原创 PAData PANews

Original PAData PANews

分析师 | Carol 编辑 | Tong 出品 | PANews

Analyst Carol Tong PANews

*Audrey亦对本文有所贡献

*Audrey also contributed to this paper.

近期,比特币一举冲破19800美元创下历史新高,根据CoinMarketCap的统计,截至12月6日,比特币全年涨幅已经达到了168.68%,仅10月以来的涨幅就高达82.17%。关于此轮牛市背后的动因,市场的普遍观点是,机构持续入金推动了币价连续上涨。其中,备受关注的大机构就是灰度。

In the recent past, Bitcoin has broken through US$ 19,800 at an all-time high. According to CoinMarketCap, by 6 December, it had risen by 168.68 per cent a year, or 82.17 per cent since October alone. With regard to the driving force behind this round of cattle, the prevailing view in the market is that continued institutionalization has driven the price of the currency up successively.

灰度是全球最大的数字货币资产管理公司之一,背靠数字货币投资集团(Digital Currency Group, DCG),成立于2013年。通过在美股二级市场发行GBTC、ETHE、LECN等“纸黄金”,灰度成功构连了数字货币市场和传统金融市场,为机构和合格投资者合规地投资数字货币资产提供了平台。再加上灰度设定的不可赎回机制和长达6个月的锁仓期,使其逐渐成为市场上一股强大的多头力量。

Greyscale, one of the largest digital money management companies in the world, was established in 2013 behind the Digital Corporation Group, DCG. By issuing “paper gold” such as GBTC, ETHE, LEG, etc. in the US second-tier market, it has successfully built up digital money markets and traditional financial markets, providing a platform for institutions and qualified investors to invest digital money assets in a compliant manner.

根据灰度发布的季度投资报告,灰度的资管规模从去年第四季度的约6.07亿美元扩大至近期的约125.72亿美元,翻了整整20倍。其中,灰度各产品的资产配置有什么变化?持续买入比特币,是推动此轮币价上涨的最终动力吗?双重出金模式下,灰度基金的套利空间有多大?PAData将通过灰度每日公布的投资数据详解近半年灰度各产品资管规模的变化及其与市场的相关性。

According to the quarterly investment reports issued by Greyscale, the size of the Greyscale has increased from about $607 million in the fourth quarter of last year to about $12,572 million in the recent past, a full 20-fold increase. Of this, how has the asset allocation of the Greyscale products changed?

10种信托基金产品多上线于2018年

近两年无新品

目前,灰度共推出了10种投资产品,其中9种是单一资产信托基金,1种是多元资产基金。BTC Trust是灰度最早推出的产品,始发于2013年9月25日。此后,一直到2017年,灰度才陆续上线了ETC Trust、ZEC Trust和ETH Trust。2018年,随着全球数字货币市场进入第一个发展高峰,灰度不仅推出了第一款多元资产基金Digital Large Cap Fund,还上线了包括BCH、LTC、XRP等在内的5种单一资产基金。但最近两年,灰度始终没有上线新的投资产品。

At present, Greyscale has launched 10 investment products, nine of which are single asset trust funds and one multi-asset fund. BTC Trust was the first product to be launched in Greyscale, which started on 25 September 2013. Since then, it has been on track until 2017, when ETC Trust, ZEC Trust and ETH Trust. In 2018, as the global digital currency market entered its first development peak, Greyscale not only launched the first multi-asset fund, Digital Large Cap Fund, but also five single-asset funds, including BCH, LTC, XRP, etc.

