摘要:离比特币减半还有90天左右,昨日至今主流币再次强势反攻,比特币强弱指数已破90点,后续大盘有望继续上行。对于比特币减半行情,预计减半前会有一个小牛行情,但之后有所回调,而在减半后的一年至两年内有可能出现疯牛行情。

Summary: About 90 days before Bitcoin is halved, the mainstream currency has re-attacked again since yesterday, and the Bitcoin Power and Power Index has broken 90 points, and the next round is expected to continue. For Bitcoin, it is expected that there will be a calf before it is halved, but then there will be a return, and there will be a mad cow in between one and two years after it is halved.

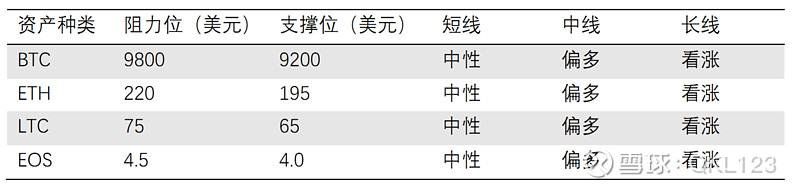

据QKL123数据统计,2020年02月06日16时,8BTCCI大盘指数报14634.55点,24小时涨跌为+6.16%,反映大盘明显上行;总成交额9835.40亿元,24小时变化+28.01%,市场活跃度明显增加。比特币强弱指数报85.03点,24小时涨跌-3.35%,比特币在整个市场的相对表现明显变弱;Alternative情绪指数为61(前值53),市场情绪表现为贪婪。

According to data from QKL123, on 0602, 2020, at 16:55, the 8BTCCI index reported 14634.16 per cent, a 24-hour up/down to +6.16 per cent, reflecting a clear upswing; a total transaction of 98,354 million yuan, a 24-hour change + 28.01 per cent, and a marked increase in market activity. The Bitcoin weakness index reported 85.03 points, a 24-hour up/down - 3.35 per cent, and the relative performance of Bitcoin in the market as a whole was significantly weaker; the Alternative mood index was 61 (formerly 53), and market sentiment was characterized by greed.

市值前十加密资产中(剔除USDT),BCH 24小时上涨幅度最大(+14.84%),XRP 24小时上涨幅度最小(+0.97 %)。ChaiNext USDT场外折溢价指数报100.27,24小时涨跌为+0.07%;USDT 报6.98元,24小时涨跌为-0.43%;USDC报7.00,24小时涨跌为-0.50%。

Of the top 10 encrypted assets with market value excluded from USDT, the biggest increase in BCH 24-hour (+14.84 per cent) and the smallest increase in XRP 24-hour (+0.97 per cent). The ChaiNext USDT off-site premium index reported 100.27 and the 24-hour increase fell to +0.07 per cent; the USDT reported $6.98, with a 24-hour increase and decline of -0.43 per cent; and the USDC reported 7.00, with a 24-hour increase and decline of -0.50 per cent.

分析师观点:

Analyst perspective:

近期,减半行情成为当下的热议话题。按照目前比特币的全网算力等数据进行估算,距离下一次比特币减半还有90天,比特币每四年的区块奖励减半预计在05月初发生。虽然在此前对减半行情曾多次提及,这里有必要再做一个分析总结,以作前瞻。

According to current data such as Bitcoin’s Web-wide computing, 90 days remain before the next bitcoin is halved, and the four-year block reward of Bitcoin is expected to be halved by early 05. Although this has been mentioned many times before, there is a need for another analytical summary to look ahead.

这里将减半行情一分为二:一个是减半前的行情走势(未来1-3月),一个是减半后的行情走势(未来1-2年)。

There will be a two-fold split: one before halving (for the next January-March) and one after halving (for the next 1-2 years).

