比特币第四次减半已经发生,比特币供应量的年化通胀率降低了50%,在稀缺性方面决定性地超越了黄金。在衡量减半时,多个网络统计数据中的增长率都在下降,而这些措施的绝对值继续攀升至新的 ATH。现货价格上涨和 ATH 决定性突破提振了投资者的盈利能力,这抑制了矿商收入较年初下降 50% 的情况。

The fourth halving of Bitcoin has already taken place, with annualized inflation in bitcoin supply falling by 50%, and decisively exceeding gold in terms of scarcity. In measuring the reduction, growth rates in several web-based statistics have declined, while the absolute value of these measures continues to rise to the new ATH. The rise in spot prices and the decisive breakthrough in ATH boosted investors’ profitability, reducing miners’ incomes by 50% earlier in the year.

通缩供给

constriction supply

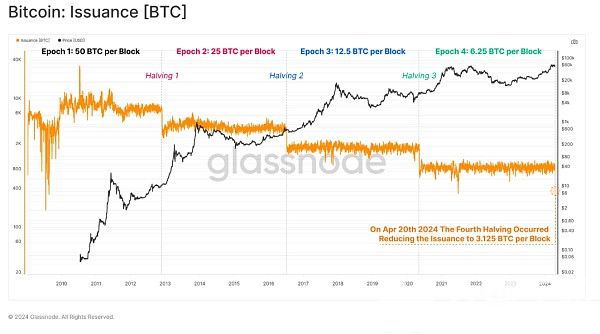

由于称为“难度调整”的巧妙的挖矿算法,比特币供应曲线是确定的。 该协议调整了比特币挖矿过程的难度,使得无论应用多少挖矿设备,平均区块间隔都保持在 600 秒(10 分钟)左右。

The Bitcoin supply curve is determined by a sophisticated mining algorithm called “ difficulty adjustment & & rdquo. The agreement adjusts the difficulty of the bitcoin mining process, leaving the average block spacing around 600 seconds (10 minutes) regardless of the number of mining equipment applied.

每 210,000 个区块(大约 4 年时间段),就会发生预定的开采量减少,新铸造的 BTC 减少 50%。 第四次比特币减半发生在周末,区块补贴从每个区块 6.25 BTC 下降到 3.125 BTC,或者每天大约开采 450 BTC(针对已开采的 144 个区块)。

For every 210,000 blocks (approximately four years), there will be a reduction in the planned level of mining and a 50 per cent reduction in the new BTC. The fourth half of Bitcoin occurred on weekends, with block subsidies falling from 6.25 BTC to 3.125 BTC per block, or about 450 BTC per day (for 144 mined blocks).

进入第四次减半,已开采19,687,500 BTC,相当于终端供应量2100万BTC的93.75%。 因此,未来 126 年中只剩下 1,312,500 枚 BTC 可供开采,其中当前阶段开采了 656,600 枚(3.125%)。 有趣的是,每次减半都代表一个点:

As a result, only 1,312,500 BTCs will be available for mining in the next 126 years, of which 656,600 (3.125 per cent) have been mined in the current phase. Interestingly, the reduction in the number of BTCs represents one point at a time:

剩余供应百分比等于新的区块补贴(3.125 BTC/区块 vs 剩余 3.125%)。

The remaining supply percentage is equal to the new block subsidy (3.125 BTC/block vs remaining 3.125%).

剩余供应量的 50%(131.25 万比特币)将在第四次减半和第五次减半之间开采。

Fifty per cent of the remaining supply (131.25 million bitcoins) will be mined between the fourth and fifth halves.

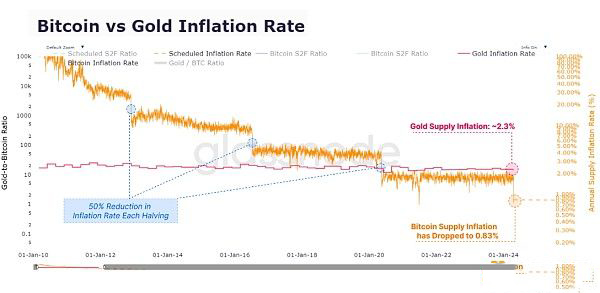

随着区块奖励的减半,通货膨胀率也大约每 4 年减半。 这使得比特币供应量的新年化通胀率为 0.85%,低于上一时期的 1.7%。

As block incentives are halved, the inflation rate is also roughly halved every four years, which results in a new annual inflation rate of 0.85 per cent for bitcoin supply, down from 1.7 per cent in the previous period.