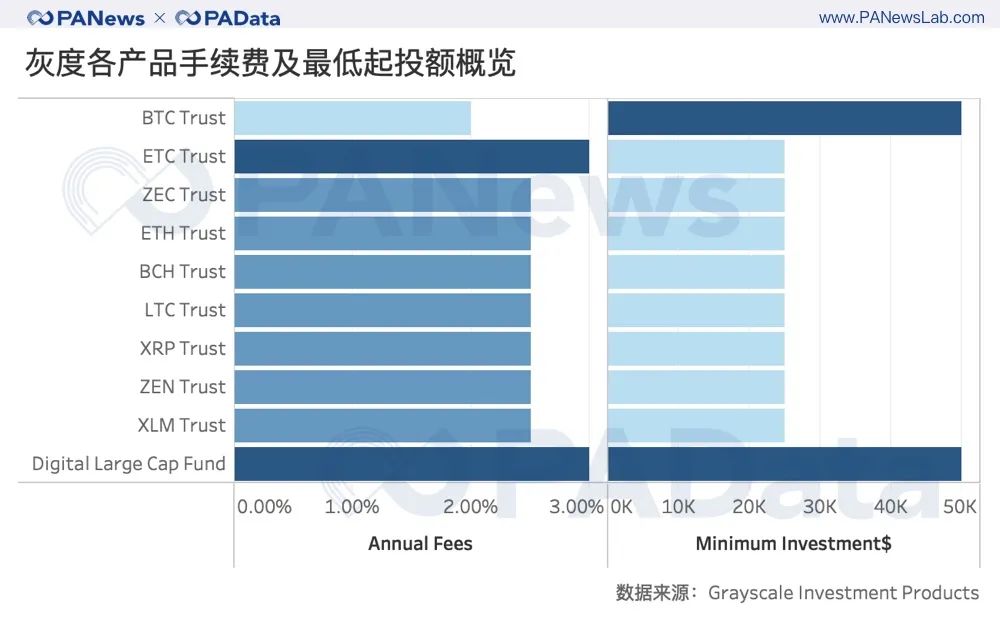

从起投门槛来看,除了BTC Trust和Digital Large Cap Fund要求5万美元以上以外,其他8种投资产品的最低投资额度都是2.5万美元。

From the entry threshold, the minimum investment level for the eight other investment products was $25,000, with the exception of BTC Trust and Digital Large Cap Fund, which requested more than $50,000.

灰度通过收取币本位管理费来获得收益。目前,BTC Trust的年管理费为2%,ETC Trust和Digital Large Cap Fund的年管理费为3%,其他产品的年管理费为2.5%。这些管理费将直接从投资者的数字货币份额中扣除。

Grayscales are profitable by charging local currency administration fees. Currently, BTC Trust has an annual management fee of 2%, ETC Trust and Digital Large Cap Fund 3%, and other products 2.5%. These fees will be deducted directly from the investor’s digital currency share.

从产品模式来看,灰度采用的是一种不可赎回的永续信托模式,投资者通过法币资金或数字货币实物入金后,将得到相应的信托份额,比如比特币对应的信托份额为GBTC,投资者出金只能在6个月锁仓期结束后在美股二级市场上交易信托份额。

In terms of the product model, Greyscale uses an indefensible and permanent trust model, whereby investors receive a corresponding share of the trust, e.g., the relative share of Bitcoin in the trust is GBTC, and the investor's share of the trust can only be traded in the United States stock market at the end of the six-month lock-down period.

资产总额突破125亿美元

近期变动较大

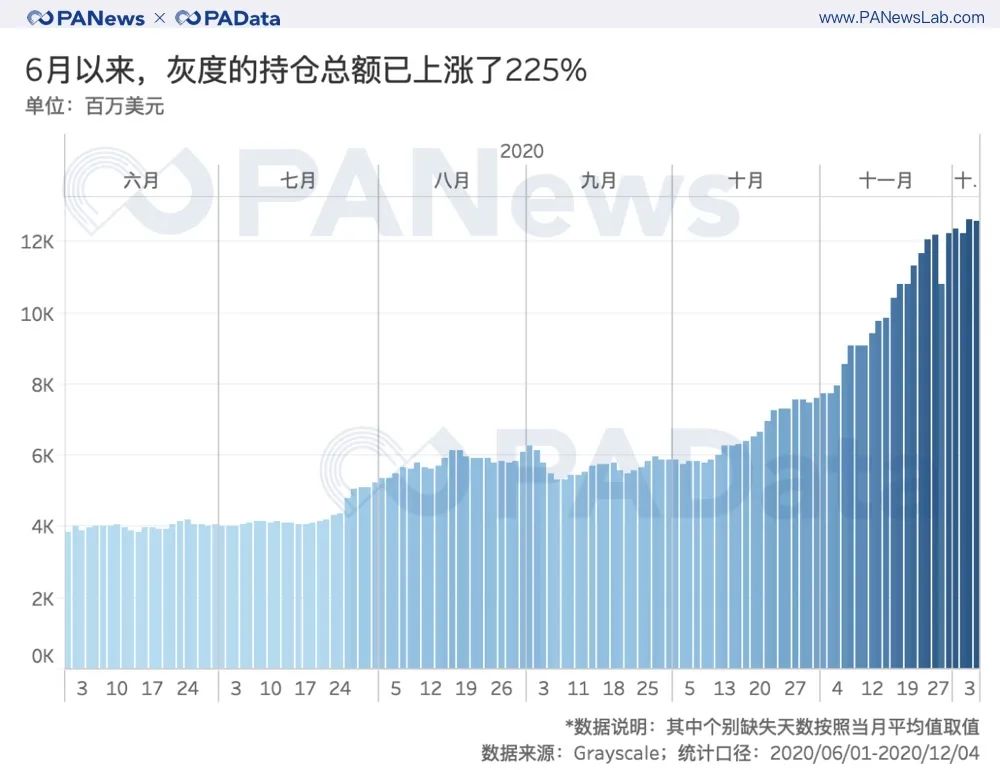

PAData统计了今年6月以来灰度公布的投资数据,数据显示,最近半年,灰度的资管规模从6月1日的约38.67亿美元扩大至12月4日的约125.72亿美元,涨幅达到225%。其中,随着10月以后比特币币价的飙升,灰度的资管规模也快速增长。10月1日至12月4日期间,灰度的持仓总额上涨了114.25%,并且11月以后资管规模基本稳定在100亿美元以上。

