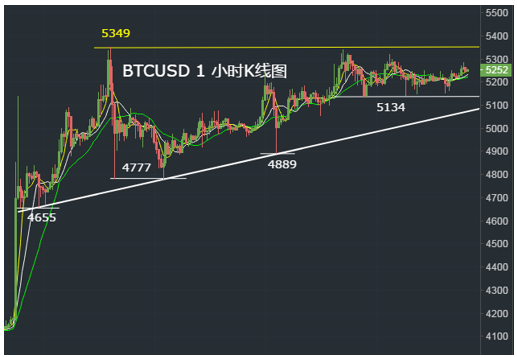

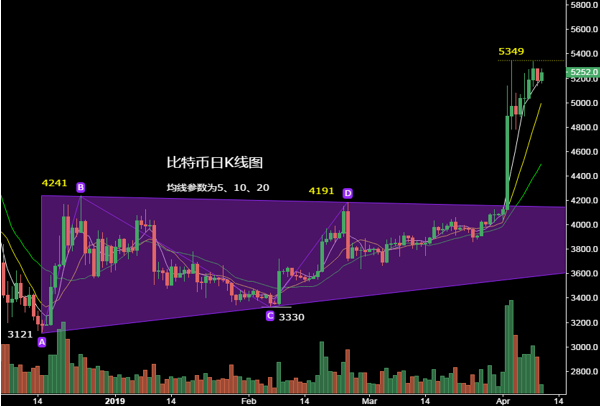

比特币k线图怎么看?本文主要讲解比特币开盘价和收盘价的用法、分享技术形态的破位后的市场情绪和交易法、涉及大部分形态,底部形态和顶部形态以及中继形态,均线和趋势图,下图是比特币收敛三角形破位之后的走势,时间周期是以日K线为单位,周期形成的时间走势比较长,三个半月。也有短周期的K线走势图,1小时K线图。

What about the bitcoink line? The paper focuses on the use of bitcoin opening and receiving prices, market sentiment and trading methods after sharing technology patterns, which involve most of the forms, bottom and top patterns, as well as relay patterns, mean lines and trend maps. The following is the trend following the fall of the Bitcoin triangle, which is time-bound in Japanese-Kline, with a longer period of three and a half months. There are also short-cycle Kline trend maps, with an hour-long K-line map.

图2图3是1小时K线图,时间周期是一小时K线走势图。这个收敛三角形形形成的时间也比较短,三五天或者一个星期。

Figure 3 of figure 2 is a one-hour K-line map, with an hour-long K-line map. This condensed triangle also takes a relatively short period of time, three or five days or one week.

图2 - 比特币1小时K线走势图

Figure 2 - One-hour K-line map of Bitcoin

图3 - 莱特币1小时K线走势

Figure 3 - One-hour movement of Lightcoin's K Line

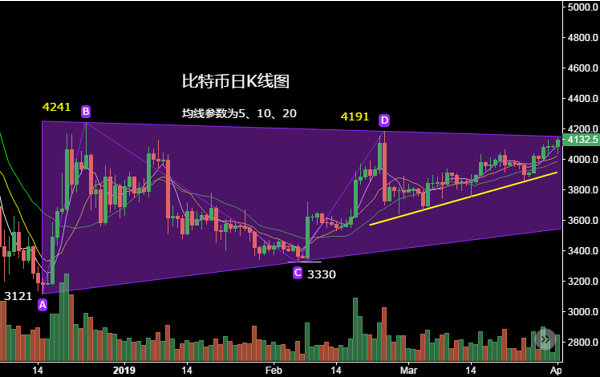

为什么突破后可以追涨,向下击穿为什么可以做空,先看日K线图4为四月2号突破的K线图,收敛三角形突破后不管真假都跟,假如是假突破,那么应该如何去避免,在什么地方支持离场。

Why are we going to go up and down, why are we going down, look at the K-line map of the first K-line 4 for the second of April, pick up the triangle and follow whether it is true or not, and, if it is, how are we going to avoid it and where we're going to support it?

图4 -上周二向上突破

Figure 4 - Breaking up last Tuesday.

4.1号靠近压力线时,收敛三角形没有突破的4100上方都是压力,越接近压力线,做空离场的位置,有人会选择逢低做多,逢高做空,当然也有部分人选择观望。三角形上轨压力线的附近去做空的时候,止损位一定是在4243方,也就是说当价格向上突破4240之后,基本上做空的人都会离场。

4.1 When the pressure line is close to the pressure line, the four hundred above the condensed triangle is pressure, and the closer to the pressure line, the more one can make an exit position, the more one can choose to do it, the higher one, the higher one, and, of course, some of the other. When you do it near the pressure line in the triangle, the damage must be 4243, which means that when the price goes up to 4240, the essentially empty person will leave.