减半前,受到比特币供给增量减半的利好预期,同时叠加阶段性反弹,很可能会延续一波明显的上涨行情,但一旦利好预期被市场兑现之后,加上区块奖励减半对矿工的冲击,很可能会出现一个较大的回调整理。预计市场价格表现上,很可能和2012年减半前的相似,都出现了一个明显的小牛和小熊,后续两个月左右比特币价格可能会冲击高到13000美元左右进行回调整理。

The expected benefits of halving the bitcoin supply increase by half, coupled with a build-up-phase rebound, are likely to perpetuate a significant upturn, but once the benefits are expected to be realized by the market, coupled with the impact of block incentives to halve on miners, there is likely to be a larger readjustment. Market price performance is expected to be similar to that of pre-2012, with a distinct calf and bear, with prices likely to hit about US$ 13,000 in the next two months or so.

减半后,市场需求并不会在短时间内出现递增,比特币供给增量的减半将会作为一个疯牛行情的蓄力点,长期走势虽然向好,但还需要结合比特币或加密资产的基本面来进行跟进判断。从历史表现来看,在未来的1-2年很可能会迎来一个疯牛行情,但需要有不断利好的消息催化。预计市场价格表现上,下一次疯牛行情有可能达到10万美元的最高点,但从估值模型上来看减半后落到5万美元左右。

After halving, market demand will not increase in a short period of time, and halving the volume of bitcoin supply will serve as a stamina for mad cow behavior. Long-term trends, while positive, will need to be followed up in conjunction with the basics of bitcoin or encrypted assets.

另外,观察近一年来比特币强弱指数(BTCX)的表现,在去年的09月初和12月底出现了两个峰值(116和111),相对去年03月至04月份的低谷,翻了近一倍多。但近日,BTCX已经跌破近六个月以来的低点(90),主流山寨币表现相对强势,目前已经摆脱久违的阴霾,这对于大盘来说是一个较强的支撑信号,后市大盘走势依然乐观。

Moreover, observing the performance of the Bitcoin weak index (BTCX) over the past year, two peaks (116 and 111) peaked at the beginning of September and the end of December last year, nearly doubling from the lows of 2003-04 last year. In recent days, however, BTCX has fallen through the lows of nearly six months (90), the relatively strong performance of mainstream mountain coins, which are now emerging from a long-overdue shadow, is a strong sign of support for the big plate, and the post-market momentum remains optimistic.