PADATA has measured investment data published since June of this year, showing that in the last six months, the size of the grey scale has increased from approximately $3,867 million on 1 June to approximately $12,572 million on 4 December, an increase of 225%. Of this amount, the size of the grey scale has grown rapidly as Bitcoin prices soared since October. Between 1 October and 4 December, the total size of the grey scale rose by 114.25%, and has remained largely stable beyond November at over $10 billion.

从资管规模的变化来看,6月以来,灰度的资管规模平均每日扩大0.95%左右,相当于每日增持约6489.48万美元。

In terms of changes in the scale of funding, since June, the size of the grey scale has increased by an average of around 0.95 per cent per day, equivalent to an increase of approximately $6,484 million per day.

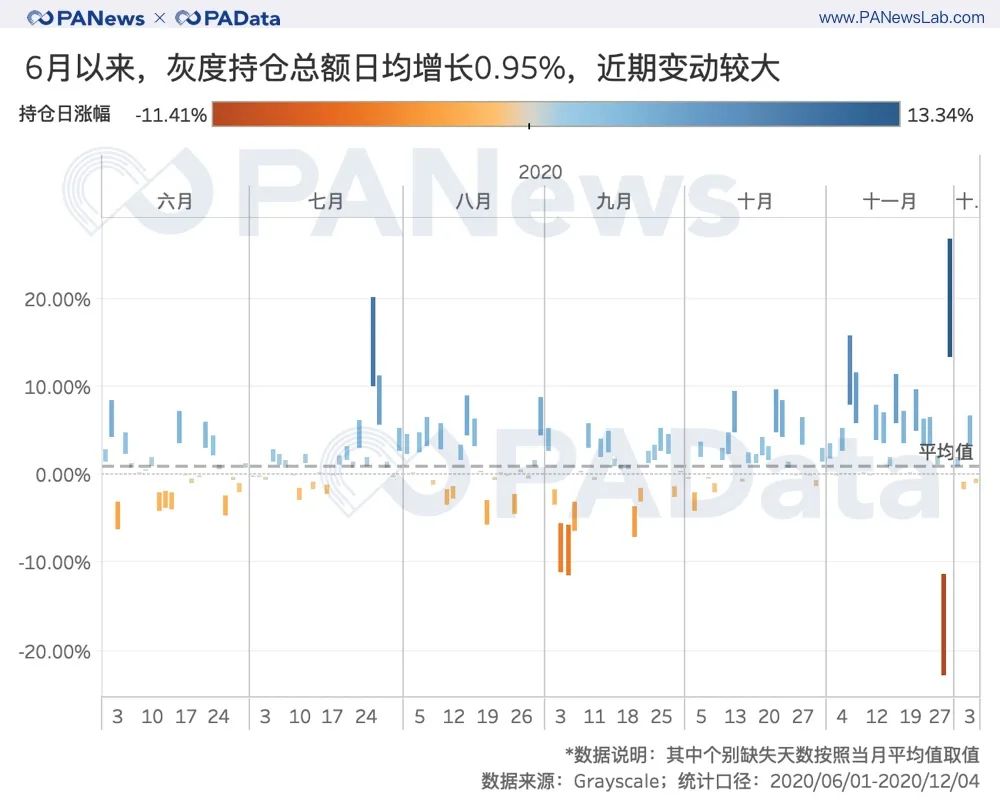

尤其是10月以后,灰度单日增/减持的规模较大,超过5%的就有7天。值得关注的是,11月30日,比特币币价创下历史新高后,当日灰度的资管规模扩大了13.34%,相当于约14.39亿美元。而在11月26日,比特币处于短期低位时,按照当月资管规模的均值估计,当日灰度的资管规模或减少了17.66%,相当于减持约21.51亿美元。

In particular, after October, the size of the grey line increased/drawn to more than 5 per cent for seven days. It is a matter of concern that, on 30 November, when the Bitcoin price reached an all-time high, the size of the grey scale increased by 13.34 per cent on that day, equivalent to approximately $1,439 million. On 26 November, when Bitcoin was at a short-term low, it was estimated, based on average monthly size, that the size of the grey line decreased by 17.66 per cent on that day, equivalent to a reduction of approximately $2,151 million.

