以太坊正与比特币进行一轮较量!

与A股市场一季度调整后极为相似的一点,除了白酒,资金也开始挖掘其他有意思的股票。现在,数字货币市场的投资者,也开始将更多的资金配置到以太坊,而不是只买比特币。

One thing very similar to the one-quarter adjustment of the A-share market is that, in addition to white wine, funds are starting to tap into other interesting stocks. Now, investors in the digital money market are also beginning to allocate more money to Etheria, rather than just buying bitcoins.

全球第二大市值的以太坊,正引领新一轮市场,这就像茅台不等于A股,比特币也不等于数字货币。在最近30天时间内,以太坊的价格上涨了60%,创出历史新高,而比特币同期下跌了7%。

The second-largest market market in the world, Etheria, is leading a new round of markets, which is like a hut that is not equal to A shares, and a bitcoin is not equal to a digital currency. In the last 30 days, the price of Ethio has risen by 60%, reaching an all-time high, while Bitcoin has fallen by 7% over the same period.

值得注意的是,比特币从周一高于5.8万美元一路跌至最低跌至不足5.4万美元。5月4日美股盘初,比特币达到5.5万美元上方,耶伦有关小幅加息的言论过后跌破5.4万美元,24小时内跌幅扩大至近8%。截至美股收盘,比特币重回5.4万美元上方。

It is worth noting that Bitcoin dropped from over $58,000 on Monday to a low of less than $54,000. At the beginning of the 4 May, Bitcoin reached over $55,000, and Ellen’s talk about a small interest increase fell over $54,000, increasing the drop to nearly 8 per cent in 24 hours. By the close of the deal, Bitcoin returned back over $54,000.

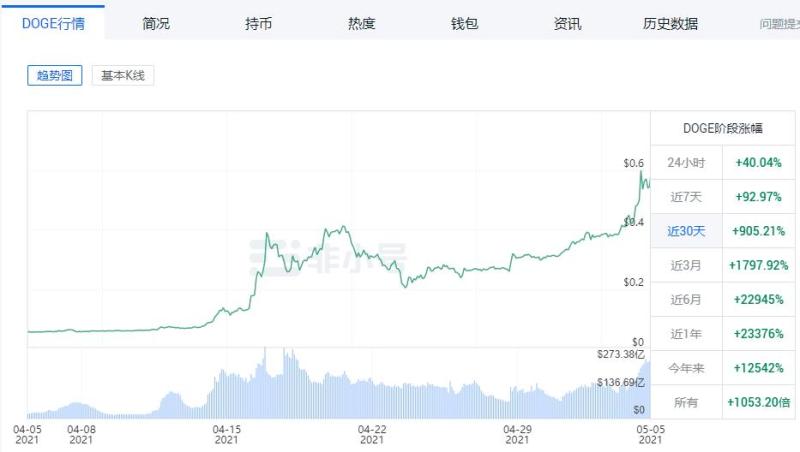

此外,狗狗币在24小时暴涨40%,数据显示,狗狗币市值现已超越瑞波币市值,位列第四。5月4日晚间,狗狗币站上0.6美元/枚,刷新历史新高。过去7天涨近一倍,如果从今年年初算起,涨幅超过100倍。

In addition, the doggie price rose by 40% in 24 hours, and the data show that the market value of the doggie price is now fourth in rank. On the evening of May 4th, the doggie price rose by about 0.6 dollars per piece, refreshing its history. The last seven days have nearly doubled, and if it starts at the beginning of this year, it will rise by more than 100 times.

在过去相当长一段时间,比特币的表现长期引领市场,就像股王茅台那样引领A股。数字货币市场的这种变化似乎具有趋势性,比特币在全部数字货币市场的占比,在2017年最高达80%,去年7月降至60%。今年五一期间,比特币的市值占比又降至47%,而以太坊在过去三年间的市值占比不断提高,目前已在币圈总市值中达到近18%。

For a long time, Bitcoin’s performance has led the market for a long time, as has its A share of the stock of King Maotai. This change in the digital currency market appears to be trendy, with Bitcoin accounting for 80% of the total digital currency market in 2017 and 60% in July last year. The market value of Bitcoin fell to 47% during the 51st year, while the market value of Ether was rising over the past three years, and has now reached nearly 18% of the total currency market value of the ring.

融资账户方面,大量习惯场外配资、融资融券的股票投资者进入数字货币市场,导致以太坊、比特币的融资账户规模持续增长。在最近24小时内,共有142292个配资或融资账户爆仓超过66亿元人民币,其中绝大部分爆仓来自比特币、以太坊的融资融券账户。

In the case of financing accounts, a large number of equity investors in customary off-site financing and financing coupons have entered the digital money market, which has led to a steady increase in the size of the financing account in Taiwan and Bitcoin. In the last 24 hours, a total of 1,42292 matching or financing accounts have exploded in excess of $6.6 billion, the vast majority of which came from the Bitcoin and Etheria finance coupon accounts.