图5 -突破收敛三角形前

Figure 5 - Breaking through the trigonometry

图6 -突破当天的日K线4.2号

Figure 6 - Breaking the day's line 4.2.

当时突破之后,图6为4月2号的K线图了,当时突破走到4400- 4600.这些价格只要看到它向上突破了4241.那么它已经是向上突破,或者说他突破4200上方,它就已经是向上突破了。

After the breakthrough, figure 6 was a K-line map for April 2, when the breakthrough reached 4400-4600. The price as long as it was seen breaking up 4241, it was already breaking up, or he was breaking up over 4200, it was breaking up.

有一些交易者是以时间周期,为日为单位的,有可能会以周为单位,也就是说他们持仓可能是几周,也就是说在这个三角形区间,他们也有可能几周看涨,也有可能是几周看跌的。但是这些用户只要是看到价格向上突破4200或者4241上方之后,那么他们都会有一个统一的思维就是市场应该上涨了,做空的一定离场。

Some traders are time-cycled, day-by-day, and perhaps week-by-week, that is, they can hold a warehouse for weeks, that is to say, in this triangle, they can look up for weeks, or they can look down for weeks. But as long as these users see prices breaking upwards above 4200 or 4241, they will all have a single idea that the market should rise and be empty.

关键就在于刚刚突破的时候,市场情绪的转变。重点注意当时突破的时候,市场情绪是什么样的。

The key is a shift in market sentiment at the time of the break-up. Focus on what market sentiment was at the time of the break-up.

原本做多的,看到向上突破押对宝,会持续看涨,形态突破后,形态看涨,看涨的会加仓做多(注意动作是买入开仓),原本做空(在12月15日至4月1日期间做空的),突破收敛三角形后,上行趋势明朗后,会及时止损离场,做空离场的人亏损后,为了急于盈亏平衡,做空的仓位止损离场后,会反手做多,看涨。这个时候,做空的人止损离场(是买入平仓,注意是动作是买入),反手主动性做多,(动作是买入开仓,也是买入),观望的人看到趋势明朗后,也会进场追多,交易动作也是买入,所有的交易者,在短时间内集中的动作都是买入,那么价格自然会在短时间内报复性上涨。所以比特币4月2号突破4200的时候,它上涨的力度非常非常快。

After doing a lot of things, seeing a break-up, a break-up, a change of shape, a build-up, a build-up (note that the move was to buy the open warehouse), a break-up (from 15 December to 1 April), an upturn, a clear exit, a clear exit, a sharp break-up, an up-and-go, an up-and-go, a rush to balance, an up-and-go, an up-and-go, an up-and-up. At this point, a break-out, a buy-in, a buy-in, a run-in, a run-down, a run-in, a run-down, a run-off, a run-in, a run-up, a run-in, a buy-in, a run-in, a run-in, a short-off, a price rise.

获利空间的关键点是确定的方向感和速度,买到什么价格,赚多少钱,取决于速度,如果买的时间够快够早,自然后面买的人就把这个价格进高,那么获利的空间就会很大,所以在关键点的时候,在交易上要求较高,要实时盯盘,特别是关键是的变盘时间点,几个月才接近上轨,值得花时间去盯盘。

The key point in the profit space is a sense of direction and speed, what price is bought, how much money is earned, depending on the speed at which it is bought early enough for those who buy it in the back of nature to raise the price, so that at the critical point, there is a high demand for transactions, a real-time stakeout, especially the key changeboard time point, and it is worth taking a few months to get on track.

比特币日K线图中收敛三角形的宽度。收敛三角形的最宽有多宽,最宽是4241-3121.最宽就是1100的空间。有一小部分人长线持续看空,或者说在很低的价格去看空。那么也有一部分人是持续看多,那也就是这个区间什么人都有,也有在更低的价格 3400或者是3500做空的人。

The width of the triangle is condensed in the Bitcoin K-line map. The width of the trigonometry is wide, with the width being 4241-3121. The widest is 1,100 space. There are a small number of long lines that remain empty, or at very low prices.

但是当价格向上突破4200的时候,如果这些持续看空的交易员,他最大的亏损达到600到700个点,那么,如果说要把这单给赚回来,那就要反手去再去做多600到700个点。基本上做空的人就会反手都达到盈亏平衡。这个区间最大的波动是1100.最低的价格3300-3400下方附近做空的人亏得最多,突破4200的时候,就可能要亏损800个点,需要反手看涨800块钱才平衡,当价格向上突破4200之后看涨800个点是5000.最多的价格就是在4300-4400会有一些挂,也有可能在往上4300左右,或者是4250上方,它就有可能挂单了。

But when the price breaks up to 4200, if these constant-looking traders have their biggest losses of between 600 and 700 points, then if they're going to make it back, they're going to have to do 600 to 700 more points. Those who are basically empty are going back to the balance. The biggest volatility in this zone is the lowest price of 110.0 per cent, the highest loss of those near the lower price of 3300 to 3400, the highest loss of 800 points, the need to look back at 800 dollars to balance, and the most price increase of 800 points after the price breaks up to 4200 is 5,000. The most price is that at 4300 to 4400, which may be around 4300, or 4250, which may be higher.