BTC信托份额占比超80%

ETH信托份额明显上升

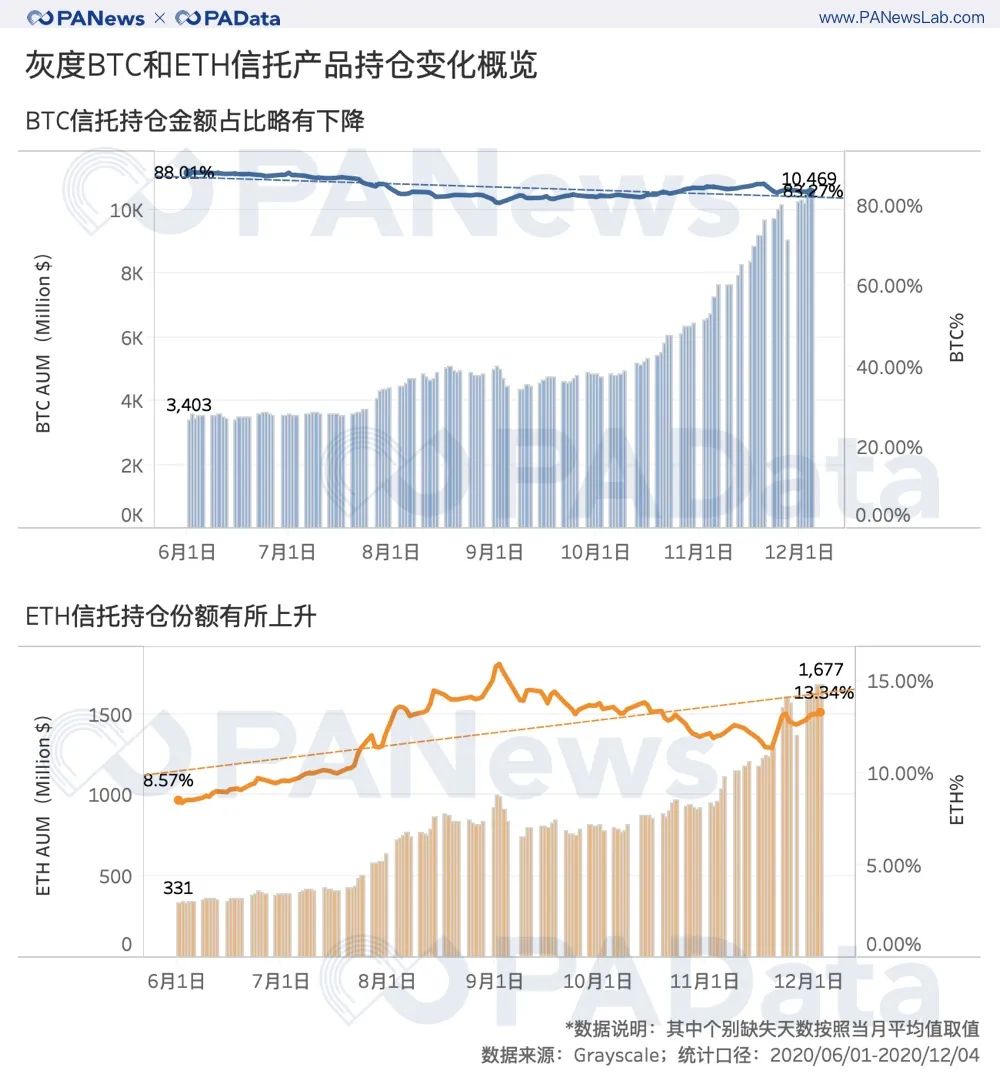

BTC Trust是灰度最早上线的产品,也一直是灰度最重要的产品。6月以来,灰度BTC Trust的资管规模从6月1日的约34.03亿美元扩大至12月4日的约104.69亿美元,涨幅约为207.66%。但BTC Trust持仓总量占灰度持仓总量的比例却略微有所下降,从6月1日的占比88.01%下降至12月4日的占比83.27%,下降了近5个百分点。

BTC Trust is the first and most important greyscale product. Since June, the size of BTC Trust has increased from approximately $3.403 billion on 1 June to about $10.469 billion on 4 December, an increase of approximately 207.66%. But the BTC Trust stock as a proportion of total grey capacity has declined slightly, from 88.01% on 1 June to 83.27% on 4 December, a decrease of nearly 5 percentage points.

ETH是今年另一个备受关注的资产。灰度ETH Trust的资管规模从6月1日的约3.31亿美元扩大至12月4日的约16.77亿美元,涨幅达到了406.16%,相当于翻了5倍。而且ETH Trust的持仓量占灰度总持仓量也呈现上升趋势,从6月1日的8.57%上升至12月4日的13.34%,提高了近5个百分点。

ETH is another asset of concern this year. The size of ETH Trust’s management grew from approximately $331 million on 1 June to about $1,677 million on 4 December, a fivefold increase of 406.16%.

