加密货币市场在不断发展,作为投资者和爱好者,了解推动这些数字资产价值的潜在因素非常重要。评估加密货币时要考虑的最关键方面之一是它的供应。

As investors and lovers, it is important to understand the potential factors that drive the value of these figures. One of the most critical aspects to be considered in assessing encrypted money is its availability.

对于按市值计算的第二大加密货币以太坊而言,鉴于最近转向 ETH 2.0 和权益证明共识机制,了解其供应至关重要。

For the second largest encrypt currency in market value terms to be known to the Tails, it is essential to know its supply in view of the recent shift to an ETH 2.0 and a consensus-building mechanism for proof of interest.

在本文中,我们将深入探讨以太坊供应的各个方面,包括以太坊的数量、总供应量、通货膨胀、挖矿和质押、供应分配以及对供应的任何限制。

In this paper, we will explore in depth the various aspects of the supply of the etherm, including the number of etherms, total supply, inflation, mining and pledge, distribution of supplies and any restrictions on supply.

是否投资 ETH 或 BTC 的决定性因素之一,尤其是对于初学者加密货币投资者而言,是最大供应量。

One of the determining factors for whether or not to invest in ETH or BTC is the largest supply, especially for beginner encrypting currency investors.

比特币极端主义者进一步强化了这一点,他们打压了在源代码中没有供应上限的加密货币(通货膨胀货币)。然而,以太坊向股权证明的转变彻底改变了这场辩论。

Bitcoin extremists have further reinforced this by crushing encrypted currencies (inflationary currencies) that do not have a supply ceiling in the source code. However, the shift to equity as evidenced by the Tails has completely changed the debate.

如果您想了解还剩多少比特 币 ,我们有一篇单独的文章。

If you want to know how many bits of coin there are left, we have a separate article.

以太坊的供应是评估加密货币时要考虑的关键因素。它将帮助您了解资产的稀缺程度以及相对于需求存在的资产数量。随着越来越多的人试图购买稀缺资产,相对于需求的供应减少可能导致价格上涨。相反,如果硬币相对于需求而言充足,价格可能会下跌,因为买家由于缺乏稀缺性而无法抬高价格。

As more and more people try to buy scarce assets, a reduction in supply relative to demand may lead to higher prices. Conversely, if coins are sufficient to match demand, prices may fall, because buyers cannot raise prices because they are scarce.

那么,目前有多少以太坊?

So, how many Etherms are there?

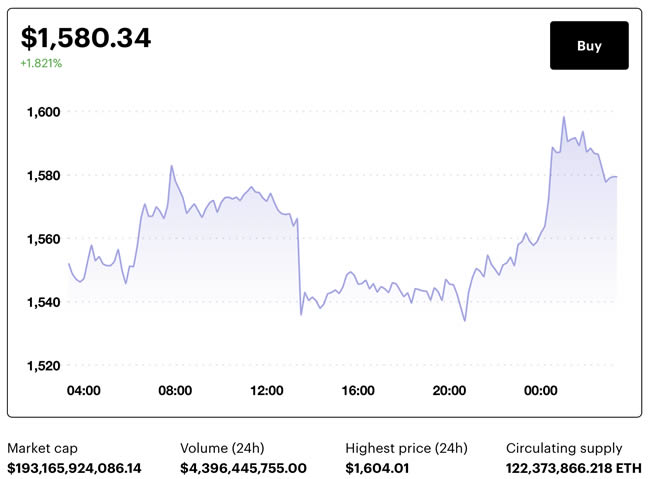

以太坊的总供应量是将永远存在的最大以太币数量。截至 2023 年 1 月 15 日,以太坊的总供应量目前超过 1.223 亿个 ETH。

As of January 15, 2023, the total supply of Etheria is currently over 122.3 million ETHs.

关于 ETH 的统计数据(图片来源)

请务必注意,以太坊总供应量(或以太坊最大供应量)不同于循环供应量。流通供应量是指当前流通并可在市场上交易的以太坊数量。

It is important to note that the total supply (or maximum supply) is different from the circular supply.

实际上,流通供应量总是小于总供应量,因为一些以太坊可能会因忘记私钥或其他因素而丢失。然而,从理论上讲,这两者被认为是相等的,因为没有可靠的方法可以知道确切的循环供应量。

In fact, the flow supply is always smaller than the total supply, because some of the ethers may be lost by forgetting their private keys or other factors. In theory, however, the two are considered to be equal, because there is no reliable way to know the exact circular supply.

还值得注意的是,以太坊的总供应量不同于最大供应量。ETH 是通货膨胀的,这意味着新的以太币会定期添加到总供应量中。

It is also worth noting that the total supply of Etheria is different from the maximum supply. The ETH is inflationary, which means that the new Ether will be added regularly to the total supply.