第四次减半也标志着比特币与黄金比较的一个重要里程碑,历史上首次比特币的稳态发行率(0.83%)低于黄金(~2.3%),标志着比特币头衔的历史性交接——成为最稀缺的资产。

The fourth halve of

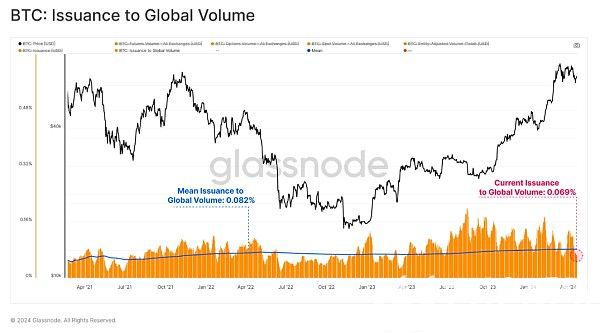

然而,重要的是要正确看待减半的规模。 在评估减半对市场动态的相对影响时,与比特币生态系统内的全球交易量相比,新开采的比特币数量仍然非常小。

However, it is important to look at the scale of halving. In assessing the relative impact of halving on market dynamics, the number of newly mined bitcoins is still very small compared to the volume of global transactions within the Bitcoin ecosystem.

开采量仅占我们今天看到的链上转账量、现货量和衍生品量的一小部分,目前相当于任何一天转移和交易总资本的不到 0.1%。

Mining amounts to only a small fraction of the chain transfers, spot volumes and derivatives we see today, and currently amounts to less than 0.1 per cent of the total capital transferred and traded on any given day.

因此,比特币减半对可用交易供应量的影响在各个周期中都在减弱,这不仅是因为开采的比特币数量减少,而且还因为围绕它的资产和生态系统规模的扩大。

As a result, the impact of the halving of

接地气的期望

The Earth's expectations.

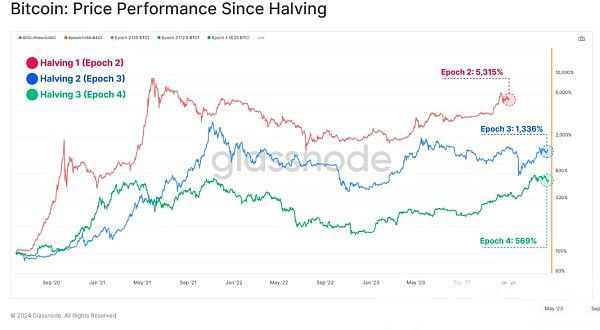

减半是一个重要且广为人知的事件,自然会导致人们对其对价格走势影响的猜测加剧。 平衡我们的期望与历史先例并根据过去的表现创建宽松的界限可能很有用。

Halve is an important and well-known event, which naturally leads to increased speculation about its impact on price trends. Balancing our expectations with historical precedents and creating liberal boundaries based on past performance may be useful.

比特币在各个减半时期的价格表现差异很大,我们认为早期的减半时期与今天有很大的不同,无法起到很大的指导作用。 随着时间的推移,我们确实看到了回报递减和总回撤效应减弱,这是市场规模不断扩大以及推动市场规模增长所需资本流动规模的自然结果。

Bitcoin’s price performance varied widely from one year to the next, and we believe that the earlier period of halving was very different from today and could not provide much guidance. Over time, did see a decline in returns and a weakening of the total pullback effect, which is a natural consequence of the expanding size of markets and the scale of capital flows needed to drive market-scale growth.