在灰度多个投资产品中,多元资产基金Digital Large Cap Fund也值得关注。根据灰度的产品介绍,该基金的目标是寻求总计占整个数字资产市场70%的大型数字资产,目前的标的包括BTC、ETH、XRP、BCH和LTC这五种,每份包括0.00047320 BTC、0.00273567 ETH、0.00047615 BCH、1.09619609 XRP和0.00154624 LTC。

Among the greyscale multiple investment products, the multi-asset fund Digital Large Cap Fund is also of interest. According to the Greyscale product, the objective of the fund is to seek large-scale digital assets totalling 70% of the total digital asset market. The current targets are BTC, ETH, XRP, BCH and LTC, each of which consists of 0.000047320 BTC, 0.00273567 ETH, 0.00047615 BCH, 1.09619961960XRP and 0.001154624 LTC.

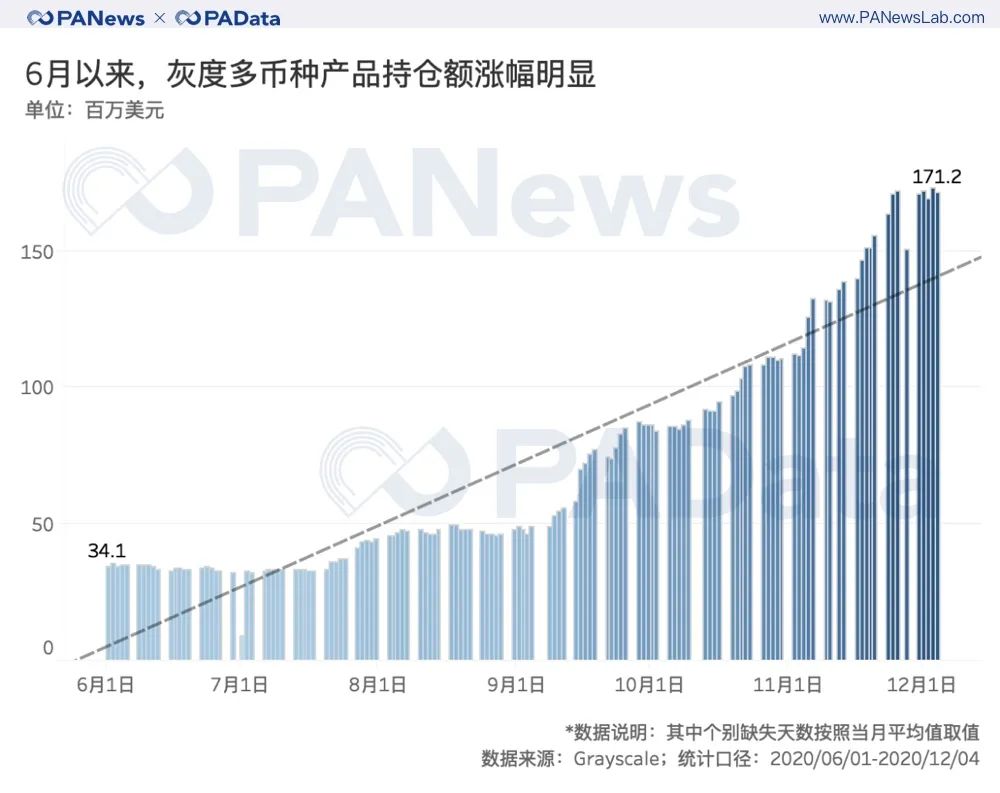

6月以来,Digital Large Cap Fund的资管规模已经从3410万美元扩大至1.71亿美元,涨幅约为402.05%,与ETH Trust的资管规模增幅相当。基金的持仓总量占比也从0.88%上升至1.36%,已成为仅次于BTC Trust和ETH Trust、高于其他单币种信托的投资产品。

Since June, the size of the Fund’s management has increased from $34.1 million to $171 million, an increase of approximately 402.05 per cent, corresponding to the increase in the size of the ETH Trust. The Fund’s total holdings also increased from 0.88 per cent to 1.36 per cent, becoming an investment product after BTC Trust and ETH Trust, which is higher than other single-currency trusts.

信托基金规模变动与当日币价弱相关

The change in the size of the

在此轮牛市中,不少观点认为背后的上涨动力来自灰度等大机构持续入金,从数据来看,灰度的增/减持对二级市场究竟有怎样的影响?

In the city of Bulls, there are a number of views that the driving force behind the rise is the continued flow of money from large institutions such as Greyscale, which, in terms of data, has had an impact on the secondary market.

