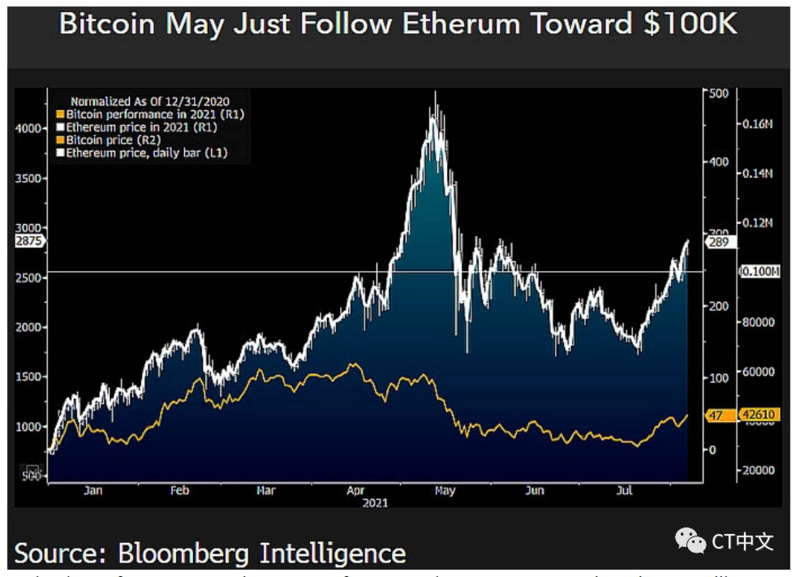

自今年年初以来,以太坊(ETH)的市场表现已超过比特币(BTC),增长超过320%,而比特币的回报率为54%。然而,据彭博资讯(Bloomberg intelligence)高级大宗商品策略师迈克·麦克格隆(Mike McGlone)称,比特币将很快赶上以太坊的涨幅,这甚至可能将其价格推高至10万美元。

Since the beginning of the year,

8月9日,当比特币的价格超过46000美元时,该分析师在推特上表示:“如果比特币今年赶上以太坊的表现,最大加密货币的价格将接近100000美元。”

On 9 August, when the price of bit exceeded $46,000, the analyst tweeted: “If Bitcoin caught up with Taiku this year, the price of the largest encrypted currency would be close to $100,000.”

比特币表现与以太坊表现(2021年)

bitcoins and Ethernos (2021)

尽管McGlone没有详细说明使比特币的年增长率与以太坊的年增长率相当的因素,但他在上一份关于加密货币的报告中提到了一些催化剂,这些催化剂可以将比特币的价格推高到六位数。报告指出:

Although McGlone did not elaborate on the factors that make Bitcoin's annual growth rate equal to that of Ether, he mentioned in his last report on encrypted currency a number of catalysts that could push bitcoin prices up to six digits. The report states:

在比特币和以太坊的80%左右,彭博银河加密货币指数(BGCI)的大部分表现来自人们对新兴加密货币作为全球数字储备资产的更广泛理解,以及金融技术和货币系统的加速数字化。

In about 80 per cent of Bitcoin and Etheria, much of the BGCI is reflected in the broader understanding of emerging encrypted currencies as global digital reserve assets, as well as in the accelerated digitization of financial technology and monetary systems.

比特币的支持者认为,它可以与美元竞争,成为全球储备资产。一个重要原因是这种加密货币的固定供应上限,在支持者看来,这使其成为比美元更稳健的货币(仅美联储在2020年就印制了3.1万亿美元)。

Bitcoin’s supporters argue that it can compete with the dollar and become a global reserve asset. An important reason is the fixed supply cap for this encrypted currency, which, in their view, makes it a more robust currency than the dollar (the Fed printed $3.1 trillion in 2020 alone).

结果,比特币去年上涨了260%,反映出投资者将其视为对抗美元引发的通胀的工具。

As a result, Bitcoin rose by 260 per cent last year, reflecting investors'perception of it as a tool against dollar-induced inflation.

比特币近年来的价格表现

Bitcoin's price performance in recent years

在2021年初的调查中,高盛还指出,对比特币的需求受到机构投资者的抑制,包括养老基金、全球主权财富基金和基金会。尽管如此,由于缺乏明确的加密货币法规,QFII即使拥有数万亿美元的储备,也无法将这些基金投入比特币市场。

In a survey in early 2021, Goldman Sachs also pointed out that the demand for Bitcoin was constrained by institutional investors, including pension funds, global sovereign wealth funds, and foundations. Despite this, QFII, even with trillion-dollar reserves, could not invest these funds in the Bitcoin market in the absence of clear, encrypted monetary regulations.

autonomy capital management分析师表示,受监管的比特币交易所买卖基金将加速比特币在机构中的应用。此外,他们表示,尽管投资者认为比特币是一种高度波动的资产,但它与传统风险因素缺乏相关性,这对他们来说是个好消息;

Moreover, they say that while investors consider Bitcoin to be a highly volatile asset, its lack of relevance to traditional risk factors is good news for them;

autonomy的分析师补充道:

Autonomy's analyst added:

如果我们假设比特币在投资者投资组合中的权重与当前黄金相同,其价格将是2.8倍,即约112000美元。

If we assume that Bitcoin has the same weight as the current gold in the investor's portfolio, the price would be 2.8 times that of approximately $112,000.

