全球最大加密货币交易所币安(Binance)创始人赵长鹏认罪。

The founder of the largest encrypted currency exchange in the world, Binance Zhao Chang Peng, pleaded guilty.

当地时间11月21日,美国司法部官网发文称,运营着全球最大加密货币交易所Binance.com的币安控股有限公司(Binance Holdings Limited,简称Binance)承认参与涉嫌洗钱、无证汇款和违反制裁的行为,并同意支付43亿美元罚款。同时,币安创始人兼首席执行官(CEO)赵长鹏承认自己未能维持有效的反洗钱计划,并已辞去Binance首席执行官的职务。

On November 21, local time, the U.S. Attorney-General’s Network wrote that Binance Holdings Limited (Binance Holdings Limited), which operates the world’s largest encrypted currency exchange, admitted to being involved in money-laundering, unlicensed remittances, and sanctions violations, and agreed to pay $4.3 billion in fines. At the same time, the founder and CEO (CEO) Zhao Chang Peng admitted that he had failed to maintain an effective anti-money-laundering plan and resigned as Chief Executive Officer of Binance.

作为认罪协议的一部分,币安同意被没收25亿美元,并支付18亿美元的刑事罚款,总计罚款43亿美元。币安还同意保留一名独立的合规监察员三年,纠正和加强其反洗钱和制裁合规计划。

As part of the plea agreement, the currency agreed to confiscate $2.5 billion and pay $1.8 billion in criminal fines totalling $4.3 billion. It also agreed to retain an independent compliance ombudsman for three years to correct and strengthen its anti-money-laundering and sanctions compliance plan.

美国司法部指出,币安没有实施有效的反洗钱计划。多年来,币安允许用户在不提交电子邮件地址以外的任何身份信息的情况下,开立账户和进行交易。同时,美国的制裁法禁止美国人与其受美国制裁的客户进行交易,包括伊朗等受到全面制裁的司法管辖区的客户。尽管如此,币安并没有实施阻止美国用户与伊朗用户交易的控制措施,在2018年1月至2022年5月,币安故意失职导致美国用户与通常居住在伊朗的用户之间的交易超过8.98亿美元。

Meanwhile, US sanctions laws prohibit Americans from trading with their US-sanctioned clients, including fully sanctioned jurisdictions like Iran. Despite this, it has not implemented controls to prevent U.S. users from trading with Iranian users, and the deliberate failure of U.S. users to do business with Iran between January 2018 and May 2022 resulted in over $898 million in transactions between U.S. users and users usually residing in Iran.

“币安在追求利润的过程中对自己的法律义务视而不见。它的故意失职让资金通过它的平台流向恐怖分子、网络罪犯和虐待儿童者。”美国财政部长珍妮特·耶伦表示,“为了确保遵守美国法律法规,今天的历史性处罚和监督标志着虚拟货币行业的一个里程碑。任何想从美国金融体系中获益的机构,无论位于哪里,都必须遵守保护我们所有人免受恐怖分子、外国敌对势力和犯罪侵害的要求,否则将面临后果。”

“The currency has ignored its legal obligations in the pursuit of profit. It has deliberately failed to allow funds to flow through its platforms to terrorists, cybercriminals and child abusers.” US Treasury Secretary Janet Yellen has stated that “to ensure compliance with United States laws and regulations, today's historic penalties and supervision mark a milestone in the virtual money industry. Any institution that wishes to benefit from the United States financial system, wherever located, must comply with the requirements of protecting us all from terrorists, foreign hostile forces and criminal acts, or face consequences.”

当地时间11月21日下午4点36分,币安创始人赵长鹏发布推文称,在当天辞去了币安首席执行官的职务,并表示“我犯了错误,我必须承担责任”。他还表示,辞职后会先休息一阵子,后续可能进行一些被动投资,成为区块链、Web3、DeFi(去中心化金融)、人工智能和生物技术领域初创公司的少数股东。赵长鹏还宣布币安前区域市场全球主管Richard Teng出任币安的新任首席执行官。

On 21 November, at 4.36 p.m. local time, the founder of the currency, Zhao Chang Peng, issued a tweet stating that he had resigned from the post of Chief Executive Officer of the currency on the same day, stating that “I made a mistake and I have to take responsibility.” He also stated that the resignation would be followed by a break and that some passive investments could be made as minority shareholders in block chains, Web3, DeFi (decentralized finance), artificial intelligence, and biotechnology start-ups.

记者了解到,今年6月初,美国证券交易委员会(SEC)以违反美国联邦证券法的指控起诉全球最大的加密货币交易所币安及其创始人赵长鹏,称币安及赵长鹏经营着一个“欺诈网络”。

Journalists learned that in early June this year, the United States Securities and Exchange Commission (SEC) sued the world's largest encrypted currency exchange, the currency of Zhao Chang Peng and his founder, for alleged violations of the United States Federal Securities Act, alleging that Yuan and Zhao Chang Peng operated a “fraud network”.