资金流出比特币,以太坊走出独立行情

funds flow out of bitcoin and use the talisman to move out of independence

就在许多股票投资者将比特币,作为对数字货币市场认知的全部之际,以太坊的价格创出了历史新高。

At a time when many equity investors had introduced bitcoins as the full recognition of the digital currency market, the price of the talisman had reached an all-time high.

5月4日,全球第二大数字货币以太坊的价格突破3500美元,24小时内价格上涨近13%。3500美元的价格,也意味着以太坊创出了价格的历史新高,并且这发生在比特币价格回调的一个月内。截至5月5日早上,以太坊价格维持在3300美元。

On May 4, the second-largest digital currency in the world reached $3,500 at a 24-hour price, with prices rising by almost 13 per cent. Prices of $3,500 also mean that the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the price of the house of the house of the house, which was maintained at $3,300 in the price of the price of 5 May.

以太坊的这种强势,与比特币近期弱势直接相关。数字货币市场与A股的轮动和结构性调整,具有相似的特征。在贵州茅台最近持续弱势震荡之际,许多二线蓝筹品种,在最近的A股市场中走出独立行情,甚至创出历史新高。

Digital money markets have similar features to A’s rotation and structural adjustment. At a time of recent and continuing vulnerability shocks in the Kudo in Guizhou, many of the two-line blues have emerged from independence in the recent A’s market, or even from historical heights.

也正因为此消彼长的市场特点,以太坊的强势使得一些投资者认为,以太坊恐怕会成为比特币的最大空头!

And because of its preponderance of market characteristics, the strength of the Tai Ho has led some investors to believe that it would be the biggest void for Bitcoin!

以太坊或成比特币最大空头?

“长期来看,我确实认为比特币的空头就是以太坊。”知名交易员和分析师Crypto Cobain认为,如果以太坊持续上涨超过比特币的市值,那么这可能会损害领先的加密资产的成功,因为长期的比特币资产持有者会将其持有的资产换为以太坊。

“In the long run, I do think that Bitcoin's empty head is Etheria.” Crypto Cobain, a well-known trader and analyst, argues that if the market value of Bitcoin continues to rise in the same direction, it could undermine the success of the leading encrypted asset, because long-term Bitcoin asset holders would trade their holdings for Etheria.

券商中国记者也注意到,比特币在全球数字货币市值的占比,一度在2017年3月达到80%,包括以太坊在内的诸多数字货币市值占比只有20%。而今,随着山寨币价格的苏醒,比特币的市值占比日渐下降,在2019年8月,比特币的市值占比降至70%,山寨币的市值占比上升到30%,在2020年7月,比特币的市值占比又降至60%,

Chinese journalists also note that Bitcoin’s share of the global market value of digital currencies reached 80 per cent in March 2017, with only 20 per cent of the market value of many digital currencies, including the Pacific. Today, with the rise of the price of the mountain currency, the market value of Bitcoins is declining, falling to 70 per cent in August 2019, and the market value of the mountain coins rose to 30 per cent, and to 60 per cent in July 2020.

随着2021年以来,以太坊的价格的持续走强,截至2021年5月5日,在加密市场整体市值中,比特币的市值占比已降至47%,以太坊的市值占比则升至18%。

With the continued strengthening of the price of Taiwan since 2021, by 5 May 2021, the market value of Bitcoin had fallen to 47 per cent of the overall market value of the encryption market, and to 18 per cent of the market value of the Taiyeon market.

市场研究公司FundStrata表示,加密货币的叙事正在从比特币转向以太坊,今年将以太坊的目标价格定为1万美元。由于以太坊网络上正在开发新的金融应用程序,因此FundStrata对以太坊看好,该应用程序在过去一年中规模显著增长。这些应用程序为以太坊网络产生的费用约为比特币的3倍,而比特币的市值为3倍。FundStrata还预计今年比特币将达到10万美元,而数字货币的总市值将达到5万亿美元。

According to the market research company Fundstrata, crypto-currency narratives are shifting from bitcoin to etherp, with a target price of $10,000 this year. The Fundstrata is looking forward to the development of a new financial application on the etherm network, which has grown significantly over the past year. These applications cost about three times more than Bitcoin and three times the market value of Bitcoin. Fundstrata also expects to reach $100,000 this year, while the total market value of the digital currency will reach $5 trillion.