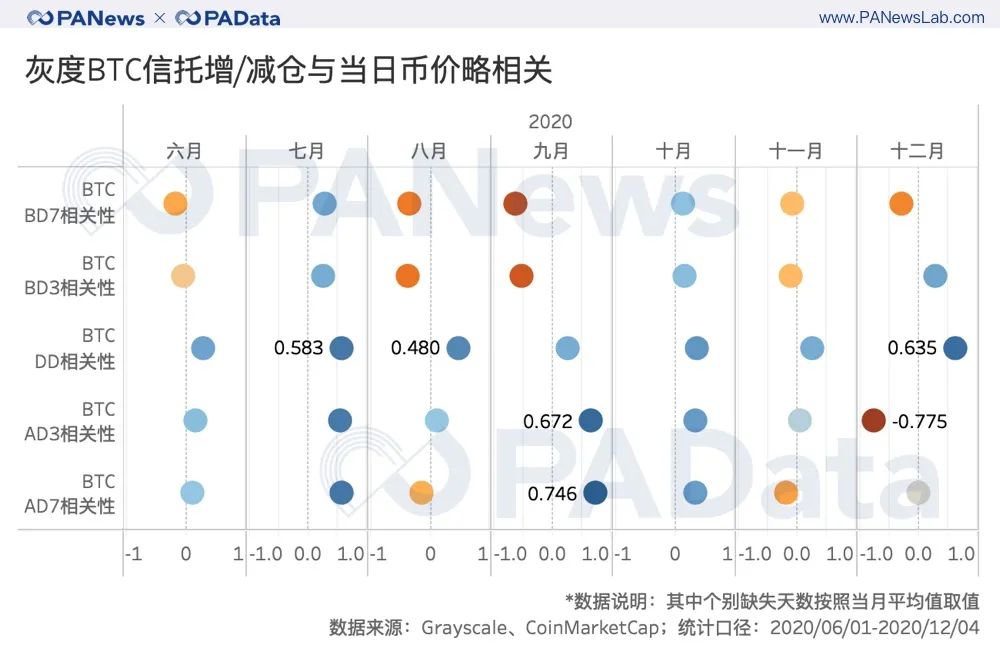

PAData统计了灰度BTC Trust每日增/减持规模与当日币价、前后7天(不含当日)平均币价、前后3天(不含当日)平均币价之间的皮尔森系数以观察两者之间的相关性。

PAData measured the correlation between the daily scale of the greyscale BTC Trust and the Pearson coefficient between the current Japanese currency price, the average currency value for seven days (excluding the day) and the average currency value for three days (excluding the day).

根据统计,今年6月以来,整体而言,灰度BTC Trust的增/减持与币价均无相关性。但是,个别月份表现出一定的弱相关,尤其是BTC Trust的增/减持对当日币价有一定的微弱影响。比如,今年7月、8月和12月,BTC Trust的增/减持与当日币价的相关系数达到了0.5左右,12月达到了0.63,这意味着,BTC Trust增持的当日BTC币价很可能上涨,反之亦然,BTC Trust减持的当日BTC币价很可能下跌。

For example, in July, August, and December of this year, BTC Trust’s increase/decrease was about 0.5 per cent, and in December it was 0.63 per cent, which means that BTC Trust’s increase was likely to rise on the day in which it was held, and vice versa, that BTC Trust’s decline was likely to fall.

但这还不能说明两者之间存在因果关系,只是说明在表象上具有关联性。

However, this does not explain the existence of a causal link between the two, but rather the appearance of a correlation.

除了与当日币价略相关以外,BTC Trust的增/减持与后一周的币价也略相关。比如9月和12月,BTC Trust的增/减持与后3天平均币价、后7天平均币价之间的相关系数也达到了0.6左右,12月与后3天平均币价的相关性更是达到了-0.77,这意味着BTC Trust增持的后三天内BTC币价很可能下跌,反之,BTC Trust减持的后三天内BTC币价很可能上涨。而9月,BTC Trust的增/减持与后3天平均币价、后7天平均币价之间则是略强的正相关,即增持很可能与币价上涨同时出现。

In addition to being slightly related to the currency price of the day, BTC Trust’s increase/loss is slightly related to the price of the following week. For example, in September and December, BTC Trust’s increase/loss was also about 0.6 per cent in relation to the average price of the next three days, the latter seven days in relation to the average price, and the latter three days in relation to -0.77, which means that BTC Trust is likely to fall within the next three days, whereas BTC Trust is likely to rise within the next three days.