图7-收敛三角形的振幅有多宽,第一目标的空间就有多大。

Figure 7 -- The breadth of the amplitude of the condensed triangle and the space for the first target.

图8-技术走势的规律性

Figure 8 - Regularity of technological trends

技术走势的规律性,可以看一下当时比特币这个日K线周期的一个趋势图8.之前核心课程教过大家看趋势有三种方法,最早讲的是三板斧里面的一种方法,要不就趋势线,要不是趋势的定义,要不就是均线,就是这三种方法。看当时比特币价格,在4月1号之前的一个星期,或者说在3月27号之后比特币的日线图均线的上方,之前讲技术课的时候一直强调日K线图在均线上方明显就是强势。下方的这条倾斜向上的支撑线,可以发现这条支撑线下方的支撑位是越来越高的,当时向上突破4200之前,虽然没有向上突破,也可以发现最低点是越来越高,就像打地基。

There were three ways to see trends before the core course, which was a trend figure for the Japanese Kline cycle of Bitcoin. The first was one of the three axes, either a trend line, or a trend definition, or a flat line, or these three methods. The price of bitcoin at the time, a week before April 1, or above the average of the bitcoin, after March 27, had been emphasized in the course of the technical course, that the Japanese Kline was clearly strong over the same line. The backline at the lower side of the curve, it could be found that the support position at the bottom of the line was increasing, and before the 4200 break-up, the lowest point could be found to be ever higher, if not higher, as in the case of the foundations.

还有其他的形态,比如头肩底头肩顶,或者说M头,双头双顶或者双底,性质都是一样,其市场情绪都一样,只关键找出当时突破的那条关键压力线,者支撑线或者破位点。

There are other forms, such as head on the shoulder, or head M, head on both sides, or both, of the same nature, with the same market mood, only to find the key pressure line that was broken at the time, the support line or the break point.

图9-上升三角形

Figure 9 - Upscaling Triangles

上升三角形,它的特点就是上方是同一个水平价位,下方的支撑线是越来越高的。这种走势是蓄势,等待的就是向上突破。

The rise of the triangle is characterized by the same horizontal value above, and the line of support below is getting higher. This is an upturn, waiting for a breakthrough.

这种收敛三角形形态突破向上突破或者向下击穿也好,都会憋一段时间,为什么市场要憋一段时间,因为憋得越久,爆发力就越强。

This condensed triangle break-up, or punch-down, can hold back for a while. Why does the market hold back for a while, because the longer it holds, the more explosive it will be.

图10双底或双顶形态

Figure 10 Double bottom or double-top form

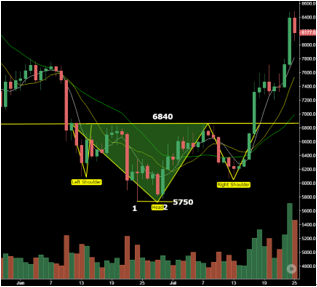

这个双底形态是比特币六月中旬到七月底的一个走势。这双底形成的时间是在6月11号到7月17号。这个双底的头有一号二号图10.那么头的位置呢,头肩底的阿双头顶着这个头是5750.在这个7月17号比特币,没有向上突破这个。双头底之前只能够假设它是一个双头底,只有当它向上突破6840之后才能确认双底形态成立图11.就像比特币在上周向上突破压力线的时候。

This double bottom shape is a movement between mid-June and the end of July by Bitcoin. The two bottoms are formed from June 11 to July 17. The first two bottoms are number 10. The head is located in figure 10.

6840是一条水平的压力线实际当中也可以是倾斜的,这里面比较特殊,它是一条水平线。这条水平线就相当于上周比特币向上突破4200的时候那条压力线一样的,跟这个收敛三角形向上突破市场的情绪是一模一样的,就是在6840的时候,也有一些交易者可能背靠6847做空,但是做空的话他就有可能会亏损,这些做空的人亏损之后,为了盈亏平衡就会反手去做多,做多的人还会加仓。在它突破颈线的时候突破压力线的时候,当时市场上在短时间之内,所有的人都在做多大家都在做多的话,也就是所有的人都在进场的时候,那么这个价格自然会被抬高,所以在它突破颈线之后力度是最大的。

6840 is a horizontal pressure line that can actually be tilted. It's special. It's a horizontal line. It's the same as when Bitcoin broke up 4200 last week. It's exactly the same as when this trigonometry broke through the market. At 6840, there are traders who may be emptied on 6847, but there is a risk that he will lose, and those who do it will do more for the sake of profit and balance, and many more for the sake of saving. When it breaks the pressure line, within a short period of time, everyone is doing more, that is, when everyone comes in, then the price will naturally be raised, so it will be the greatest when it breaks the neck line.