虽然比特币有望在华尔街被采用,但在2020年12月达到约73%的峰值后,其主导地位显著下降。现在这一比例为47.17%,反映出交易员已将投资转向其他数字资产。

Although Bitcoin is expected to be adopted on Wall Street, its dominant position declined significantly after reaching a peak of about 73 per cent in December 2020. It now stands at 47.17 per cent, reflecting the turnover of investments to other digital assets.

尤其是以太坊成为比特币领先指数下跌的最大受益者。其在加密货币行业的主导地位已从2020年12月的10.06%上升到撰写本文时的20.05%。

In particular, it has been the largest beneficiary of the decline in the Bitcoin leading index. Its dominance in the crypto-currency sector has risen from 10.06% in December 2020 to 20.05% at the time of writing.

以太坊领先指数在2021年几乎翻了一番

It almost doubled in 2021.

以太坊主导地位的上升部分归因于NFT的爆炸性增长。NFT是一种数字文档,其原创性和稀缺性可以通过公共账户进行验证。

The rise in the dominance of the Tai Po is partly attributable to the explosive growth of NFT. NFT is a digital document whose originality and scarcity can be verified through public accounts.

此外,去中心化化金融的蓬勃发展,包括基于以太坊区块链的贷款和其他金融服务,促进了以太坊在公众中的采用。

In addition, the boom in decentralized finance, including loans and other financial services based on the Etheria , has facilitated its introduction in the public.

以太坊开发者也在采取措施扩大区块链。8月5日,以太坊通过伦敦hard fork更新了其软件,以成为未来成熟的利益证明协议。

ETA developers are also taking steps to expand the chain of blocks . On August 5, ETA updated its software through London hard fork to prove its future maturity.

这一更新还增加了供应的通缩压力,改进建议EIP-1559带来了降低成本的功能。仅在第一天,EIP-1559就摧毁了价值200万美元的ETH。

This update has also increased supply deflationary pressures, and improved recommendation EIP-1559 has introduced cost-cutting functions. On the first day alone, EIP-1559 destroyed $2 million worth of .

根据超声波资金,截至周一,EIP-1559摧毁了价值约550万美元的ETH。

According to ultrasound funds, EIP-1559 destroyed ETH, valued at approximately $5.5 million, as of Monday.

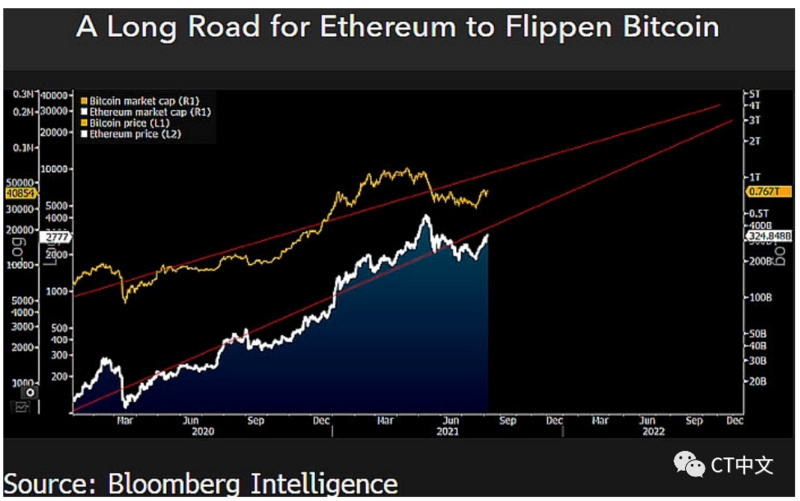

McGlone指出,以太坊过去的表现表明,到2022年或2023年,其市场价值可能超过比特币。然而,分析师将比特币的目标价格定为100000美元。

McGlone points out that the past performance of Ethio suggests that by 2022 or 2023, its market value may exceed that of Bitcoin. However, analysts set the target price of Bitcoin at $100,000.

预计以太坊的市场价值将与比特币在2023年达到峰值时的市场价值相同

is expected to have the same market value as Bitcoin at its peak in 2023 .

他说:“尽管我们看到比特币的价格上涨至10万美元,但似乎没有什么能阻止以太坊的市值超过比特币的进程。”

He said, “Although we see an increase in the price of bitcoin to $100,000, nothing seems to stop the process where the market value of Ethio exceeds bitcoin.”

根据区块链中心的数据,到目前为止,以太坊在网络交易和总交易费用方面已经超过比特币。

According to data from the block chain centre, Ether has so far exceeded Bitcoin in terms of network transactions and total transaction costs.

Title of the article: analyst: .

文章链接:https://www.btchangqing.cn/311015.html

更新时间:2021年08月11日

Update: 11/08/2021

本站大部分内容均收集于网络,若内容若侵犯到您的权益,请联系我们,我们将第一时间处理。注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论