然而,以太坊网络自转向股权证明以来发生了变化,这可能会影响其通货膨胀率。

However, the changes in the Etherm network since the shift to equity certification may affect its inflation rate.

在 Merge 之前,新的 ETH 是从两个来源生成的:执行层(即主网)和共识层(即信标链)。但是,由于网络转向股权证明,执行级别的发行已完全停止。这使得 ETH 的每日发行量从 13,000 减少到约 1,700。

Before Merge, the new ETH was generated from two sources: the executive level (i.e. the main network) and the consensus level (i.e. the beacon chain). However, the distribution of the executive level has been completely stopped as the network moves to a certificate of equity. This has reduced the daily distribution of ETH from 13,000 to about 1,700.

此外,当 Ether 用于支付 gas 费用时,它会被销毁,这意味着它会从总供应量中移除。这个过程被称为“以太坊货币政策”,它的建立是为了通过引入通货紧缩机制来控制以太币的通货膨胀率。

Moreover, when Ether pays for gas, it will be destroyed, which means it will be removed from the total supply. This process is called &ldquao; with Taiyo monetary policy & rdquao; and it was created to control the inflation rate in the Tails by introducing deflationary mechanisms.

该网络具有自适应的收益率需求曲线。在这方面,网络的目标是在提供足够的新以太币来激励验证者保护网络,同时控制通货膨胀率以确保以太币的价值不会下降得太快之间取得平衡。这被称为“最小可行发行量”。

The network has a profit-rate demand curve for self-adaptation. In this regard, the objective of the network is to balance the provision of sufficient new TTs to incentivize certifiers to protect the network while controlling inflation to ensure that the value of the NT does not fall too fast. This is called &ldquao; the least feasible distribution & rdquao;

在这个系统中,铸造的 ETH 数量将由验证者的数量决定,随着网络活动的增加,通货膨胀率将随着时间的推移而降低。通货膨胀下降的确切速度并不固定,但目前预计将下降到每年 0.52%左右。

In this system, the number of ETHs that are forged will be determined by the number of certifiers, and inflation will decrease over time as network activity increases. The exact rate of inflation decline is not fixed, but is now expected to drop to around 0.52 per cent per year.

如果网络活动足够多(当 gas 价格超过 16 gwei 时),销毁的 ETH 数量可能会大于铸造的 ETH 数量,从而导致通货紧缩。

If network activity is large enough (when gas prices exceed 16 gwei), the number of ETHs destroyed may be greater than the number of ETHs forged, leading to deflation.

自从以太坊转向股权证明以来,每天铸造的以太币数量大幅减少。现在,每天大约发行 1,700 个 ETH。

The amount of Ether coins that have been forged every day has decreased significantly since the shift to equity certification. Now, about 1,700 ETHs are distributed every day.

在以太坊网络过渡到权益证明之前,以太坊区块链基于工作量证明共识机制。在这个系统下,新的以太坊是通过一个称为挖矿的过程铸造的,矿工们竞争验证交易并向区块链添加新区块。

Prior to the transition from the Taiyan network to an entitlement certificate, the Taiyan block chain was based on a workload-based consensus-building mechanism. Under this system, the new site was forged through a process known as mining, where miners competed to validate the transaction and add new blocks to the block chain.

在工作量证明系统下,挖矿的区块奖励固定为每个区块 2 个以太币。鉴于以太坊的区块时间(新区块添加到链中的频率)约为 13 秒,每天铸造的 ETH 总量约为 13,000。

Under the Workload Certification System, the incentive for mining blocks is fixed at 2 tuts per block. Given the time of the blocks in Etheria (the frequency of the new blocks being added to the chain) is about 13 seconds, the total number of ETHs forged per day is about 13,000.

ETH发行量减少的原因是挖矿消耗大量资源;电力,硬件的初始投资以及挖矿所需的时间。因此,必须为矿工发行更多的 ETH 以保持激励。现在以太坊网络切换到 PoS,不再需要矿工,维护网络所需的资源要少得多,因此每天发行的新 Ether 数量急剧减少。

The reason for the decrease in the distribution of ETH is that mining consumes a large amount of resources; electricity, initial investment in hardware, and the time it takes to dig. As a result, more ETHs must be distributed to miners in order to maintain incentives.

很难准确地说出谁拥有最多的以太坊,因为加密货币的所有权通常是匿名的,并且可以分布在多个地址中。

It is difficult to say with precision who owns the largest number of Ethers, since the ownership of encrypted money is usually anonymous and can be spread over multiple addresses.

大多数人的第一个假设是该项目的创始人和主要贡献者Vitalik Buterin 。但这种假设很可能是错误的。

The first hypothesis of most people is Vitalik Buterin, the founder and main contributor to the project. But it is probably wrong.