比特币贡献不足5%,这家公司炒币9成盈利来自以太坊

就像今年2月初贵州茅台市值达到3万亿后,聪明的资金,就已结开始增加配置其他股票资产。当比特币价格一度接近惊人的7万美元后,越来越多的资金,也正在流向以太坊,而不是只买比特币。

Just as early in February, when the market value of Maotai in Guizhou reached $3 trillion, smart money began to increase the allocation of other equity assets. When Bitcoin prices were once close to an amazing $70 million, more and more money was flowing to Etheria, not just to buy bitcoin.

5月3日,纳斯达克上市的数字支付技术公司Mogo宣布已购买约146枚以太坊,平均价格为2780美元,Mogo计划将其现金和投资组合价值的5%投资至加密货币。该公司已经投资了比特币,迄今为止在公开市场上收购了约18枚比特币,交易的平均价格为33083美元。

On 3 May, the digital payment technology company, Mogo, listed by NASDAQ, announced that it had purchased about 146 e-Taiwans at an average price of $2780, and that Mogo planned to invest 5 per cent of its cash and portfolio value in encrypted currency. The company had invested in bitcoins and had so far acquired about 18 bitcoins on the open market, with an average transaction price of $33,083.

豪掷6亿元投资数字货币的港股上市公司美图公司,它在数字货币上的投资策略,就极具前瞻性——它没有把“宝”压在比特币上,而是将已结超涨的比特币作为第二大资产,而将以太坊作为持仓比重最大的资产,这显然不同于传统的“韭菜”——即那些把比特币简单等同于数字货币的股票小散。

The investment strategy of the Hong Kong stock listing company Metas, which has invested $600 million in digital currency, is very forward-looking — rather than plunging the treasure on bitcoin, it is treating the overstretched bitcoin as the second largest asset, instead of the overstretched bitcoin as the largest warehouse-holding asset, which is clearly different from the traditional “cooking” — that is, the small dissipation of stocks that simply equate bitcoin to digital currency.

按照美图公司投资的成本看,这家港股公司持有以太坊总计31000个,持仓成本约1480美元,截至2021年5月5日早上,以太坊的单价突破3330美元,这意味着美图公司在以太坊上的盈利高达5735万美元,折合人民币的盈利为3.71亿元。

In terms of the cost of USI’s investment, the Hong Kong stock company held a total of 31,000 Etherias at a warehouse cost of approximately US$1,480 and, as of the morning of 5 May 2021, exceeded US$ 33,330 at a unit price, which means that USI made up US$ 57.35 million in profits in Ether and US$ 371 million in profits equivalent to the RMB.

而在比特币的投资上,美图公司的比特币持仓均价约为52653美元一枚,美图公司合计持有940.1枚比特币。截至2021年5月5日凌晨,比特币的价格维持在54800美元附近。也就是说,美图公司在比特币上的盈利约为200万美元,折合人民币的盈利为1294万元。

In the case of Bitcoin investments, the average price of Bitcoin was approximately $52,653 and Metco held 940.1 bitcoins. By early 5 May 2021, Bitcoin prices remained close to $54,800. That is to say, it earned approximately $2 million on Bitcoin and 1.294 million won on the renminbi.

总体而言,美图公司6亿元数字货币投资,总计获利3.84亿元人民币,其中以太坊对利润的贡献高达96.6%,比特币对盈利的贡献仅为3%。

Overall, USI invested $600 million in digital currency, earning a total of RMB 384 million, of which the contribution of Ethio to profits amounted to 96.6 per cent, while the contribution of Bitcoin to profits amounted to only 3 per cent.

为何走弱的比特币还有足够的关注度?

Why does the weak bitcoin have enough attention?

虽然比特币在短期阶段上的盈利贡献能力大幅减弱,但这不意味着,比特币的吸引力彻底输给以太坊。

While Bitcoin's ability to make profitable contributions in the short term has diminished significantly, this does not mean that Bitcoin's appeal has been completely lost to Ether.

理解这个问题,就像A股投资者看待贵州茅台一样。尽管贵州茅台在大幅上涨后,已导致许多追高的投资者损失惨重,但贵州茅台的价格只要下跌充分,就能吸引更多的投资者重新进入。

Understanding this problem, like A-share investors view the Guo Dai in Guizhou. Despite the massive rise that has led to heavy losses for many of the high-hungry investors, you can attract more investors to re-enter if prices fall well.