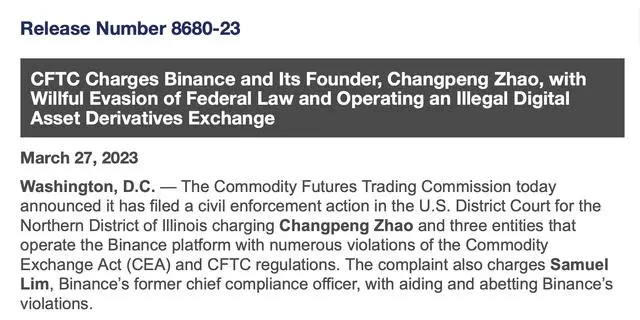

早在当地时间3月27日11时24分,美国商品期货交易委员会(CFTC)在官网宣布,已向美国伊利诺伊州北区联邦地区法院提起一项民事执行诉讼,指控赵长鹏和三家运营币安平台的实体多次违反《商品交易法》(CEA)和CFTC规定。CFTC还指控币安前首席合规官(CCO)塞缪尔·林(Samuel Lim)协助和教唆币安的违规行为。

As early as 27 March, at 1124 hours local time, the United States Commodity Futures Trading Commission (CFTC) announced on its network that a civil enforcement action had been filed with the U.S. Federal District Court for the Northern District of Illinois, alleging multiple violations of the provisions of the Commodity Exchange Act (CEA) and the CFTC by Zhao Changping and three entities operating currency platforms. CFTC also accused the former Chief Compliance Officer (CCO) Samuel Lim of aiding and abetting currency violations.

根据起诉书,2019年7月至今,币安为美国居民提供和执行了商品衍生品交易。CFTC认为,币安的合规项目一直是无效的,在赵长鹏的指示下,币安指示其员工和客户规避合规控制,以实现公司利润最大化。指控称,尽管币安作为期货经纪商(FCMs)有收集用户身份验证信息的法律义务,但在大部分时间里,币安并没有要求客户在平台上交易前提供任何身份验证信息,并且未能实施旨在预防及发现恐怖主义融资与洗钱的基本合规程序。

According to the indictment, from July 2019 to the present, the currency supplied and executed derivatives trading for United States residents. CFTC argued that the currency security compliance project had been ineffective and that, under the instructions of Zhao Chang Peng, it instructed its employees and customers to circumvent compliance controls in order to maximize corporate profits. It was alleged that, despite the legal obligation to collect user identification information as a futures broker (FCCs), for most of the time, it did not require customers to provide any authentication information prior to trading on platforms and failed to implement basic compliance procedures aimed at preventing and detecting terrorist financing and money-laundering.

3月28日,币安在官网博客发布了赵长鹏对CFTC起诉的回应。赵长鹏在回应中表示,尽管币安与CFTC合作了两年多,但CFTC还是提出了一项意想不到、令人失望的民事诉讼。“经初步审查,诉状似乎对事实的叙述不完整,我们不同意诉状中对许多问题的指控。”

On March 28, Huo Changping published a response to the CFTC's indictment on the official web site. In his response, Zhao Changping stated that despite having worked with the CFC for more than two years, the CFTC had filed an unexpected and disappointing civil action. “After a preliminary examination, the petition seemed to be incomplete in its description of the facts, and we disagree with the charges against many of the issues in the petition.”

赵长鹏表示,币安网开发了一流的技术,以确保合规性,在任何情况下都不进行盈利交易或“操纵”市场。币安是第一个实施强制性KYC(了解客户)计划的全球(非美国)交易所,至今仍具有KYC与AML(反洗钱)方面的最高标准之一。

According to Zhao Chang Peng, currency security is the first global (non-United States) exchange to implement mandatory KYC (know-your-customer) programs, and still has one of the highest standards for KYC and AML (anti-money-laundering).

公开资料显示,币安是一家全球性的加密货币交易所,为超过100种加密货币提供交易平台。2018年4月,币安每秒140万次的交易能力吸引了600万用户,成为全球最大的加密货币交易所。币安英文名字“Binance”基于单词binary和finance的组合,提供150多种加密货币的交易,包括比特币、以太坊、莱特币以及其BNB代币。

In April 2018, the currency’s ability to deal 1.4 million times a second attracted 6 million users and became the world’s largest encrypted currency exchange. The currency’s English name, Binance, is based on a combination of words binary and finance, and provides more than 150 encrypted currency transactions, including Bitcoin, Etheria, Letco, and its BNB tokens.

“如果败诉,被指控者将面临没收非法所得、民事罚款、限制交易等处罚;如果涉及到内幕交易情节严重的,可能涉及到刑事处罚。”中银律师事务所高级合伙人、中银区块链与数字货币法律研究中心主任刘晓宇对记者表示。

“In case of failure, the accused faces the penalty of confiscation of illicit proceeds, civil fines, restrictions on transactions, etc., and, if the circumstances of the insider transaction are serious, criminal penalties may be involved.” Liu Xiaoyu, Senior Partner of the Sino-Chinese Law Office, Director of the Sino-Sino-Son Block Chain and Digital Monetary Law Research Centre, indicated to the journalist.

刘晓宇表示,加密(数字)资产以及以区块链为基础的底层分布式账本技术的发展可能在改进支付系统、增加金融包容性以及创建金融价值分配机构方面提供支持,进而改变行业或商业模式,但其去中心化、匿名性的特点也为洗钱、黑市交易等犯罪活动提供了便利,增加了各国政府监管难度。因此,加密(数字)资产行业的发展同时面临机遇与挑战。

Liu Xiaoyu indicated that the development of encryption (digital) assets and bottom-distributed book technologies based on block chains may provide support in improving payment systems, increasing financial inclusion, and creating financial value allocation institutions, thereby changing industry or business patterns, but that their decentralization, anonymity, etc., also facilitates criminal activities such as money-laundering, black market transactions, and makes it more difficult for governments to regulate.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论