一、现货BTC行情

i, 昨日BTC最低触及9100美元后转上,今日凌晨02时有小幅放量,最高触及9700美元,尝试上攻未果,目前在9600美元附近震荡,短时站稳9600美元的可能性较大。 Yesterday, BTC moved up with a minimum of $9,100. At 0200 this morning, a small amount was released, reaching a maximum of $9,700. The attempt was unsuccessful. The current shock near $9,600 is more likely to hold on to $9,600 in a short period of time. 二、现货ETH行情 ETH在昨日最低触及185美元之后开始上行,于昨日晚间开始向上突破,空军力量相对薄弱,并无明显的量能释放,但上方面临筹码较为集中区域,压力位220美元。日线RSI显示,短时超买严重,回调震荡可能性较大。 The ETH started moving up after yesterday’s lowest touch of $185, and yesterday evening it began to break upwards, with the air force relatively weak and with no apparent amount to release, but with a more concentrated leverage area, with a pressure position of $220. The Sunline RSI shows that short-time overpurchases are serious, and retortion shocks are more likely. 三、现货LTC行情 BTC长期趋势转好,未来一至两年有望迎来疯牛行情。智能合约平台龙头ETH、山寨币龙头LTC、DPoS龙头EOS可逢低配置。 The BTC’s long-term trend is positive, and it is expected to be a mad cow for the next one to two years. 2.中线(1-3月) 2. Midline (January-March) BTC站上200日均线,叠加减半利好预期,BTC有望走出一波上涨行情,目前并未结束,可逢低加仓。 On the 200-day average of BTC, which is expected to be reduced by half, the BTC is expected to move out of a wave of upswings, which is not yet over, at a time of low upkeep. 3.短线(1-3天) 3. Short lines (1-3 days) 短时超买,观望为主。 Short buy, long wait and see. 附录:指标释义 Appendix : Interpretation of indicators 1. 8BTCCI大盘指数 1. 8BTCI Large Disc Index 8BTCCI大盘指数由现有区块链全球市场中规模大、流动性好的最具代表性Token组成,以综合反映整个区块链Token市场的价格表现。 The 8BTCCI index consists of the largest and most representative Token in the global market of the existing block chain to reflect the price performance of the Token market as a whole. 2.比特币强弱指数 2. Bitcoin Weak Index 比特币强弱指数(BTCX)反映比特币在整个Token市场兑换情况的指标,进而体现比特币在市场中的竞争强弱,用来衡量比特币对一揽子Token相对价格的变化程度。BTCX指数越大,说明比特币在Token市场越强势。 The Bitcoin Power and Power Index (BTCX) reflects the index of bitcoin conversion across the Token market, and thus the extent to which bitcoin is competitive in the market and measures the extent to which bitcoin changes relative to the Token basket. The bigger the BTCX index, the stronger the bitcoin is in the Token market. 3.Alternative情绪指数 3. Alternative Emotional Index 恐惧&贪婪指数(Fear & Greed Index)反映市场的情绪变化,0意味着“极度恐惧”,100意味着“极度贪婪”。该指标的成份包括:波动性(25%),交易量(25%),社交媒体(15%),网络问卷(15%),市场占有率(10%),趋势(10%)。 The Fear & Greed Index (FEAR & Green Index) reflects changes in the mood in the market, with 0 meaning “extreme fear” and 100 meaning “extreme greed”. The components of the indicator include volatility (25 per cent), turnover (25 per cent), social media (15 per cent), web-based questionnaires (15 per cent), market occupancy (10 per cent) and trends (10 per cent). 4.USDT场外折溢价指数 4. USDT off-site premium index ChaiNext USDT场外折溢价指数(USDT OTC INDEX)由 USDT/CNY 场外价格除以离岸人民币汇率再乘以 100 后获得。指数为100时表示USDT平价,指数大于100表示USDT溢价,小于100则表示USDT折价。 The ChaiNet USDT off-site premium index (USDT OTC INDEX) is obtained by USDT/CNY off-site prices multiplied by 100 RMB. The index is 100 for USDT parity, more than 100 for USDT premium, and less than 100 for USDT discount. 5.资金净流入(出) 5. Net financial inflows (out/out/out/out/out/out/out/) 该指标反映二级市场资金流入流出情况。通过计算全球交易平台(未剔除虚假交易)的流入资金与流出资金之差,正值表示资金净流入,负值则表示资金净流出。其中,上涨时成交额计为流入资金,下跌时成交额计为流出资金。 The indicator reflects flows to and from the secondary market. By calculating the difference between inflows to and outflows from the global trading platform (where false transactions have not been removed), the positive value represents net inflows and the negative value represents net outflows. 6.BTC-囤币指标 6. BTC - Money hoarding indicator 囤币指标由微博用户ahr999创建,辅助比特币定投用户结合择机策略做出投资决策。该指标由两部分的乘积组成,前者为比特币价格与比特币200日定投成本的比值;后者为比特币价格与比特币拟合价格的比值。一般情况下,当指标低于0.45时更适合增大投资额(抄底),时间区间占比约为21%;当指标位于0.45和1.2之间时适合采取定投策略,时间区间占比约为39%。 The index was created by microblogging user ahr999 to support investment decision-making by Bitcoin target users in a combination of machine-selection strategies. The indicator consists of two components: the ratio of bitcoin prices to bitcoins 200 days of bid; and the ratio of bitcoins to bitcoins to bitcoins. In general, the indicator is better suited to increase investment when it is below 0.45, with a time-zone ratio of about 21%; and the indicator is between 0.45 and 1.2, with a time-zone ratio of about 39%. 注:加密资产属于高风险类资产,本文仅供决策参考,不构成投资建议。 Note : Encrypted assets are classified as high-risk assets for decision-making purposes only and do not constitute an investment recommendation.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论