红色: Epoch 2 价格表现:+5315%,最大回撤为 -85%

red: Epoch 2 Price Performance: +5315% with maximum retreat -85%

蓝色: Epoch 3 性价比:+1336%,最大回撤为 -83%

Blue: Epoch 3 Prices: +1336% with maximum withdrawal -83%

绿色: Epoch 4 性价比:+569%,最大回撤为 -77%

Green: Epoch 4 Prices: +569% with maximum withdrawal -77%

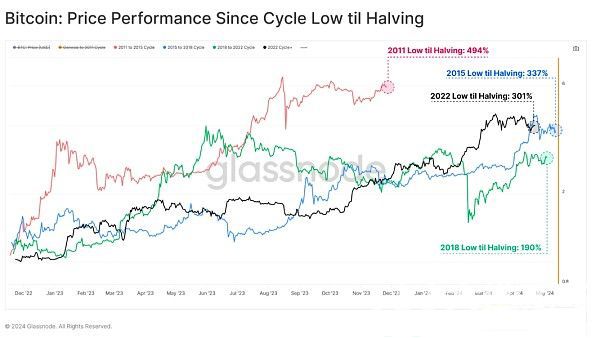

评估自周期低点直至减半的价格表现,我们注意到 2015 年、2018 年与当前周期之间存在明显相似之处,均经历了约 200% 至约 300% 的增长。

To assess price performance from the low of the cycle until it is halved, we note that there are clear similarities between 2015, 2018 and the current cycle, with growth ranging from about 200 per cent to about 300 per cent.

然而,我们当前的周期是有记录以来唯一一个在减半事件之前果断突破前一个 ATH 的周期。

However, our current cycle is the only one that has recorded a decisive break in the previous ATH cycle before the halving event.

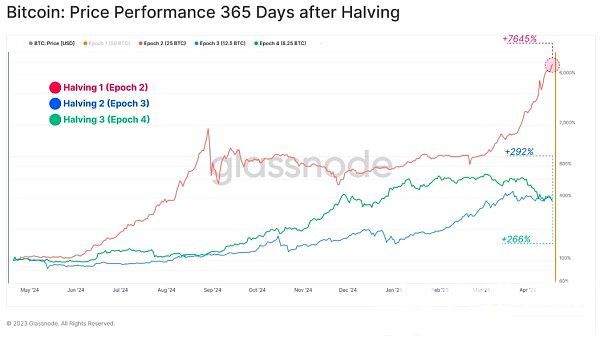

另一个视角是检查每次减半后 365 天内的市场表现。 第二个时期的表现要大得多,但我们必须考虑到,当今市场的动态和格局相对于 2011-2013 年期间已经发生了显著变化。

Another perspective is to examine market performance for 365 days after each reduction by half. The second period has been much larger, but we must take into account that the dynamics and patterns of today’s markets have changed significantly over the period 2011-2013.

因此,最近的两个时期(3 和 4)提供了对资产规模影响的更丰富的描述。

As a result, the last two periods (3 and 4) provide a richer picture of the impact on the size of the assets.

红色: Epoch 2 价格表现:+7,258%,最大回撤为 -69.4%

Red: Epoch 2 Price Performance: +7,258% with maximum retreat - 69.4%

蓝色: Epoch 3 性价比:+293%,最大回撤为 -29.6%

Blue: Epoch 3 Price: +293% with maximum retreat - 29.6%

绿色: Epoch 4 价格表现:+266%,最大回撤为 -45.6%

Green: Epoch 4 Price Performance: +26.6% with maximum withdrawal -45.6%

虽然减半事件后的一年在历史上表现强劲,但在此过程中也出现了一些严重的价格下跌,范围从 -30% 到 -70%。

While the year following the halving event was historically strong, there were also some serious price declines in the process, ranging from -30 per cent to -70 per cent.

历史有时相似

History is sometimes similar.

在 2022 年熊市期间,一个常见的说法是价格永远不会低于上一个周期的 ATH(当时在 2017 年设定的 2 万美元)。 这当然是无效的,因为在 2022 年底广泛的去杠杆化过程中,价格比 2017 年周期高点下跌了 25% 上述。

During Bear City in 2022, it was common to say that prices would never be lower than the ATH of the previous cycle (set at $20 million in 2017). This is certainly not effective, because in the broader deleveraging process at the end of 2022, prices fell by 25 per cent over the 2017 cycle.