而对许多A股的基金经理而言,看待贵州茅台也不仅仅在于一两个季度的股价表现。尽管许多基金经理承认,拿着贵州茅台可能面临短期不赚钱、甚至跑输那些持有其他股票的基金经理,但根据基金公司的季报可以看出,包括张坤、刘彦春、王宗合在内的知名基金经理,依然在今年第一季度末的十大重仓股中,给予贵州茅台以足够的持仓比重。

For many fund managers in Unit A, it is not just about one or two quarters of stock price performance. While many fund managers admit that they may face short-term failure to make money or even run out of fund managers who hold other shares, the Fund’s quarterly reports show that well-known fund managers, including Zhang Quan, Liu Yanchun, Wang Chongqing, still hold enough warehouse weight in the top ten heavy warehouse holdings at the end of the first quarter of this year.

上述A股基金经理持仓贵州茅台的心态、策略,与大机构继续持仓比特币的心态如出一辙,尽管比特币价格似乎太高,向上的弹性或在一两个季度内继续跑输,但这些机构依旧将比特币作为主要的资产。

The above-mentioned A share fund manager has the same mentality, strategy and attitude as the big agencies continue to hold the kangaroo bitcoin, and despite the seemingly high price of bitcoin, its elasticity or its continued loss in one or two quarters, they still use bitcoin as their principal asset.

4月30日,美股上市公司MicroStrategy公布了其2021年第一季度财报。财报显示,其2021年第一季度总共以10.86亿美元购买了约20857枚比特币,平均购买价格为每枚52087美元。

On 30 April, the United States stock company MicroStrategy published its first quarter of 2021, which showed that it had purchased some 20857 bitcoins for a total of $1,086 million in the first quarter of 2021, at an average purchase price of $52,087 per unit.

也包括对数字货币情有独钟的特斯拉公司CEO马斯克,他在今年一季度投资15亿美元进入数字货币市场,这15亿美元并未进行分散投资,而是全部买入比特币这一单一品种。显而易见的是,作为对数字货币市场有深刻理解的马斯克,他对以太坊的强势表现,但他依旧只买比特币,这体现出马斯克个人的投资理解,与A股基金经理明知贵州茅台在一两个季度内,不可能跑赢其他二线蓝筹,但这些基金经理依旧将非常大的投资比重,放在贵州茅台这只股票上。

It also includes Tesla's CEO, who invested $1.5 billion in the digital currency market in the first quarter of this year, which did not spread out, but bought all of it in a single variety of bitcoins. Clearly, as a man with a deep understanding of the digital money market, Mr. Muske, who demonstrated the power of Ether, but who still buys only bitcoins, which is a reflection of Mask’s personal understanding of investment, and the fact that it is impossible for the manager of the A-share fund to win the other two-line blues within a quarter or two, these fund managers still put a very large share of the investment on that stock in your state.

比特币、以太坊融资融券账户爆仓多

bitcoin, of .

值得一提的是,在最近以太坊大幅上涨、比特币持续阴跌的一个月,数字货币市场也出现了大规模爆仓的现象。

It is worth mentioning that a month after the recent sharp rise in the Etherm and the continuing decline of Bitcoin, the digital currency market has also witnessed large-scale busts.

显然,一个基本的常识是,买入比特币、以太坊本身不会爆仓,就像一个A股的投资者,买入贵州茅台,也不可能面临爆仓,但投资者如果以10倍杠杆,在2500元的股价附近买入贵州茅台——截至目前,贵州茅台已跌至2000元附近,那么该股票投资者所持仓的10倍杠杆,若不进行追加保证金,则该股票账户必然爆仓。

Clearly, it is a basic common sense that buying in bitcoin will not per se blow up a warehouse, like an A-share investor, buying in Guizhou huts, and it will not be possible to face an explosion, but if an investor uses 10 times leverage to buy in Guizhou huts near the value of $2,500 — so far, your state has fallen close to $2,000 — then the stock investor holds a ten-fold leverage of the warehouse, and if no additional bond is made, the stock account will collapse.

比特币、以太坊的爆仓,也是因为投资者高杠杆交易所致。

Bitcoin, Etherburg, was also the result of high-leveraging transactions by investors.

券商中国记者注意到,截至2021年5月5日早上,共有142292人在最近24小时内爆仓,合计爆仓金额10.2亿美元,折合为66亿元人民币。上述10.2亿美元的爆仓金额中,最大的爆仓来自做空比特币,比特币的融资账户爆仓约2.47亿美元,其次是以太坊的融资账户,爆仓2.3亿美元,瑞波币融资账户排名第三,爆仓金额为4621万美元

As of the morning of May 5, 2021, a total of 1,42292 people exploded in the last 24 hours, amounting to $1.02 billion, equivalent to $6.6 billion. Of the $1.02 billion, the largest explosion came from empty bitcoin and bitcoin's financing account, amounting to $247 million, followed by Ethako's financing account, $230 million, Riboco's finance account, third place, and $4.62 million.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论