那么,Vitalik 拥有多少个以太坊?

So, Vitalik has how many Etherms?

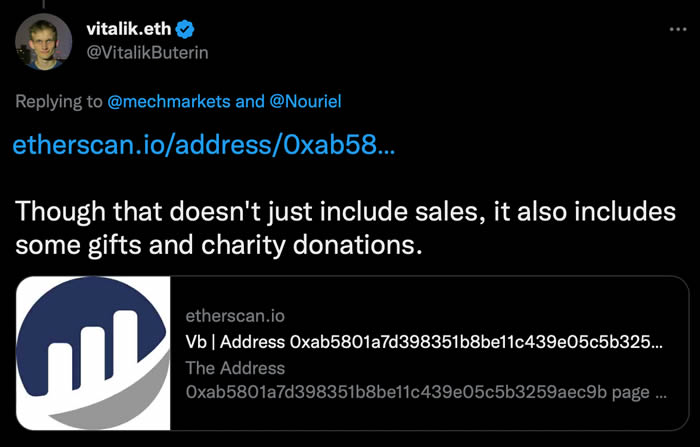

2018 年 10 月,Buterin在Twitter上透露了他的ETH 公共 地址 ,他声称已经进行了“所有大额交易”。通过查看Etherscan上的公共地址,我们可以看到 Vitalik 拥有超过 0.53 个 ETH(在撰写本文时)。

In October 2018, Buterin revealed his ETH public address on Twitter, claiming that “ all major transactions & rdquao; and by looking at the public address on Ethercan, we can see that Vitalik has more than 0.53 ETHs (at the time of writing).

Vitalik Buterin 在 Twitter 上透露了他的 ETH 公共地址。(图片来源)

然而,这个数字可能并不准确,因为大多数有经验的加密货币投资者通常会将资金分散到多个钱包和交易所。因此,准确了解 Buterin 真正拥有多少 ETH 是不切实际的。

However, this figure may not be accurate, because most experienced crypto-currency investors usually spread funds across multiple wallets and exchanges. It is therefore unrealistic to know exactly how much ETH Buterin actually has.

然而,有一些已知实体被认为持有大量以太币。

However, a number of known entities are considered to hold large amounts of NT.

已知最大的以太坊持有者之一是以太坊基金会,该基金会的成立是为了支持网络的发展。根据基金会2022 年的年度报告,它持有 ETH 总供应量的 0.297%,超过其国库的 99%。

According to its annual report for 2022, it holds 0.297% of the total supply of ETH, more than 99% of its national treasury.

以太坊的另一个主要持有者是加密货币交易所,它们持有大量的以太坊作为其资产的一部分,以促进交易和其他交易。这些交易所包括 Binance、Kraken、Bitfinex 等。

Another major holder is the crypto-currency exchange, which holds a large number of Taipas as part of its assets to facilitate transactions and other transactions. These include Binance, Kraken, Bitfinex, etc.

还有一些大型持有者被认为是以太坊的早期投资者,或者随着时间的推移已经积累了大量的以太坊。几个个人持有者拥有大量的以太坊,但很难确定他们是谁,因为加密货币的所有权通常是匿名的。

There are also large holders who are considered to be early investors in the Etherm, or who have accumulated a large amount of Etherm over time. Several individual holders own large numbers of Etherms, but it is difficult to determine who they are, because the ownership of encrypted money is usually anonymous.

从以太坊转向权益证明以来,其通货膨胀率已大幅降低。由于质押而将 ETH 锁定在智能合约中也有助于显着抑制代币的抛售压力。

The rate of inflation has declined significantly since the shift from Etheria to equity. Locking the ETH in smart contracts because of pledges has also helped to curb the sales pressure of the tokens.

所有这一切,再加上活跃的开发人员社区不断努力推动该项目,使以太坊成为一个基础强大的项目,并为投资者提供了更多购买ETH 的理由。

All of this, together with the ongoing efforts of the active community of developers to move the project forward, has made Etheria a strong-based project and has provided investors with more justification for purchasing ETH.

我们希望这篇文章能够回答以太坊代币的数量及其供应变化情况。所以,在积极投资以太坊之前,继续做你的研究,了解更多关于项目的信息并做好计划。

We hope that this article will answer the changes in the number and supply of Taiwan's tokens. So, before actively investing in it, continue to do your research, learn more about the project and plan it.

以上就是有多少个以太坊?深入研究 ETH总量和市值的详细内容,更多关于以太坊总量和市值介绍的资料请关注脚本之家其它相关文章!

That's how many of them are in Etheria? Look into the details of Ether's total quantity and market value. More information about Ether's total and market value is available in other relevant script homes!

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论