最近流传着类似的说法,即在减半发生之前价格无法突破新的 ATH。 今年3月,该说法再次失效。 我们在 3 月份看到的 ATH 源于历史上供应紧张 (WoC-46-2023) 和新现货 ETF 带来的显著需求兴趣。

In March this year, it failed again. The ATH that we saw in March stemmed from historical supply constraints (WoC-46-2023) and the remarkable demand interest of the new spot ETF.

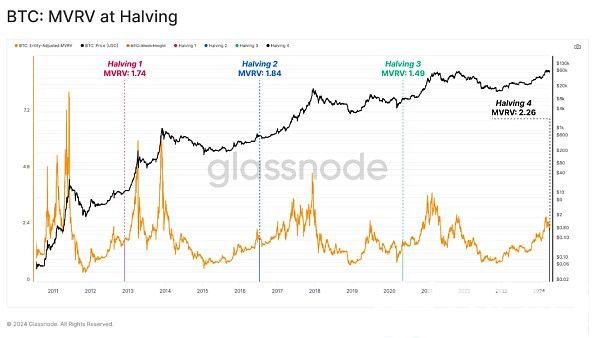

此次价格上涨也对投资者持有的未实现利润产生了重大影响。 目前,代币供应中持有的未实现利润是减半事件以来最大的(以 MVRV 衡量)。

This price increase has also had a significant impact on the unrealized profits held by investors, which are currently the largest (measured in MVRV) since the halving of money supply.

换句话说,截至减半之日,投资者持有相对于其成本基础而言最大的账面收益。 MVRV 比率为 2.26,这意味着 BTC 的平均单位账面收益为 +126%。

In other words, as of the date of halving, investors hold the largest book gain relative to their cost base. MVRV ratio is 2.26, which means that BTC has an average unit book gain of +126 per cent.

根本性增长

Fundamental growth

在上一节中,我们评估了以减半为中心的历史价格表现。 在下一节中,我们将把重点转向网络基本面的增长,包括挖矿安全、矿工收入、资产流动性和减半时期的结算量。

In the previous section, we assessed historical price performance centred on halving. In the next section, we will shift our focus to growth in network fundamentals, including mining safety, miners’ income, asset liquidity, and settlement levels during the period of halving.

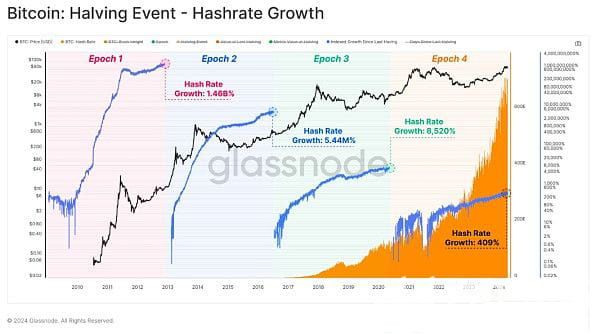

算力是一种网络统计数据,用于评估挖矿群体的集体“火力”。 在减半时期,算力的增长速度已经放缓,但每秒的绝对哈希值继续增长,目前为每秒 620 Exahash(相当于地球上所有 80 亿人每秒完成 775 亿次哈希)。

Arithmetic is a web-based statistical measure used to assess the collective & ldquo; firepower & rdquo;

有趣的是,算力在每次减半事件中都处于或接近新的 ATH,这表明可能会发生两种情况:

Interestingly, arithmetic is in or close to a new ATH at each halving event, which suggests that two situations may occur:

更多 ASIC 设备即将上线;

More ASIC devices are about to be online;

更高效的哈希 ASIC 硬件正在生产中。

More efficient Hashi ASIC hardware is being produced.

从这两种情况得出的结论是,尽管开采量每次减半都会减少 50%,但总体安全预算不仅足以维持当前的 OPEX 成本,而且还足以刺激 CAPEX 和 OPEX 领域的进一步投资。

In both cases, it is concluded that, although a 50 per cent reduction in the amount of mining will occur each time, the overall security budget is sufficient not only to sustain the current OPEX costs, but also to stimulate further investment in CAPEX and OPEX.