图11 -双底形态

Figure 11 - Double bottom form

图12 -双头顶形态

Figure 12 - Two-headed top form

这是一个双头顶,就是去年七月底到八月初的行情。头部是8480就是最高位,颈限是7300.可以看一下7300到8480空间有多大,第一,目标到位就是6100. 8480-7300空间是1180.这个颈限到头部的空间有多宽向下的空间就有多大,所以7300再减掉1180.那么这个价格就到了6120.也就是达到了6000下方去。那么同样的形态破位或位点在哪里,在7300.也就是说我们一定要把这个破一点给找到,就是关键的支撑线找到,当时这条线是7300.也就是说当价格击穿7300之后,很多人都在做空。

It's a double-head, and it's between the end of July and the beginning of August last year. The head is 8480 at the top, the neck is 7,300. The neck limits are 7,300 to 8480. First, the target is 6100.8480-7300, the neck is 1180. The size of the neck is 1180. The size of the neck is 1180. So 7300 is reduced by 1180. So the price is 6120.

图12严格意义上来讲,它是一个双头顶,也就是双头顶和头,肩顶。差别就是一个是两个头,一个是一个头,其实都没有太大分别,关键就是看它击穿颈线的空间,也就是说关键的支撑位破位之后,那才能够说明这个头肩顶或者是一个双头顶成立。

In the strict sense of figure 12, it is a double head, that is, a double head and a head, a shoulder. The difference is one head, one head, which is not much different. The key is to see it go through the space of the neck line, that is, when the key support position is broken, that means that the head or the head is formed.

技术形态的破位,或者说向上突破,这个时间周期都比较长,如果大家愿意去守或者愿意去等这种形态的话,它一旦破位之后,它的空间收益率都是非常非常高的,但做去做这种交易,一年就是做不了几次。

It is a long time cycle for the technology to break, or break upwards, and once it breaks, once it is ready or willing to wait for it, its spatial yield is very high, but it cannot be done a few times a year to make such a deal.

一年的机会就那么几次,或者说一个月就那么一两次。就好像比特币一样,等三个半月,就是向上突破4200.3100到4200这个空间中间还能够做几次,但是三个半月其实就几次。

It's only a few times a year, or once or twice a month. It's like Bitcoin, three and a half months, and it's a couple of times in the middle of breaking up the 4200.3100 to 4200 spaces, but it's only a few times in three and a half months.

如果以这种形态为周期的话,交易次数就很少很少。刚刚讲了这些形态都是以日K线为周期的,其实,很多时候小周期上。特别是收敛三角形会经常在几天之内形成,也就是我们看一小时走势图上的交易机会就比较多。不管是以日K线周期,还是以一小时K线周期也好,向上突破,或者向下破位的市场情绪,都是一样的,也就是关键日K线周期,走出来的时间会比较长,那么小时K线周期走出来的时间比较短,本身一小时K线周期时间本身就很短。

If this pattern is used as a cycle, the number of transactions is very small. These patterns are described as being in the Japanese-Kline cycle, in fact, many times in the small cycle. Especially the condensed triangle is often formed in a few days, that is, we have more trading opportunities on the one-hour map.

总结一点,这些形态(收敛三角形、头肩底、头肩顶、双头顶、双头底),不管是日K线周期,还是1小时K线为周期,一般情况下,形态的振幅有多宽,破位或突破之后的空间就有多大。

To sum up, these patterns (triangulation triangles, heads, shoulders, heads, heads on top, heads on both sides), be it the Japanese-K-Line cycle or the one-hour K-Line cycle, usually the size of the amplitude of the form and the size of the space after the break or break-up.

以后看到收敛三角形在突破的时候,当然是真突破,真突破时候的空间有多大,自己可以去衡量,当然开始跟大家分享了,不管是真突破还是假突破,做了再说。所以后大家做交易的时候不妨去多找一些关键形态的破位点去做,在之前的分享课程当中也跟大家讲过,就是破位之后怎么样去做,其实很多时候去做交易都是做这种破位的,或者是突破性行情。那么突破性行情之前是教大家要去跟,就是突破之后真突破,假突破都要去跟。

When you see a breakthrough in the trigonometric triangle, of course, it's a real breakthrough, you can measure it, and you start to share it, whether it is a real break or a false break, and you can do it again. When you make a deal, you have to look for some more of the key points, and when you do it in the previous sharing sessions, you can tell you how to do it, and when you do it, it's a lot of times you do it, or it's a breakthrough.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论