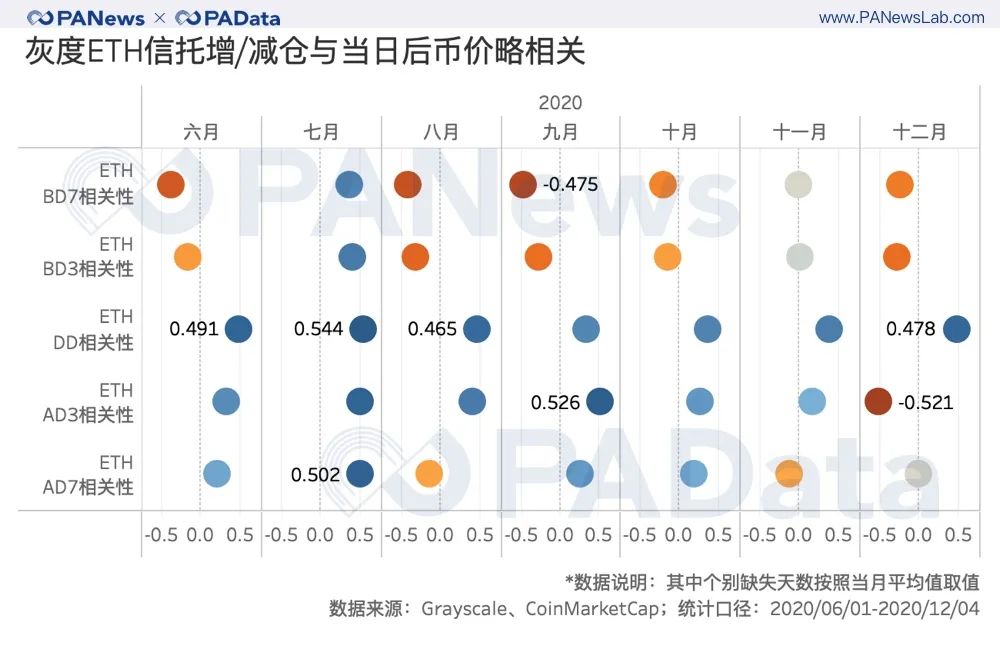

ETH Trust的增/减持与币价的相关性也类似,整体而言,灰度ETH Trust的增/减持与币价均无相关性,但个别月份表现出一定的弱相关,且信托资管规模增/减持同样都是与当日及日后的币价略有关联。

The ETH Trust gains/downscalings are similar to those associated with currency prices. Overall, the Greyscale ETH gains/downscalings are not relevant to currency prices, but there is a certain degree of weakness in individual months, and the increase/downswings in the size of trust funds are also slightly related to current and future currency values.

比如,6月、7月、8月和12月,ETH Trust的增/减持与当日币价的相关系数达到了0.5左右,也就是说,ETH Trust增持的当日ETH币价很可能上涨,反之亦然。另外,7月、9月和12月,ETH Trust的增/减持与后3日平均币价、后7日平均币价也成弱相关,其中12月为负的弱相关,即增持可能与币价下跌同时出现。

For example, in June, July, August, and December, ETH Trust’s increase/loss was about 0.5, which means that ETH Trust’s increase was likely to rise on the same day, and vice versa. In July, September, and December, ETH Trust’s increase/loss was associated with a weakening of the average currency for the next three days and the average for the next seven days, of which a negative weakness was associated with a possible fall in currency prices in December.

虽然灰度的资管规模变化与市场变化只有非常微弱的关联,但灰度代表的大机构资金持续布局,对提振市场信心有不可忽视的隐性作用。

While changes in the scale of the grey scale are associated with market changes only marginally, the large institutions represented by the grey scale continue to be spread out and have an inescapable hidden effect on boosting market confidence.

LTC和BCH场外溢价高

由于灰度设定了不可赎回的信托模式,因此投资者想要出金获利只能通过在美股二级市场中交易份额的途径来实现。灰度目前有6种产品的份额可在二级市场交易,包括GBTC(BTC Trust)、BCHG(BCH Trust)、ETHE(ETH Trust)、ETCG(ETC Trust)、LECN(LTC Trust)和GDLC(Digital Large Cap Fund)。

Since Greyscale has an indefensible fiduciary model, investors can only make profits by trading shares in the US second-tier market. The Greyscale shares of six products can now be traded in the second-tier market, including the GBTC (BTC Trust), BCH Trust, ETHE (ETH Trust), ETCG (ETC Trust), LTC Trust and GDLC (Digital Large Cap Fund).