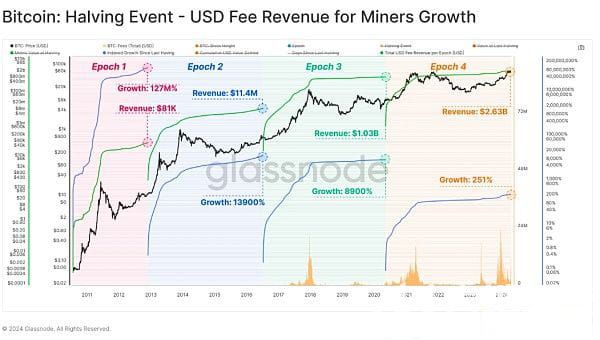

以美元计价时,矿工收入的增长率同样在下降,但绝对规模却在净扩张。 过去 4 年,矿工累计收入达到惊人的 30 亿美元,比上一个时期增长了一个数量级。

When denominated in United States dollars, the growth rate of miners’ incomes is also declining, but on a net scale. Over the past four years, the cumulative revenues of miners have reached an alarming $3 billion, an increase of a magnitude over the previous period.

已实现上限是衡量一段时间内投资和存储在比特币中的资本的强大工具,可用于比较以美元计价的跨周期流动性增长。

The cap has been achieved as a powerful tool for measuring investment and capital stored in bitcoin over time, which can be used to compare the growth in liquidity over the United States dollar.

通过这种衡量,比特币中已“存储”了总价值 5600亿美元的美元价值。 已实现上限较上一个时期增长了 439%,支撑了该资产目前 1.4 万亿美元的市值。 同样值得注意的是,尽管比特币存在着臭名昭著的波动性、糟糕的头条新闻和周期性的回撤,但资本仍在继续流入。

By this measure,

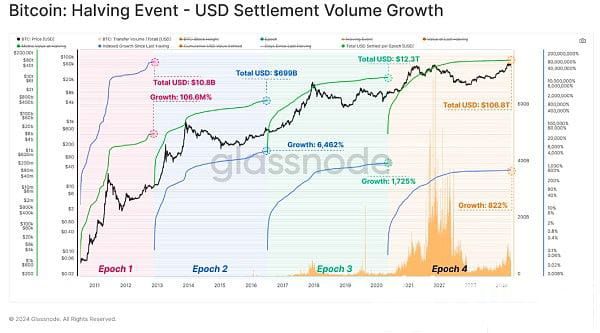

最后,如果我们评估减半时期结算的转账量,我们可以看到在过去四年中,网络转账和结算的经济价值高达106万亿美元。 现在需要注意的是,这考虑的是原始的未经过滤的交易量,并且不会针对内部钱包管理进行调整。

Finally, if we assess the amount of transfers settled during the halved period, we can see that, over the past four years, the economic value of network transfers and settlements has been $106 trillion. What needs to be noted now is that this takes into account the original unfiltered volume of transactions and will not be adjusted for internal wallet management.

尽管如此,每笔交易都是在没有中介的情况下进行结算的,这凸显了比特币网络令人难以置信的大规模价值吞吐能力。

Nevertheless, every transaction is settled without an intermediary, which highlights the incredible capacity of the Bitcoin network for large-scale value vomiting.

总结

随着备受期待的减半完成,每个区块的开采量减半,资产的稀缺性加剧,比特币资产的稀缺性决定性地超越黄金。

With the expected reduction of half, the extraction of each block will be reduced by half, the scarcity of assets will increase, and the scarcity of Bitcoin assets will go decisively beyond gold.

比较各个时期,算力、网络结算、流动性和矿工收入的增长都出现收缩。 然而,这些指标的绝对价值增加了一个数量级,从市场规模来看,这是一个令人难以置信的令人印象深刻的壮举。

There has been a contraction in the growth of arithmetic, network settlements, liquidity, and miners’ incomes over time. However, the absolute value of these indicators has increased by a measure of magnitude, which is an incredibly impressive feat in terms of market size.

值得注意的是,与之前的减半相比,各行各业的市场投资者的网络盈利能力均大幅提高。 这包括基础矿工阶层,他们已进入减半,算力达到 ATH,这表明有足够的安全预算来刺激运营支出和资本支出需求。

It is worth noting that there has been a significant increase in the network profitability of market investors from all walks of life, compared to the previous half. This includes the basic miners, who have already halved to reach ATH, indicating that there is enough security budget to boost operating and capital demand.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论