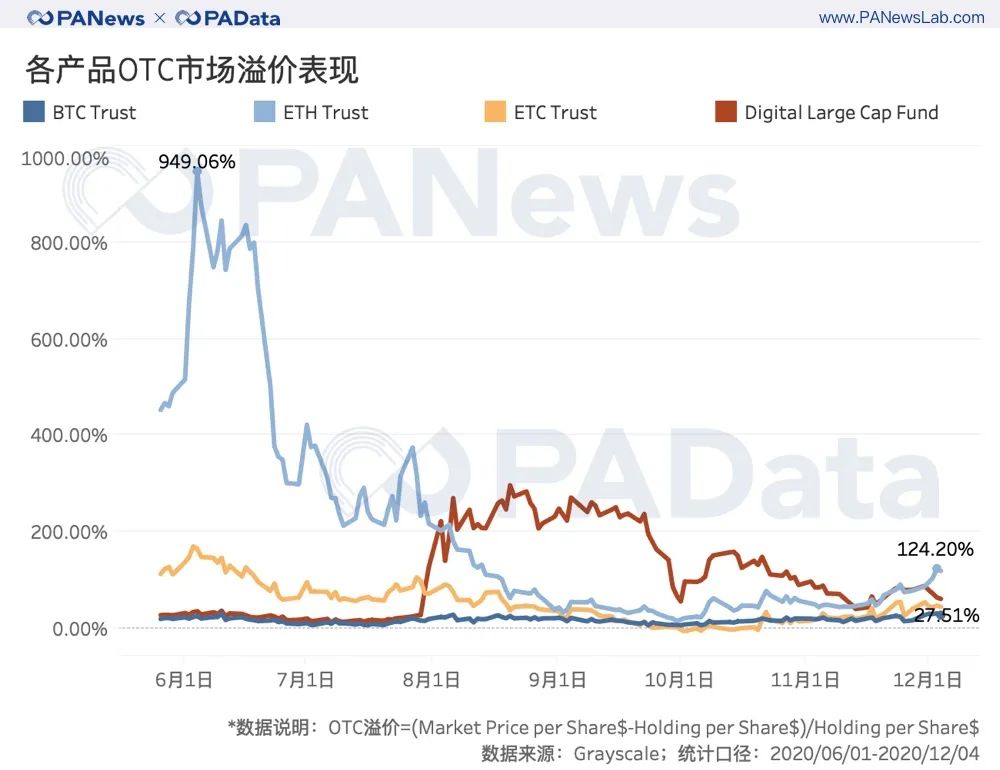

PAData计算了每份份额价格和场外交易价格之间的溢价率,根据统计,除了ETC Trust的份额溢价短暂低于0以外,其他各投资产品的溢价空间都较大。

PAData calculates the premium rate between each share price and the off-site transaction price, which, according to statistics, is larger for all investment products except ETC Trust, whose share premium is briefly less than zero.

其中BTC Trust的份额溢价是目前所有产品中溢价最低的,约为27.61%,最近半年的平均溢价约为17.17%。ETH Trust今年的溢价较高,目前的溢价约为124.20%,年中一度高达至949.06%,全年平均溢价率高达208.81%。多元资产基金Digital Large Cap Fund今年的溢价表现也不错,目前约为61.22%,8月至10月期间一度高于200%,全年平均溢价率也达到了110.64%。

The BTC Trust share premium is currently the lowest among all products, at about 27.61 per cent, with an average premium of about 17.17 per cent in the last six months. The ETH Trust premium was higher this year, with a current premium of about 124.20 per cent, with an average annual premium of 949.06 per cent, and an average annual premium of 208.81 per cent. The Multi-Asset Fund's Digital Large Cap Fund also performed well this year, with a premium of about 61.22 per cent, which was once higher than 200 per cent between August and October, and an average annual premium of 110.64 per cent.

另外值得关注的是LTC Trust和BCH Trust今年的溢价表现。从灰度披露的数据来看,LTC Trust份额的全年平均溢价率高达948.11%,当前溢价约为2677.09%,最近半年最高溢价约为5873.72%。溢价同样异常高的还有BCH Trust的份额,根据统计,其全年平均溢价率约为468.16%,当前溢价约为1252.40%,全年最高溢价约为1331.99%。

Also of concern is this year’s premium performance by LTC Trust and BCH Trust. The average annual premium on LTC Trust’s share is 948.11%, based on the data disclosed in greyscale, and the current premium is about 2677.09%, with a peak of 5873.72% in the last six months. The premium is also exceptionally high, with an average annual premium of 468.16%, according to statistics, and a current premium of 1252.40%, and a maximum annual premium of 1331.99%.

进一步观察OTCQX上的交易情况后,可以发现造成极端高溢价率的高场外交易价格只有少量交易量,这意味着这种极端高回报存在一定的偶然性。而且,LTC Trust和BCH Trust的份额于8月18日刚刚上市,上市初期可能波动较大,但之后或慢慢回归市场共识,LTC Trust的溢价在近期有了明显的回调。喜欢此内容的人还喜欢

A further look at the transactions on OTCQX reveals that the high off-the-shelf transaction prices that resulted in extremely high premium rates are only a small amount of transactions, which means that there is some chance of such an extreme high return. Moreover, the shares of LTC Trust and BCH Trust, which were just listed on August 18, may be volatile at an early stage, but then, or slowly, back to market consensus, the LTC Trust premium has returned significantly in the near future.

原标题:《深度数据 | 灰度资管规模一年翻20倍,连续买买买对市场究竟影响几何?》

Original title: Deep Data Grayscale Manager size 20 times the size of a year, how geometric are the effects on the market of successive purchases?

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论